XRP (Ripple) Investment: A Potential Path To Financial Freedom?

Table of Contents

Understanding XRP and its Technology

What is XRP?

XRP is the native cryptocurrency of the Ripple network, a real-time gross settlement system (RTGS), currency exchange, and remittance network. Unlike Bitcoin, which relies on a proof-of-work consensus mechanism, XRP operates on a unique consensus protocol designed for speed and efficiency. Its primary function is facilitating fast and low-cost international money transfers between financial institutions.

How Does Ripple Technology Work?

The Ripple protocol utilizes a distributed ledger technology (DLT) to track transactions, ensuring transparency and security. Its consensus mechanism, known as the Ripple Consensus Ledger (RCL), is designed for high throughput, enabling thousands of transactions per second. This speed and efficiency are significant advantages compared to other cryptocurrencies like Bitcoin and Ethereum, which can experience slower transaction times and higher fees, particularly during periods of high network congestion.

- Unique Features of XRP: XRP boasts significantly faster transaction speeds and lower fees than Bitcoin and Ethereum. Its focus on institutional adoption also sets it apart.

- Scalability of the Ripple Network: The Ripple network is designed for scalability, capable of handling a large volume of transactions without compromising speed or efficiency. This makes it attractive to financial institutions looking for a reliable and efficient payment solution.

- Role of Ripple Labs: Ripple Labs, the company behind the Ripple network, plays a significant role in developing and promoting the technology, fostering partnerships with banks and financial institutions globally.

XRP Investment Strategies

Buying and Holding (HODLing)

A common XRP investment strategy is "HODLing" – buying and holding XRP for the long term, anticipating price appreciation as the cryptocurrency gains wider adoption. This strategy requires patience and a tolerance for volatility, but it can potentially yield significant returns if XRP's value increases over time.

Trading XRP

Short-term trading involves buying and selling XRP based on market fluctuations. This requires a strong understanding of technical analysis, market trends, and risk management. Successful short-term trading depends on accurately predicting price movements, which is inherently challenging and risky.

Staking XRP (if applicable)

While not currently a core feature, future developments in the XRP Ledger may include staking opportunities, allowing users to earn rewards for participating in network security and validation. Keep an eye on Ripple's announcements for potential staking options.

- Exchange Options for Buying XRP: Several cryptocurrency exchanges offer XRP trading pairs, including Coinbase, Binance, Kraken, and others. Research and choose a reputable exchange carefully.

- Risk Management and Diversification: Never invest more than you can afford to lose. Diversifying your investment portfolio across various assets is crucial to mitigating risk.

- Impact of Regulatory Changes: The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and adoption. Stay informed about regulatory developments.

Risks and Rewards of XRP Investment

Volatility and Market Risk

The cryptocurrency market is notoriously volatile, and XRP is no exception. Its price can experience dramatic fluctuations due to market sentiment, regulatory changes, and technological developments. This volatility presents both opportunities and significant risks to investors.

Regulatory Uncertainty

The ongoing legal uncertainty surrounding XRP, stemming from the SEC lawsuit, creates significant risk. A negative outcome could significantly impact XRP's price and adoption. Conversely, a positive resolution could lead to a substantial increase in value.

Security Risks

Storing XRP involves security risks, including exchange hacks and the loss of private keys. Utilizing secure wallets and practicing good cybersecurity hygiene is crucial to protect your investment.

- Potential Benefits of Investing in XRP: The potential for substantial long-term growth is a primary benefit. Increased adoption by financial institutions could drive significant price appreciation.

- Downsides and Potential Losses: The high volatility, regulatory uncertainty, and security risks highlight the potential for substantial losses.

- Importance of Thorough Research and Due Diligence: Before investing in XRP, conduct extensive research and understand the associated risks fully.

XRP vs. Other Cryptocurrencies

Comparing XRP to Bitcoin and Ethereum

XRP differs significantly from Bitcoin and Ethereum in its design, purpose, and target market. While Bitcoin aims to be a decentralized digital gold and Ethereum a platform for decentralized applications (dApps), XRP focuses on enabling fast and efficient cross-border payments.

| Feature | XRP | Bitcoin | Ethereum |

|---|---|---|---|

| Purpose | Payments | Store of Value | Smart Contracts |

| Transaction Speed | Very High | Relatively Low | Moderate |

| Transaction Fees | Very Low | Can be High | Can be High |

| Consensus | Ripple Consensus Ledger | Proof-of-Work | Proof-of-Stake |

Analyzing XRP's Potential for Growth

XRP's potential for growth hinges on several factors, including increased adoption by financial institutions, a positive resolution to the SEC lawsuit, and further technological advancements in the Ripple network.

- XRP's Unique Advantages: Speed, efficiency, and low transaction costs are key advantages.

- XRP's Disadvantages: Regulatory uncertainty and competition from other cryptocurrencies pose significant challenges.

- Long-Term Outlook for XRP: The long-term outlook depends on several factors and remains uncertain.

Conclusion

XRP (Ripple) investment presents a potential path to financial freedom, but it's crucial to acknowledge the inherent risks. While the potential for high returns exists, the volatility, regulatory uncertainty, and security risks cannot be ignored. This article provides an overview of XRP and its investment landscape but doesn't constitute financial advice. Before considering an XRP (Ripple) investment, conduct thorough research, understand your risk tolerance, and consult with a qualified financial advisor. Weigh the risks and rewards carefully before considering an XRP (Ripple) investment and remember to consult with a financial advisor. Further reading on financial literacy and cryptocurrency investment is strongly recommended.

Featured Posts

-

Postawa Polakow Wobec Dzialan Trumpa Na Ukrainie Sondaz

May 07, 2025

Postawa Polakow Wobec Dzialan Trumpa Na Ukrainie Sondaz

May 07, 2025 -

Cavaliers Vs Spurs Injury Report And Game Preview For March 27th

May 07, 2025

Cavaliers Vs Spurs Injury Report And Game Preview For March 27th

May 07, 2025 -

Warriors Contact Kevon Looney In Nba Free Agency

May 07, 2025

Warriors Contact Kevon Looney In Nba Free Agency

May 07, 2025 -

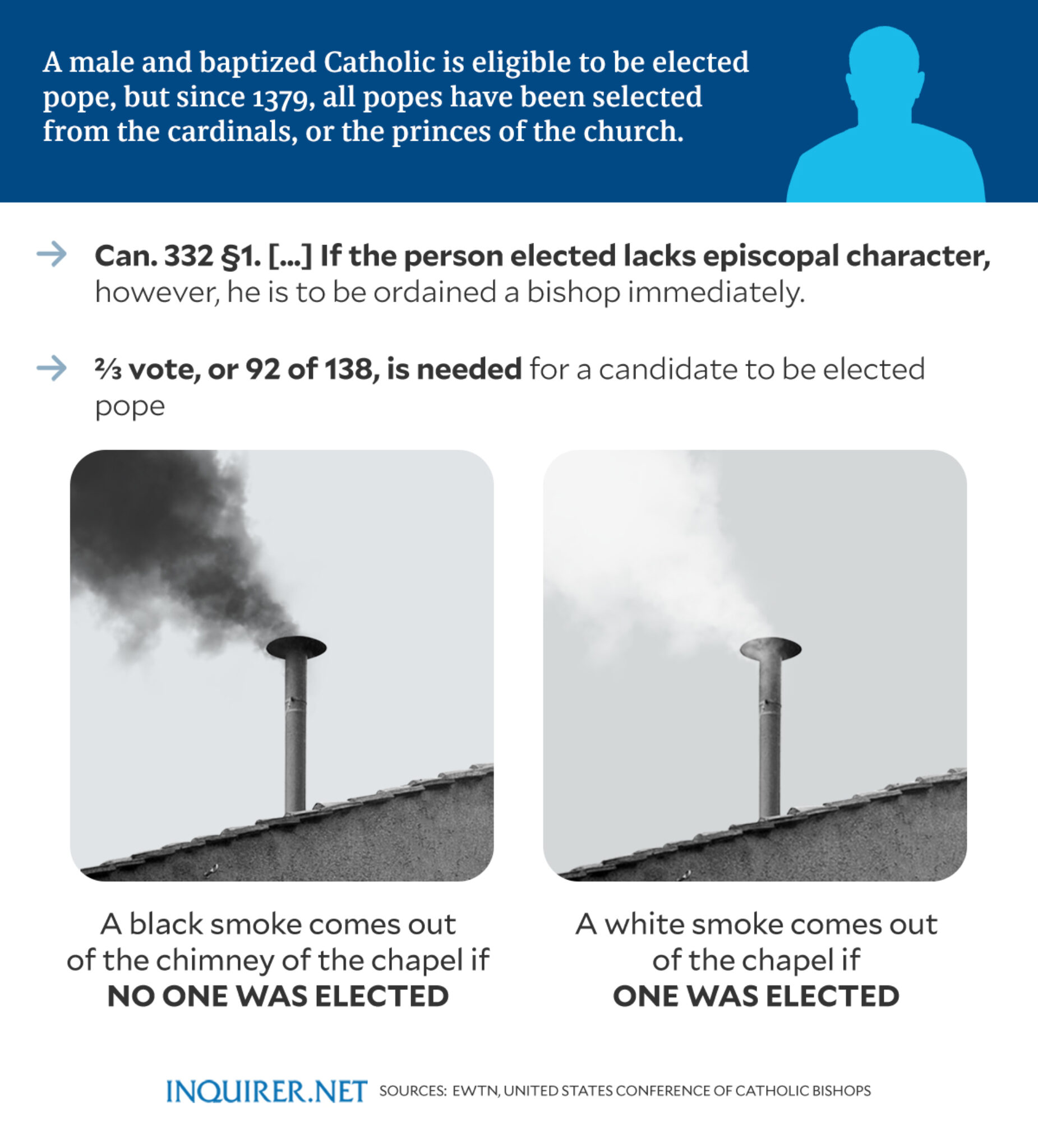

A Conclave Explained The Process Of Selecting The Next Pope

May 07, 2025

A Conclave Explained The Process Of Selecting The Next Pope

May 07, 2025 -

Ontarios Highway 401 Tunnel Fords Call For National Significance

May 07, 2025

Ontarios Highway 401 Tunnel Fords Call For National Significance

May 07, 2025