XRP (Ripple) Price Below $3: Investment Opportunity Or Risk?

Table of Contents

Understanding the Current Market Conditions for XRP

Macroeconomic Factors Influencing Crypto Prices

The cryptocurrency market is heavily influenced by broader macroeconomic trends. Factors such as regulatory changes globally, Bitcoin's price movements (often considered a bellwether for the entire crypto market), and overall investor sentiment significantly impact cryptocurrency valuations, including XRP.

- Regulatory Crackdowns: Increased regulatory scrutiny in various jurisdictions can trigger sell-offs across the crypto market.

- Institutional Adoption: Growing institutional adoption of cryptocurrencies can lead to increased demand and higher prices.

- Major Announcements: News regarding technological advancements, partnerships, or new use cases for cryptocurrencies can influence market sentiment and price.

Keywords: Crypto market volatility, Bitcoin price correlation, regulatory landscape.

Ripple's Legal Battle and its Impact on XRP Price

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a long shadow over XRP's price. The SEC alleges that XRP is an unregistered security, a claim that Ripple vehemently denies. The outcome of this case will significantly affect XRP's future and its price.

- Key Developments: Closely monitoring court filings, expert testimony, and any significant rulings is crucial for understanding the trajectory of this case.

- Potential Outcomes: A favorable ruling for Ripple could send XRP's price soaring, while an unfavorable outcome could lead to further price declines.

- Implications for XRP Value: The uncertainty surrounding the legal battle contributes to XRP's price volatility, making it a high-risk investment for some.

Keywords: SEC lawsuit, Ripple vs SEC, legal uncertainty, XRP price prediction.

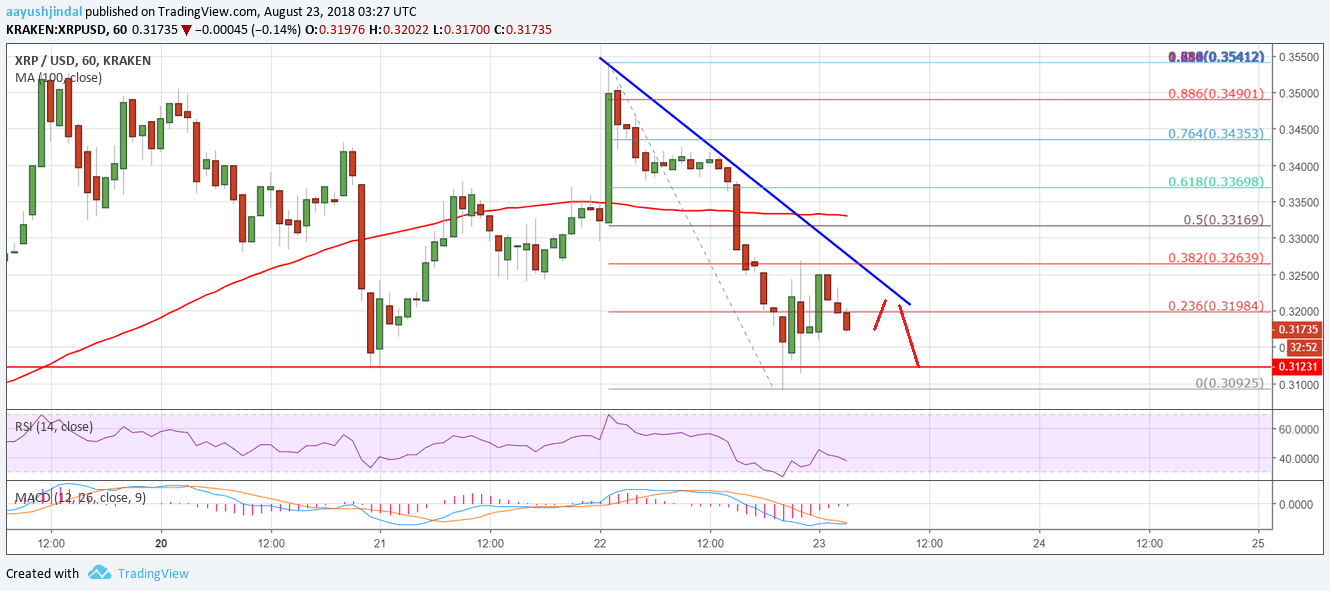

Technical Analysis of XRP Price Charts

Technical analysis of XRP's price charts can offer insights into potential support and resistance levels. Studying indicators like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help identify potential buying or selling opportunities. (Note: Including charts here would significantly enhance this section, but is beyond the scope of this text-based response.)

- Moving Averages: Analyzing 50-day and 200-day moving averages can indicate trend direction.

- RSI: The RSI helps determine whether XRP is overbought or oversold.

- MACD: The MACD can signal potential trend reversals.

Keywords: XRP technical analysis, chart patterns, support and resistance, trading indicators.

Evaluating the Potential Risks of Investing in XRP Below $3

Volatility and Price Fluctuations

Cryptocurrency investments, especially in XRP, are inherently volatile. Past performance shows significant price swings, highlighting the potential for substantial losses. Investing only what you can afford to lose is paramount.

- Past Price Swings: Review historical XRP price charts to understand the magnitude of past volatility.

- Potential for Further Drops: The ongoing legal uncertainty and broader market conditions could lead to further price declines.

Keywords: Cryptocurrency risk, XRP volatility, investment risk tolerance.

Regulatory Uncertainty and its Impact

The regulatory landscape for cryptocurrencies remains uncertain globally. The outcome of the Ripple-SEC case and future regulatory actions could significantly impact XRP's value and its usability.

- Different Regulatory Scenarios: Consider various potential regulatory outcomes and their impact on XRP's price and trading.

- Consequences for XRP Investors: Regulatory uncertainty creates significant risk for investors, potentially leading to substantial losses.

Keywords: Regulatory risk, legal uncertainty, XRP future.

Assessing the Potential Rewards of Investing in XRP Below $3

Potential for Price Appreciation

Despite the risks, XRP's price could rebound significantly, potentially exceeding previous highs. Several factors could contribute to price appreciation.

- Positive Legal Outcomes: A favorable ruling in the Ripple-SEC case could trigger a substantial price increase.

- Increased Adoption: Growing adoption of RippleNet and On-Demand Liquidity (ODL) could boost XRP's demand and price.

Keywords: XRP price prediction, price appreciation, potential return on investment.

Ripple's Technology and Ecosystem

Ripple's technology and its expanding ecosystem offer long-term potential. RippleNet, a global payments network, and On-Demand Liquidity (ODL), a solution enabling faster and cheaper cross-border payments, are key factors driving adoption.

- RippleNet's Growth: The expansion of RippleNet to new financial institutions could increase XRP demand.

- ODL's Impact: Wider adoption of ODL could significantly boost XRP's utility and value.

Keywords: RippleNet, ODL, XRP utility, blockchain technology.

Conclusion: Making Informed Decisions About XRP Below $3

Investing in XRP at its current price below $3 presents both potential opportunities and significant risks. The ongoing legal battle, market volatility, and regulatory uncertainty are all critical factors to consider. Thorough research, a clear understanding of your risk tolerance, and a well-defined investment strategy are essential before investing in XRP or any cryptocurrency. Is the current XRP (Ripple) price below $3 an investment opportunity or a risk? The answer depends on your risk tolerance and research. Learn more and make an informed decision today!

Featured Posts

-

Kl Ma Tryd Merfth En Blay Styshn 6 Mwasfat Ser Wtarykh Alisdar

May 02, 2025

Kl Ma Tryd Merfth En Blay Styshn 6 Mwasfat Ser Wtarykh Alisdar

May 02, 2025 -

Mo Salah Contract Liverpools Plan And The Risks

May 02, 2025

Mo Salah Contract Liverpools Plan And The Risks

May 02, 2025 -

Nebraskas Successful Voter Id Campaign A National Clearinghouse Award Winner

May 02, 2025

Nebraskas Successful Voter Id Campaign A National Clearinghouse Award Winner

May 02, 2025 -

Preview Colorado Buffaloes Vs Texas Tech Red Raiders

May 02, 2025

Preview Colorado Buffaloes Vs Texas Tech Red Raiders

May 02, 2025 -

Savor The Flavors Culinary Delights On Windstar Cruises

May 02, 2025

Savor The Flavors Culinary Delights On Windstar Cruises

May 02, 2025