XRP (Ripple) Under $3: Investment Opportunities And Risks

Table of Contents

Potential Investment Opportunities in XRP Below $3

The current price of XRP presents potential opportunities for savvy investors willing to navigate the inherent risks. Several factors contribute to this potential:

Technological Advantages of RippleNet

RippleNet, Ripple's payment solution, offers a compelling technological edge. It leverages blockchain technology to facilitate faster and cheaper cross-border payments compared to traditional banking systems. This efficiency has attracted the attention of major financial institutions globally.

- Faster, cheaper cross-border payments: RippleNet significantly reduces transaction times and costs, making it an attractive alternative to SWIFT and other legacy systems.

- Scalability: Unlike some cryptocurrencies, RippleNet is designed for scalability, handling a high volume of transactions without compromising speed or efficiency.

- Partnerships with major financial institutions: Ripple has established partnerships with numerous banks and financial institutions worldwide, boosting the adoption and credibility of its technology. This institutional backing strengthens XRP's position in the market.

- Potential for wider adoption: As the global demand for efficient cross-border payments increases, RippleNet's technology is well-positioned to capture a significant market share, potentially driving up the price of XRP. This wider adoption is a key factor in predicting future XRP price increases. The integration of RippleNet within the global financial system through fintech solutions is another crucial aspect of its potential success.

Increased Institutional Adoption

The growing interest from institutional investors is a significant factor influencing XRP's potential. Many large financial institutions are exploring the use of Ripple's technology and XRP in their operations.

- Examples of partnerships with banks and financial institutions: Numerous partnerships with major players demonstrate the growing confidence in Ripple's technology and its potential to disrupt the traditional financial system.

- Potential for increased liquidity: Increased institutional investment usually translates to higher liquidity, making it easier to buy and sell XRP without significantly impacting its price.

- Impact on price: As institutional adoption increases, the demand for XRP is likely to rise, potentially pushing its price upwards. This increased demand from institutional investors adds a crucial layer of support for XRP's price.

Future Regulatory Clarity

The ongoing legal battle between Ripple and the SEC remains a major factor affecting XRP's price. A positive resolution could significantly impact investor confidence and unlock significant growth potential.

- Potential positive outcomes of the lawsuit: A favorable ruling could remove the regulatory uncertainty surrounding XRP, leading to increased investor confidence and potentially driving up its price.

- Potential for increased regulatory clarity: A clear legal framework would provide much-needed certainty for investors and could attract more institutional participation in the XRP market.

- Long-term impact on investor confidence: A positive resolution to the lawsuit could significantly boost investor confidence in XRP, leading to a long-term price increase. The eventual regulatory clarity is a pivotal aspect impacting XRP's long-term price.

Risks Associated with Investing in XRP Below $3

Despite the potential upsides, investing in XRP carries significant risks that must be carefully considered:

Regulatory Uncertainty

The ongoing SEC lawsuit against Ripple casts a long shadow over XRP. An unfavorable outcome could have severe consequences.

- Potential negative outcomes of the lawsuit: An adverse ruling could negatively impact XRP's price, potentially leading to delisting from major exchanges and a significant loss of investor confidence.

- Risk of delisting from exchanges: If deemed a security, XRP could be delisted from major exchanges, significantly reducing its accessibility and liquidity.

- Impact on investor confidence: Negative regulatory developments could erode investor confidence, leading to price volatility and potential capital losses. The regulatory risk is a significant aspect of XRP investment that needs thorough assessment.

Market Volatility

The cryptocurrency market is inherently volatile, and XRP is no exception. Price fluctuations can be dramatic and unpredictable.

- Impact of market trends on XRP's price: Overall market trends, as well as news and events specific to XRP, can cause significant price swings.

- Potential for significant price drops: Sudden and sharp price drops are a common occurrence in the crypto market, posing a significant risk to investors.

- Need for a long-term investment strategy: Investing in XRP requires a long-term perspective and a tolerance for significant price volatility. A robust, long-term investment strategy is essential to mitigate the risks associated with market volatility.

Competition in the Crypto Market

XRP faces stiff competition from numerous other cryptocurrencies vying for market share.

- Competition from other cryptocurrencies: The crypto market is highly competitive, with new projects and technologies constantly emerging.

- Potential for technological disruption: Technological advancements could render existing cryptocurrencies obsolete, impacting XRP's market position.

- Need for continuous innovation: To maintain competitiveness, Ripple needs to continue innovating and adapting to the rapidly evolving landscape of the crypto market. The competitive landscape of the cryptocurrency market is a critical factor to consider when assessing XRP's investment potential.

Conclusion

XRP's current price below $3 presents both attractive investment opportunities and substantial risks. While RippleNet's technological advantages and potential institutional adoption offer significant growth potential, the ongoing regulatory uncertainty and inherent market volatility demand cautious consideration. Before investing in XRP, conduct thorough due diligence, fully understand the associated risks, and carefully assess your own risk tolerance. Remember, this article is for informational purposes only and does not constitute financial advice. Learn more about XRP (Ripple) and its potential by exploring reliable sources and making informed investment decisions. Only invest what you can afford to lose.

Featured Posts

-

Controversy Erupts Trump Administration Demands Removal Of Transgender Swimmers Records From University Of Pennsylvania

May 01, 2025

Controversy Erupts Trump Administration Demands Removal Of Transgender Swimmers Records From University Of Pennsylvania

May 01, 2025 -

Panoramas Chris Kaba Episode A Police Watchdogs Ofcom Complaint And Its Implications

May 01, 2025

Panoramas Chris Kaba Episode A Police Watchdogs Ofcom Complaint And Its Implications

May 01, 2025 -

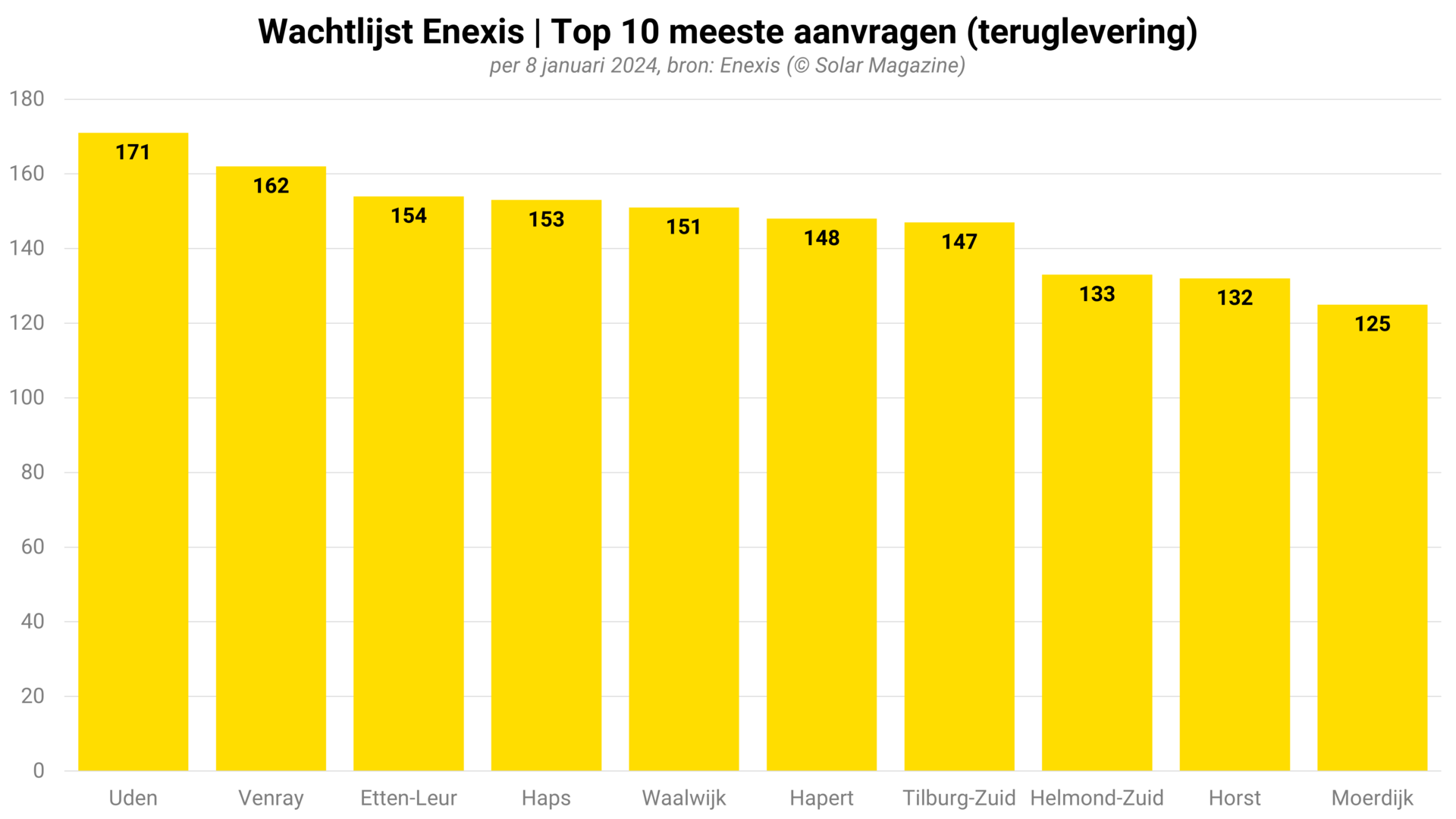

Duizenden Limburgse Bedrijven Op Wachtlijst Voor Enexis Aansluiting

May 01, 2025

Duizenden Limburgse Bedrijven Op Wachtlijst Voor Enexis Aansluiting

May 01, 2025 -

Tough Tests Ahead Celtic Championship Hopes Hinged On Upcoming Homestand

May 01, 2025

Tough Tests Ahead Celtic Championship Hopes Hinged On Upcoming Homestand

May 01, 2025 -

The Ultimate Michael Jordan Fast Facts Guide

May 01, 2025

The Ultimate Michael Jordan Fast Facts Guide

May 01, 2025