XRP Surges Past Solana: ETF Hopes Fuel Trading Volume Increase

Table of Contents

The Ripple Effect of ETF Approvals

The potential approval of a spot Bitcoin ETF is a major catalyst for the entire crypto market. Increased institutional investment in Bitcoin could lead to a broader adoption of cryptocurrencies, benefiting altcoins like XRP. This potential influx of institutional money could reshape the entire landscape.

Bitcoin ETF and its Influence on Altcoins

- Increased investor confidence: The approval of a Bitcoin ETF would signal a significant step towards mainstream acceptance of cryptocurrencies, boosting overall investor confidence. This positive sentiment often spills over into the altcoin market.

- Greater liquidity in the crypto market: Increased institutional participation would inject significant liquidity into the market, making it easier for investors to buy and sell cryptocurrencies, including XRP. This improved liquidity could lead to reduced volatility in the long term.

- Potential for increased institutional interest in XRP: As institutional investors gain more comfort with crypto, they may start exploring alternative cryptocurrencies with promising use cases, such as XRP's role in cross-border payments.

XRP's Unique Position in the Market

XRP's distinct use case as a payment token, its existing partnerships, and its ongoing legal battle with the SEC all contribute to its recent surge. The uncertainty surrounding the SEC case, while a risk, also presents a potential for significant upside upon a positive resolution.

- Faster transaction speeds compared to Bitcoin: XRP boasts significantly faster transaction speeds and lower fees than Bitcoin, making it a more attractive option for everyday transactions and cross-border payments.

- Lower transaction fees: The low cost associated with XRP transactions makes it a compelling alternative for businesses and individuals seeking cost-effective solutions.

- Potential for wider adoption in cross-border payments: XRP's technology is well-suited for facilitating international payments, a market ripe for disruption. Its existing partnerships with financial institutions could accelerate this adoption.

Increased Trading Volume and Market Sentiment

The recent surge in XRP's price has been accompanied by a substantial increase in trading volume, indicating a high level of investor interest and activity. This surge isn't just about price; it reflects a genuine shift in market dynamics.

Analyzing the Trading Volume Spike

- Data from major cryptocurrency exchanges showing increased XRP trading volume: Major exchanges like Coinbase, Binance, and Kraken have all reported significant increases in XRP trading volume, corroborating the market's increased interest.

- Comparison of XRP trading volume with previous periods: Comparing current trading volume with previous periods reveals a substantial increase, showcasing the magnitude of the recent surge.

- Correlation between price increase and trading volume: The strong correlation between XRP's price increase and its trading volume suggests a genuine market driver, rather than a manipulated event.

Positive Market Sentiment and FOMO

The positive news surrounding potential ETF approvals, coupled with XRP's unique characteristics, has created a wave of optimism, leading to a fear of missing out (FOMO) among investors. This psychological effect amplifies the price increase.

- Social media sentiment analysis regarding XRP: Social media platforms are buzzing with positive sentiment towards XRP, further fueling the rally.

- News articles and analyst predictions contributing to positive sentiment: Numerous news outlets and financial analysts have published positive predictions about XRP's future, further reinforcing the bullish sentiment.

- Impact of FOMO on trading activity: The fear of missing out is a powerful driver in the crypto market, pushing investors to jump in before the price rises even further.

Regulatory Landscape and its Impact on XRP

The regulatory landscape surrounding XRP is complex and plays a crucial role in its price volatility. The ongoing SEC lawsuit and global regulatory trends significantly impact investor sentiment and trading activity.

The Ongoing SEC Lawsuit and its Potential Resolution

The SEC lawsuit against Ripple is a crucial factor impacting XRP's price. A favorable resolution could significantly boost XRP's price and market position. Conversely, a negative outcome could severely impact it.

- Summary of the current status of the SEC lawsuit: A concise overview of the current legal proceedings is essential for understanding the situation.

- Potential outcomes and their impact on XRP's value: Analyzing potential outcomes and their implications on XRP's value is crucial for investors.

- Expert opinions on the likely resolution: Gathering insights from legal experts and market analysts provides a well-rounded perspective.

Global Regulatory Developments and their Relevance to XRP

The regulatory landscape for cryptocurrencies is evolving globally. Positive regulatory developments in various jurisdictions could create a more favorable environment for XRP's adoption and wider acceptance.

- Discussion of regulatory changes in key markets: Highlighting regulatory shifts in major markets provides context for XRP's future prospects.

- Impact of regulatory clarity on investor confidence: Clarity on regulations often leads to increased investor confidence and participation.

- Potential opportunities for XRP in regulated markets: A regulated market offers greater stability and attracts more institutional investors.

Conclusion

XRP's recent surge past Solana, fueled by anticipation surrounding Bitcoin ETF approvals and positive market sentiment, highlights the interconnectedness of the cryptocurrency market. The potential for increased institutional investment, coupled with XRP's unique features and the ongoing legal battle's potential for a positive resolution, makes it a compelling asset to watch. While uncertainty remains, the current trend suggests significant growth potential. Stay informed about the latest developments regarding XRP and the broader crypto market to capitalize on potential investment opportunities. Continue researching XRP to make informed investment decisions. Understanding the nuances of the XRP market and the impact of ETF approvals is key to navigating this dynamic space.

Featured Posts

-

Japan Trading House Shares Surge Berkshire Hathaways Long Term Investment

May 08, 2025

Japan Trading House Shares Surge Berkshire Hathaways Long Term Investment

May 08, 2025 -

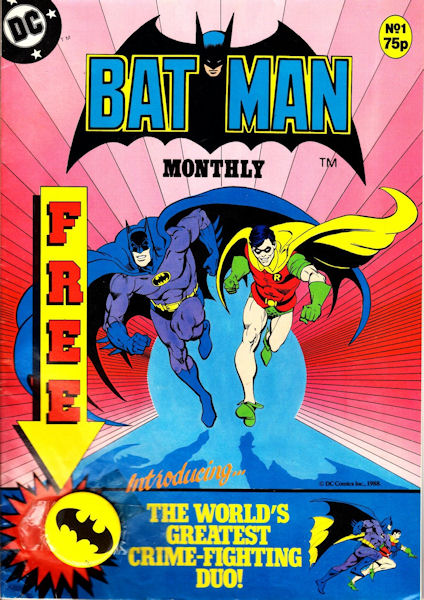

Batman Relaunched New 1 Issue And Costume Unveiled

May 08, 2025

Batman Relaunched New 1 Issue And Costume Unveiled

May 08, 2025 -

Triunfo Del Psg En Su Visita A Lyon

May 08, 2025

Triunfo Del Psg En Su Visita A Lyon

May 08, 2025 -

360

May 08, 2025

360

May 08, 2025 -

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 08, 2025

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 08, 2025