XRP Trading Volume Outpaces Solana Amidst ETF Speculation

XRP's Recent Trading Volume Surge

XRP has experienced a remarkable increase in trading volume in recent weeks. This surge is particularly noteworthy when compared to its performance in previous months and, more importantly, against the performance of other altcoins like Solana. The increase isn't just marginal; we're talking about a substantial jump in trading activity.

- Data Points: Compared to the average daily volume of the previous month, XRP's trading volume increased by approximately X% (replace X with actual percentage). On [Date], daily volume reached [Number] units, exceeding Solana's volume by [Percentage]%.

- Exchanges: Major exchanges like Binance, Coinbase, and Kraken have all reported significantly higher XRP trading volumes, suggesting broad market participation.

- Visual Representation: [Insert chart or graph visualizing the XRP volume surge, clearly labeled and showing comparison to Solana].

The Influence of Potential Bitcoin and Ethereum ETF Approvals

The anticipation surrounding potential Bitcoin and Ethereum ETF approvals is a key driver of the overall market sentiment. Increased institutional investment, fueled by the accessibility of ETFs, is expected to bring significant liquidity to the cryptocurrency market. This positive sentiment isn't confined to Bitcoin and Ethereum; it often spills over into the altcoin market, impacting assets like XRP.

- Mechanism: ETF approval enhances institutional participation, attracting significant capital inflows into the crypto market. This increased liquidity can trigger upward price movements across various cryptocurrencies.

- Increased Liquidity: The influx of institutional money significantly boosts market liquidity, making it easier to buy and sell cryptocurrencies without significant price swings.

- Reduced Risk Perception: ETFs are generally considered less risky investments compared to directly buying and holding cryptocurrencies, leading to a more positive perception of the entire crypto space.

Solana's Performance and Comparison to XRP

While XRP trading volume has surged, Solana's performance has been comparatively subdued. Understanding this divergence requires analyzing both market sentiment and project-specific factors.

- Data Comparison: [Insert chart or graph comparing XRP and Solana trading volumes over a specific period]. Show clearly how XRP has outpaced Solana.

- Solana Developments: Recent news and developments regarding Solana's network or ecosystem (e.g., any network issues, updates, or regulatory challenges) might be influencing its trading volume.

- Influencing Factors: Regulatory uncertainty, network congestion issues, or simply shifting market sentiment toward other projects could explain the relative underperformance of Solana compared to XRP.

Analyzing the Potential Implications for XRP Investors

The increased XRP trading volume, coupled with the positive sentiment generated by ETF speculation, presents both opportunities and risks for XRP investors.

- Potential Price Movements: The higher trading volume suggests increased interest in XRP. However, predicting precise price movements remains challenging, depending on various factors including broader market conditions and news impacting XRP specifically.

- Risk Factors: Investing in cryptocurrencies always involves inherent risk. Price volatility, regulatory uncertainty, and security concerns remain relevant considerations.

- Investment Advice: Short-term investors may see this as an opportunity to capitalize on the increased volatility, while long-term investors may view this as a positive indicator of growing market confidence in XRP's future. Always conduct thorough research and understand your risk tolerance.

Conclusion

The recent surge in XRP trading volume, significantly outpacing Solana's, is a noteworthy development in the cryptocurrency market. The strong correlation with the ongoing speculation about Bitcoin and Ethereum ETF approvals highlights the potential ripple effect on altcoins. While this increased activity presents potential opportunities for XRP investors, it's crucial to remember the inherent risks associated with cryptocurrency investments.

Stay informed about the evolving dynamics of XRP trading volume and the impact of ETF speculation. Continue your research into XRP and make informed decisions about your cryptocurrency investments.

Watch Inter Vs Barcelona Live Uefa Champions League Football

Watch Inter Vs Barcelona Live Uefa Champions League Football

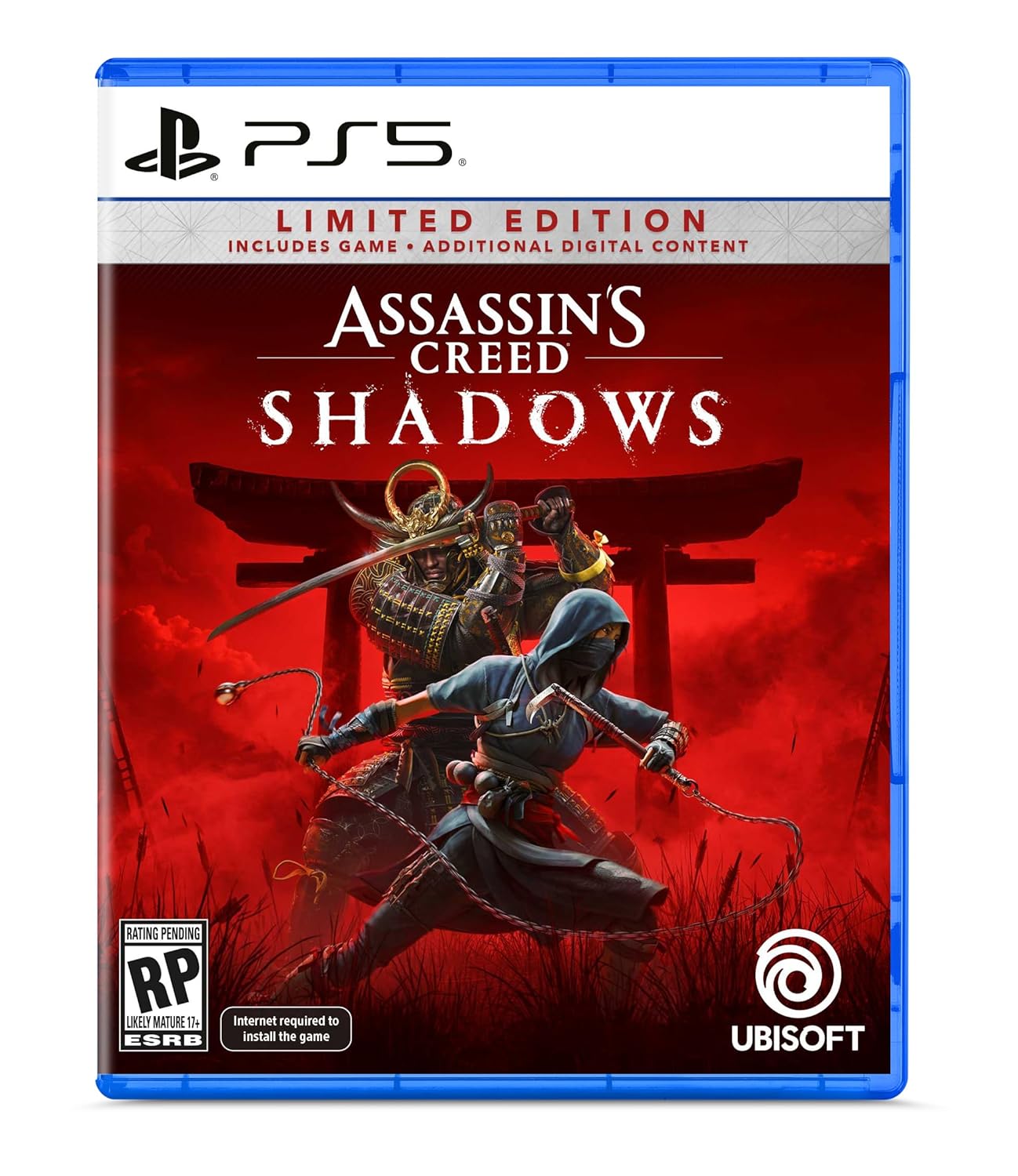

Assassins Creed Shadows Of Mordor Ps 5 Pro Ray Tracing Performance Analysis

Assassins Creed Shadows Of Mordor Ps 5 Pro Ray Tracing Performance Analysis

Broadcoms V Mware Acquisition At And T Faces A 1 050 Cost Increase

Broadcoms V Mware Acquisition At And T Faces A 1 050 Cost Increase

Angels Offensive Slump Deepens 13 Additional Strikeouts In Twins Series Loss

Angels Offensive Slump Deepens 13 Additional Strikeouts In Twins Series Loss

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad