XRP's Potential: ETF Applications, SEC Decisions, And Ripple's Next Chapter

Table of Contents

The SEC Lawsuit and its Ripple Effects on XRP's Price and Adoption

The SEC lawsuit against Ripple Labs, which alleged that XRP was an unregistered security, significantly impacted XRP's price and adoption. The uncertainty surrounding the case created volatility in the XRP market. However, the judge's partial ruling in July 2023 brought a degree of clarity, declaring that institutional sales of XRP did not constitute unregistered securities offerings. This development had a positive impact on XRP's price and investor sentiment, although the ruling remains complex and open to interpretation.

-

The Judge's Ruling and its Implications: The partial summary judgment wasn't a complete victory for either side. While it clarified the status of some XRP sales, the question of whether programmatic sales constituted securities remains. This ambiguity continues to influence the price.

-

Impact on XRP Listings on Exchanges: Many exchanges delisted XRP during the height of the lawsuit, causing decreased liquidity and accessibility. However, following the partial ruling, several exchanges have reinstated XRP trading, improving access for investors.

-

Impact on Investor Sentiment and Trading Volume: The lawsuit created significant uncertainty, leading to decreased investor confidence and trading volume. The partial ruling helped restore some confidence, leading to an increase in trading volume. However, complete regulatory clarity is still needed to fully unlock XRP's potential.

-

Potential Future Legal Challenges: Despite the partial ruling, the SEC could still appeal the decision, and further legal challenges remain a possibility. This uncertainty continues to be a factor influencing XRP's price and adoption.

The Rise of XRP ETFs: A Catalyst for Mainstream Adoption?

The growing interest in XRP exchange-traded funds (ETFs) represents a potential catalyst for mainstream adoption. XRP ETFs would offer investors easier access to XRP through regulated channels, potentially increasing liquidity and reducing the barriers to entry. This increased accessibility could significantly boost XRP's price and overall market capitalization.

-

Benefits of XRP ETFs for Investors: XRP ETFs provide increased convenience and regulatory compliance compared to directly purchasing XRP on cryptocurrency exchanges. This ease of access is attractive to institutional investors and retail investors alike.

-

Potential Impact on XRP's Price and Liquidity: The approval of XRP ETFs could lead to increased demand, driving up the price. The increased trading volume through regulated exchanges would also significantly enhance liquidity.

-

Regulatory Hurdles for XRP ETF Approval: Securing approval for an XRP ETF faces significant regulatory hurdles, particularly given the ongoing debate surrounding the classification of XRP as a security. The SEC's stance on cryptocurrencies will play a critical role in the approval process.

-

Companies Pursuing XRP ETF Applications: Several companies are actively exploring and potentially preparing applications for XRP ETFs, suggesting growing confidence in XRP's future and potential market demand.

Ripple's Strategic Initiatives and the Future of XRP

Ripple's ongoing projects and initiatives are crucial to XRP's long-term success. Ripple's focus on building its RippleNet payment network and fostering partnerships globally is driving XRP adoption. Their continued technological advancements are also key to maintaining XRP's competitiveness in the evolving cryptocurrency landscape.

-

Ripple's Partnerships and Collaborations: Ripple has built a strong network of partnerships with financial institutions globally, integrating XRP into their payment systems. These partnerships are critical for expanding XRP's reach and utility.

-

Ripple's Efforts in Promoting XRP Adoption: Ripple actively engages in initiatives to promote XRP adoption among businesses and institutions, showcasing its potential as a fast, efficient, and cost-effective solution for cross-border payments.

-

Ripple's Technology and its Potential Applications: Ripple's technology, particularly the XRP Ledger, is known for its speed and scalability. This technology has applications beyond payments, including supply chain management and other areas.

-

Ripple's Community Engagement Strategies: Ripple’s engagement with its community is vital for fostering support and driving XRP adoption. Active participation and communication build trust and contribute to the long-term success of the project.

Technological Advancements and XRP's Scalability

The XRP Ledger continues to see improvements in terms of transaction speed and efficiency. These advancements enhance XRP's scalability, addressing potential limitations that could hinder broader adoption.

-

Upgrades and Improvements to the XRP Ledger: Ongoing development and upgrades to the XRP Ledger ensure its ability to handle a growing volume of transactions efficiently and securely.

-

XRP's Scalability Compared to Other Cryptocurrencies: XRP's scalability compares favorably to many other cryptocurrencies, making it a potentially more efficient solution for large-scale transactions.

-

Potential for Increased Adoption Due to Technological Advancements: Continuous technological enhancements are crucial for attracting new users and maintaining XRP's competitiveness in the constantly evolving cryptocurrency market.

Conclusion

The future of XRP remains inextricably linked to the regulatory landscape, the success of XRP ETF applications, and Ripple's ongoing strategic initiatives. While uncertainty remains, the partial victory in the SEC lawsuit and the growing interest in XRP ETFs suggest significant potential for growth. The continuous technological advancements and Ripple's proactive approach to partnership development further strengthen XRP's position in the cryptocurrency market. To make informed decisions, stay abreast of the latest developments surrounding XRP and its ecosystem. Continue to research and understand the potential of XRP and its role in the evolving cryptocurrency landscape. Follow the developments in XRP and its ETF applications for a deeper understanding of this promising digital asset.

Featured Posts

-

Bibee Guardians Overcome Judge Yankees In 3 2 Thriller

May 01, 2025

Bibee Guardians Overcome Judge Yankees In 3 2 Thriller

May 01, 2025 -

Anchor Brewing Companys Closure A Legacy Ends After 127 Years

May 01, 2025

Anchor Brewing Companys Closure A Legacy Ends After 127 Years

May 01, 2025 -

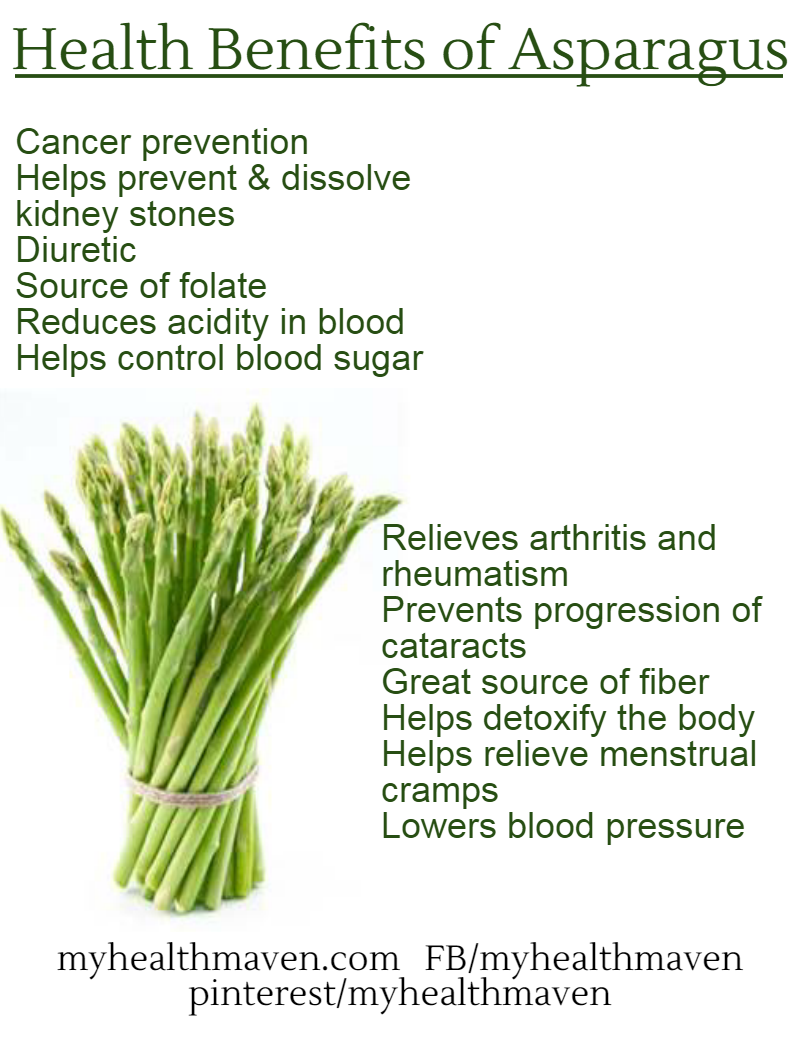

How Healthy Is Asparagus Nutritional Benefits And Health Effects

May 01, 2025

How Healthy Is Asparagus Nutritional Benefits And Health Effects

May 01, 2025 -

Mail Delays In Louisville Congressman Calls Out Usps Lack Of Transparency

May 01, 2025

Mail Delays In Louisville Congressman Calls Out Usps Lack Of Transparency

May 01, 2025 -

Open Ais New Tools For Effortless Voice Assistant Creation 2024 Developer Event

May 01, 2025

Open Ais New Tools For Effortless Voice Assistant Creation 2024 Developer Event

May 01, 2025