XRP's Strong Performance: Outpacing Bitcoin And Other Cryptocurrencies After Grayscale ETF News

Table of Contents

The cryptocurrency market has been buzzing with excitement following Grayscale's Bitcoin ETF application, but one digital asset has quietly stolen the show: XRP. This altcoin has demonstrated exceptional post-Grayscale performance, significantly outpacing Bitcoin and many other cryptocurrencies. This article delves into the factors driving XRP's impressive rally, exploring the technical analysis, market sentiment, and future outlook for this increasingly popular digital asset.

Grayscale's Spot Bitcoin ETF Application and its Ripple Effect on XRP

Grayscale's ongoing legal battle with the SEC over its spot Bitcoin ETF application is the undeniable catalyst for the recent market surge. A potential approval could dramatically shift the cryptocurrency landscape, leading to a massive influx of institutional investment into Bitcoin. However, the positive ripple effect extends far beyond Bitcoin alone, significantly impacting altcoins like XRP.

-

The Catalyst: How the SEC's Potential Approval Impacts the Entire Market: The SEC's decision will profoundly affect investor confidence across the cryptocurrency market. A positive ruling would likely trigger a broad market rally, boosting investor confidence in both Bitcoin and altcoins. The anticipation surrounding this decision itself fuels speculation and drives significant trading activity.

-

XRP's Unique Position: Why it's Benefiting Disproportionately: XRP's exceptional performance isn't merely coincidental. Its established use case in cross-border payments, coupled with the ongoing Ripple vs. SEC lawsuit, positions it uniquely for substantial price appreciation. A positive resolution to the legal battle could be a major catalyst. Moreover, general positive sentiment towards Bitcoin ETFs often spills over into the altcoin market, benefiting assets with strong fundamentals and utility, such as XRP. The price performance comparison between XRP, Bitcoin, and other major cryptocurrencies clearly demonstrates XRP's outperformance in this period. [Insert chart/graph comparing XRP, BTC, and other major altcoins here].

Technical Analysis: Understanding XRP's Price Surge

A closer look at XRP's price charts reveals several key technical indicators that support the recent price surge.

-

Chart Patterns and Indicators: Identifying Key Trends: XRP's price charts showcase clear bullish patterns, with the asset breaking through significant resistance levels accompanied by a notable increase in trading volume. Technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages all point to strong upward momentum. A successful breakout from a period of consolidation could signal even further price appreciation.

-

Trading Volume and Market Sentiment: Gauging Investor Confidence: The dramatic increase in XRP trading volume, combined with overwhelmingly positive social media sentiment, underscores a significant surge in investor confidence. News-driven trading activity, particularly surrounding the Grayscale ETF application and Ripple's legal progress, has amplified the price increase. Increased institutional investment is also believed to be a contributing factor to the upward trajectory.

Future Outlook: Is the XRP Rally Sustainable?

While XRP's recent performance has been remarkable, considering its long-term sustainability requires a balanced perspective.

-

Factors Contributing to Continued Growth: Widespread adoption of XRP in cross-border payments, strategic partnerships and collaborations, and positive regulatory developments could all contribute to sustained growth. The ongoing development of Ripple's technology and its expansion into new markets are also key factors.

-

Potential Risks and Challenges: The ongoing legal uncertainty surrounding XRP and Ripple remains a significant risk. Market corrections are inherent in the cryptocurrency market, and periods of volatility could impact XRP's price negatively. Concerns about market manipulation and the overall volatility of the cryptocurrency market should also be carefully considered.

Conclusion: Investing in XRP After the Grayscale News: A Cautious Approach

XRP's impressive post-Grayscale rally is undeniably linked to the positive sentiment surrounding the Bitcoin ETF application and broader market optimism. While the potential for future growth is significant, investors must acknowledge the inherent risks associated with the cryptocurrency market. Before investing in XRP, thorough research is crucial. Diversification of your investment portfolio and responsible investment strategies are paramount. Only invest what you can afford to lose and stay informed about the latest news and developments concerning XRP and the broader cryptocurrency market. Remember, making informed decisions is key to successful investing in XRP.

Featured Posts

-

Arsenal Manager Arteta Under Fire From Collymore News And Analysis

May 08, 2025

Arsenal Manager Arteta Under Fire From Collymore News And Analysis

May 08, 2025 -

The Long Walk Trailer Intense Footage And First Impressions

May 08, 2025

The Long Walk Trailer Intense Footage And First Impressions

May 08, 2025 -

Jayson Tatum Wrist Injury Boston Celtics Head Coachs Statement

May 08, 2025

Jayson Tatum Wrist Injury Boston Celtics Head Coachs Statement

May 08, 2025 -

Kripto Varliklar Ve Riskler Bakan Simsek In Aciklamalari

May 08, 2025

Kripto Varliklar Ve Riskler Bakan Simsek In Aciklamalari

May 08, 2025 -

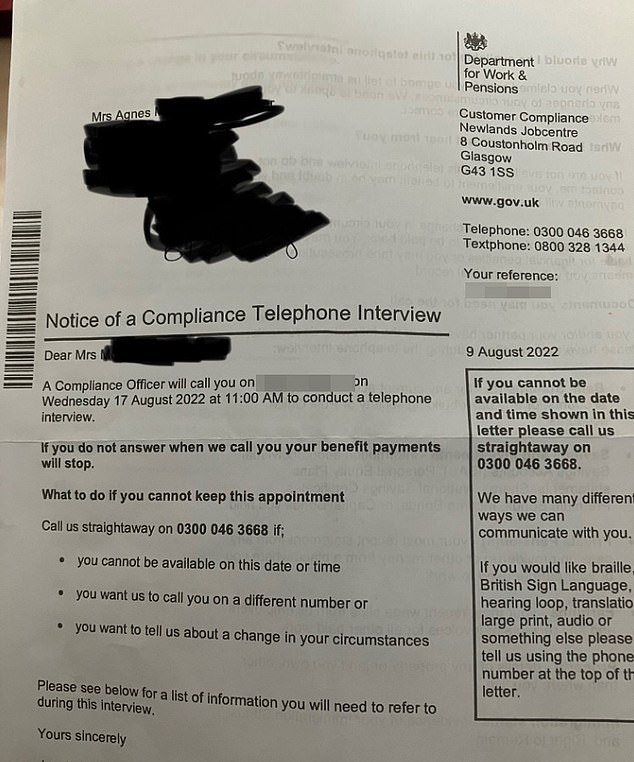

Action Needed Missing Dwp Letter Could Cost You 6 828

May 08, 2025

Action Needed Missing Dwp Letter Could Cost You 6 828

May 08, 2025