XRP's Uncertain Future: Analyzing The Derivatives Market's Influence

Table of Contents

The Ripple Case and its Impact on XRP Derivatives Trading

The ongoing Ripple lawsuit against the SEC has cast a long shadow over the XRP ecosystem, significantly impacting the XRP derivatives market. The SEC's assertion that XRP is an unregistered security has led to delistings on several major cryptocurrency exchanges, creating uncertainty for traders and investors. This uncertainty has directly affected the trading volume and liquidity of XRP derivatives.

-

Reduced trading volume on major exchanges due to delisting concerns: Many exchanges, fearing regulatory repercussions, have delisted XRP, reducing the overall trading volume and consequently impacting the liquidity of its derivatives. This has made it harder for investors to easily buy or sell XRP-based derivative contracts.

-

Increased volatility stemming from news related to the lawsuit: Every court filing, expert testimony, or legal development in the Ripple case sends shockwaves through the XRP market, causing significant price swings. This heightened volatility directly translates into increased risk and opportunity within the XRP derivatives market, particularly for options traders.

-

Impact on the availability of XRP derivatives contracts: The legal uncertainty has discouraged some market makers from offering XRP derivatives contracts, further reducing liquidity and potentially limiting hedging opportunities for investors.

-

Emergence of decentralized exchanges and their role in the XRP derivatives market: Decentralized exchanges (DEXs) have stepped in to fill the void left by centralized exchanges, offering an alternative venue for trading XRP and its derivatives. However, DEXs often present challenges in terms of liquidity and regulatory clarity.

The legal uncertainties surrounding XRP directly affect investor confidence. Positive developments in the lawsuit often lead to price surges, while negative news can trigger significant sell-offs, creating substantial volatility within the XRP derivatives trading landscape. The lack of regulatory clarity adds to this instability, making it difficult to predict future market behavior.

Volatility and Liquidity in the XRP Derivatives Market

The relationship between XRP price volatility and the trading volume of its derivatives is inherently intertwined. High volatility often attracts traders seeking to profit from price swings, leading to increased trading activity in options contracts. However, the market's relatively small size compared to other cryptocurrencies like Bitcoin or Ethereum contributes to challenges in maintaining consistent liquidity.

-

High volatility leading to increased trading opportunities in options contracts: Options contracts allow traders to speculate on future price movements without owning the underlying asset (XRP). High volatility increases the potential for significant profits or losses, making options trading particularly attractive during periods of uncertainty.

-

Low liquidity in certain XRP derivative markets hindering efficient price discovery: Low liquidity can lead to wide bid-ask spreads, making it difficult to execute trades at favorable prices. This lack of liquidity is especially pronounced in some less-traded XRP derivative products.

-

Correlation between spot market price and derivative prices: Generally, the price of XRP derivatives is closely correlated with the spot price of XRP. However, significant deviations can occur during periods of extreme volatility or low liquidity.

-

Role of market makers and their influence on liquidity: Market makers play a critical role in providing liquidity to the XRP derivatives market. Their willingness to quote bid and ask prices helps facilitate trading, but their participation is affected by the overall level of risk and uncertainty.

The different types of XRP derivatives, including options, futures, and swaps, each offer unique strategies for hedging and speculation. Options contracts provide flexibility, while futures contracts offer standardized contracts for hedging future price risks. Swaps allow for the exchange of cash flows based on XRP price movements. However, maintaining liquidity in these relatively niche markets continues to be a significant challenge.

The Role of Institutional Investors in the XRP Derivatives Market

Currently, institutional participation in the XRP derivatives market remains relatively limited compared to other more established cryptocurrencies. Regulatory uncertainty, perceived risk, and the lack of a well-established regulatory framework contribute to this limited involvement.

-

Limited institutional participation compared to other cryptocurrencies: Many institutional investors are hesitant to invest heavily in XRP due to the ongoing legal uncertainty and regulatory ambiguity.

-

Potential for increased institutional involvement if regulatory clarity improves: Clearer regulatory guidelines regarding XRP's status could significantly increase institutional investor participation. This increased interest would likely boost market liquidity and reduce volatility.

-

Impact of institutional trading strategies on price and volatility: The actions of large institutional investors can disproportionately influence XRP's price and volatility. Their trading strategies, whether hedging or speculative, can have a significant impact on the market.

-

Use of derivatives for hedging and speculation by institutional actors: Institutional investors may utilize XRP derivatives for hedging against price risks associated with their XRP holdings or for speculative trading opportunities.

Decentralized Finance (DeFi) and XRP Derivatives

The rise of Decentralized Finance (DeFi) has opened new avenues for XRP derivatives trading. DeFi protocols offer alternative platforms for accessing these instruments, potentially increasing accessibility and innovation while presenting unique challenges.

-

Advantages and disadvantages of decentralized XRP derivatives exchanges: DEXs offer certain advantages, such as increased transparency and reduced reliance on centralized intermediaries. However, they also present challenges, including potential smart contract vulnerabilities and the lack of regulatory oversight.

-

Transparency and security concerns related to DeFi protocols: While DeFi aims for increased transparency, smart contract vulnerabilities and potential exploits remain a concern. Security audits and rigorous testing are crucial to mitigate these risks.

-

Potential for increased innovation and accessibility: DeFi protocols have the potential to foster innovation in XRP derivatives products and increase access to these instruments for a wider range of users.

-

Regulatory implications of DeFi-based XRP derivatives: The regulatory landscape for DeFi-based XRP derivatives is still evolving and poses challenges in terms of oversight and compliance.

Conclusion

The XRP derivatives market, while still developing, plays a crucial role in shaping the future of XRP. The ongoing legal battles and regulatory uncertainty significantly influence trading volume, volatility, and liquidity. Understanding the interplay between these factors, particularly the evolving role of institutional investors and the emergence of DeFi-based derivatives, is key to navigating the complexities of this market. Increased regulatory clarity could significantly boost institutional participation, ultimately enhancing the maturity and stability of the XRP derivatives market. Therefore, continued monitoring of the XRP derivatives market and its evolution is crucial for all investors seeking to understand the full picture of XRP's uncertain future. Stay informed about developments in the XRP derivatives market to make informed investment decisions.

Featured Posts

-

Pakistans Global Trade Ahsans Push For Technological Advancement

May 08, 2025

Pakistans Global Trade Ahsans Push For Technological Advancement

May 08, 2025 -

Arsenal Manager Arteta Under Fire From Collymore News And Analysis

May 08, 2025

Arsenal Manager Arteta Under Fire From Collymore News And Analysis

May 08, 2025 -

Sufians Praise For Gcci Presidents Successful Made In Gujranwala Exhibition

May 08, 2025

Sufians Praise For Gcci Presidents Successful Made In Gujranwala Exhibition

May 08, 2025 -

3 Factors Suggesting A Potential Xrp Price Rally Ripple And Remittix

May 08, 2025

3 Factors Suggesting A Potential Xrp Price Rally Ripple And Remittix

May 08, 2025 -

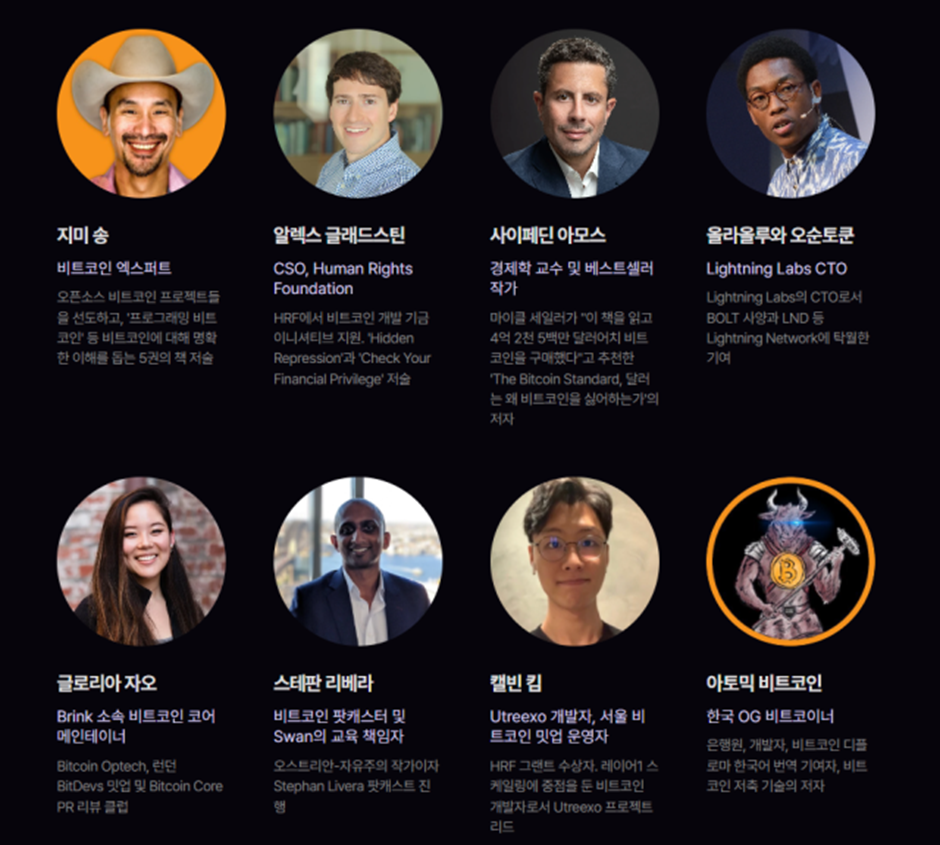

Bitcoin Seoul 2025 Asias Largest Bitcoin Conference

May 08, 2025

Bitcoin Seoul 2025 Asias Largest Bitcoin Conference

May 08, 2025