Your Real Safe Bet Portfolio: Building A Secure Financial Future

Table of Contents

Understanding Your Risk Tolerance & Financial Goals

Before diving into specific investments, understanding your risk tolerance and financial goals is paramount. This self-assessment forms the bedrock of your safe bet portfolio strategy. Your investment choices should directly reflect your comfort level with risk and your long-term objectives.

-

Define your investment timeline: Are you saving for retirement (long-term), a down payment (mid-term), or an upcoming vacation (short-term)? Your timeline significantly impacts your investment choices. Long-term goals allow for greater risk tolerance, while short-term goals necessitate a more conservative approach.

-

Determine your risk tolerance: Are you a conservative investor prioritizing capital preservation, a moderate investor seeking a balance between risk and return, or an aggressive investor comfortable with higher risk for potentially higher returns? Honest self-assessment is crucial. Consider using online risk tolerance questionnaires to gauge your comfort level.

-

Set realistic financial goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) goals. This could include a desired retirement income, a down payment on a house, funding your children's education, or building a specific level of wealth.

-

Consider professional financial advice: If you're unsure about any aspect of your risk tolerance or financial goal setting, consider consulting a qualified financial advisor. They can provide personalized guidance and help you create a comprehensive investment strategy.

Diversification: The Cornerstone of a Safe Bet Portfolio

Portfolio diversification is the cornerstone of any safe bet portfolio. It involves spreading your investments across various asset classes to mitigate risk. Don't put all your eggs in one basket!

-

Benefits of asset class diversification: Diversification reduces the impact of poor performance in any single asset class. If one investment underperforms, others may offset those losses.

-

Geographic and sector diversification: Diversifying across different geographies and economic sectors further reduces risk. A downturn in one region or industry won't necessarily impact all your investments.

-

Examples of diversified portfolios: A conservative portfolio might consist primarily of bonds and high-yield savings accounts. A moderate portfolio might include a mix of bonds, stocks, and real estate. An aggressive portfolio might have a higher allocation to stocks and other higher-growth investments.

-

Different investment types: Consider including a mix of asset classes such as stocks (individual stocks, mutual funds, ETFs), bonds (government bonds, corporate bonds), real estate (REITs, direct property investment), and alternative investments (depending on your risk tolerance).

Core Holdings: Building the Foundation of Your Safe Bet Portfolio

Your safe bet portfolio needs a strong foundation of core holdings—stable, low-risk investments that provide a base of capital preservation and potentially some income.

-

Role of low-risk investments: These investments aim to protect your principal while generating a steady, albeit often modest, return.

-

Government bonds: Generally considered very low-risk, offering a relatively predictable return and stability.

-

High-quality corporate bonds: Offer slightly higher yields than government bonds but carry a slightly higher level of risk.

-

High-yield savings accounts and CDs (Certificates of Deposit): Provide readily accessible funds with FDIC insurance (up to certain limits) and offer relatively low returns but are highly liquid.

-

Stable value funds: These mutual funds aim to maintain a stable net asset value, making them a relatively low-risk option.

Strategic Allocation of Growth Investments

While core holdings provide stability, incorporating growth investments strategically adds the potential for long-term capital appreciation.

-

Balancing core and growth: The proportion of growth investments depends entirely on your risk tolerance and investment timeline. Younger investors with longer timelines can often tolerate a higher proportion of growth investments.

-

Index funds and ETFs: These offer diversified exposure to broad market indexes (like the S&P 500), providing a relatively efficient way to gain exposure to the stock market without extensive research.

-

Importance of rebalancing: Regularly rebalancing your portfolio—adjusting the allocation of assets to maintain your desired asset allocation—is crucial. This helps to control risk and capitalize on market fluctuations.

Regular Review and Rebalancing

Your safe bet portfolio isn't a "set it and forget it" strategy. Regular review and rebalancing are essential.

-

Importance of regular reviews: Annual or semi-annual reviews allow you to monitor your portfolio's performance, assess your progress towards your financial goals, and make necessary adjustments.

-

Rebalancing process: Rebalancing involves selling some of the assets that have outperformed their targets and buying more of those that have underperformed, bringing your portfolio back to your desired asset allocation.

-

Adapting to market changes: Market conditions change. Your investment strategy may need adjustments based on economic factors, interest rate changes, or other relevant events. Staying informed is key.

Conclusion

Building a safe bet portfolio requires careful planning and a long-term perspective. By understanding your risk tolerance, diversifying your assets, establishing a strong core of low-risk investments, and regularly reviewing and rebalancing your portfolio, you can significantly increase your chances of building a secure financial future. Don't delay your path to financial security. Start building your safe bet portfolio today! Learn more about creating a personalized investment strategy tailored to your needs and goals.

Featured Posts

-

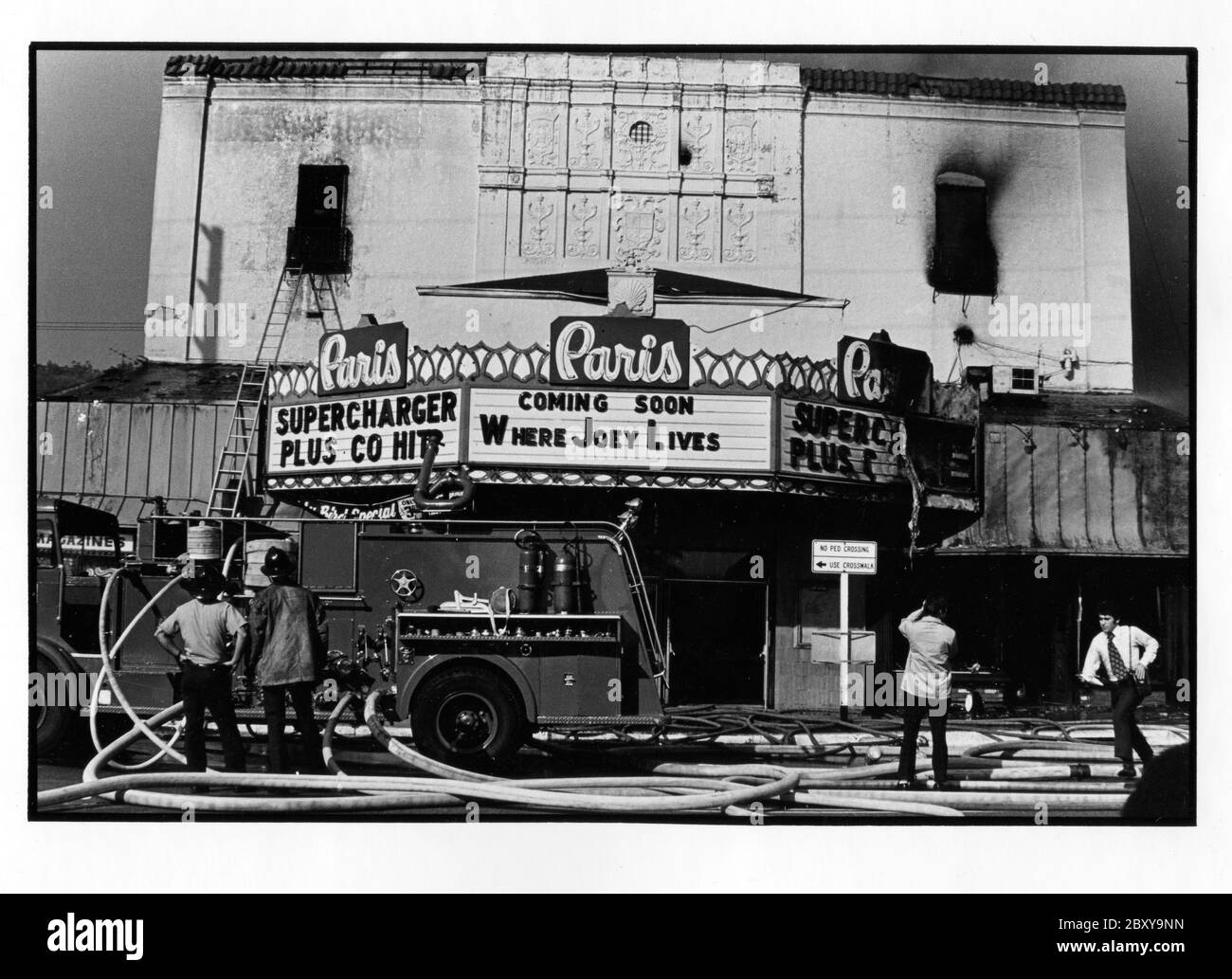

Un Debut D Incendie Mobilise Les Pompiers A La Mediatheque Champollion De Dijon

May 09, 2025

Un Debut D Incendie Mobilise Les Pompiers A La Mediatheque Champollion De Dijon

May 09, 2025 -

Warming Temperatures Soft Mud Slow Anchorage Fin Whale Skeleton Recovery Efforts

May 09, 2025

Warming Temperatures Soft Mud Slow Anchorage Fin Whale Skeleton Recovery Efforts

May 09, 2025 -

Is This Uk City Facing A Ghettoisation Crisis Due To Caravan Sites

May 09, 2025

Is This Uk City Facing A Ghettoisation Crisis Due To Caravan Sites

May 09, 2025 -

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Automakers

May 09, 2025

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Automakers

May 09, 2025 -

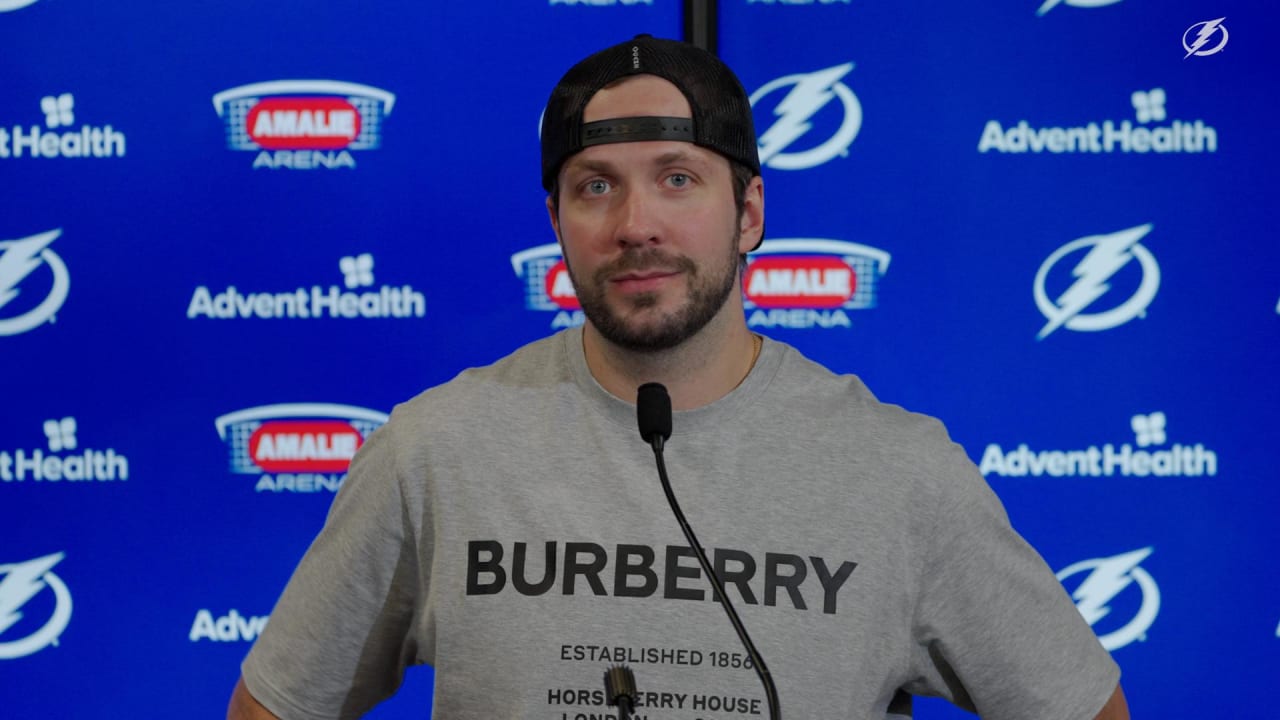

Kucherovs Brilliance Leads Lightning To 4 1 Victory Over Oilers

May 09, 2025

Kucherovs Brilliance Leads Lightning To 4 1 Victory Over Oilers

May 09, 2025