Yuan Trading Range Widens As PBOC Intervention Decreases

Table of Contents

Reduced PBOC Intervention and its Impact

The PBOC's decreased involvement in managing the Yuan's exchange rate signifies a potential transition towards a more market-determined mechanism. This move reflects a broader strategic objective: to allow market forces a greater influence in setting the currency's value.

Decreased Market Manipulation

- Reduced buying and selling of Yuan in the forex market: The PBOC is less actively intervening to control the Yuan's value against other currencies. This means fewer direct interventions to support or suppress the currency.

- Increased reliance on market supply and demand: The Yuan's exchange rate is now more susceptible to the interplay of market forces, meaning its value is determined more by the balance of supply and demand for the currency in the global market.

- Greater transparency in the exchange rate setting: While not entirely transparent, the reduced intervention leads to a less controlled, and potentially more transparent, exchange rate setting process, although market forces remain complex and unpredictable.

Implications for Currency Volatility

Less intervention directly translates to heightened volatility in the Yuan's exchange rate. This increased volatility manifests as a wider Yuan trading range, meaning larger price swings within a given period.

- Increased fluctuations in daily Yuan exchange rates: Investors and businesses can expect to see more significant daily variations in the Yuan's value against other major currencies like the US dollar (USD), the Euro (EUR), and the Japanese Yen (JPY).

- Greater potential for both appreciation and depreciation: The Yuan's value can now appreciate or depreciate more significantly depending on the prevailing market conditions and sentiment.

- Higher risk-reward profile for Yuan-denominated investments: Investing in Yuan-denominated assets carries a higher risk-reward profile due to the amplified volatility. This means higher potential returns but also a greater chance of losses.

Factors Contributing to the Widening Yuan Trading Range

Several factors are contributing to the expansion of the Yuan trading range, both external and internal to the Chinese economy.

Global Economic Uncertainty

Global economic headwinds significantly influence the Yuan's value, contributing directly to its wider trading range.

- Impact of US Federal Reserve monetary policy: Decisions by the US Federal Reserve, such as interest rate hikes, directly impact global capital flows and influence the relative value of the Yuan against the USD.

- Influence of the Eurozone economic climate: The economic health of the Eurozone also impacts the Yuan, as investors adjust their portfolios based on global economic forecasts.

- Geopolitical tensions and their effect on global capital flows: Global political instability and conflicts can lead to significant shifts in capital flows, affecting the demand for and thus the value of, the Yuan.

China's Economic Outlook

Domestic economic conditions within China also exert a strong influence on the Yuan's performance and contribute to the widening trading range.

- Impact of China's zero-Covid policy changes: The shift away from the zero-Covid policy has had substantial effects on the Chinese economy, impacting investor confidence and the Yuan's exchange rate.

- Effect of government stimulus measures on the economy: Government interventions, such as stimulus packages, aim to boost economic activity but can also impact the currency's value and its volatility.

- Influence of real estate market developments: The health and performance of China's real estate sector significantly influence overall economic confidence and consequently, the Yuan's exchange rate.

Strategies for Navigating the Widening Yuan Trading Range

Navigating the expanded Yuan trading range requires careful planning and strategic implementation.

Hedging Strategies for Businesses

Businesses engaged in international trade with China should actively consider employing hedging techniques to mitigate currency risks stemming from the volatile Yuan trading range.

- Forward contracts and options contracts: These financial instruments can help lock in exchange rates for future transactions, protecting against potential losses from adverse currency movements.

- Currency swaps and other hedging instruments: A range of other financial tools are available to manage currency risk, depending on specific business needs and risk tolerance.

- Diversification of currency exposure: Spreading out currency exposures across different currencies can help mitigate the impact of Yuan volatility on a business's overall financial performance.

Investment Opportunities and Risks

The increased volatility presents both opportunities and risks for investors. A cautious approach that prioritizes thorough risk assessment and diversification is crucial.

- Potential for higher returns in a volatile market: Skilled investors can potentially capitalize on the increased volatility through carefully selected investments and trading strategies.

- Increased risk of capital losses: The inherent volatility also increases the risk of significant capital losses, necessitating careful due diligence and risk management.

- Importance of thorough due diligence before investment: Conducting exhaustive research and employing appropriate risk assessment tools is critical before any investment in Yuan-denominated assets.

Conclusion

The widening Yuan trading range, largely driven by reduced PBOC intervention, fundamentally alters the dynamics of the Chinese currency. Understanding the interplay of global economic uncertainty and China's domestic economic conditions is paramount for businesses and investors alike. Implementing effective hedging strategies, coupled with rigorous risk assessments, are essential for successfully maneuvering this more volatile environment. Closely monitoring the Yuan trading range and proactively adjusting strategies in response to changing market conditions is vital for both risk management and potential opportunities. Continuously assess your exposure to the Yuan trading range and adapt your strategy accordingly.

Featured Posts

-

Paddy Pimblett Choked Unconscious 35 Second Loss To Ex Soldier

May 15, 2025

Paddy Pimblett Choked Unconscious 35 Second Loss To Ex Soldier

May 15, 2025 -

Direkt Ucuslar Ve Kibris Tatar In Son Aciklamalarinin Etkisi

May 15, 2025

Direkt Ucuslar Ve Kibris Tatar In Son Aciklamalarinin Etkisi

May 15, 2025 -

Celtics Injury Report Key Guard Out For Game 3 Against Magic

May 15, 2025

Celtics Injury Report Key Guard Out For Game 3 Against Magic

May 15, 2025 -

Dodgers Left Handed Hitters Can They Turn Things Around

May 15, 2025

Dodgers Left Handed Hitters Can They Turn Things Around

May 15, 2025 -

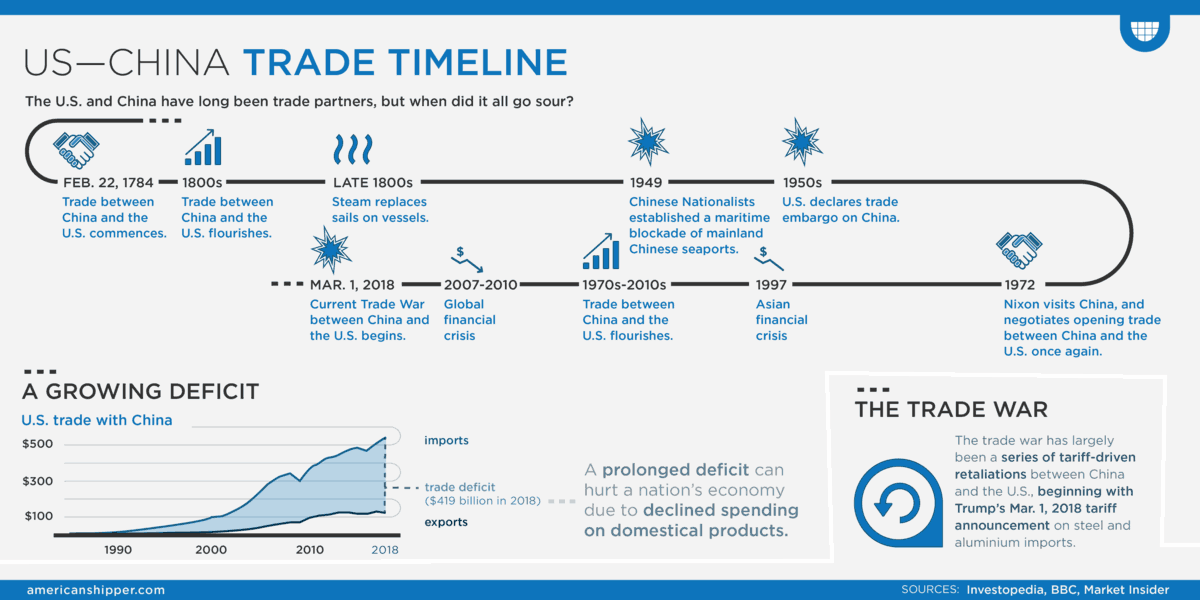

The Us China Trade War Who Conceded First

May 15, 2025

The Us China Trade War Who Conceded First

May 15, 2025