1,050% VMware Price Hike: AT&T's Concerns Over Broadcom's Acquisition

Table of Contents

The 1050% VMware Price Increase: A Deep Dive

The sheer magnitude of the VMware price hike is unprecedented. We're not talking about a minor adjustment; this is a 1050% increase in some cases, representing a transformative shift in the cost of essential virtualization software and services. This affects businesses of all sizes, from small startups to large corporations like AT&T. The impact varies depending on the specific VMware products and services utilized.

The reasons behind such a drastic price jump are complex, but Broadcom's strategy is a key factor. The acquisition allows Broadcom to leverage its market dominance and potentially extract maximum profit from a captive customer base. This strategy, while potentially lucrative in the short term, could have significant long-term consequences for the industry's competitiveness and innovation.

- Examples of specific VMware product price increases: Reports indicate price increases ranging from 1050% for certain licenses to more moderate hikes for others, depending on the product and licensing model. Specific numbers remain largely confidential due to individual contracts.

- Comparison of previous VMware pricing to the post-acquisition pricing: Before the acquisition, VMware’s pricing, while high, was generally considered competitive within the enterprise virtualization market. The post-acquisition prices represent a significant departure from this norm, potentially making alternatives more attractive.

- Impact on different sized businesses (small, medium, large): Smaller businesses may find themselves priced out of the market entirely, forcing them to seek less robust or more expensive alternatives. Medium-sized businesses face substantial budget challenges, while large corporations like AT&T are forced to reassess their IT spending and potentially negotiate with Broadcom.

AT&T's Vocal Opposition: Concerns and Implications

AT&T hasn't shied away from expressing its deep concern about the VMware price hike. The company, a major player in the telecommunications industry, relies heavily on VMware's virtualization technologies for its critical infrastructure. The significant cost increase directly threatens AT&T's operational efficiency and profitability.

The vulnerability stems from AT&T's extensive use of VMware across its network. A massive price increase like this leaves them with limited options. They may consider legal action, regulatory challenges, or exploring alternative virtualization solutions – all costly and potentially disruptive endeavors. The potential financial impact on AT&T's bottom line is considerable, potentially affecting its ability to invest in other areas of its business.

- Specific quotes from AT&T representatives: Public statements from AT&T have expressed serious apprehension, emphasizing the unfairness and potential market distortion caused by the drastic price increases. (Specific quotes can be included here if available from reputable news sources.)

- Analysis of AT&T's reliance on VMware technologies: AT&T's network infrastructure depends on VMware for virtualization, server management, and various other critical operations. Switching away would be a massive undertaking.

- Potential alternatives AT&T might consider: Alternatives like OpenStack, Kubernetes, or other virtualization platforms are available, but migrating away from VMware is a complex and time-consuming process.

- Potential financial impact on AT&T's bottom line: The price increase could represent hundreds of millions of dollars in additional costs annually for AT&T, impacting its profitability and potentially its investment strategies.

Broader Market Impacts of the VMware Price Hike

The implications of this VMware price hike extend far beyond AT&T. The increase affects businesses across various sectors, potentially stifling innovation and increasing the cost of doing business in the digital age. Smaller companies and startups may find themselves unable to afford VMware's products, shifting the market towards less expensive (and potentially less powerful) alternatives.

This could lead to increased competition in the virtualization market, driving innovation and forcing incumbents to reassess their pricing strategies. The impact on cloud computing and hybrid cloud strategies is also significant; many organizations rely on VMware for their hybrid cloud deployments, and increased costs could force a re-evaluation of these strategies.

- Impact on smaller companies and startups: Many startups depend on cost-effective solutions, and this price hike could shut them out of the market, hindering innovation.

- Potential for increased competition from alternative virtualization solutions: The drastic price increase will likely accelerate the adoption of open-source and alternative virtualization technologies.

- Predictions for future VMware pricing strategies: The future direction of VMware's pricing under Broadcom remains unclear, but the initial price hike suggests a focus on maximizing profits.

- Analysis of investor reactions to the price increase: Investors' reactions have been mixed, reflecting both the potential for short-term gains and long-term risks associated with such aggressive pricing strategies.

Regulatory Scrutiny and Potential Antitrust Concerns

The significant VMware price hike has naturally raised antitrust concerns. Regulatory bodies such as the FTC and the EU are likely to scrutinize Broadcom's actions, investigating potential violations of antitrust laws. The possibility of investigations, legal challenges, and potential penalties looms large. The outcome of this scrutiny could significantly impact not only Broadcom and VMware but also the broader technology industry's mergers and acquisitions landscape.

- Summary of regulatory actions taken or planned: (Information on any current investigations or actions should be included here from reliable news sources.)

- Opinions from industry experts on the regulatory landscape: Experts' opinions on the likelihood of regulatory intervention and potential outcomes will provide valuable context.

- Potential penalties Broadcom might face: Potential penalties could range from fines to forced divestitures, impacting Broadcom’s future strategies.

- Impact of regulatory decisions on future acquisitions in the tech sector: The outcome of this scrutiny will set a precedent for future mergers and acquisitions in the tech industry.

Conclusion: Navigating the Post-Acquisition VMware Landscape

The 1050% VMware price hike following Broadcom's acquisition is a watershed moment for the enterprise software market. AT&T's vocal opposition highlights the significant and far-reaching consequences of this drastic cost increase. The magnitude of the price increase—a 1050% jump in some instances—cannot be overstated; it forces businesses to rethink their IT strategies and potentially seek out alternatives. The impact extends beyond individual companies, raising serious antitrust concerns and prompting regulatory scrutiny.

To navigate this new landscape, businesses must stay informed about ongoing developments regarding the Broadcom acquisition and its impact on VMware pricing. Follow reputable news sources, track regulatory actions, and explore alternative solutions to mitigate the effects of this dramatic price increase. The future of VMware, and the virtualization market as a whole, will be shaped by the outcomes of these ongoing developments.

Featured Posts

-

The Importance Of Middle Management Benefits For Companies And Employees

Apr 22, 2025

The Importance Of Middle Management Benefits For Companies And Employees

Apr 22, 2025 -

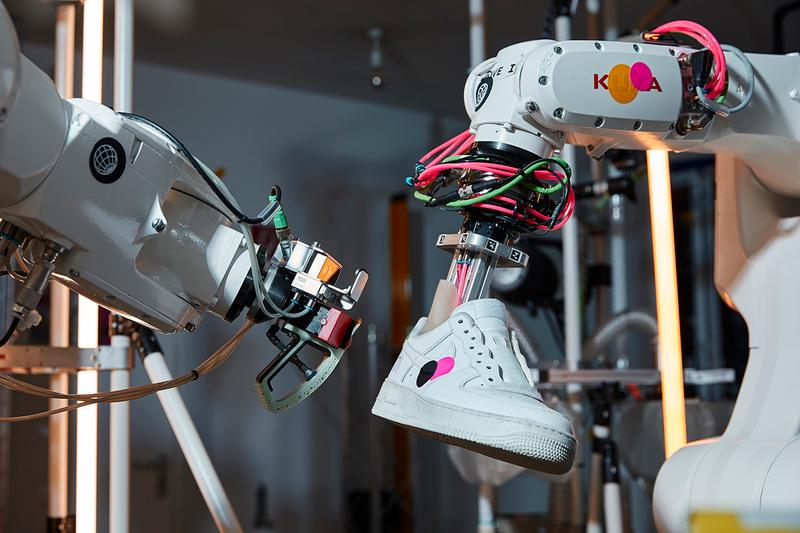

Addressing The Challenges Of Robotic Nike Shoe Production

Apr 22, 2025

Addressing The Challenges Of Robotic Nike Shoe Production

Apr 22, 2025 -

Analyzing The Economic Fallout Of Trumps Policies

Apr 22, 2025

Analyzing The Economic Fallout Of Trumps Policies

Apr 22, 2025 -

American Protests Against Trump A Cnn Politics Report

Apr 22, 2025

American Protests Against Trump A Cnn Politics Report

Apr 22, 2025 -

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

Apr 22, 2025

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

Apr 22, 2025