2% Drop In Amsterdam Stock Exchange Following Trump's Latest Tariffs

Table of Contents

H2: Immediate Market Reaction to the Tariffs

H3: AEX Index Plunge

The 2% plunge in the AEX Index occurred swiftly following the official announcement of the new tariffs. Trading volume spiked significantly, indicating heightened investor anxiety and a rapid sell-off. The volatility observed in the hours following the announcement suggests a high degree of uncertainty and fear amongst market participants.

-

Specific Companies Affected: Companies heavily reliant on exporting goods to the US, particularly within the agricultural and manufacturing sectors, were disproportionately affected. For example, [insert name of a specific Dutch company and its percentage drop, citing the source]. Similar impacts were observed in [mention another company and its sector].

-

Data Sources: The 2% drop is confirmed by data from the official AEX website [link to AEX website], as well as reports from reputable financial news sources such as the Financial Times [link to FT article] and Bloomberg [link to Bloomberg article].

-

Comparison to Previous Reactions: This drop is comparable to, or even more pronounced than, previous market reactions to Trump's tariff announcements, suggesting that investor confidence is increasingly fragile in the face of ongoing trade uncertainty.

The immediate market reaction reflects a clear loss of investor confidence, stemming from fears of reduced export opportunities and potential damage to the Dutch economy. The prevailing sentiment was one of apprehension, with many investors opting to secure their positions rather than risk further losses.

H2: The Impact on Dutch Businesses and the Netherlands Economy

H3: Export-Oriented Sectors

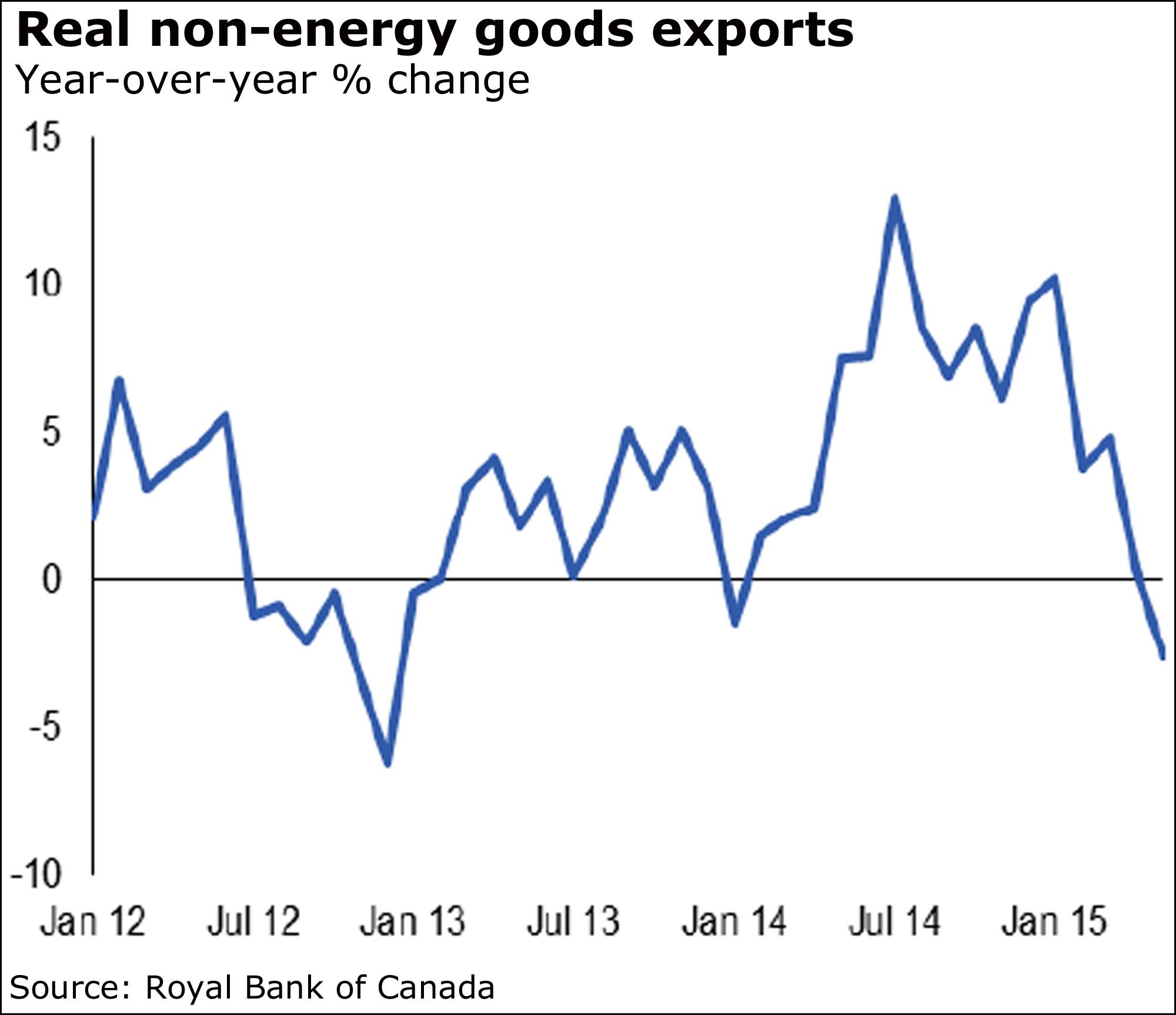

The Netherlands, with its highly export-oriented economy, is particularly vulnerable to the impact of these tariffs. Sectors such as agriculture (especially flowers and dairy), manufacturing (specifically high-tech components and machinery), and logistics are expected to face significant headwinds.

-

Examples of Affected Companies: [Insert names and details of Dutch companies in affected sectors]. These companies are likely to experience reduced demand for their products in the US market, leading to potential financial difficulties.

-

Job Losses and Reduced Investment: The reduction in export opportunities could lead to job losses within these vulnerable sectors, impacting employment figures and overall economic growth. Furthermore, reduced profitability may deter future investment, potentially hindering long-term economic development.

-

Impact on Dutch GDP Growth: The overall impact on Dutch GDP growth is expected to be negative, though the precise extent remains uncertain and will depend on several factors, including the duration of the tariffs and the response of other trading partners. The Netherlands Central Bank [link to relevant publication] has already expressed concerns.

The long-term economic consequences for the Netherlands will depend heavily on the government's ability to mitigate the negative effects of these tariffs and to diversify its export markets.

H2: Global Implications and the Wider Trade War

H3: International Market Uncertainty

The drop in the Amsterdam Stock Exchange is not an isolated event. The announcement of Trump's latest tariffs has created significant uncertainty in global markets, reflecting the interconnectedness of the world economy.

-

Reactions of Other Major Stock Exchanges: Similar negative reactions were observed in other major stock exchanges around the world, highlighting the widespread concern over the escalating trade war. [Mention specific examples, linking to relevant news sources].

-

Potential for Escalation: The ongoing trade disputes significantly increase the risk of further escalation, potentially leading to a broader and more damaging trade war with unpredictable consequences.

-

Impact on Global Supply Chains: Disruptions to global supply chains are a significant concern, as companies grapple with increased costs and uncertainty regarding access to key markets. This further contributes to global economic instability.

The Amsterdam Stock Exchange drop serves as a stark reminder of the global reach and ramifications of trade conflicts, impacting not only the directly involved nations but the entire global economic landscape.

H2: Analyst Predictions and Future Outlook for the AEX

H3: Expert Opinions

Financial analysts hold varied opinions on the AEX's potential recovery and the long-term consequences of the tariffs. Some remain cautiously optimistic, predicting a rebound in the AEX once the initial shock subsides.

-

Analyst Quotes and Predictions: [Insert quotes from reputable financial analysts and their predictions, citing sources]. These diverse opinions reflect the inherent uncertainties surrounding the future trajectory of the trade war.

-

Different Scenarios for the AEX: The future of the AEX is contingent on several factors, including the duration and scope of the tariffs, the response of the Dutch government, and the overall resolution of the trade conflict. A prolonged trade war could lead to further declines, while a swift resolution could result in a more rapid recovery.

-

Potential Mitigating Factors: The Dutch government's response to the tariffs, including potential financial support for affected businesses and efforts to diversify export markets, will play a crucial role in shaping the future outlook for the AEX.

The future of the AEX, and indeed the Dutch economy, remains uncertain. However, the capacity for resilience and adaptation will be pivotal in navigating the challenges presented by the current trade landscape.

3. Conclusion

The 2% drop in the Amsterdam Stock Exchange following Trump's latest tariffs represents a significant event, highlighting the vulnerability of the Dutch economy and the broader global markets to escalating trade tensions. The immediate impact on Dutch businesses, particularly in export-oriented sectors, is substantial, with potential long-term consequences for jobs and economic growth. Global implications are far-reaching, increasing uncertainty and potentially disrupting supply chains. Analyst predictions vary, but a swift resolution to the trade conflict is crucial for a quicker recovery of the AEX.

Call to Action: Stay updated on the Amsterdam Stock Exchange's response to Trump's tariffs and monitor the AEX Index for further fluctuations related to the ongoing trade war. Follow reputable financial news sources like the Financial Times [link to FT] and Bloomberg [link to Bloomberg] for the latest developments. Understanding the impact of these tariffs is crucial for investors and businesses alike.

Featured Posts

-

Bank Of Canada Rate Cut Odds Diminish On Strong Retail Sales

May 25, 2025

Bank Of Canada Rate Cut Odds Diminish On Strong Retail Sales

May 25, 2025 -

Kharkovschina 40 Svadeb Za Odin Den Kakaya Data Stala Populyarnoy Foto

May 25, 2025

Kharkovschina 40 Svadeb Za Odin Den Kakaya Data Stala Populyarnoy Foto

May 25, 2025 -

I Allagi Stratigikis Tis Mercedes Gia Tin F1

May 25, 2025

I Allagi Stratigikis Tis Mercedes Gia Tin F1

May 25, 2025 -

Dazi Trump Sul Tessile Analisi Dell Impatto Su Nike E Lululemon

May 25, 2025

Dazi Trump Sul Tessile Analisi Dell Impatto Su Nike E Lululemon

May 25, 2025 -

Melanie Thierry Et Raphael Surmonter Les Difficultes D Une Famille Nombreuse

May 25, 2025

Melanie Thierry Et Raphael Surmonter Les Difficultes D Une Famille Nombreuse

May 25, 2025