2% Drop In LVMH Shares After Weak Q1 Sales Performance

Table of Contents

Analysis of LVMH's Q1 Sales Performance

Key Figures and Shortfalls

LVMH's Q1 2024 sales performance fell short of expectations, resulting in a significant impact on LVMH stock. While the exact figures require further official reporting, initial indications suggest a notable percentage decrease compared to Q1 2023. Key areas of underperformance include:

- A steeper-than-anticipated slowdown in growth across several key brands, possibly including specific fashion houses and even certain watch divisions. More detailed brand-specific sales data will be crucial in understanding the extent of the individual performance issues.

- Weaker-than-projected sales in specific geographic regions. While Asia has been a major growth driver for luxury goods in recent years, early indicators suggest that this region, particularly mainland China, experienced a slowdown in growth compared to previous quarters. Europe and North America might also have contributed to the overall weakness, with decreased consumer confidence potentially influencing purchasing behavior.

- The actual sales figures significantly missed analyst expectations. This disparity between anticipated and reported results contributed to the negative investor reaction and subsequent drop in LVMH share price.

Impact of External Factors

Several external factors contributed to LVMH's weaker-than-expected Q1 performance. The global economic climate played a significant role:

- Global Inflation and Economic Slowdown: Rising inflation and concerns about a potential global recession dampened consumer spending, particularly in the discretionary luxury goods sector. High-value purchases, such as luxury handbags and jewelry, are often the first to be cut from budgets when economic uncertainty rises.

- Geopolitical Instability: The ongoing war in Ukraine and the complex economic recovery in China created significant uncertainties in the global market, negatively affecting consumer confidence and impacting supply chains. Disruptions to trade routes and increased logistical costs further compressed margins.

- Supply Chain Disruptions: Lingering supply chain issues, though less severe than in previous years, still impacted production and delivery timelines, potentially leading to stock shortages and unmet demand.

Investor Reaction and Market Sentiment

Immediate Market Response

The 2% drop in LVMH shares followed the release of the Q1 sales figures, indicating a swift and negative market response. High trading volume accompanied the price decline, suggesting considerable investor activity driven by concerns over the weaker-than-expected results. Several analysts downgraded their price targets for LVMH stock, adding further downward pressure. This negative sentiment also impacted related luxury stocks, highlighting the interconnectedness of the sector.

Long-Term Implications for LVMH

While the Q1 results are concerning, LVMH's long-term prospects remain strong due to its established brand portfolio and market dominance. However, the company will likely need to adapt its strategies:

- Price Adjustments: LVMH might consider strategic price adjustments to maintain margins while remaining competitive and attracting consumers. This would need careful evaluation to balance profitability with maintaining demand.

- Targeted Marketing Campaigns: Reinforcing brand messaging and deploying targeted marketing campaigns to revitalize demand and appeal to specific consumer segments is likely in the works.

- Diversification Strategies: Exploring diversification into new markets or product categories could provide resilience in the face of economic fluctuations.

The potential for a recovery in subsequent quarters exists, contingent on improvements in the global economy, successful implementation of new strategies, and a renewed surge in consumer confidence. However, close monitoring of the overall luxury goods market is essential.

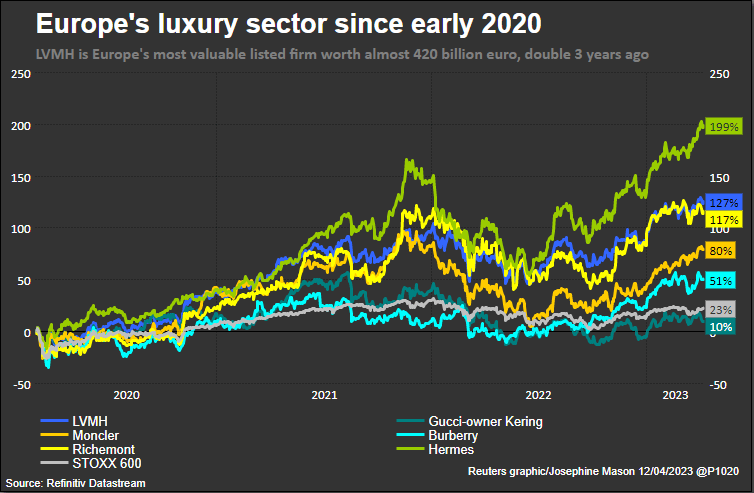

Comparative Analysis with Competitors

Performance of Rival Luxury Brands

Comparing LVMH's Q1 performance to its main competitors, such as Kering (owner of Gucci and Yves Saint Laurent) and Hermès, will be crucial. Determining if the underperformance was unique to LVMH or reflective of a broader industry-wide slowdown will provide a clearer perspective. Initial reports suggest that some other luxury brands also saw slower than expected growth, but the full impact across the luxury goods sector requires more data.

Market Share Implications

The Q1 results might lead to shifts in market share among luxury brands. If competitors perform relatively better, LVMH could experience a slight decrease in its market share. However, LVMH’s long-term dominance in the luxury goods market remains largely unaffected, provided they can address current challenges and adapt to changing market conditions effectively.

Conclusion

The 2% drop in LVMH shares reflects a weaker-than-expected Q1 sales performance influenced by a confluence of factors: a global economic slowdown, geopolitical instability, and lingering supply chain disruptions. While the immediate market reaction was negative, LVMH's strong brand portfolio and market position offer long-term resilience. The company's response to these challenges, including potential price adjustments and targeted marketing campaigns, will be critical for regaining momentum. The comparative performance of other luxury brands will further illuminate the extent of the industry-wide impact versus issues unique to LVMH.

Call to Action: Stay informed about the ongoing developments in the luxury goods market and the performance of LVMH shares. Continue to monitor LVMH's financial news and market analysis for a better understanding of LVMH stock performance and investment strategies. Follow our updates for further insights into the LVMH share price and the broader luxury market.

Featured Posts

-

Svadby Na Kharkovschine 600 Brakov Za Mesyats Tendentsii I Statistika

May 25, 2025

Svadby Na Kharkovschine 600 Brakov Za Mesyats Tendentsii I Statistika

May 25, 2025 -

80 Millio Forintert Extrak Ez A Porsche 911

May 25, 2025

80 Millio Forintert Extrak Ez A Porsche 911

May 25, 2025 -

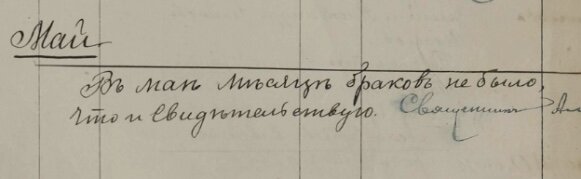

Market Reaction To Uk Inflation Reduced Boe Rate Cut Expectations And Pound Appreciation

May 25, 2025

Market Reaction To Uk Inflation Reduced Boe Rate Cut Expectations And Pound Appreciation

May 25, 2025 -

Dax Kurs Eroeffnung In Frankfurt Und Auswirkungen Des Futures Verfalls

May 25, 2025

Dax Kurs Eroeffnung In Frankfurt Und Auswirkungen Des Futures Verfalls

May 25, 2025 -

Monaco Nice L Equipe Selectionnee Pour La Reception

May 25, 2025

Monaco Nice L Equipe Selectionnee Pour La Reception

May 25, 2025