20M XRP Purchased: Whale Activity Signals Potential Price Surge

Table of Contents

The cryptocurrency world is abuzz! A recent transaction involving a staggering 20 million XRP purchased by a whale has sent ripples—pun intended—through the market, igniting speculation of a potential price surge. Whale activity, especially on a scale this large, often significantly influences market sentiment and price movements. Understanding the implications of this massive XRP purchase is crucial for anyone invested in or considering investing in the cryptocurrency.

Understanding the Significance of Whale Activity in the Crypto Market

Cryptocurrency whales are high-net-worth individuals or entities holding massive amounts of cryptocurrency. Their influence on market prices is undeniable. Because of their substantial holdings, a single buy or sell order from a whale can create significant price volatility. This is particularly true in less liquid markets like some altcoins, where a large order can easily move the needle.

The psychological impact is significant, too. Large buy orders often trigger the fear of missing out (FOMO) among smaller investors, leading to a cascading effect of further buying and pushing the price upwards. Conversely, large sell-offs can spark panic selling.

- Whales possess significant capital to manipulate short-term price movements. Their actions are not always based on fundamental analysis but can be driven by speculative strategies.

- Their actions often trigger buying or selling frenzies among smaller investors. This herd mentality can amplify price swings dramatically.

- Analyzing whale wallets provides valuable insights into market trends. Tracking their activities can offer clues about potential price shifts, though it's not foolproof.

Numerous historical examples demonstrate the impact of whale activity. For instance, large XRP purchases in the past have been correlated with subsequent price increases, though correlation does not equal causation. Similar effects have been observed with Bitcoin and other major cryptocurrencies.

Analyzing the 20M XRP Purchase: Implications and Speculation

While the exact details surrounding the 20M XRP purchase—the date, exchange, and buyer's identity—may not be publicly available due to privacy concerns, the sheer volume of the transaction warrants attention. Several interpretations exist:

- Accumulation for a future price increase: The whale might be accumulating XRP in anticipation of a bullish market, aiming to profit from a significant price rise.

- Strategic move unrelated to price speculation: The purchase could be part of a broader, long-term investment strategy, or related to other market activities unrelated to short-term price manipulation.

The implications for XRP's price are multifaceted. Short-term price increases are certainly a possibility due to the FOMO effect. However, long-term price movement will depend on various other factors, including the overall market sentiment and the outcome of the Ripple lawsuit.

- Possible reasons for the large purchase include long-term investment, anticipation of regulatory changes, or even a strategic play within a decentralized finance (DeFi) protocol.

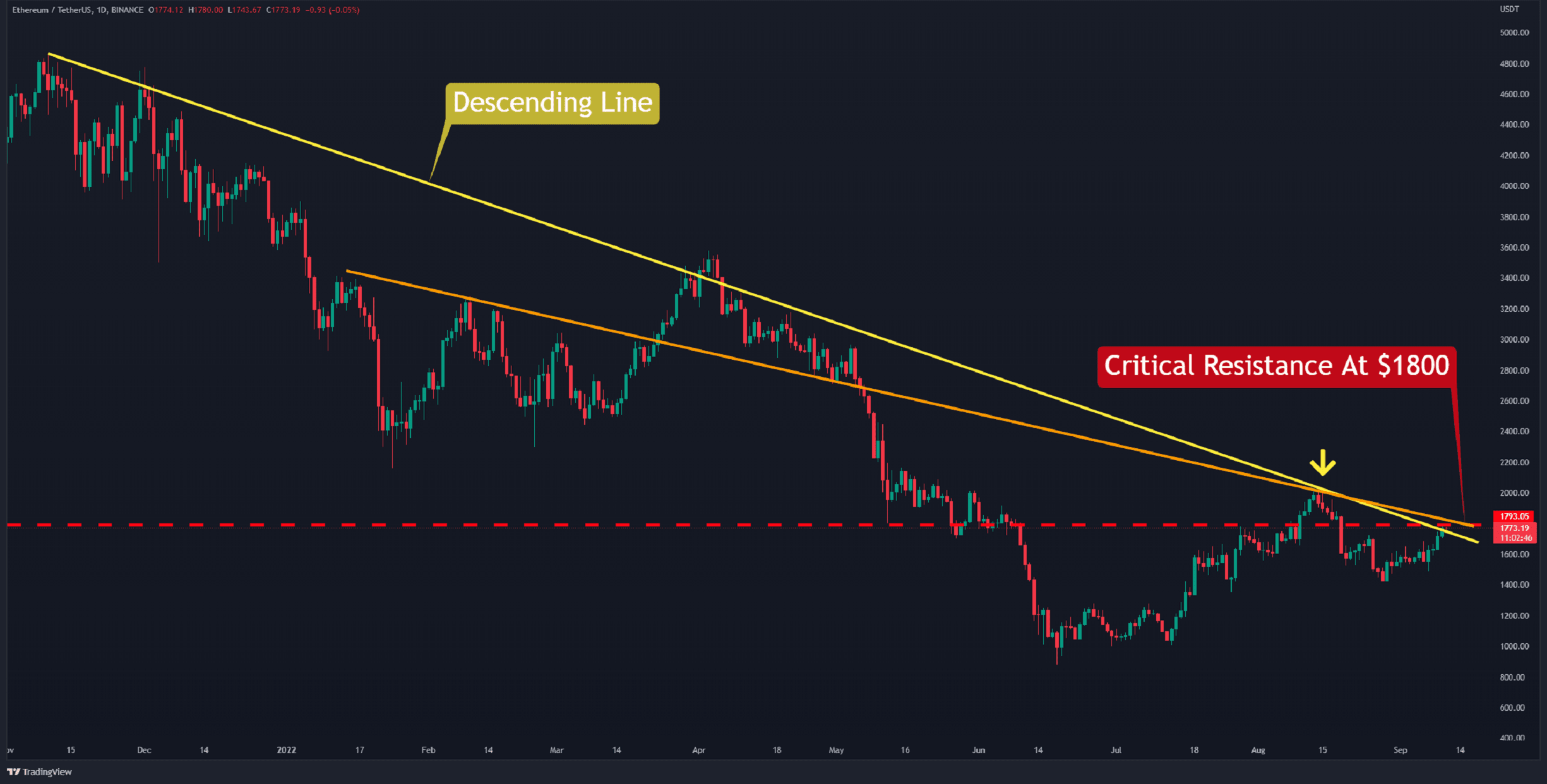

- Technical analysis of XRP's price chart in the days and weeks following the purchase can provide valuable insights into the impact of this transaction.

- News or events that could correlate with the purchase might include developments in Ripple’s legal case or broader market trends.

The Ripple Factor: How Ripple's Legal Battle Impacts XRP Price

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a long shadow over XRP's price. The SEC's claim that XRP is an unregistered security creates considerable regulatory uncertainty. This uncertainty significantly impacts investor confidence, making many hesitant to invest heavily in XRP.

- The SEC's allegations against Ripple center around the claim that XRP sales were unregistered securities offerings.

- Potential outcomes of the lawsuit range from a complete SEC victory to a dismissal of the charges, each having significant implications for XRP's price.

- The influence of legal uncertainty is undeniable; it keeps XRP trading volume and volatility relatively high.

Positive developments in the Ripple case, such as favorable court rulings or settlements, could significantly boost investor confidence and drive XRP's price upwards. Conversely, negative news could lead to further price drops.

XRP Price Prediction and Future Outlook

Predicting the future price of XRP is highly speculative. While the recent 20M XRP purchase suggests potential upside, a number of other factors could impact the price significantly. These include the outcome of the Ripple lawsuit, overall market sentiment towards cryptocurrencies, and technological advancements within the XRP ecosystem.

- Possible price targets depend heavily on the various scenarios playing out, ranging from highly optimistic to very conservative.

- Factors influencing future price movements include market sentiment, regulatory developments, technological advancements in the XRP Ledger, and adoption by businesses and financial institutions.

- It is crucial to remember that any price prediction is speculative. Conduct your own research and don’t invest more than you can afford to lose.

Conclusion

The recent purchase of 20 million XRP by a cryptocurrency whale highlights the considerable influence of whale activity on market dynamics. While this large transaction suggests potential for a price surge, several factors must be considered. The ongoing Ripple lawsuit presents significant regulatory uncertainty, impacting investor confidence and adding to the inherent volatility of the cryptocurrency market. Ultimately, the future price of XRP depends on a convergence of factors, including the Ripple case outcome, overall market conditions, and technological advancements.

Stay tuned for further updates on this significant XRP whale activity and potential price surges. Conduct your own thorough research and make informed investment decisions based on your own risk tolerance and understanding of the market. Remember that investing in cryptocurrencies involves significant risk, and past performance is not indicative of future results.

Featured Posts

-

1 050 Price Hike At And T Details Broadcoms Impact On V Mware Costs

May 08, 2025

1 050 Price Hike At And T Details Broadcoms Impact On V Mware Costs

May 08, 2025 -

Dwp Benefit Stoppage 355 000 Affected 3 Month Notice Given

May 08, 2025

Dwp Benefit Stoppage 355 000 Affected 3 Month Notice Given

May 08, 2025 -

5880 Rally Projected Altcoin Poised To Outperform Xrp

May 08, 2025

5880 Rally Projected Altcoin Poised To Outperform Xrp

May 08, 2025 -

Ethereum Price Analysis Sustained Strength And Future Outlook

May 08, 2025

Ethereum Price Analysis Sustained Strength And Future Outlook

May 08, 2025 -

Counting Crows Snl Appearance A Turning Point In Their Career

May 08, 2025

Counting Crows Snl Appearance A Turning Point In Their Career

May 08, 2025