30% Drop For Palantir: Time To Invest?

Table of Contents

Analyzing the Reasons Behind Palantir's Stock Decline

Recent Financial Performance and Market Sentiment

Palantir's recent earnings reports have been a key factor in the stock's decline. While the company has shown consistent growth in revenue, certain aspects of its financial performance, such as slowing growth rates or missed earnings expectations, may have disappointed investors. This, coupled with a broader negative market sentiment towards tech stocks and increased market volatility, has put downward pressure on PLTR stock. Specific negative news, including perhaps concerns about increased competition in the big data analytics sector or regulatory hurdles, may have also contributed to the sell-off. Understanding the interplay between Palantir earnings, overall tech stock market performance, and specific news impacting PLTR is crucial for assessing the current situation.

- Palantir earnings: Carefully examine the quarterly and annual reports for any inconsistencies or trends.

- PLTR earnings comparisons: Benchmark Palantir's performance against its competitors.

- Tech stock market analysis: Understand the overall health and sentiment of the technology sector.

- Market volatility: Assess the impact of broader economic factors on Palantir stock.

Understanding the Long-Term Growth Potential of Palantir

Despite the recent downturn, Palantir possesses significant long-term growth potential. Its innovative data mining and big data analytics capabilities are revolutionizing various sectors, from government intelligence to commercial applications. The continued expansion of the big data analytics market presents a huge opportunity for Palantir, particularly given its strong foothold in government contracts. These contracts offer revenue stability, providing a buffer against short-term market fluctuations.

- Big data analytics market growth: Research the projected growth of this market and Palantir's position within it.

- Government contracts: Analyze the long-term value and stability of Palantir's government partnerships.

- Palantir growth trajectory: Assess historical growth rates and projections for future growth.

- PLTR future innovations: Investigate Palantir's R&D efforts and potential future product offerings.

Evaluating the Risk and Reward of Investing in Palantir Now

Assessing the Risks

Investing in a growth stock like Palantir inherently involves risk. The company faces potential challenges, including intense competition from established tech giants and emerging startups. Regulatory hurdles and the reliance on government contracts for a significant portion of its revenue also represent potential risks. A thorough Palantir risk assessment is essential before making any investment decisions.

- Investment risk: Understand the volatility associated with growth stocks.

- Growth stock risk: Acknowledge the higher risk-reward profile compared to established companies.

- Palantir risk assessment: Conduct a comprehensive analysis of the specific risks facing the company.

- Competitive landscape: Analyze the competitive threat from other big data analytics companies.

Weighing the Potential Rewards

Despite the risks, the potential rewards of investing in Palantir are significant. If the company successfully executes its growth strategy and maintains its innovative edge, the potential for substantial returns (Palantir ROI) is high. The current low stock price presents an opportunity for investors to acquire shares at a potentially discounted price, anticipating a stock market recovery and a rebound in Palantir's valuation compared to competitors.

- Palantir ROI: Research potential return on investment scenarios based on various growth projections.

- PLTR investment potential: Consider the potential for capital appreciation and dividend income.

- Stock market recovery: Assess the likelihood of a broader market rebound and its impact on PLTR stock.

- Competitive valuation: Compare Palantir's valuation metrics to those of its competitors.

Practical Considerations for Investing in Palantir

Diversification and Risk Management

Before considering a Palantir investment, remember the importance of diversification. Don't put all your eggs in one basket. Investing in Palantir should be part of a well-diversified portfolio that aligns with your individual risk tolerance. A conservative investor may choose a smaller allocation, while a more aggressive investor might allocate a larger percentage of their portfolio.

- Investment diversification: Spread your investments across various asset classes and sectors.

- Portfolio management: Regularly review and adjust your portfolio based on market conditions and your investment goals.

- Risk tolerance: Understand your own risk appetite before making any investment decisions.

Long-Term vs. Short-Term Investment Strategies

The choice between a long-term or short-term Palantir investment strategy depends largely on your individual investment goals and risk tolerance. A long-term strategy focuses on the company's long-term growth potential, weathering short-term market fluctuations. A short-term strategy involves more frequent trading, attempting to profit from short-term price movements. Thorough research is crucial regardless of your chosen strategy.

- Long-term investment: Invest with a long-term horizon, focusing on Palantir’s long-term growth potential.

- Short-term investment: Engage in more active trading, seeking to profit from short-term price swings.

- Palantir investment strategy: Choose a strategy aligned with your individual risk tolerance and goals.

Conclusion: Is Now the Time to Buy Palantir Stock?

The recent 30% drop in Palantir's stock price presents both risks and rewards. While the company faces challenges in a competitive market, its innovative technology and long-term growth potential remain compelling. The decision of whether or not to invest in Palantir stock depends on your individual risk tolerance, investment goals, and thorough due diligence. It's crucial to conduct your own research and consider Palantir stock as only one component of a diversified portfolio. This article is not financial advice. Consider a Palantir investment only after careful consideration of the factors discussed above. Investigate Palantir stock options and learn more about Palantir before investing.

Featured Posts

-

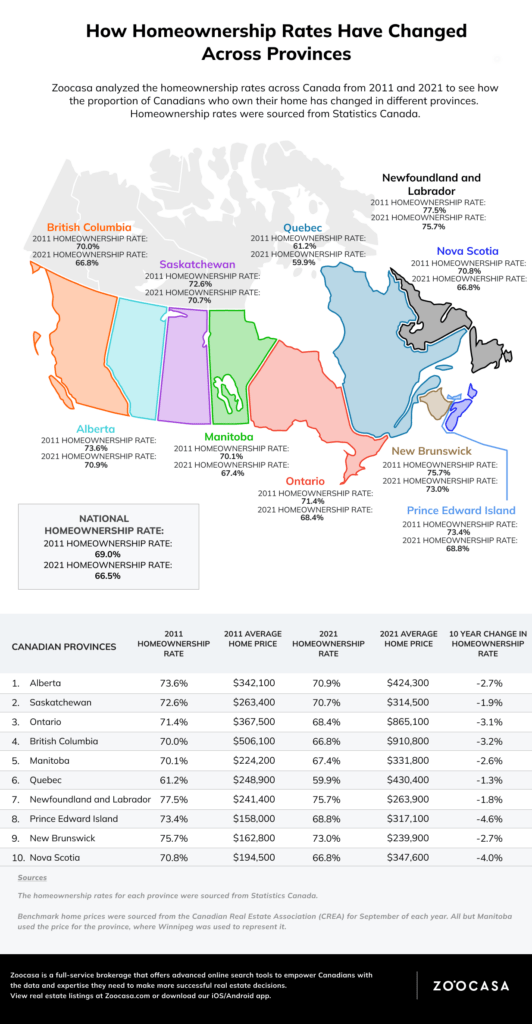

Is Homeownership In Canada Unaffordable Due To High Down Payments

May 10, 2025

Is Homeownership In Canada Unaffordable Due To High Down Payments

May 10, 2025 -

Aocs Sharp Criticism Of Pro Trump Fox News Anchor

May 10, 2025

Aocs Sharp Criticism Of Pro Trump Fox News Anchor

May 10, 2025 -

Trumps Transgender Military Ban A Clearer Look At The Arguments

May 10, 2025

Trumps Transgender Military Ban A Clearer Look At The Arguments

May 10, 2025 -

Ice Detention Case Judge Grants Release For Tufts University Student Rumeysa Ozturk

May 10, 2025

Ice Detention Case Judge Grants Release For Tufts University Student Rumeysa Ozturk

May 10, 2025 -

Bondi Announces One Of The Largest Fentanyl Seizures In Us History

May 10, 2025

Bondi Announces One Of The Largest Fentanyl Seizures In Us History

May 10, 2025