65 Hudson's Bay Leases Generate Strong Investor Interest

Table of Contents

The Appeal of Hudson's Bay Properties for Investors

The significant investor interest in these 65 Hudson's Bay leases stems from several key factors, making them highly attractive real estate investment opportunities.

Prime Locations and High Foot Traffic

A major draw for investors is the strategic placement of these properties. Many are located in high-traffic areas within major metropolitan centers, ensuring maximum visibility and accessibility for tenants.

- Examples of Desirable Locations: These leases often include prime downtown core locations in major Canadian cities, as well as prominent spots within busy shopping malls. Specific examples (if available from public records or press releases) should be included here.

- Advantages of High Foot Traffic: High foot traffic translates directly into increased brand awareness and potential sales for tenants, leading to higher rental income and property values for investors. The visibility offered by these locations is a key differentiator.

Strong Anchor Tenants and Lease Stability

The existing tenants in these 65 Hudson's Bay leases are often strong, reputable businesses with long-term leases. This provides investors with a level of stability and predictability regarding rental income.

- Prominent Tenants: (If possible, include the names of major tenants occupying these spaces to further enhance credibility and attract investor interest.) This adds concrete evidence of the quality of tenants and strengthens the investment case.

- Benefits of Long-Term Leases: Long-term leases minimize the risk associated with frequent tenant turnover and vacancy periods, ensuring a steady stream of rental income for investors. This predictability is a key attraction for investors seeking reliable returns.

Growth Potential and Future Development

Many of these properties also offer significant growth potential, with opportunities for renovations, expansions, or even redevelopment. This potential for increased value adds to their attractiveness.

- Planned Developments or Renovations: (If there are any public plans for renovations or expansions, mention them here). These plans demonstrate potential for increased rental income and property appreciation.

- Potential for Rental Increases and Higher Property Values: As the surrounding areas develop and the retail sector strengthens, the potential exists for significant increases in both rental income and overall property value, presenting substantial returns for investors in Hudson's Bay leases.

Market Conditions Driving Investor Demand

The current market conditions are also significantly contributing to the high demand for Hudson's Bay leases and real estate investment in general.

Low Interest Rates and Abundant Capital

Low interest rates and the availability of capital are key factors driving investor appetite for real estate investments, including these Hudson's Bay leases.

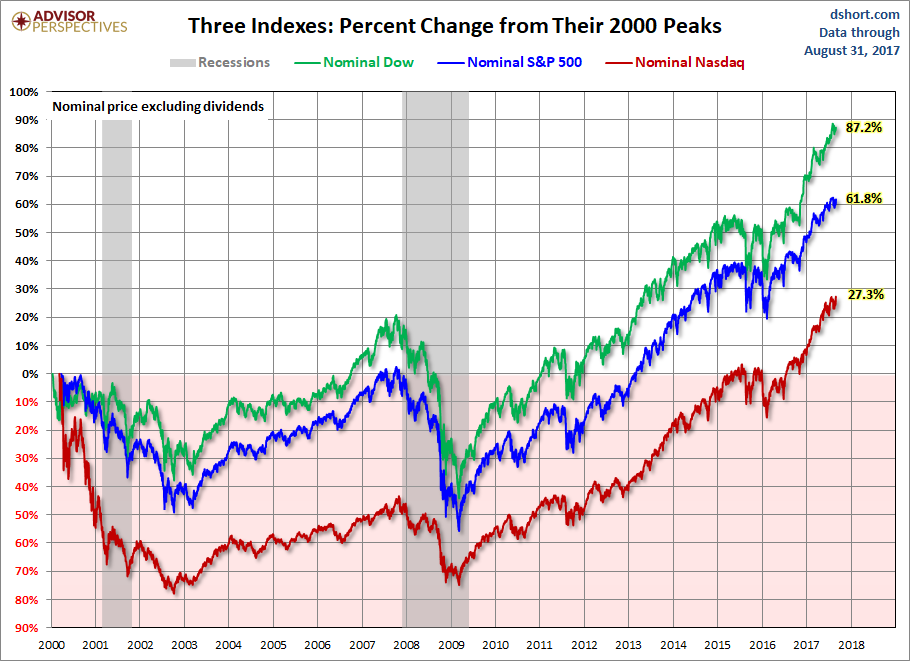

- Current Interest Rate Environment: The current low-interest rate environment makes borrowing more affordable, encouraging investors to leverage debt to finance real estate purchases.

- Availability of Capital for Real Estate Investments: Significant amounts of capital are currently being allocated to real estate, increasing competition for prime properties like those within the Hudson's Bay portfolio.

Strong Retail Sector Recovery

The retail sector is showing signs of recovery after facing several recent challenges. This positive outlook makes retail real estate, such as the spaces offered under Hudson's Bay leases, even more appealing.

- Relevant Statistics on Retail Sales Growth: (Cite any relevant statistics on retail sales growth to provide concrete evidence supporting the recovery narrative). Positive growth in the retail sector strengthens the case for investment in retail properties.

- Positive Outlook for the Retail Industry: The overall trend suggests a positive outlook, making investments in retail real estate, particularly prime locations like those leased by Hudson's Bay, an attractive proposition.

Investment Strategies and Opportunities

Investors have several options when considering these Hudson's Bay leases.

Direct Investment vs. REITs

Investors can choose between direct investment in individual properties or investing in Real Estate Investment Trusts (REITs) that focus on similar properties.

- Pros and Cons of Each Approach: Direct investment offers greater control but requires more capital and expertise; REITs provide diversification and liquidity but may offer lower returns.

- Financial Considerations for Each Option: Each option has different financial implications concerning capital requirements, risk profiles, and potential returns. Investors should carefully weigh these factors before making a decision.

Due Diligence and Risk Assessment

Before making any investment decisions, thorough due diligence and risk assessment are crucial. It's highly recommended to consult with financial professionals.

- Key Factors to Consider During Due Diligence: Thorough due diligence includes analyzing lease agreements, assessing tenant creditworthiness, and reviewing property condition reports.

- Potential Risks and Mitigation Strategies: Investors should consider potential risks such as market downturns, changes in tenant occupancy, and interest rate fluctuations. Developing mitigation strategies for these risks is critical.

Conclusion

The strong investor interest in these 65 Hudson's Bay leases is driven by a confluence of factors: prime locations, stable tenants, positive market conditions, and potential for future growth. These properties present significant opportunities for attractive returns on investment. However, it's essential to conduct thorough due diligence and consider various investment strategies, such as direct investment or REITs.

Capitalize on the surge in interest in Hudson's Bay leases today! Research current listings and consult with financial advisors to explore these lucrative investment opportunities further. (Include links to relevant resources or related articles here, if available.)

Featured Posts

-

B And B April 3 Recap Liam Collapses After Major Argument With Bill

Apr 24, 2025

B And B April 3 Recap Liam Collapses After Major Argument With Bill

Apr 24, 2025 -

Prekrasna Ella Travolta Slicnost S Majkom I Ocem

Apr 24, 2025

Prekrasna Ella Travolta Slicnost S Majkom I Ocem

Apr 24, 2025 -

Positive Indicators Fuel Niftys Rise A Look At The Indian Market

Apr 24, 2025

Positive Indicators Fuel Niftys Rise A Look At The Indian Market

Apr 24, 2025 -

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge On Tariff Hopes

Apr 24, 2025

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge On Tariff Hopes

Apr 24, 2025 -

The Crucial Role Of Middle Managers In Boosting Company Performance And Employee Satisfaction

Apr 24, 2025

The Crucial Role Of Middle Managers In Boosting Company Performance And Employee Satisfaction

Apr 24, 2025