Stock Market Today: Dow Jumps 1000 Points, Nasdaq & S&P 500 Surge On Tariff Hopes

Table of Contents

The Dow's Historic 1000-Point Jump: A Detailed Look

The Dow's 1000-point jump represents a significant milestone, marking one of the largest single-day point gains in its history. Let's analyze this impressive feat.

Analyzing the Scale of the Gain:

The 1000-point increase translates to a percentage gain that significantly outpaces many previous market movements. This substantial surge indicates a strong wave of buying activity across various sectors. To put it in perspective, this represents a [insert percentage]% increase, surpassing previous records of [mention comparable historical events and their percentage gains].

Identifying Leading Sectors:

Several sectors contributed significantly to the Dow's surge. The technology sector, a key driver of market performance, experienced substantial gains, reflecting positive investor sentiment towards tech giants. Financial and industrial stocks also played a significant role, demonstrating broad-based market strength.

- Specific examples of companies with significant gains: [List specific companies and their percentage gains – e.g., Apple (+X%), Microsoft (+Y%), etc.].

- Notable market indicators: The VIX volatility index, often considered a measure of market fear, experienced a decline, indicating reduced investor anxiety.

- [Insert chart showing the Dow's movement throughout the day]

Nasdaq and S&P 500 Follow Suit: Broad Market Strength

The positive momentum wasn't confined to the Dow; both the Nasdaq and S&P 500 experienced substantial gains, reflecting broad-based market strength.

Nasdaq's Performance:

The Nasdaq Composite mirrored the Dow's upward trajectory, registering a [insert percentage]% increase. This strong performance was largely driven by gains in the technology sector, reinforcing the positive investor sentiment towards tech companies.

S&P 500's Reaction:

The S&P 500, a broader market index representing 500 large-cap US companies, also reacted positively, registering a [insert percentage]% increase. This indicates a widespread market rally, not limited to specific sectors.

- Key factors driving gains: Positive news regarding trade negotiations and robust corporate earnings reports played a crucial role.

- Comparison of sector performance: [Compare the percentage change across different sectors within the Nasdaq and S&P 500, highlighting any significant differences].

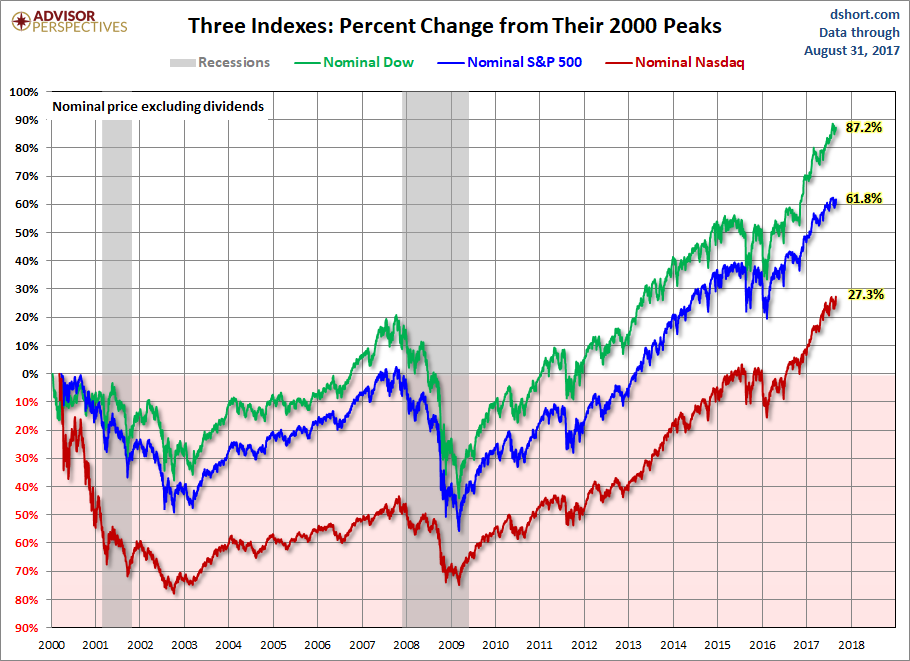

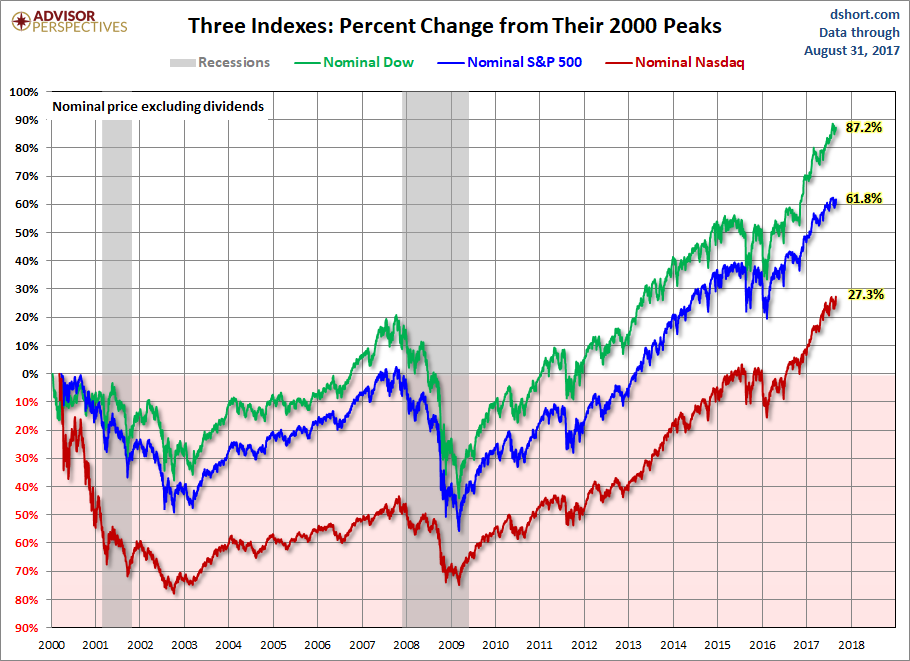

- [Insert chart comparing the percentage change in Dow, Nasdaq, and S&P 500]

Tariff Hopes Fuel the Rally: Understanding the Impact of Trade Policy

The primary catalyst for today's market rally is the renewed optimism surrounding trade negotiations.

The Role of Trade Negotiations:

Recent developments in trade talks between [mention countries involved] have sparked investor confidence. [Specifically mention any positive news or agreements reached, linking to credible news sources].

Investor Sentiment and Market Psychology:

This positive news significantly improved investor sentiment and risk appetite. Investors, previously cautious due to trade uncertainties, are now more willing to invest in the market, leading to the significant surge in indices.

- Specific tariff agreements/announcements: [Mention any specific details of agreements or announcements that boosted investor confidence].

- Expert opinions: [Quote prominent financial experts commenting on the long-term effects of these developments].

- Remaining uncertainties: [Acknowledge any remaining risks or uncertainties related to the trade negotiations].

Expert Analysis and Future Market Outlook: What Lies Ahead?

While today's gains are impressive, it's crucial to consider the broader market outlook.

Analyst Predictions:

Many market analysts are cautiously optimistic, suggesting that the current rally could continue if positive trade developments persist. However, several analysts caution against overconfidence, emphasizing the need to monitor key economic indicators.

Potential Risks and Challenges:

Several factors could impact future market performance. Geopolitical uncertainty, economic slowdowns in key global markets, and potential shifts in investor sentiment represent potential headwinds.

- Quotes from financial experts: [Include quotes from prominent financial experts offering their predictions and perspectives].

- Key economic indicators to watch: [Mention key economic indicators that will influence future market trends].

- Market scenarios: [Discuss different market scenarios – bullish, bearish, and sideways – and their likelihood].

Conclusion: Stock Market Today – Navigating the Upswing and Looking Ahead

Today's stock market witnessed a dramatic upswing, with the Dow Jones soaring 1000 points, and the Nasdaq and S&P 500 following suit. Renewed hopes surrounding trade tariffs played a pivotal role in this market rally. While expert analysis suggests cautious optimism, potential risks remain. To navigate the complexities of the stock market today and understand future market movements, it’s crucial to stay informed. Stay updated on the stock market by subscribing to reputable financial newsletters, following leading financial news sources, and consulting with a qualified financial advisor before making any investment decisions. Understanding the stock market's daily fluctuations is key to making informed decisions. Monitor today's market trends to stay ahead of the curve.

Featured Posts

-

Section 230 And Banned Chemicals A Judges Ruling On E Bay Listings

Apr 24, 2025

Section 230 And Banned Chemicals A Judges Ruling On E Bay Listings

Apr 24, 2025 -

The Closure Of Anchor Brewing Company What Does It Mean For Craft Beer

Apr 24, 2025

The Closure Of Anchor Brewing Company What Does It Mean For Craft Beer

Apr 24, 2025 -

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 24, 2025

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 24, 2025 -

Herros Hot Shooting 3 Point Contest Win Highlights All Star Weekend

Apr 24, 2025

Herros Hot Shooting 3 Point Contest Win Highlights All Star Weekend

Apr 24, 2025 -

Understanding The Oil Market Price Developments On April 23rd

Apr 24, 2025

Understanding The Oil Market Price Developments On April 23rd

Apr 24, 2025