7% Drop In Amsterdam Stock Market: Trade War Fears Fuel Market Sell-off

Table of Contents

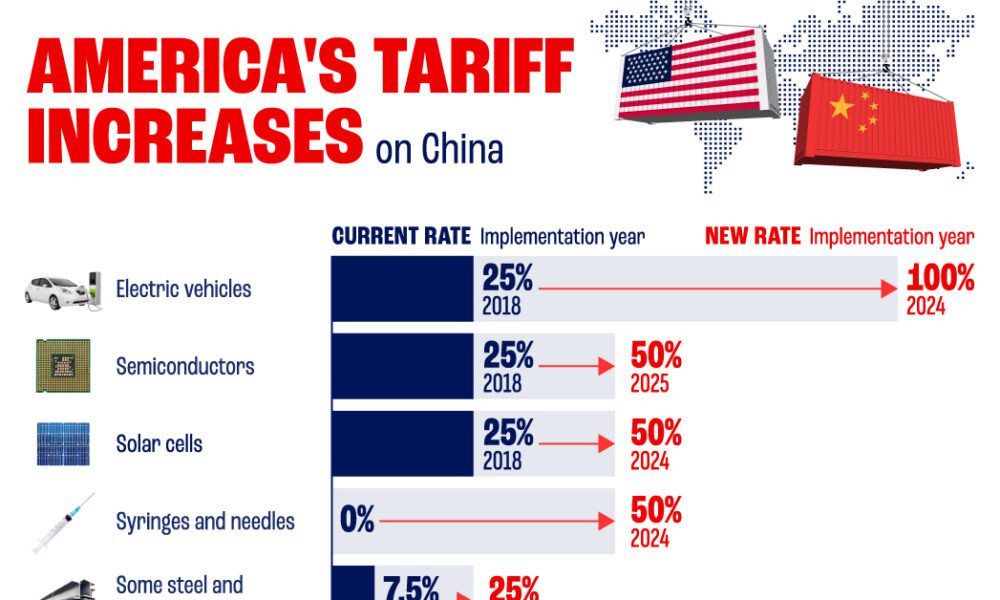

Trade War Fears as the Primary Catalyst

The current surge in global trade tensions is the primary catalyst behind the Amsterdam Stock Market's downturn. The Netherlands, a significant player in international trade, is particularly vulnerable to escalating tariffs and trade restrictions. The uncertainty surrounding future trade agreements further erodes investor confidence, leading to a sell-off in the AEX (Amsterdam Exchange Index).

- Rising tariffs on Dutch exports: Increased tariffs on Dutch agricultural products, particularly flowers and dairy, are already impacting export revenues. Similarly, tariffs on high-tech exports, crucial to the Dutch economy, are causing significant concern.

- Uncertainty surrounding future trade agreements: The lack of clarity regarding future trade deals with key partners creates uncertainty, discouraging investment and prompting businesses to adopt a wait-and-see approach. This uncertainty directly impacts investor confidence in the Amsterdam Stock Market.

- Decreased global demand affecting Dutch businesses: Trade wars often lead to decreased global demand for goods and services. Dutch businesses, heavily reliant on exports, are directly impacted, leading to lower profits and reduced investment.

- Negative impact on specific sectors: The technology sector, a significant component of the Amsterdam Stock Market, is particularly vulnerable to trade disputes. Similarly, the agricultural sector is facing considerable challenges due to rising tariffs and reduced global demand. The impact of global trade uncertainty on investor confidence cannot be overstated.

Impact on Key Amsterdam-Listed Companies

The sell-off in the Amsterdam Stock Market has significantly impacted several key companies listed on the AEX. The uncertainty surrounding global trade has led to widespread declines across various sectors.

- Percentage drops for specific major companies: ASML, a leading semiconductor equipment manufacturer, experienced a notable percentage drop, reflecting the vulnerability of the tech sector. Unilever, a multinational consumer goods giant, also saw a significant decline, highlighting the impact of decreased global demand. ING, a major banking institution, faced pressure due to broader market concerns.

- Analysis of sector-specific impacts: Technology stocks, given their global interconnectedness, proved to be more vulnerable to the negative sentiment surrounding the trade war. The agricultural sector also felt the immediate impact of rising tariffs.

- Significant company announcements or reactions: Several companies have issued statements expressing concern about the current economic climate and the potential long-term impact of the trade war on their businesses. These announcements further fueled the market sell-off.

International Market Reactions and Global Implications

The decline in the Amsterdam Stock Market is not an isolated incident. The ripple effect is evident in other European and global markets, demonstrating the interconnected nature of the global financial system.

- Correlation with other major European stock indices: The DAX (Germany) and CAC 40 (France) also experienced declines, reflecting a broader European market response to the escalating trade tensions. This correlation underscores the global impact of trade wars.

- Impact on the Euro and other currencies: The uncertainty surrounding the global economy is causing fluctuations in currency markets. The Euro, in particular, has experienced volatility in response to the trade war and its impact on the European Union.

- Statements from international financial institutions or experts: International Monetary Fund (IMF) and other experts have expressed concerns about the potential negative consequences of escalating trade wars on global economic growth. These statements further amplify the gravity of the situation.

Potential Mitigation Strategies and Future Outlook

Addressing the current crisis requires coordinated action from both the Dutch government and the European Union. Several potential mitigation strategies are being considered.

- Government intervention measures: The Dutch government may implement fiscal stimulus measures to boost economic activity and bolster investor confidence in the Amsterdam Stock Market.

- EU actions to alleviate trade war pressures: The European Union is actively exploring options to alleviate trade war pressures and protect its member states' interests. This could include negotiations with other trading partners or the implementation of countermeasures.

- Expert opinions on the short-term and long-term outlook for the Amsterdam Stock Market: Experts hold varying opinions on the short-term and long-term outlook, with some predicting a market recovery once trade tensions ease, while others foresee prolonged uncertainty. The Amsterdam Stock Market forecast remains uncertain.

Conclusion

The 7% drop in the Amsterdam Stock Market represents a significant event, directly linked to escalating trade war fears. This sell-off has impacted key companies listed on the AEX, highlighting the vulnerability of various sectors and triggering reactions in other European and global markets. Government intervention and EU actions are crucial to alleviate the pressures and foster market recovery.

Stay informed about the evolving situation in the Amsterdam Stock Market. Follow our updates for continuous analysis and insights on the impact of trade wars and global economic uncertainty on the Amsterdam Stock Exchange and its listed companies. Monitor the Amsterdam Stock Market closely for further developments.

Featured Posts

-

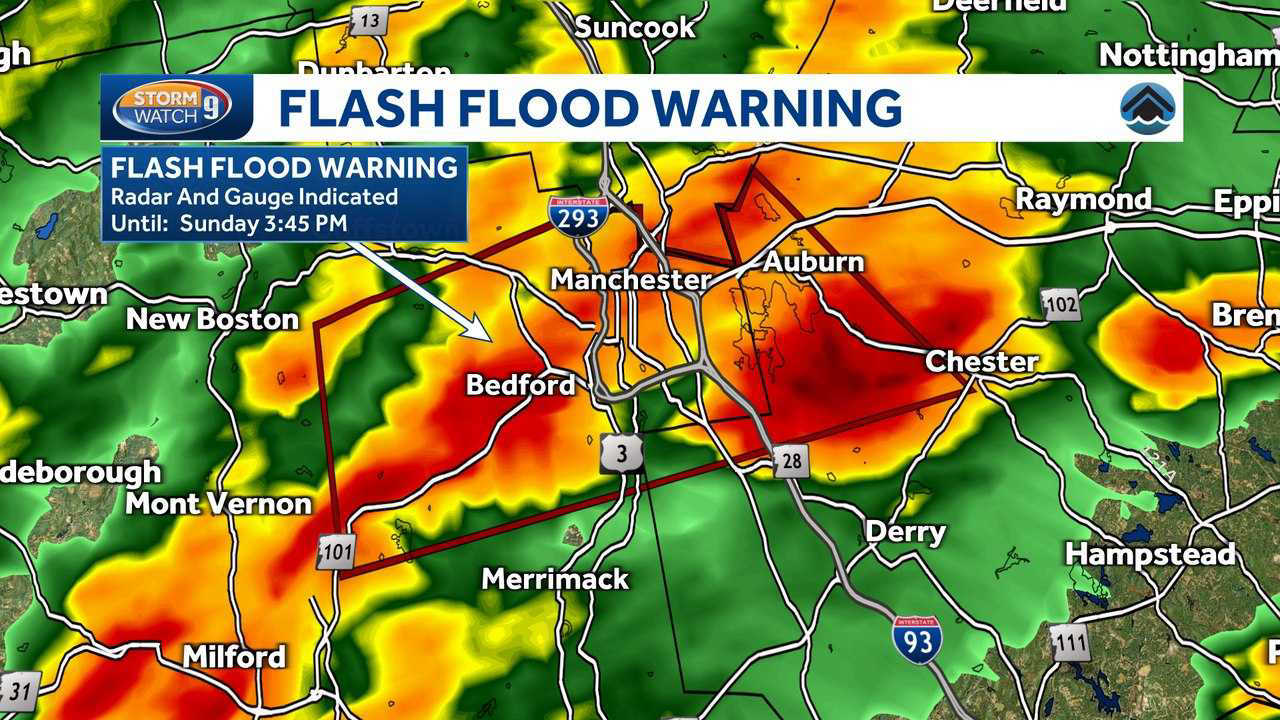

Urgent Flash Flood Warning Issued For Hampshire And Worcester Thursday Night

May 25, 2025

Urgent Flash Flood Warning Issued For Hampshire And Worcester Thursday Night

May 25, 2025 -

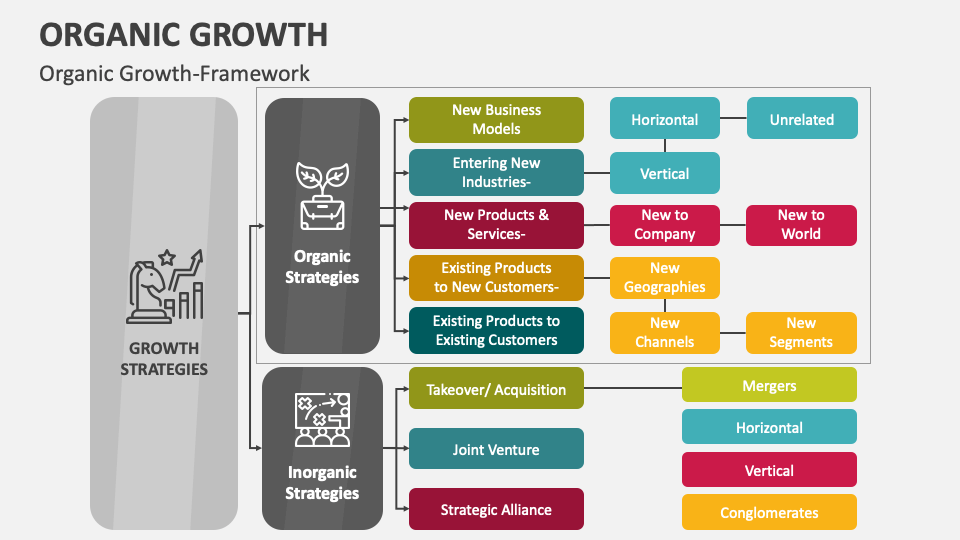

Organic Growth Strategy Leads Cenovus To Dismiss Meg Bid Speculation

May 25, 2025

Organic Growth Strategy Leads Cenovus To Dismiss Meg Bid Speculation

May 25, 2025 -

Apple Stock Sell Off Tim Cooks Tariff Projection Hits Hard

May 25, 2025

Apple Stock Sell Off Tim Cooks Tariff Projection Hits Hard

May 25, 2025 -

Famous Falls From Grace 17 Celebrities Who Lost Everything

May 25, 2025

Famous Falls From Grace 17 Celebrities Who Lost Everything

May 25, 2025 -

Real Madrid Deki Sorusturma Arda Gueler I De Etkileyecek Mi

May 25, 2025

Real Madrid Deki Sorusturma Arda Gueler I De Etkileyecek Mi

May 25, 2025