7% Plunge For Amsterdam Stocks: Trade War Uncertainty Creates Market Volatility

Table of Contents

Understanding the Impact of Trade Wars on Global Markets

The interconnected nature of global finance:

Trade disputes don't exist in isolation. The global economy is intricately interwoven, meaning that even seemingly unrelated markets feel the ripple effects of trade tensions. A trade war between two major powers can disrupt supply chains, impacting businesses and investors worldwide. This interconnectedness is particularly relevant for a trading nation like the Netherlands.

- Disrupted Supply Chains: Trade wars create bottlenecks and delays, increasing costs for businesses reliant on international trade.

- Eroded Investor Confidence: Uncertainty surrounding trade policies discourages investment, leading to reduced economic activity.

- Fluctuating Currency Exchange Rates: Trade wars can significantly affect currency values, impacting the profitability of international transactions.

Specific vulnerabilities of the Dutch economy:

The Netherlands, with its highly export-oriented economy, is particularly vulnerable to trade tensions. Many Dutch companies rely heavily on international trade, making them susceptible to disruptions caused by trade wars.

- Agriculture: Dutch agricultural exports, a significant portion of the national economy, are highly sensitive to trade tariffs and sanctions.

- Technology: Dutch technology companies face challenges in accessing global markets and securing supply chains in a climate of trade uncertainty.

- Logistics and Shipping: The Netherlands' pivotal role in European logistics is directly impacted by trade disruptions, affecting transportation costs and efficiency.

The role of investor sentiment:

Market reactions to trade wars are often driven by fear and uncertainty. Investor sentiment plays a crucial role in shaping stock market performance. Negative news about trade relations can trigger a sell-off, even if the immediate economic impact is minimal.

- Fear-Driven Selling: Investors often react swiftly to negative news, leading to rapid price declines.

- Uncertainty Avoidance: Investors prefer predictable environments, and trade war uncertainty creates significant risk aversion.

- Flight to Safety: During times of heightened uncertainty, investors often move their capital into safer assets like government bonds, further depressing stock prices.

Analyzing the 7% Drop in Amsterdam Stock Prices

Sector-specific analysis:

The recent 7% drop in Amsterdam stock prices wasn't uniform across all sectors. Some industries were hit harder than others.

- Technology: Technology companies experienced a significant decline, reflecting concerns about disrupted supply chains and reduced consumer demand. For example, company X saw a 12% drop, while company Y fell by 9%.

- Finance: The financial sector also felt the impact, with banking stocks experiencing a noticeable decrease due to increased uncertainty in the global economy.

- Agriculture: The agricultural sector, a key component of the Dutch economy, suffered a more moderate decline, reflecting the sector's inherent resilience and adaptability.

Comparison to other European markets:

While the 7% drop in Amsterdam was significant, it wasn't entirely isolated. Other European markets also experienced declines, albeit to varying degrees.

- FTSE 100 (London): A 3% decline, indicating a broader European trend of market correction.

- DAX (Frankfurt): A 4% drop, reflecting similar anxieties about trade war consequences across the continent.

Short-term vs. long-term implications:

The short-term outlook remains uncertain, with potential for both a quick recovery or prolonged instability. The long-term consequences will depend on the resolution (or escalation) of the trade conflict.

- Quick Recovery Scenario: A swift resolution to the trade dispute could lead to a relatively quick rebound in Amsterdam stock prices.

- Prolonged Instability: Continued trade tensions could result in further market volatility and a slower recovery.

Strategies for Navigating Market Volatility

Diversification of investment portfolios:

Diversification is crucial for mitigating risk during times of market uncertainty. Spreading investments across different asset classes and geographical regions can help reduce the impact of any single market downturn.

- Asset Allocation: Diversify across stocks, bonds, real estate, and other assets to balance risk and return.

- Geographic Diversification: Invest in companies and markets outside the Netherlands to reduce exposure to regional economic shocks.

Long-term investment approach:

Maintaining a long-term perspective is essential when navigating market volatility. Short-term fluctuations should not dictate long-term investment strategies.

- Ignoring Short-Term Noise: Focus on long-term growth potential rather than reacting to daily market movements.

- Dollar-Cost Averaging: Invest regularly regardless of market conditions to smooth out volatility.

Seeking professional financial advice:

Seeking guidance from a qualified financial advisor is highly recommended, especially during periods of market uncertainty. A financial expert can provide personalized advice tailored to your individual circumstances and risk tolerance.

- Personalized Investment Plans: A financial advisor will create a plan aligned with your financial goals and risk profile.

- Risk Management Strategies: Experts can help you develop strategies to mitigate risks associated with market volatility.

Conclusion: Preparing for Future Amsterdam Stock Market Volatility

The 7% plunge in Amsterdam stocks serves as a stark reminder of the impact of trade war uncertainty on global markets. Understanding market volatility and employing appropriate risk management strategies are crucial for navigating future economic challenges. Staying informed about global economic events, diversifying investment portfolios, and adopting a long-term investment approach are vital steps in mitigating risks. Consider consulting with a financial advisor to develop a personalized plan to manage future Amsterdam stock market volatility and trade war uncertainty. Stay updated on global economic developments through reputable financial news sources like the Financial Times, Bloomberg, and the Economist.

Featured Posts

-

Nicki Chapmans 700 000 Country Home Investment A Smart Escape

May 24, 2025

Nicki Chapmans 700 000 Country Home Investment A Smart Escape

May 24, 2025 -

89 Svadeb V Krasivuyu Datu Na Kharkovschine Rekord Dnya

May 24, 2025

89 Svadeb V Krasivuyu Datu Na Kharkovschine Rekord Dnya

May 24, 2025 -

Celebrity Sighting Neal Mc Donough At Boises Acero Boards And Bottles

May 24, 2025

Celebrity Sighting Neal Mc Donough At Boises Acero Boards And Bottles

May 24, 2025 -

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

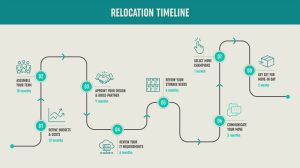

Your Country Escape Awaits A Step By Step Relocation Plan

May 24, 2025

Your Country Escape Awaits A Step By Step Relocation Plan

May 24, 2025