7% Stock Market Drop In Amsterdam: Trade War Uncertainty Creates Volatility

Table of Contents

Understanding the 7% Stock Market Drop in Amsterdam

The 7% drop in the Amsterdam stock market represents a significant event, marking one of the most substantial single-day declines in recent years. This sharp decrease immediately impacted investor confidence, leading to widespread concern about the health of the Dutch and broader European economies.

- Specific date and time of the drop: [Insert Date and Time of Drop, if available. Otherwise, remove this bullet point.]

- Key indices affected: The AEX index, the benchmark index of the Euronext Amsterdam exchange, experienced the brunt of the fall. Other related indices likely saw similar declines.

- Comparison to previous market drops in Amsterdam: [Compare to previous significant drops, providing context and percentage changes. Include data source citation if possible.]

- Volume of trading during the drop: The trading volume during the drop likely spiked significantly, reflecting heightened investor activity and panic selling. [Include data if available, with source.]

Trade War Uncertainty: The Primary Culprit

The primary driver behind the Amsterdam stock market's volatility is the ongoing uncertainty surrounding global trade wars. These protracted disputes inject significant risk into the global economy, causing investors to adopt a more risk-averse stance.

- Specific trade wars influencing the Amsterdam market: The US-China trade war, Brexit's ongoing uncertainties, and other bilateral trade disputes all contribute to a climate of apprehension. These conflicts create unpredictable market conditions.

- Investor uncertainty and risk aversion: The lack of clarity regarding future trade policies leads to investor uncertainty. This uncertainty fosters risk aversion, prompting investors to sell off assets to protect their capital.

- Impact on specific sectors: Sectors heavily reliant on international trade, such as technology and agriculture, are particularly vulnerable to trade war disruptions. [Provide specific examples of affected Dutch companies and their performance.]

- Relevant statistics and data: [Include relevant statistics, such as import/export data for the Netherlands, illustrating the impact of trade disputes. Cite sources.]

Impact on Dutch Businesses and Investors

The stock market drop has far-reaching consequences for Dutch businesses and individual investors. The decline in stock prices directly impacts company valuations and investor wealth.

- Effect on company valuations and stock prices: Dutch companies listed on the Amsterdam Stock Exchange experienced a significant reduction in their market capitalization. This directly affects their ability to raise capital and invest in future growth.

- Impact on consumer confidence and spending: The market volatility can negatively impact consumer confidence, leading to reduced spending and potentially slowing economic growth in the Netherlands.

- Potential job losses and economic slowdown: If the downturn persists, it could lead to job losses and a broader economic slowdown, impacting various sectors of the Dutch economy.

- Investor strategies employed during the drop: Many investors likely employed defensive strategies such as hedging, diversification, and increased allocation to less volatile assets during this period.

Navigating Market Volatility: Strategies for Investors

Navigating market volatility requires a proactive approach to investment management. A well-defined strategy can help mitigate risks and potentially capitalize on opportunities.

- Importance of diversification: Diversifying investment portfolios across different asset classes and geographical regions is crucial to reduce overall portfolio risk.

- Risk assessment and management techniques: Investors should regularly assess their risk tolerance and implement appropriate risk management techniques.

- Long-term investment strategies vs. short-term trading: Long-term investors are better positioned to weather short-term market fluctuations. Short-term trading during volatile periods is generally riskier.

- Seeking professional financial advice: Seeking advice from a qualified financial advisor can provide personalized guidance tailored to individual circumstances and risk profiles.

Potential Future Outlook for the Amsterdam Stock Market

Predicting the future of the Amsterdam stock market is inherently challenging, but several factors will influence its trajectory.

- Analysis of global economic factors: The resolution (or escalation) of trade disputes, global economic growth rates, and interest rate policies will significantly impact the Amsterdam market.

- Potential for market recovery and growth: Depending on the resolution of trade uncertainties and broader economic conditions, a market recovery and subsequent growth are possible.

- Possible government interventions or policies: Government interventions, such as fiscal stimulus or monetary policy adjustments, could influence the market's direction.

- Expert opinions and predictions: Financial analysts' predictions and outlooks provide valuable insights, though it's important to note that these are not guarantees.

Conclusion

The 7% stock market drop in Amsterdam serves as a stark reminder of the impact of global trade war uncertainty on even relatively stable markets. Understanding the contributing factors to this volatility is crucial for investors seeking to navigate effectively. Diversification, robust risk management, and a long-term investment horizon are essential tools for weathering such turbulent periods. While the future remains uncertain, proactive planning and potentially seeking professional financial advice can mitigate risks and potentially position investors to capitalize on future opportunities in the Amsterdam stock market.

Call to Action: Stay informed about the latest developments impacting the Amsterdam stock market and the global economy to make sound investment decisions. Learn more about mitigating risks associated with trade war uncertainty and develop a robust strategy for navigating future Amsterdam stock market volatility.

Featured Posts

-

The Kyle Walker Annie Kilner Situation Recent News And Developments

May 25, 2025

The Kyle Walker Annie Kilner Situation Recent News And Developments

May 25, 2025 -

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 25, 2025

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 25, 2025 -

Nicki Chapmans Seven Figure Property Investment A Case Study In Escape To The Country

May 25, 2025

Nicki Chapmans Seven Figure Property Investment A Case Study In Escape To The Country

May 25, 2025 -

Long Delays On M6 Motorway Due To Van Accident

May 25, 2025

Long Delays On M6 Motorway Due To Van Accident

May 25, 2025 -

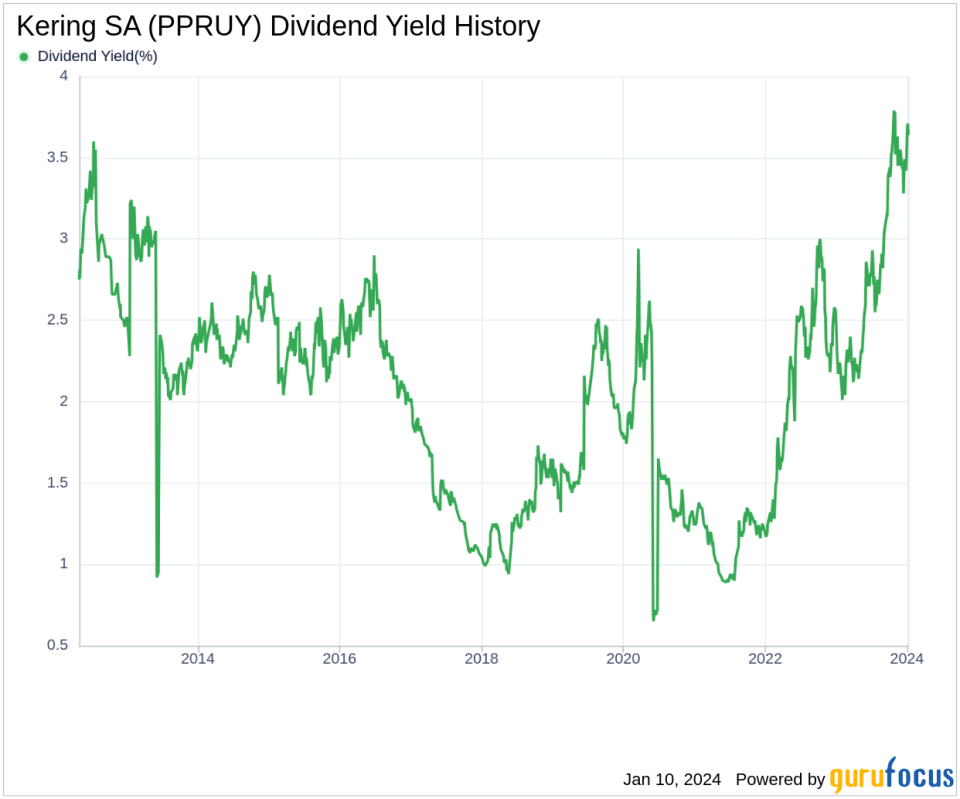

Weak Q1 Results Send Kering Shares Down 6

May 25, 2025

Weak Q1 Results Send Kering Shares Down 6

May 25, 2025