ABN Amro Bonus Scheme Under Investigation: Risk Of Substantial Fine

Table of Contents

Details of the ABN Amro Bonus Scheme Under Investigation

The heart of the investigation lies in the structure and implementation of ABN Amro's bonus scheme. Allegations suggest that the scheme violated several crucial regulations, potentially leading to significant legal and financial repercussions. While specifics are still emerging, reports indicate irregularities concerning the allocation of bonuses, potentially linked to questionable sales practices and a disregard for established risk management protocols. This ABN Amro bonus scandal has raised serious questions about the bank’s internal controls and oversight.

- Specific regulations allegedly breached: Reports suggest potential violations related to anti-money laundering regulations, tax evasion laws, and possibly breaches of conduct relating to the promotion of unsuitable financial products.

- Timeline of events: The investigation reportedly began following a whistleblower report in [Insert Year, if available], prompting a thorough internal review by ABN Amro and subsequent regulatory intervention. The timeline may extend further back, depending on the scope of the investigation.

- Key individuals involved: While names haven't been publicly released, the investigation is likely focusing on individuals involved in the design, implementation, and management of the bonus scheme, including senior executives and possibly compliance officers.

Regulatory Bodies Involved in the Investigation

Several prominent regulatory authorities are involved in the investigation, each playing a crucial role in determining the extent of the alleged misconduct and imposing penalties. The primary bodies are expected to include:

- De Nederlandsche Bank (DNB): The Dutch Central Bank will likely be heavily involved due to its oversight of ABN Amro's operations within the Netherlands. Their focus will probably be on the compliance with Dutch banking regulations and AML/CFT requirements. They hold significant power to impose substantial fines.

- European Central Bank (ECB): Given ABN Amro's operations across the Eurozone, the ECB is likely to be involved to ensure compliance with EU-wide banking regulations. Their area of concern will overlap with the DNB, focusing on systemic risk and financial stability within the broader European banking system. They can also impose significant penalties.

- Other potential regulatory bodies: Depending on the specifics of the alleged violations, other regulatory agencies, both national and international, may also become involved.

Potential Penalties and Consequences for ABN Amro

The potential penalties facing ABN Amro are significant, encompassing substantial fines and a considerable impact on its reputation and financial health.

- Estimated range of potential fines: The potential fine could reach hundreds of millions of Euros, depending on the severity of the violations and the regulatory bodies involved. The final amount will heavily depend on the findings of the ongoing investigation.

- Potential impact on stock price: News of the investigation and the potential for substantial fines has already impacted ABN Amro's share price, and further negative developments could lead to more significant drops.

- Loss of business opportunities: Reputational damage caused by this investigation could lead to the loss of clients and business opportunities, impacting the bank's future growth and profitability.

- Potential legal action from affected parties: Individuals or entities who suffered losses due to the alleged misconduct of the bonus scheme could initiate legal action against ABN Amro, adding to the bank's financial burden.

The Future of ABN Amro’s Compensation Practices

This investigation will undoubtedly force ABN Amro to reconsider its compensation practices. The fallout may lead to fundamental changes in how bonuses are structured and awarded.

- Possible reforms to the bonus system: ABN Amro will likely overhaul its bonus scheme, introducing stricter criteria for awarding bonuses and a greater emphasis on long-term performance and ethical conduct. Expect a focus on aligning individual incentives with the bank's overall strategic goals and risk appetite.

- Enhanced compliance training for employees: The bank will likely implement more comprehensive compliance training programs to ensure employees understand and adhere to relevant regulations and internal policies. This will include a stricter focus on responsible business practices and ethical considerations.

- Increased oversight of compensation practices: Expect more rigorous internal audits and independent reviews of compensation practices to prevent future occurrences of alleged misconduct. This will increase transparency and accountability within the bank’s compensation structure.

The ABN Amro Bonus Scheme Investigation – Key Takeaways and Next Steps

The ABN Amro bonus scheme investigation highlights the importance of robust regulatory compliance and ethical corporate governance within the financial sector. The potential for substantial fines and lasting reputational damage serves as a stark warning to other financial institutions. The investigation's outcome will significantly impact ABN Amro's future and could lead to significant changes in its compensation and risk management practices.

To stay informed about the ongoing developments in this important case, follow the ABN Amro bonus scheme investigation closely. You can learn more about the potential fine for ABN Amro and other related news by following reputable financial news sources and official statements from the regulatory bodies involved. Stay updated on the ABN Amro bonus scheme scandal and its implications for the banking industry as the investigation progresses.

Featured Posts

-

Bp Ceo Pay Drop 31 Reduction In Executive Compensation

May 22, 2025

Bp Ceo Pay Drop 31 Reduction In Executive Compensation

May 22, 2025 -

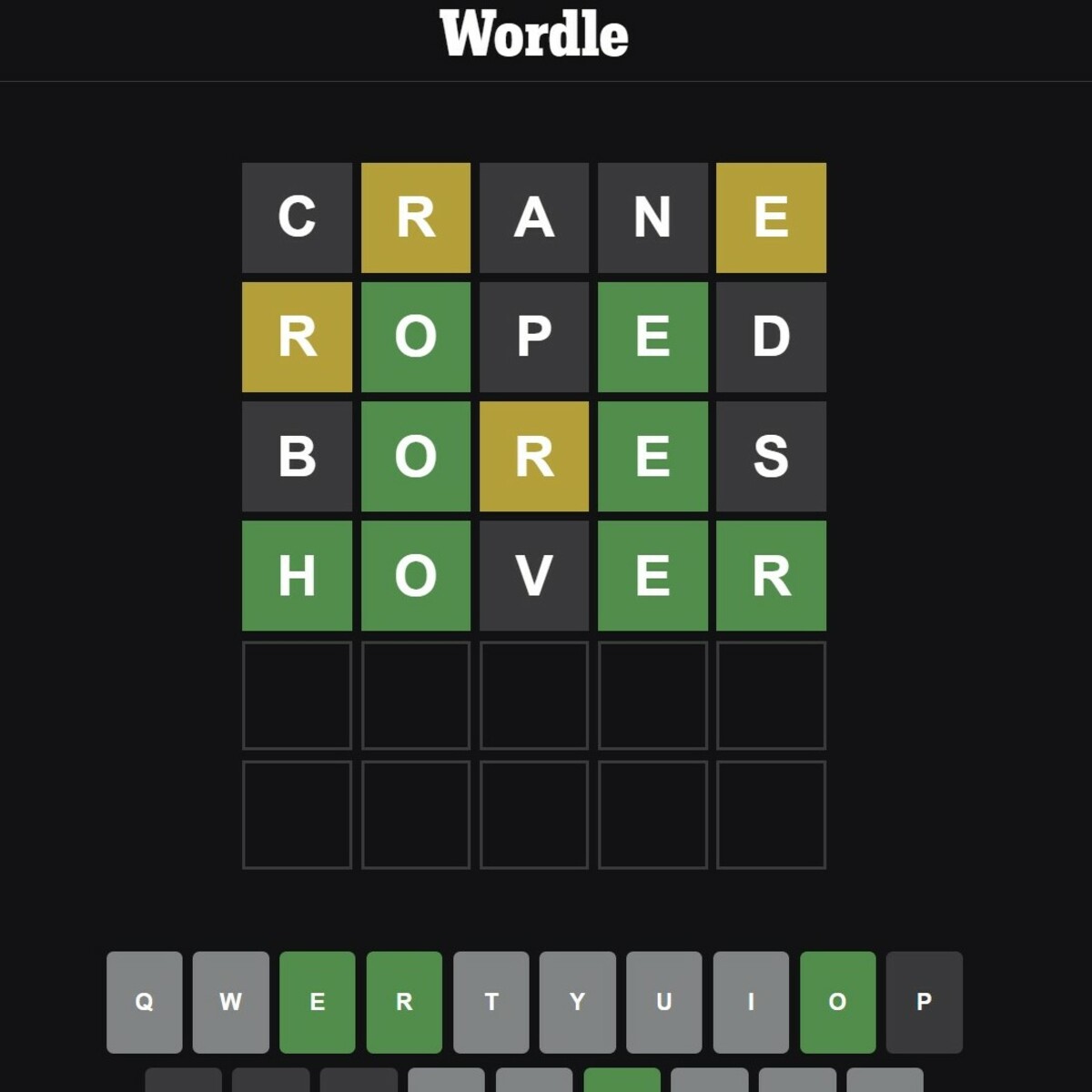

Nyt Wordle Help Hints And Answer For April 8th Puzzle 1389

May 22, 2025

Nyt Wordle Help Hints And Answer For April 8th Puzzle 1389

May 22, 2025 -

The Impact Of Us Export Controls On Nvidia Ceos Perspective

May 22, 2025

The Impact Of Us Export Controls On Nvidia Ceos Perspective

May 22, 2025 -

Ronaldo I Kho Lund Imitatsi A Na Slav Eto I Reaktsi Ata Na Cr 7

May 22, 2025

Ronaldo I Kho Lund Imitatsi A Na Slav Eto I Reaktsi Ata Na Cr 7

May 22, 2025 -

Posthaste Signs Point To A Canadian Home Price Correction

May 22, 2025

Posthaste Signs Point To A Canadian Home Price Correction

May 22, 2025