ABN Amro: Huizen Betaalbaar, Of Loopt Nederland Te Zaniken? (GeenStijl)

Table of Contents

ABN Amro's Standpunt: Een Analyse van de Rapportbevindingen (ABN Amro's Position: An Analysis of the Report Findings)

ABN Amro's latest report provides a detailed overview of the current state of the Dutch housing market. Let's delve into its key conclusions and methodologies.

Belangrijkste Conclusies van het Rapport (Main Conclusions of the Report):

The report highlights several key findings:

- Average House Price Increases: The average house price in the Netherlands increased by X% in the last year, continuing a trend of sustained growth over the past decade. Specific regional data should be included here, referencing the source report. (e.g., "In Amsterdam, the increase was significantly higher at Y%, while in the province of Friesland, it was a more modest Z%").

- Regional Variations: Significant regional disparities in affordability are evident. The Randstad region, including Amsterdam, Rotterdam, and The Hague, experiences considerably higher prices compared to more rural provinces.

- Impact of Interest Rates: The recent rise in hypotheekrente (mortgage interest rates) has undeniably impacted affordability, increasing monthly mortgage payments for potential homebuyers. The report likely quantifies this impact, which should be cited here with specific figures.

- Affordability Ratios: The report likely calculates affordability ratios (e.g., the ratio of average house price to average income). These figures, crucial for understanding affordability, should be included and explained clearly.

Methodologie en Beperkingen van het Onderzoek (Methodology and Limitations of the Research):

ABN Amro's analysis likely relies on a robust statistical analysis (statistische analyse) using extensive dataverzameling (data collection) from various sources. However, it's crucial to acknowledge any potential limitations. For example:

- Data Representativiteit (Representativeness): The report's conclusions depend on the representativeness of the data used. Any potential biases in data selection should be discussed.

- External Factors: The report may not fully account for all external factors influencing house prices, such as government policies or unforeseen economic events.

De Publieke Opinie: Klagen of Gerechtvaardigde Bezorgdheid? (Public Opinion: Complaining or Justified Concern?)

The public perception of housing affordability is strongly negative. But is this justified? Let's examine the socio-economic context.

Sociaal-economische Aspecten (Socio-economic Aspects):

Rising huizenprijzen Nederland disproportionately affect lower and middle-income groups. The increasing gap between income (inkomen) and housing costs exacerbates sociale ongelijkheid (social inequality), limiting accessibility (toegankelijkheid) to homeownership for many. Statistics illustrating income inequality and its correlation with housing affordability should be included here.

Regionale Verschillen in Betaalbaarheid (Regional Differences in Affordability):

Affordability varies dramatically across the Netherlands. The Randstad, a hub for economic activity, experiences significantly higher huisvesting (housing) costs compared to other provinces. This creates a two-tiered system, where access to suitable housing is heavily skewed towards those living in, or able to commute to, these high-demand areas. Comparing specific provinces illustrates the stark contrast in affordability.

Toekomstige Trends en Verwachtingen (Future Trends and Expectations)

Understanding future trends requires analyzing the role of the government and predicting market behavior.

De Rol van de Overheid (The Role of the Government):

Government intervention through overheidsbeleid (government policy) is crucial. Policies impacting housing affordability include:

- Bouwwetgeving (Building Regulations): Streamlining building permits and encouraging the construction of more affordable housing is essential.

- Belastingen (Taxes): Tax incentives for first-time homebuyers or adjustments to property taxes could influence affordability. Specific examples of current and proposed government initiatives should be included.

Voorspellingen voor de Huizenmarkt (Predictions for the Housing Market):

Predicting future trends in the housing market (marktprognose) is complex. However, factors influencing huizenprijzen Nederland include:

- Renteontwikkeling (Interest Rate Development): Future interest rate changes will directly impact mortgage affordability.

- Economische groei (Economic Growth): Strong economic growth can positively influence affordability, while economic downturns can negatively impact it.

Conclusion:

The ABN Amro report provides valuable insights into the complexities of the Dutch housing market. While the report may offer a specific perspective, the debate surrounding huizenprijzen Nederland is multifaceted. The considerable rise in house prices has undeniably created affordability challenges for many, particularly those from lower socio-economic backgrounds. However, the extent to which this constitutes a crisis is open to interpretation. Whether the public outcry is justified depends on individual circumstances and perspectives.

Call to Action: Continue the discussion! Share your thoughts on the huizenprijzen Nederland and whether you think the concerns about affordability are valid. Join the conversation using #HuizenmarktNederland #DutchHousing.

Featured Posts

-

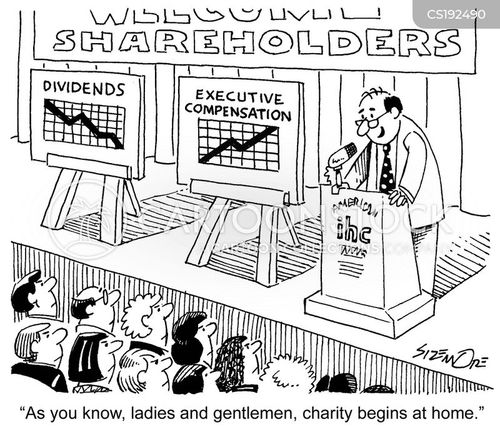

Bp Executive Compensation A 31 Decrease

May 21, 2025

Bp Executive Compensation A 31 Decrease

May 21, 2025 -

Migrant Hotel Fire Tory Councillors Wife Claims Innocent Intent

May 21, 2025

Migrant Hotel Fire Tory Councillors Wife Claims Innocent Intent

May 21, 2025 -

Ea Fc 24 Fut Birthday Tier List For The Top Performing Players

May 21, 2025

Ea Fc 24 Fut Birthday Tier List For The Top Performing Players

May 21, 2025 -

The Enigma Of The Red Lights A French Sky Mystery

May 21, 2025

The Enigma Of The Red Lights A French Sky Mystery

May 21, 2025 -

Efimereyontes Giatroi Patras 12 And 13 Aprilioy

May 21, 2025

Efimereyontes Giatroi Patras 12 And 13 Aprilioy

May 21, 2025