Activision Blizzard Merger Faces FTC Appeal

Table of Contents

The FTC's Arguments Against the Merger

The FTC's opposition to the Activision Blizzard merger centers on concerns about the creation of a monopoly and its potential negative impact on competition and consumers.

Concerns about Monopoly Power

The FTC's primary argument revolves around the potential for Microsoft to gain undue market dominance, particularly concerning the immensely popular Call of Duty franchise. They argue that owning Activision Blizzard would give Microsoft an unfair competitive advantage, stifling innovation and harming other game developers.

- Market Share Dominance: Microsoft already holds a substantial share of the gaming market through its Xbox consoles and PC gaming ecosystem. Acquiring Activision Blizzard, with its diverse portfolio including Call of Duty, World of Warcraft, and Candy Crush, would significantly increase this dominance, potentially creating a near-monopoly.

- Exclusion of Competitors: The FTC fears that Microsoft could leverage its ownership of Call of Duty to exclude competitors, making it difficult for other console makers like Sony PlayStation and Nintendo to compete effectively. This could lead to a less diverse and innovative gaming market.

- Anti-Competitive Behavior: The FTC's core mission is to prevent anti-competitive practices that harm consumers. They believe the merger violates this principle, potentially leading to reduced choice, higher prices, and stifled innovation within the gaming industry.

Impact on Game Prices and Innovation

The FTC also argues that the Activision Blizzard merger could lead to higher prices for games and a reduction in innovation due to decreased competition.

- Price Increases for Consumers: By controlling key franchises like Call of Duty, Microsoft could potentially raise prices or limit availability on competing platforms, directly impacting consumers' wallets.

- Reduced Game Choice: The merger could lead to a reduction in the variety of games available to consumers, as Microsoft might prioritize its own titles or neglect supporting games developed by competitors.

- Harm to Smaller Developers: Smaller game studios might find it increasingly difficult to compete with a Microsoft possessing such a large portfolio, potentially leading to a consolidation of power and a less diverse gaming market.

Microsoft's Defense of the Merger

Microsoft has vigorously defended its proposed acquisition of Activision Blizzard, arguing that the merger will benefit both gamers and the broader gaming industry.

Commitment to Fair Competition

Microsoft counters the FTC's claims by emphasizing its commitment to maintaining fair competition within the gaming market.

- Continued Call of Duty Availability: Microsoft has made public commitments to continue offering Call of Duty on PlayStation and other competing platforms, addressing a key concern raised by the FTC. They have offered long-term contracts to ensure Call of Duty remains accessible to a broad audience.

- Investments in Game Development: Microsoft has pledged to invest heavily in game development, expanding the overall gaming ecosystem rather than restricting it. This includes supporting both existing and new game studios.

- Cloud Gaming Expansion: The merger allows Microsoft to further its ambitions in cloud gaming, making games more accessible to a wider audience, potentially benefiting gamers in underserved regions.

Benefits for Gamers

Microsoft highlights the potential benefits the merger could bring to gamers, emphasizing improved gaming experiences and broader access.

- Expanded Game Library: Gamers would gain access to a significantly larger library of games across various platforms, including Xbox, PC, and potentially even mobile devices.

- Advanced Gaming Technology: The merger could accelerate advancements in gaming technology, including improvements in cloud gaming, graphics, and overall performance.

- Cross-Platform Play: The combined resources of Microsoft and Activision Blizzard could lead to increased cross-platform play opportunities, connecting gamers across different consoles and devices.

Potential Outcomes and Implications

The FTC's appeal significantly impacts the future of the Activision Blizzard merger and the broader gaming industry.

Appeal Process and Timeline

The appeal process could be lengthy, involving numerous legal filings, hearings, and potential court decisions. The timeline is uncertain, but the outcome will likely hinge on the court's interpretation of existing antitrust laws and precedents. Factors such as the judge's previous reasoning and the strength of the FTC's legal strategy will play a crucial role.

- Legal Precedents: Previous merger cases and antitrust rulings will serve as precedents, guiding the court's decision in the Activision Blizzard case.

- Judge's Reasoning: The judge's initial ruling in favor of the merger will be subject to scrutiny, potentially influencing the appeals court's decision.

- FTC's Legal Strategy: The FTC's ability to effectively present its case and demonstrate potential harm to competition will be crucial to the appeal's success.

Impact on the Gaming Industry

The outcome of the FTC's appeal will have significant implications for the gaming landscape.

- Console Sales and Market Share: The decision will directly impact the competitive dynamics between major console manufacturers like Xbox, PlayStation, and Nintendo, potentially shifting market share and sales figures.

- Game Development and Innovation: The merger's outcome will influence the future direction of game development, impacting the range of games available, their pricing, and the overall innovation within the industry.

- Mergers and Acquisitions: The decision will set a precedent for future mergers and acquisitions in the gaming industry, influencing how regulators approach similar deals in the future.

Conclusion

The Activision Blizzard merger faces a critical juncture with the FTC's appeal. The arguments presented by both sides highlight the significant implications of this deal for competition, innovation, and consumer choice within the gaming industry. The potential consequences range from the creation of a near-monopoly to increased accessibility and technological advancements in gaming. It’s crucial to carefully consider both perspectives to fully understand the complexities at play. Stay updated on the Activision Blizzard merger, following the appeal process closely to understand its lasting effects on the future of gaming. Follow the Activision Blizzard appeal to stay informed about developments in this landmark case. Learn more about the future of the Activision Blizzard merger and its potential impact on the gaming industry.

Featured Posts

-

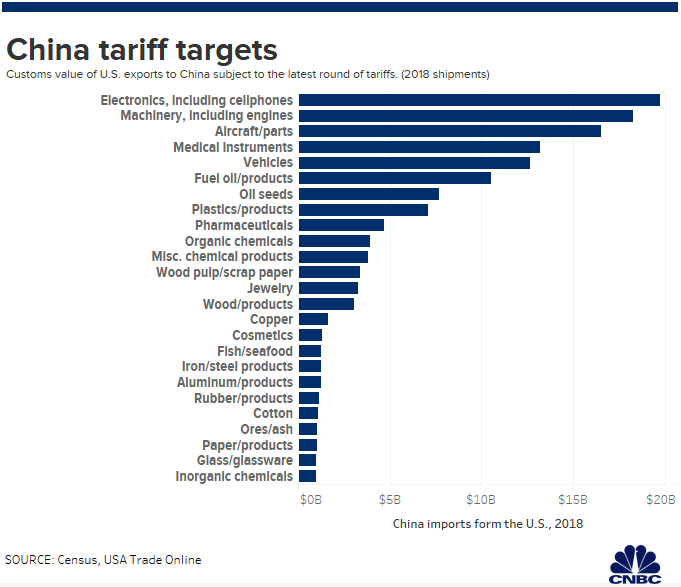

Export Led Growth Assessing Chinas Tariff Sensitivity

Apr 22, 2025

Export Led Growth Assessing Chinas Tariff Sensitivity

Apr 22, 2025 -

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 22, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 22, 2025 -

Selling Sunset Star Accuses Landlords Of Price Gouging Amidst La Fires

Apr 22, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging Amidst La Fires

Apr 22, 2025 -

Karen Read Murder Trials A Complete Timeline

Apr 22, 2025

Karen Read Murder Trials A Complete Timeline

Apr 22, 2025 -

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

Apr 22, 2025

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

Apr 22, 2025