Addressing High Stock Market Valuations: BofA's Argument For Investor Confidence

Table of Contents

BofA's Key Arguments for Sustained Market Growth

BofA's analysis points to several key factors supporting continued market growth, even in the face of high valuations. These arguments center around strong corporate performance, supportive monetary policy, and the transformative power of technological innovation.

Strong Corporate Earnings and Profitability

BofA's research highlights robust corporate earnings and profitability as a cornerstone of their positive market outlook. Their analysis suggests that many sectors are experiencing significant earnings growth, pointing to a healthy underlying economic environment.

- Examples of strong-performing sectors: Technology, healthcare, and consumer staples have demonstrated particularly impressive earnings growth.

- Evidence of robust profit margins: Many companies are maintaining healthy profit margins, indicating efficient operations and strong pricing power.

- Projections for future earnings growth: BofA's projections suggest continued earnings growth in the coming quarters, fueled by both organic growth and strategic acquisitions. This sustained corporate earnings growth is a crucial factor in supporting current stock market performance.

Low Interest Rates and Supportive Monetary Policy

The prevailing low interest rate environment and the supportive stance of central banks play a significant role in BofA's assessment. These factors contribute to increased market liquidity and encourage investment.

- Explanation of low interest rates: Low interest rates reduce borrowing costs for businesses and consumers, stimulating economic activity and boosting corporate investments.

- Potential for further rate cuts or quantitative easing: The possibility of further monetary easing measures offers additional support for asset prices, including stocks.

- How this supports investment: Increased market liquidity makes it easier for investors to access capital, further fueling investment and supporting higher valuations. This supportive monetary policy is a critical component in addressing high stock market valuations, as it fosters a favorable environment for market expansion.

Innovation and Technological Advancements

BofA emphasizes the role of technological innovation as a key driver of long-term growth, justifying the higher valuations seen in certain sectors. The disruptive potential of new technologies is expected to yield significant returns.

- Examples of innovative sectors: Artificial intelligence, cloud computing, and biotechnology are among the sectors experiencing rapid growth and attracting significant investment.

- The potential for disruption and growth: These technologies have the potential to revolutionize industries, creating new markets and opportunities for significant growth.

- How this contributes to future stock market gains: The long-term growth potential of these innovative sectors supports the higher valuations observed in the broader market. This technological advancement is key to addressing concerns surrounding high stock market valuations as it points toward future growth potential.

Addressing Concerns Regarding High Valuation Metrics

While acknowledging the high valuation multiples in the current market, BofA offers context and analysis to temper concerns. Their approach focuses on historical context, long-term growth projections, and effective risk management.

Valuation Multiples in Historical Context

BofA compares current valuation multiples, such as the Price-to-Earnings (P/E) ratio, to historical data to provide perspective. While acknowledging elevated levels compared to some historical averages, they highlight several factors influencing these metrics.

- Comparison of current multiples to previous market cycles: A comparison reveals that while current P/E ratios are high, they are not unprecedented in the context of past market cycles.

- Discussion of factors influencing these metrics: Factors like low interest rates, strong earnings growth, and expectations of future technological advancements influence valuation multiples.

- Highlighting any anomalies: BofA analyzes specific sectors or companies with unusually high valuations, providing context for potential risks and opportunities. Analyzing the historical context of valuation multiples is a key approach in addressing high stock market valuations, allowing investors to view current metrics in perspective.

The Role of Long-Term Growth Expectations

BofA emphasizes the significance of long-term growth projections in their valuation assessments. They employ sophisticated forecasting methodologies to account for future growth potential.

- Details on their forecasting methodologies: BofA utilizes a range of forecasting techniques, including discounted cash flow analysis and industry-specific growth models.

- Factors influencing long-term growth: Factors such as technological innovation, demographic trends, and global economic growth significantly influence these projections.

- How this justifies current valuations: The incorporation of robust long-term growth projections helps to justify the current valuations, suggesting that they are not necessarily unsustainable. Looking at the long-term growth expectations is a critical part of addressing high stock market valuations, ensuring a comprehensive understanding of future potential.

Managing Risk and Diversification

BofA emphasizes the importance of prudent risk management and diversification strategies in a high-valuation environment. This approach is crucial for mitigating potential downside risks.

- Strategies for risk mitigation: Strategies include diversifying across asset classes and sectors, employing stop-loss orders, and carefully selecting investments.

- Portfolio diversification: Diversifying across different asset classes and geographical regions is crucial to mitigate overall portfolio risk.

- The importance of a long-term investment horizon: A long-term investment horizon allows investors to weather short-term market fluctuations and benefit from the long-term growth potential of the market. Proper risk management is essential when addressing high stock market valuations and helps investors navigate potential uncertainties.

Conclusion: Addressing High Stock Market Valuations: A Call for Measured Optimism

BofA's analysis suggests that while high stock market valuations are a legitimate concern, several key factors support a degree of measured optimism. Addressing high stock market valuations effectively requires a balanced approach, considering both the potential risks and the opportunities presented.

Key takeaways include the strength of corporate earnings, the supportive monetary policy environment, the transformative potential of technological innovation, and the importance of considering long-term growth projections and implementing sound risk management strategies. By understanding these factors, investors can make more informed decisions. We encourage further research into BofA's reports and perspectives to gain a deeper understanding of their analysis and to develop a well-informed investment strategy for addressing high stock market valuations. Remember, a diversified portfolio and a long-term perspective are crucial tools for navigating the complexities of the current market.

Featured Posts

-

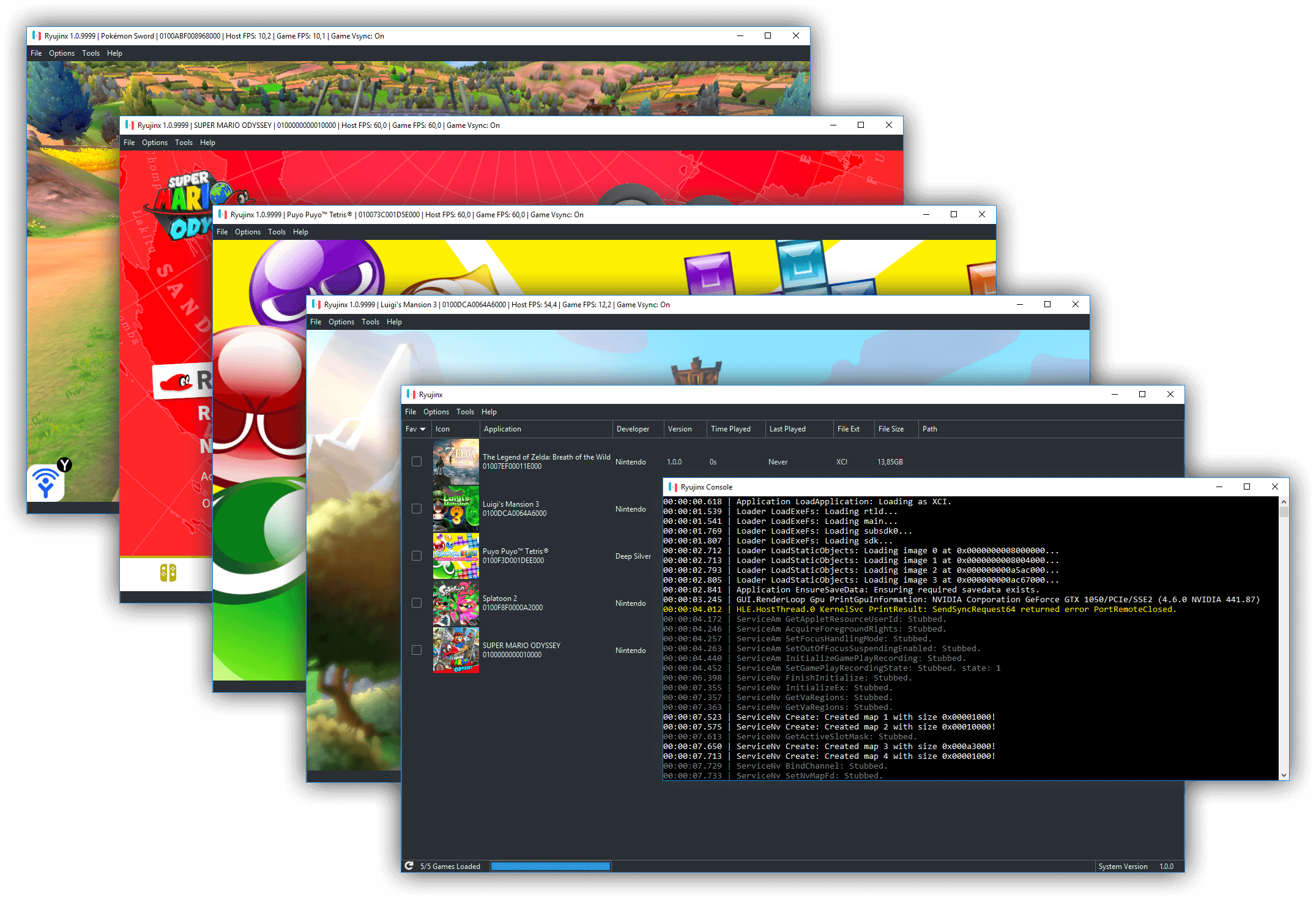

Nintendos Action Ryujinx Switch Emulator Development Ceases

Apr 22, 2025

Nintendos Action Ryujinx Switch Emulator Development Ceases

Apr 22, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 22, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 22, 2025 -

Another 1 Billion Cut Trump Administration Targets Harvard Funding

Apr 22, 2025

Another 1 Billion Cut Trump Administration Targets Harvard Funding

Apr 22, 2025 -

Chat Gpt And Open Ai The Ftc Investigation And Its Potential Outcomes

Apr 22, 2025

Chat Gpt And Open Ai The Ftc Investigation And Its Potential Outcomes

Apr 22, 2025 -

The Robotic Manufacturing Hurdles In Nike Sneaker Production

Apr 22, 2025

The Robotic Manufacturing Hurdles In Nike Sneaker Production

Apr 22, 2025