Addressing High Stock Market Valuations: Insights From BofA For Investors

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's comprehensive analysis provides a nuanced perspective on the current market situation. Their research highlights several key factors influencing these elevated valuations, along with potential risks that investors should carefully consider.

Identifying Overvalued Sectors

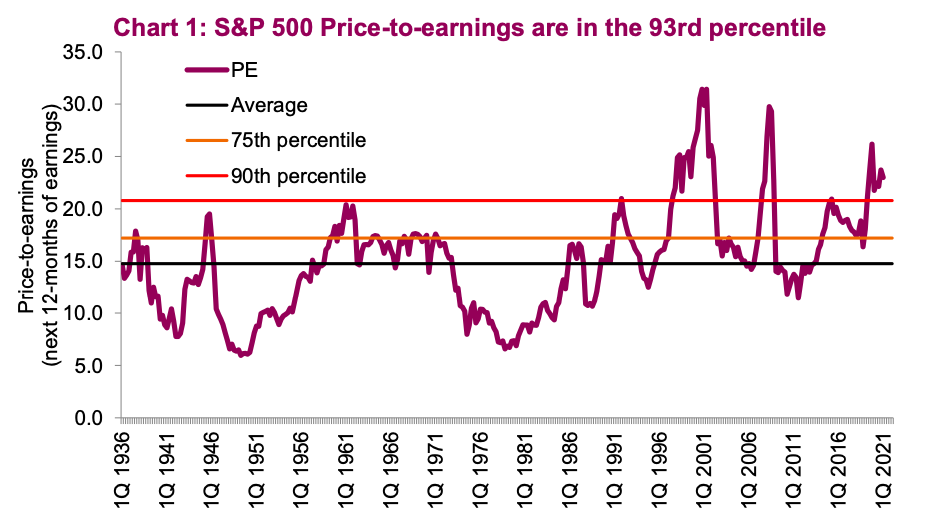

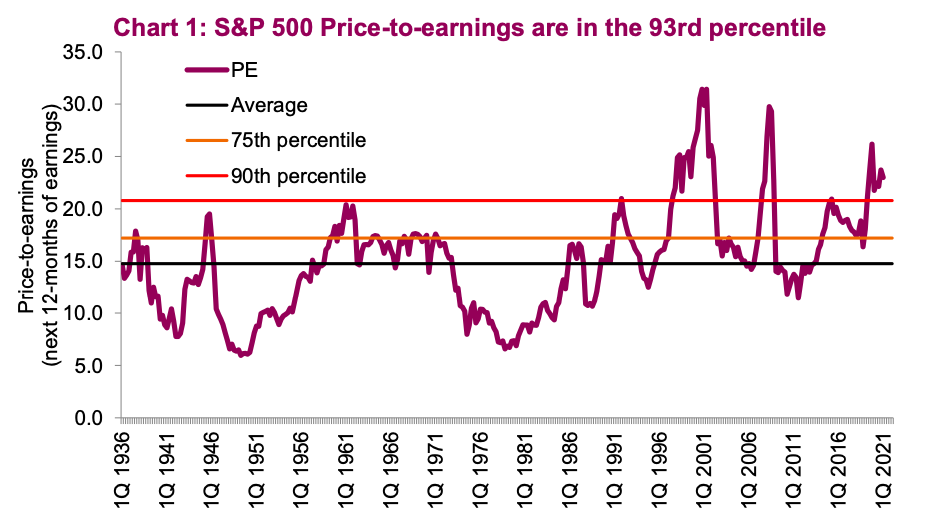

BofA's research pinpoints specific sectors showing signs of overvaluation. Their analysis relies on several key metrics, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and other valuation multiples. By comparing these metrics to historical averages and industry benchmarks, BofA identifies potential areas of concern.

-

Examples of Overvalued Sectors (according to BofA):

- Technology (particularly certain segments within the sector)

- Consumer Discretionary (driven by strong consumer spending but potentially unsustainable)

-

Metrics Used by BofA: BofA's analysts utilize a multi-faceted approach, combining fundamental analysis with technical indicators. For example, high P/E ratios compared to historical averages or industry peers suggest potential overvaluation. Similarly, elevated P/S ratios indicate that investors are paying a premium for future growth, a risk factor in a volatile market. They also consider factors like revenue growth rates, profitability, and debt levels. Specific data points from BofA's reports would need to be referenced here for a complete picture (this data is often subscription-based).

Factors Contributing to High Valuations

Several macroeconomic factors have contributed to the current high stock market valuations. BofA's experts emphasize the interplay of these forces:

- Low Interest Rates: Historically low interest rates make borrowing cheaper for companies and incentivize investors to seek higher returns in the stock market.

- Quantitative Easing (QE): Central banks' injection of liquidity into the financial system further fuels market growth.

- Positive Investor Sentiment: Overall investor optimism and a belief in continued economic growth contribute to higher valuations.

- Technological Advancements: Rapid technological innovation drives strong growth in certain sectors, leading to higher valuations for tech companies.

These factors, while contributing to growth, also create vulnerability. BofA's analysis carefully considers the potential for a correction should these supportive factors change.

Potential Risks Associated with High Valuations

High valuations inherently carry substantial risks. BofA cautions investors about several potential downsides:

- Market Corrections: A sharp decline in market prices can wipe out significant gains.

- Increased Volatility: High valuations often precede periods of increased market volatility, making it challenging to time the market.

- Inflation Concerns: Rising inflation can erode the purchasing power of returns, reducing real gains.

- Interest Rate Hikes: Future interest rate increases can reduce corporate profits and investor appetite for equities.

- Geopolitical Instability: Global uncertainties can impact investor sentiment and cause market fluctuations.

BofA recommends mitigating these risks through careful portfolio diversification and a well-defined investment strategy.

BofA's Recommended Investment Strategies

BofA suggests several strategies to navigate the challenges posed by high stock market valuations. These strategies aim to balance potential returns with risk mitigation.

Diversification Strategies

Diversification remains a cornerstone of effective investment management. BofA advises a multi-pronged approach:

- Asset Allocation: Distributing investments across different asset classes (stocks, bonds, real estate, etc.) helps reduce overall portfolio risk.

- Sector Diversification: Avoiding overexposure to any single sector mitigates the impact of sector-specific downturns.

- Geographic Diversification: Investing in companies across different geographies reduces dependence on any single economy.

BofA's specific recommendations for asset allocation would depend on the investor's risk tolerance and time horizon.

Value Investing Opportunities

While many sectors appear overvalued, BofA also identifies potential opportunities in undervalued segments.

- Examples of Undervalued Sectors (according to BofA): (Specific examples would need to be sourced from BofA's current research) This section would benefit from inclusion of specific examples and ticker symbols, if available.

- Rationale: BofA’s research would highlight why these sectors are considered undervalued. This may involve analyzing their fundamentals (earnings, revenue growth, etc.) compared to their current market capitalization.

Defensive Investment Strategies

During periods of market uncertainty, defensive strategies can help protect your portfolio:

- Increasing Cash Holdings: Holding a larger proportion of cash provides flexibility and reduces exposure to market fluctuations.

- Investing in Defensive Sectors: Sectors like utilities and consumer staples tend to be less volatile during market downturns.

- Hedging Strategies: Employing hedging strategies using derivatives can help mitigate potential losses.

BofA's research provides specific details on implementing these defensive strategies based on individual investor needs and risk profiles.

Long-Term Outlook and BofA's Predictions

BofA's long-term outlook on the stock market is typically cautious but not overly pessimistic. (Specific predictions would need to be pulled directly from BofA’s current research reports.)

- Predicted Market Performance: (Insert BofA’s prediction here – this section requires data from their reports)

- Catalysts for Change: BofA's analysis would likely identify key economic or geopolitical events that could significantly impact market performance.

- Factors Affecting Predictions: These could include inflation rates, interest rate decisions, economic growth forecasts, and geopolitical developments.

Conclusion

BofA's analysis of high stock market valuations highlights the need for careful portfolio management and a diversified investment strategy. By understanding the contributing factors, potential risks, and recommended strategies outlined above, investors can better position themselves to navigate the complexities of the current market. Review your portfolio, considering BofA's insights on overvalued and undervalued sectors, and implement diversification techniques. Remember to consult with a qualified financial advisor to create a personalized investment plan that addresses your specific needs and risk tolerance in light of these high stock market valuations. Remember, you can find more details on BofA's research (if publically available - otherwise, a link to their investment services could be added).

Featured Posts

-

Core Inflation Surge Forces Bank Of Canada Into Difficult Policy Decision

May 22, 2025

Core Inflation Surge Forces Bank Of Canada Into Difficult Policy Decision

May 22, 2025 -

Mulhouse Le Hellfest En Version Intimiste Au Noumatrouff

May 22, 2025

Mulhouse Le Hellfest En Version Intimiste Au Noumatrouff

May 22, 2025 -

Analyzing Liverpools Psg Win Arne Slots Perspective And Goalkeeping Excellence

May 22, 2025

Analyzing Liverpools Psg Win Arne Slots Perspective And Goalkeeping Excellence

May 22, 2025 -

Provence Self Guided Walking Tour Mountains To Mediterranean Coastline

May 22, 2025

Provence Self Guided Walking Tour Mountains To Mediterranean Coastline

May 22, 2025 -

Lancaster County Crash Pilots Son Released From Burn Center

May 22, 2025

Lancaster County Crash Pilots Son Released From Burn Center

May 22, 2025