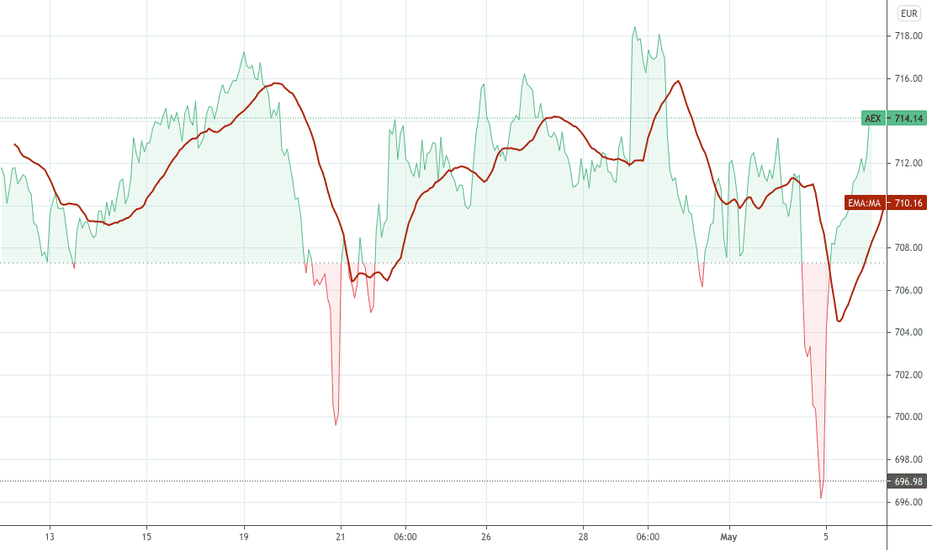

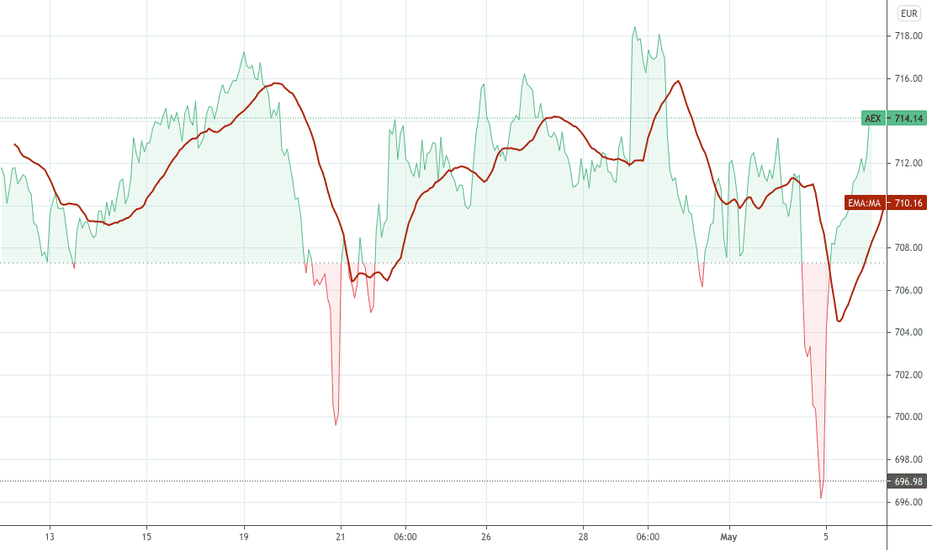

AEX Index Falls Below Key Support Level: Year's Lowest Point Reached

Table of Contents

Factors Contributing to the AEX Index Decline

Several interconnected factors have contributed to the recent slump in the AEX Index. Understanding these factors is crucial for investors to assess the risks and opportunities presented by the current market situation.

Global Economic Uncertainty

The global economic landscape is currently characterized by significant uncertainty. High inflation rates in many countries are forcing central banks to implement aggressive interest rate hikes, slowing economic growth and impacting investor sentiment. Geopolitical tensions, such as the ongoing war in Ukraine, further exacerbate this instability.

- High Inflation: Persistently high inflation erodes purchasing power and increases the cost of borrowing, negatively impacting business profitability and consumer spending.

- Interest Rate Hikes: Central bank efforts to combat inflation through interest rate increases can lead to higher borrowing costs for businesses, potentially hindering investment and economic expansion.

- Geopolitical Risks: The war in Ukraine, along with other geopolitical uncertainties, creates volatility in energy markets and supply chains, impacting business confidence and investor sentiment. Keywords: global inflation, interest rate hikes, geopolitical risks, investor sentiment.

Weakness in Specific Sectors

The decline in the AEX Index isn't uniform across all sectors. Certain sectors are experiencing more significant underperformance than others.

- Financials: Rising interest rates can impact the profitability of financial institutions, leading to decreased valuations.

- Technology: Concerns about a potential global economic slowdown are impacting tech stocks, which are often considered more sensitive to economic cycles.

- Energy: While energy prices remain high, the sector's performance is also subject to considerable volatility due to geopolitical factors. Keywords: sectoral performance, AEX financials, tech stocks, energy sector, underperformance.

Impact of European Economic Slowdown

The European economy is facing headwinds, with concerns mounting about a potential recession. This economic slowdown directly impacts the performance of the AEX Index, as many of the companies listed are heavily reliant on the European market.

- Reduced Consumer Spending: Economic uncertainty and inflation are leading to reduced consumer spending, impacting the revenue of many companies listed on the AEX.

- Supply Chain Disruptions: The ongoing disruptions to global supply chains, partly due to geopolitical factors, continue to pressure businesses and hinder economic growth.

- Recession Fears: The prospect of a recession in Europe is a major driver of the current market pessimism and is contributing significantly to the AEX Index decline. Keywords: European economy, economic slowdown, recession fears, AEX forecast.

Analyzing the Broken Support Level

The AEX Index's fall below a key support level is a significant development with important implications for future price movements.

Technical Analysis of the AEX

In technical analysis, support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further declines. Breaking below this level often signals a weakening trend and potentially further price drops.

- Chart Patterns: Analyzing chart patterns can help identify potential future price movements. The breakdown of the support level might signal the continuation of a bearish trend.

- Price Action: Closely monitoring price action around the broken support level provides valuable insights into the strength of the selling pressure. Keywords: technical analysis, support level, resistance level, chart patterns, price action.

Implications for Investors

The decline in the AEX Index presents both risks and opportunities for investors.

- Increased Volatility: The current market environment is characterized by increased volatility, meaning that prices can fluctuate significantly in short periods.

- Risk Management: Investors should implement robust risk management strategies, such as diversification and stop-loss orders, to protect their portfolios.

- Investment Strategy: A cautious approach is recommended, with a focus on companies with strong fundamentals and a proven ability to withstand economic downturns. Keywords: investment strategy, risk management, portfolio diversification, stock market volatility.

Potential Future Outlook for the AEX Index

Predicting the future performance of the AEX Index is inherently challenging, but analyzing current trends can provide some insights.

Short-Term Predictions

The short-term outlook for the AEX Index remains cautious. Further declines are possible, particularly if global economic uncertainty persists or worsens. However, potential catalysts for a rebound include positive economic news, easing geopolitical tensions, or improved corporate earnings. Keywords: short-term forecast, AEX prediction, market outlook, potential rebound.

Long-Term Prospects

The long-term prospects for the AEX Index are tied to the fundamentals of the Dutch economy and its ability to adapt to changing global conditions. The Dutch economy's resilience and its focus on innovation could support long-term growth, though the timeline remains uncertain. Keywords: long-term forecast, AEX growth, economic fundamentals, Dutch economy.

Conclusion: Navigating the AEX Index's Decline and Planning Your Next Steps

The AEX Index's fall to its year's lowest point is a result of several converging factors, including global economic uncertainty, weakness in specific sectors, and concerns about a European economic slowdown. This situation underscores the importance of careful risk management for investors. While the current market environment presents challenges, it also offers potential opportunities for those who adopt a well-informed and strategic approach to investing in the AEX Index. Stay informed about market developments and consider consulting with a financial professional before making any investment decisions related to the AEX Index, Dutch stock market investment, or AEX index trading.

Featured Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Nav Analysis And Implications

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Analysis And Implications

May 25, 2025 -

Kuluep Krizi Doert Oenemli Oyuncuya Sorusturma Acildi

May 25, 2025

Kuluep Krizi Doert Oenemli Oyuncuya Sorusturma Acildi

May 25, 2025 -

The Hells Angels A Deep Dive Into Their History And Culture

May 25, 2025

The Hells Angels A Deep Dive Into Their History And Culture

May 25, 2025 -

M56 Motorway Incident Car Overturn Results In Casualty

May 25, 2025

M56 Motorway Incident Car Overturn Results In Casualty

May 25, 2025 -

De Minimis Tariffs On Chinese Goods Key G 7 Discussions

May 25, 2025

De Minimis Tariffs On Chinese Goods Key G 7 Discussions

May 25, 2025