Alterya Acquired By Chainalysis: Enhancing Blockchain Security And Investigations

Table of Contents

Synergies Between Chainalysis and Alterya

The merger of Chainalysis and Alterya creates a powerful synergy, leveraging the strengths of both companies to offer a more comprehensive and effective solution for blockchain security and investigations.

Enhanced Data Analysis and Investigative Capabilities

The combined technologies dramatically improve data analysis for investigators. Alterya's specialized tools, known for their precise transaction tracing and detailed visualizations, complement Chainalysis's vast dataset and sophisticated analytics platform. This integration results in:

- Faster transaction tracing: Investigators can now trace cryptocurrency transactions with unprecedented speed and accuracy, uncovering hidden connections and patterns.

- Improved identification of illicit activities: The combined platform allows for more effective identification of suspicious activities, including money laundering, terrorist financing, and other financial crimes.

- More comprehensive risk assessments: Businesses can conduct more thorough risk assessments, identifying potential vulnerabilities and mitigating risks more efficiently.

- Easier visualization of complex transactions: Complex blockchain transactions can be visualized more easily, making it simpler to understand the flow of funds and identify key players in illicit activities.

For example, Alterya's advanced visualization capabilities allow investigators to quickly identify complex layering techniques used in money laundering schemes, something that previously required significant manual effort. This integration streamlines the investigation process and significantly reduces investigative time.

Strengthening AML/KYC Compliance

The acquisition significantly strengthens AML (Anti-Money Laundering) and KYC (Know Your Customer) compliance efforts for businesses operating within the cryptocurrency space. The combined platform offers:

- Automated risk scoring: Businesses can automate the risk scoring process, identifying high-risk transactions and customers more efficiently.

- Streamlined due diligence processes: KYC and AML checks can be streamlined, improving efficiency and reducing the burden on compliance teams.

- Improved detection of suspicious activity: The integrated platform offers enhanced capabilities for detecting suspicious activity, helping businesses to comply with regulations and prevent financial crime.

- Better regulatory reporting: The platform facilitates more accurate and efficient regulatory reporting, reducing the risk of penalties and fines.

For instance, cryptocurrency exchanges can utilize the combined platform to automate their customer due diligence processes, significantly reducing the time and resources required to comply with regulations like the Travel Rule.

Implications for the Blockchain Industry

The Alterya acquisition has far-reaching implications for the blockchain industry, enhancing security and improving law enforcement capabilities.

Increased Security for Crypto Businesses

The combined power of Chainalysis and Alterya significantly increases security for cryptocurrency exchanges, custodians, and other businesses operating in the blockchain space. This leads to:

- Reduced risk of fraud: Improved transaction monitoring and risk assessment capabilities help reduce the risk of various types of fraud.

- Improved protection against hacks and theft: Enhanced security measures deter malicious actors and provide better protection against hacks and theft.

- Strengthened reputation in the industry: Demonstrating a commitment to robust security measures enhances the reputation and trustworthiness of businesses.

- Greater trust among users: Increased security fosters greater trust among users, leading to increased adoption and growth of the cryptocurrency market.

The combined platform acts as a strong deterrent against malicious actors, significantly reducing the likelihood of successful attacks.

Improved Law Enforcement Capabilities

Law enforcement agencies benefit significantly from the enhanced capabilities offered by the merged entities. This includes:

- Easier tracing of criminal funds: Improved transaction tracing capabilities make it easier to trace criminal funds, even across multiple jurisdictions.

- More efficient investigations of illicit activities: The integrated platform streamlines investigations, allowing law enforcement agencies to allocate resources more efficiently.

- Improved conviction rates: Stronger evidence and faster investigations lead to improved conviction rates for financial crimes.

- Stronger deterrence of future crimes: The improved capabilities act as a stronger deterrent against future financial crimes, contributing to a safer and more secure financial ecosystem.

The technology can be instrumental in recovering stolen funds, tracing terrorist financing, and disrupting other illicit activities, contributing significantly to global efforts in combating financial crime.

Future Outlook and Potential Challenges

While the acquisition presents numerous opportunities, integrating the two companies' technologies and navigating the competitive landscape will present challenges.

Integration and Scalability

The successful integration of Alterya's technology into Chainalysis's platform is crucial. Challenges include:

- Need for seamless data flow: Ensuring a seamless flow of data between the two platforms is vital for optimal performance.

- Compatibility issues: Addressing potential compatibility issues between the different technologies is essential.

- Potential delays in integration: The integration process may take time, potentially leading to some delays in realizing the full benefits of the acquisition.

- Scalability to handle increased data volume: The combined platform needs to be scalable to handle the increasing volume of blockchain data.

Competitive Landscape

The acquisition significantly alters the competitive landscape of blockchain analytics and security:

- Increased market dominance for Chainalysis: The acquisition strengthens Chainalysis's position as a market leader in blockchain analytics.

- Potential impact on competitors: Competitors will face increased pressure to innovate and enhance their offerings to remain competitive.

- Increased pressure on rivals to innovate: The combined capabilities of Chainalysis and Alterya will push other companies in the space to innovate and develop more advanced solutions.

Conclusion

The acquisition of Alterya by Chainalysis represents a powerful combination of expertise in blockchain analytics and investigative tools, significantly enhancing the capabilities to combat financial crime and improve security within the cryptocurrency industry. This merger promises a more secure and regulated future for blockchain technology. The synergies between these two companies will undoubtedly shape the future of blockchain security and investigations, leading to a more secure and transparent digital asset ecosystem.

Call to Action: Learn more about how Chainalysis, with its acquisition of Alterya, is leading the charge in improving blockchain security and investigations. Stay informed about the latest developments in blockchain security by following Chainalysis and exploring their advanced solutions for enhanced compliance and investigative capabilities.

Featured Posts

-

Addressing Canadas Key Economic Issues A Mandate For The Next Prime Minister

May 01, 2025

Addressing Canadas Key Economic Issues A Mandate For The Next Prime Minister

May 01, 2025 -

Learn Boxing From The Experts Ace Power Promotion Seminar March 26th

May 01, 2025

Learn Boxing From The Experts Ace Power Promotion Seminar March 26th

May 01, 2025 -

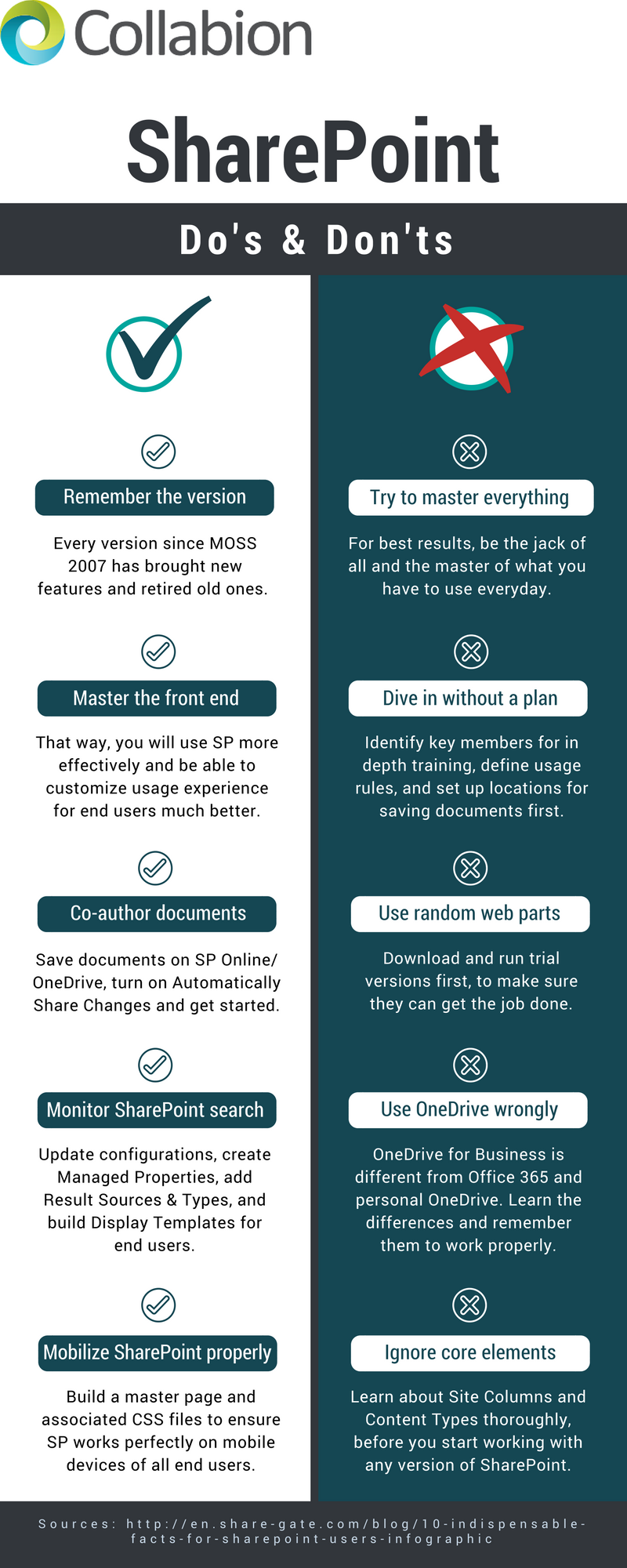

Navigate The Private Credit Job Market 5 Dos And 5 Don Ts

May 01, 2025

Navigate The Private Credit Job Market 5 Dos And 5 Don Ts

May 01, 2025 -

Bhart Ke Ntyjh Khyz Mdhakrat Ky Ahmyt

May 01, 2025

Bhart Ke Ntyjh Khyz Mdhakrat Ky Ahmyt

May 01, 2025 -

The Fight To Return Dismissed Ftc Commissioners Legal Action

May 01, 2025

The Fight To Return Dismissed Ftc Commissioners Legal Action

May 01, 2025