Amsterdam Market Crash: 7% Drop Highlights Trade War Impact

Table of Contents

The Immediate Triggers of the Amsterdam Market Crash

The sudden and severe Amsterdam market crash wasn't an isolated incident; it stemmed from a confluence of factors, primarily fueled by global economic anxieties.

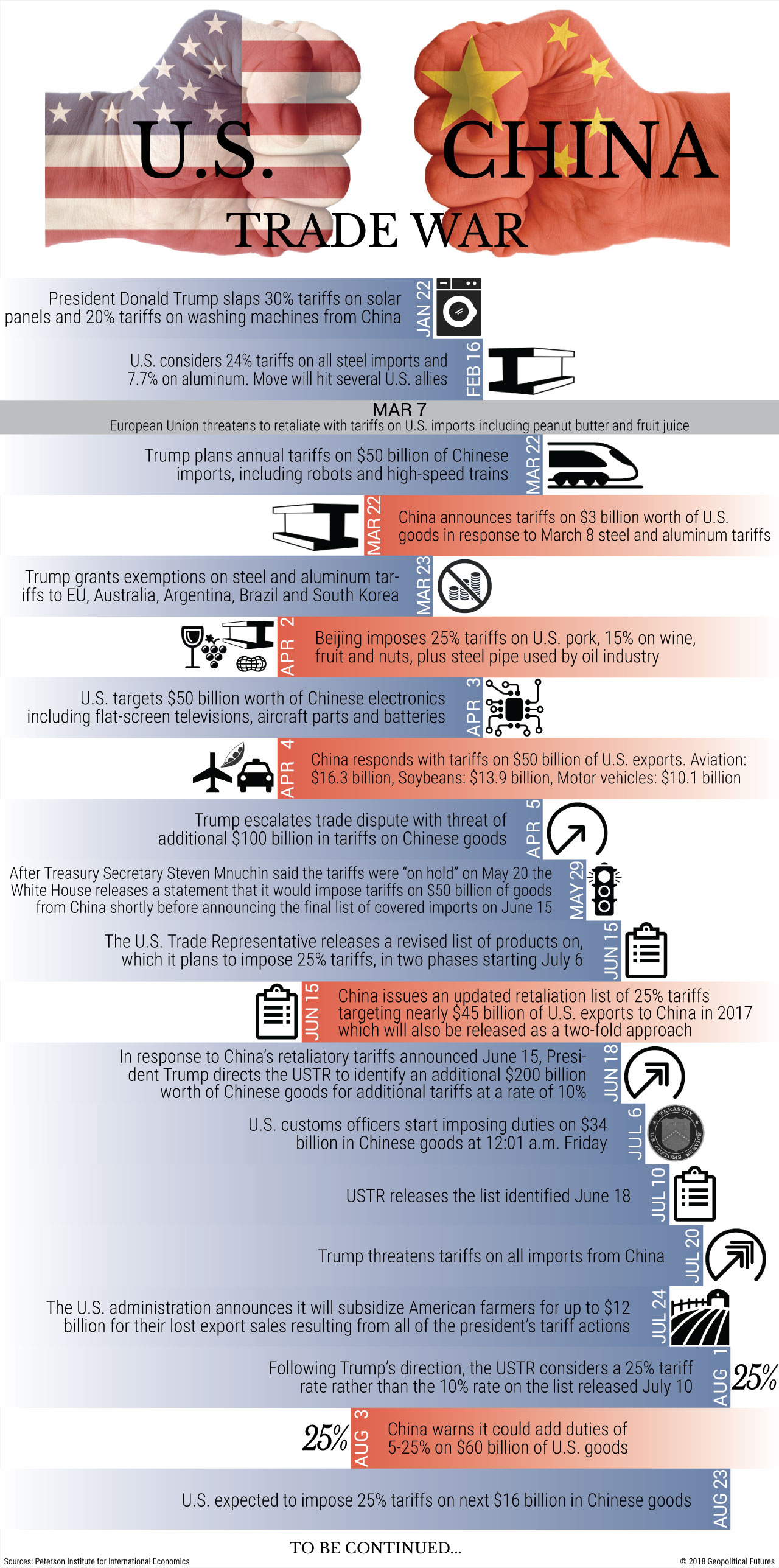

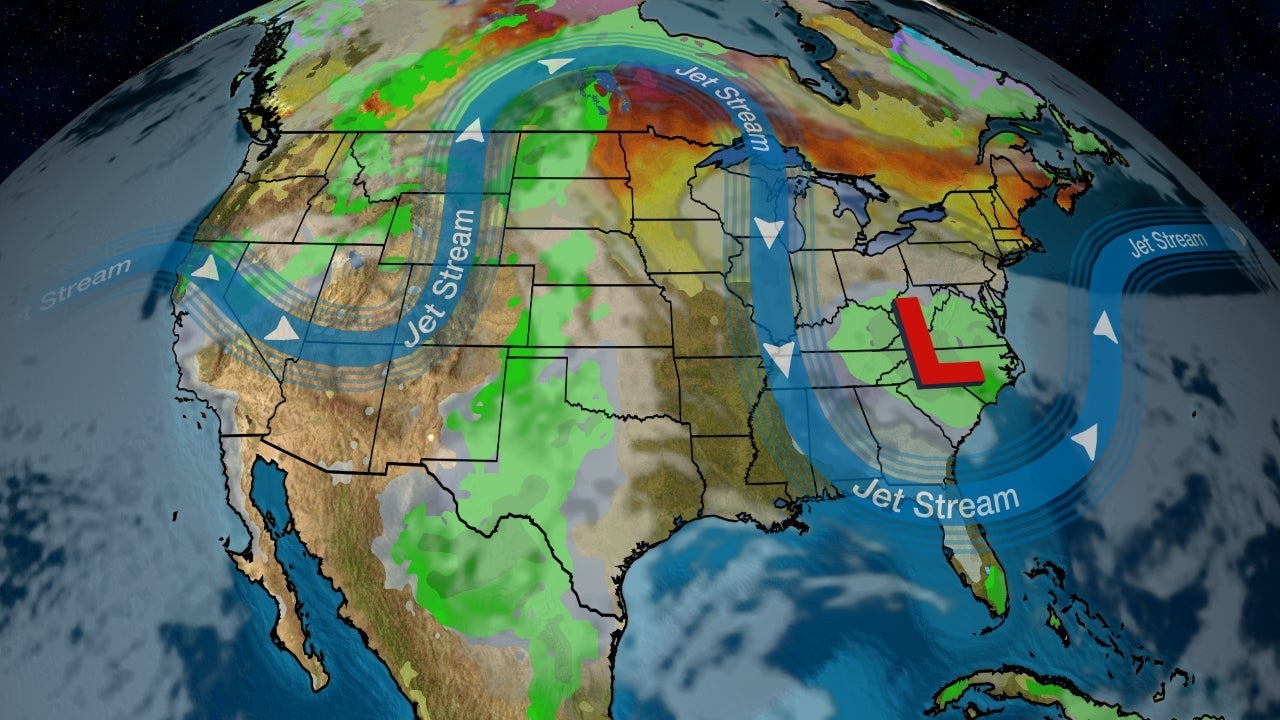

Trade War Uncertainty

The escalating trade war between major global powers, particularly the ongoing disputes impacting international trade, is cited as the primary driver of the Amsterdam market crash. Uncertainty surrounding tariffs, sanctions, and retaliatory measures creates significant volatility in global markets, and Amsterdam, being a major international trading hub, is highly susceptible.

- Increased import costs for Dutch businesses: Tariffs on imported goods increase production costs, impacting profitability and potentially leading to price increases for consumers.

- Reduced consumer confidence due to price hikes: Increased prices due to tariffs dampen consumer spending, impacting overall economic growth and market sentiment.

- Uncertainty impacting investment decisions: Businesses postpone investment decisions in an uncertain economic climate, further hindering growth.

- Negative sentiment spreading from other affected markets: The downturn in other global markets, particularly those heavily impacted by trade wars, negatively influences investor sentiment in Amsterdam.

Global Economic Slowdown

Concerns about a broader global economic slowdown significantly exacerbated the situation. The interconnected nature of the global economy means that the Amsterdam market is highly susceptible to external shocks. The slowdown contributed to the severity of the Amsterdam market crash.

- Decreased demand for Dutch exports: Slower global growth translates to reduced demand for Dutch goods and services, impacting export-oriented businesses.

- Concerns about reduced profits for multinational companies based in Amsterdam: Multinational companies operating in Amsterdam face reduced profits due to decreased global demand and increased costs.

- Impact of slowing growth in key trading partners: Slowing growth in major trading partners directly affects the Dutch economy and its market performance.

Impact on Key Sectors within the Amsterdam Market

The Amsterdam market crash didn't impact all sectors equally. Certain industries experienced disproportionately higher losses, reflecting the specific vulnerabilities of those sectors to global economic headwinds.

Technology and Semiconductor Stocks

Technology and semiconductor stocks were particularly hard hit, mirroring global supply chain disruptions caused by trade tensions. This sector's reliance on international trade makes it exceptionally vulnerable to trade wars.

- Specific examples of affected companies and their percentage drops: [Insert examples of specific companies and their percentage drops. This requires up-to-date market data].

- Analysis of the vulnerability of these sectors to trade wars: The complex and globally dispersed nature of technology supply chains makes them highly susceptible to disruptions caused by trade wars.

Financial Services

The financial services sector, a cornerstone of the Amsterdam economy, also experienced significant losses, indicating a broader loss of confidence in the market. The interconnectedness of global finance amplified the impact of the Amsterdam stock market crash.

- Impact on banking and investment firms: Reduced trading volumes and decreased investor confidence directly affected the profitability of financial institutions.

- Decreased market liquidity: Fear and uncertainty led to reduced trading activity, impacting market liquidity and making it more difficult for investors to buy or sell assets.

- Potential for further instability: The initial crash could trigger a cascade of negative consequences, leading to further instability in the financial sector.

Government Response and Potential Mitigation Strategies

The Dutch government responded to the Amsterdam market crash with a series of measures aimed at stabilizing the market and mitigating the longer-term economic impact.

Government Actions

The immediate response from the Dutch government included a combination of reassuring statements and the exploration of potential economic stimulus packages.

- Statements from government officials: [Insert details of statements made by government officials, emphasizing their commitment to stability].

- Proposed economic stimulus packages or relief measures: [Discuss potential measures such as tax cuts, investment incentives, or support for affected businesses].

- Efforts to foster investor confidence: The government likely undertook measures to reassure investors and maintain confidence in the Dutch economy.

Long-Term Strategies

Looking beyond the immediate response, the Dutch government needs to implement long-term strategies to improve the resilience of the economy to future shocks, including trade wars.

- Diversification of trade partners: Reducing reliance on specific trading partners can mitigate the impact of future trade disputes.

- Investments in domestic industries: Strengthening domestic industries reduces vulnerability to external economic shocks.

- Strengthening international economic cooperation: Working with international partners to create a more stable and predictable global trading environment is crucial.

Analyzing the Long-Term Implications of the Amsterdam Market Crash

The Amsterdam market crash has significant long-term implications for the Dutch economy and its international standing.

Investor Sentiment

The crash caused a shift in investor sentiment, leading to potential long-term consequences.

- Impact on foreign direct investment: Negative investor sentiment can deter foreign investment, hindering economic growth.

- Changes in investment strategies: Investors may adjust their strategies to reduce exposure to risk, potentially leading to capital flight.

- Potential for capital flight: Investors may move their capital to perceived safer markets, further weakening the Dutch economy.

Economic Growth Projections

The Amsterdam market crash will undoubtedly impact economic growth projections for the Netherlands.

- Revised GDP forecasts: Expect downward revisions in GDP forecasts due to reduced economic activity.

- Job market implications: The crash may lead to job losses in affected sectors.

- Potential for a recession: Depending on the severity and duration of the economic downturn, a recession is a possible outcome.

Conclusion

The Amsterdam market crash, characterized by a substantial 7% drop, serves as a stark warning about the global interconnectedness of markets and the far-reaching consequences of geopolitical events like trade wars. Understanding the triggers, sector-specific impacts, and government responses is crucial for navigating the economic uncertainty ahead. By proactively implementing long-term strategies to diversify trade, strengthen domestic industries, and foster international cooperation, the Netherlands can build a more resilient economy and minimize the impact of future Amsterdam market crashes. Stay informed about the ongoing developments and continue monitoring the impact of global trade tensions on the Amsterdam market.

Featured Posts

-

Pmi Exceeds Expectations Boosting Dow Jones Gradual Climb

May 24, 2025

Pmi Exceeds Expectations Boosting Dow Jones Gradual Climb

May 24, 2025 -

Canadians Sacrifice Vehicle Security Amidst Economic Hardship

May 24, 2025

Canadians Sacrifice Vehicle Security Amidst Economic Hardship

May 24, 2025 -

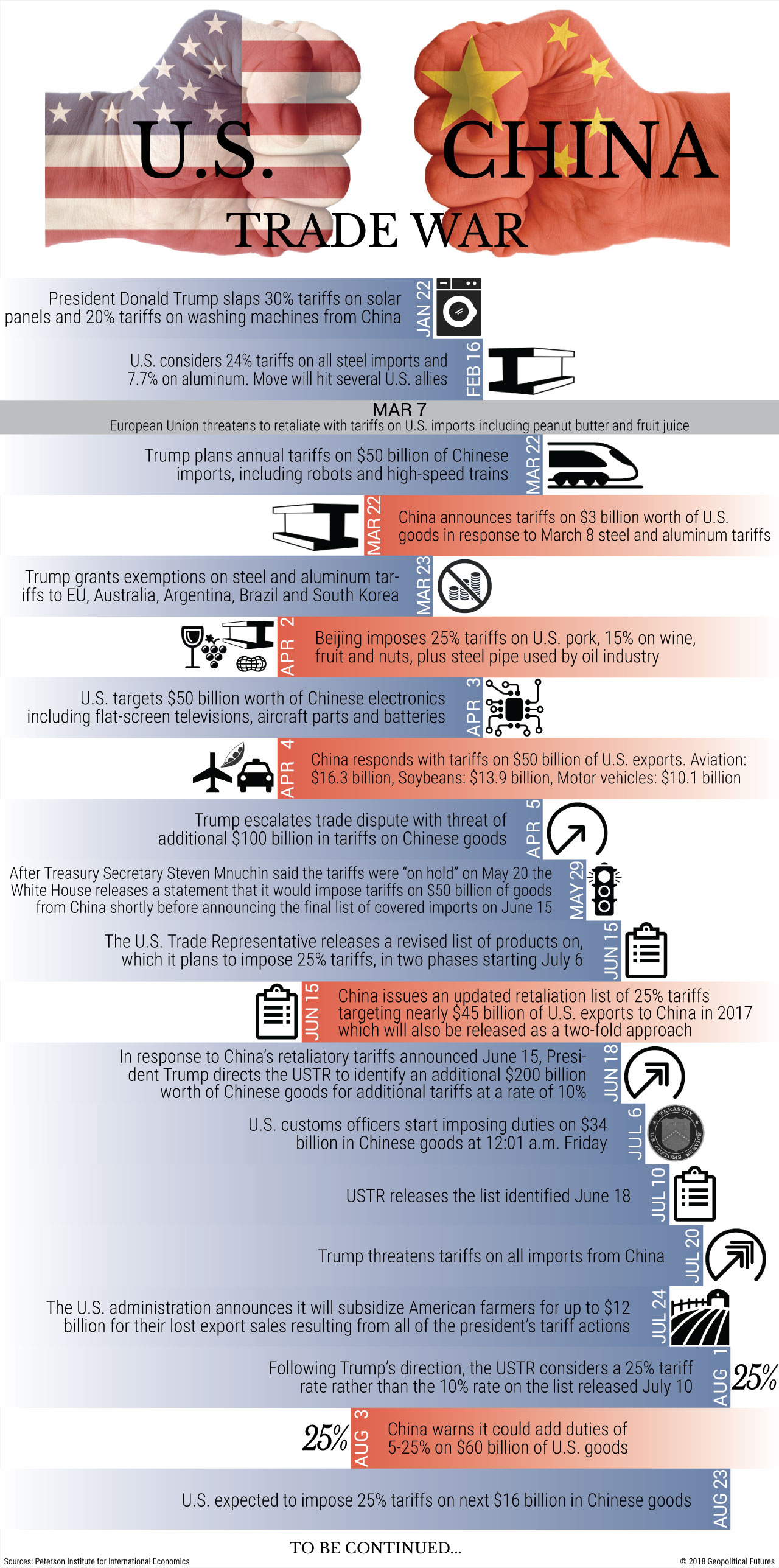

Sandy Point Rehoboth Ocean City Beaches Memorial Day 2025 Weather Prediction

May 24, 2025

Sandy Point Rehoboth Ocean City Beaches Memorial Day 2025 Weather Prediction

May 24, 2025 -

Evaluating President Ramaphosas Conduct During The White House Ambush

May 24, 2025

Evaluating President Ramaphosas Conduct During The White House Ambush

May 24, 2025 -

Execs Office365 Accounts Targeted Millions Stolen In Cybercrime Ring Feds Say

May 24, 2025

Execs Office365 Accounts Targeted Millions Stolen In Cybercrime Ring Feds Say

May 24, 2025