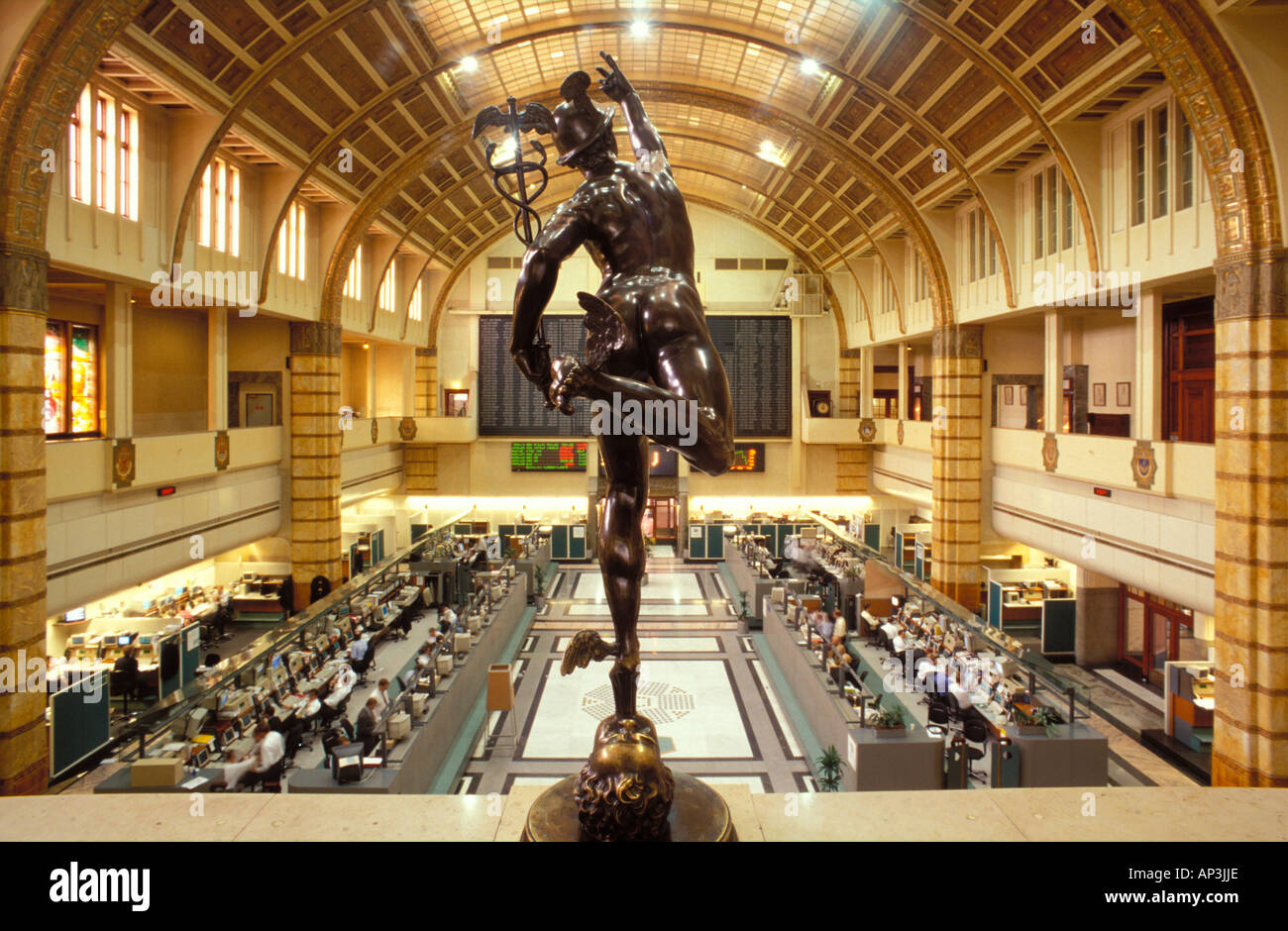

Amsterdam Stock Market: Three Days Of Significant Losses Totaling 11%

Table of Contents

Global Economic Headwinds Fuel Amsterdam Stock Market Decline

The recent 11% drop in the AEX is inextricably linked to a confluence of global economic concerns that have significantly impacted investor sentiment. The interconnected nature of the global economy means that events in one region can quickly ripple outwards, affecting markets worldwide, including the Amsterdam Stock Market.

- Rising Inflation Rates: Persistently high inflation rates in many major economies have eroded purchasing power and fueled fears of sustained price increases. This uncertainty undermines investor confidence, leading to a sell-off in riskier assets, including stocks.

- Recessionary Fears: Concerns about a potential recession in key economies like the US and Europe have further dampened investor optimism. The prospect of slowing economic growth naturally leads to reduced corporate earnings expectations and a subsequent decline in stock valuations.

- Geopolitical Instability: Ongoing geopolitical tensions and conflicts contribute significantly to market volatility. Uncertainty surrounding global trade, energy supplies, and political stability creates a risk-averse environment, prompting investors to reduce their exposure to equities.

- Rising Interest Rates: Central banks worldwide are aggressively raising interest rates to combat inflation. While this is intended to curb price increases, higher interest rates increase borrowing costs for businesses, impacting profitability and potentially slowing economic growth. This has a direct effect on the Amsterdam Stock Market and its constituent companies.

Sector-Specific Impacts on the Amsterdam Stock Exchange

The recent AEX decline wasn't uniform across all sectors. Some industries were disproportionately affected, revealing vulnerabilities within the Dutch economy and highlighting the interconnectedness of global markets.

- Energy Sector: The energy sector's performance was closely tied to fluctuating global oil prices. Volatility in energy markets had a direct impact on the valuation of energy companies listed on the AEX.

- Technology Sector: The technology sector mirrored the global trend of declining tech stocks. Concerns about overvaluation and slowing growth in the tech industry contributed to significant losses within this sector of the AEX index components.

- Financial Services: The financial services sector experienced pressure due to rising interest rates, impacting profitability and investor confidence in the sector. This is a global effect, influencing the Amsterdam Stock Market alongside others.

- Other Key Sectors: Other significant sectors within the AEX, such as healthcare and consumer goods, also experienced declines, although perhaps to a lesser extent than the energy and technology sectors. The overall impact on the AEX reflects the interconnected nature of these various sectors.

Investor Reactions and Market Volatility in Amsterdam

The sharp drop in the AEX triggered significant market volatility and a notable reaction from investors. The speed and magnitude of the decline resulted in heightened uncertainty.

- Trading Volume: Trading volume surged during the three-day period, indicating heightened activity as investors reacted to the market downturn. This spike in trading volume reflects significant buying and selling pressure.

- Shift in Investor Sentiment: Investor sentiment shifted dramatically from cautious optimism to heightened risk aversion. The rapid decline fueled panic selling in some instances, exacerbating the downward trend.

- Short-Term and Long-Term Implications: The short-term implications include continued volatility and potential further losses. The long-term implications depend on the resolution of the underlying global economic concerns and the resilience of individual companies listed on the AEX.

- Government and Regulatory Responses: While no immediate government intervention was reported, the situation is being closely monitored by regulators. Further policy responses may be considered depending on the unfolding economic landscape.

Conclusion: Navigating the Amsterdam Stock Market After Significant Losses

The 11% loss in the Amsterdam Stock Market over three days highlights the significant impact of global economic headwinds, sector-specific vulnerabilities, and volatile investor sentiment. The interconnectedness of global markets means that events outside of the Netherlands directly affect the AEX. Whether this represents a temporary market correction or a more significant shift remains to be seen. However, it underlines the importance of staying informed and making prudent investment decisions. To navigate this challenging environment, stay updated on the Amsterdam Stock Market, monitor the AEX index closely, and consider consulting a financial advisor before making any investment decisions related to the AEX or other Dutch equities. Understanding the risks associated with investing in the Amsterdam Stock Market is crucial for managing your portfolio effectively.

Featured Posts

-

The Last Rodeo Neal Mc Donoughs Standout Performance

May 24, 2025

The Last Rodeo Neal Mc Donoughs Standout Performance

May 24, 2025 -

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 24, 2025

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 24, 2025 -

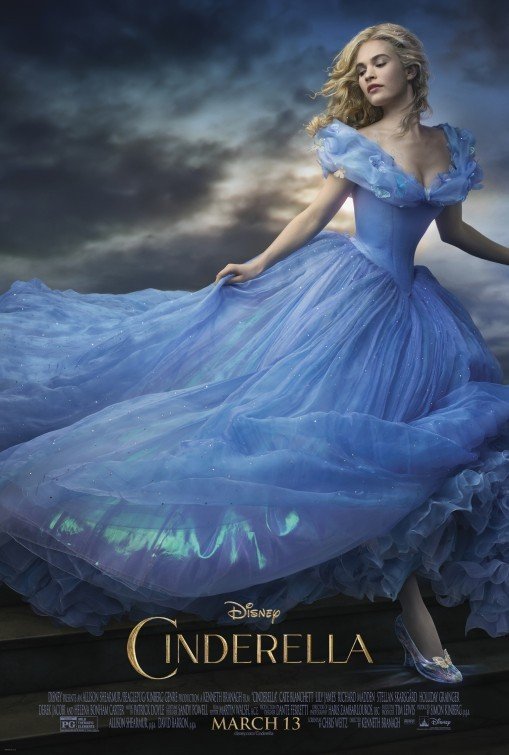

Tracking The Net Asset Value Nav Of The Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025 -

Open Ais Acquisition Of Jony Ives Ai Hardware Company A Deep Dive

May 24, 2025

Open Ais Acquisition Of Jony Ives Ai Hardware Company A Deep Dive

May 24, 2025 -

Evrovidenie 2014 Konchita Vurst Kaming Aut Devushka Bonda I Zhizn Posle Pobedy

May 24, 2025

Evrovidenie 2014 Konchita Vurst Kaming Aut Devushka Bonda I Zhizn Posle Pobedy

May 24, 2025