Amundi DJIA UCITS ETF: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

The Net Asset Value (NAV) of an ETF represents the total value of its underlying assets minus its liabilities, divided by the number of outstanding shares. Essentially, it reflects the intrinsic value of a single share in the ETF. Understanding NAV is fundamental to evaluating an ETF's performance and making sound investment decisions. For the Amundi DJIA UCITS ETF, which tracks the performance of the Dow Jones Industrial Average (DJIA), the NAV directly correlates with the overall value of the DJIA's constituent companies. Keywords: NAV calculation, asset valuation, market value, liabilities, outstanding shares.

The calculation process is relatively straightforward:

- Determine the market value of each holding: This involves finding the current market price of each stock in the Amundi DJIA UCITS ETF's portfolio.

- Sum the market values of all holdings: Add up the market values of all the individual stocks to arrive at the total asset value.

- Subtract the ETF's liabilities: This includes expenses such as management fees, administrative costs, and any other outstanding liabilities.

- Divide the result by the number of outstanding ETF shares: This final step yields the NAV per share.

Factors Affecting the Amundi DJIA UCITS ETF NAV

Several factors influence the NAV of the Amundi DJIA UCITS ETF, impacting its daily fluctuations and overall performance. Understanding these factors is critical for informed investment choices. Keywords: DJIA, Dow Jones Industrial Average, market fluctuations, currency risk, dividends, expense ratio, management fees.

- Market Fluctuations of the DJIA Components: The primary driver of the Amundi DJIA UCITS ETF's NAV is the performance of the Dow Jones Industrial Average. Positive movements in the DJIA generally lead to an increase in the ETF's NAV, while negative movements result in a decrease.

- Currency Exchange Rate Fluctuations: While less significant for a primarily US-focused index like the DJIA, any currency exposure within the ETF's holdings could affect the NAV if the exchange rates fluctuate.

- Dividend Payouts from Underlying Stocks: When the companies comprising the DJIA pay dividends, this income is typically reinvested or distributed to ETF shareholders, slightly impacting the NAV.

- Management Fees and Expenses: The ETF's operating expenses, including management fees, are deducted from the asset value, influencing the NAV calculation. A higher expense ratio will generally lead to a slightly lower NAV.

NAV vs. Market Price: Understanding the Difference

While closely related, the NAV and the market price of the Amundi DJIA UCITS ETF are not always identical. The market price reflects the price at which the ETF is currently trading on the exchange, influenced by supply and demand. Keywords: market price, bid-ask spread, trading volume, ETF price, premium, discount.

Discrepancies between NAV and market price can arise due to:

- Bid-Ask Spread: The difference between the buying (bid) and selling (ask) prices creates a slight variation.

- Trading Volume: High trading volume generally leads to a closer alignment between NAV and market price, whereas low volume can cause larger discrepancies.

- Market Sentiment: Investor sentiment and overall market conditions can also influence the market price independently of the NAV. The ETF might trade at a slight premium or discount to its NAV depending on these factors.

Where to Find the Amundi DJIA UCITS ETF NAV

Accessing the daily NAV of the Amundi DJIA UCITS ETF is straightforward. Several reliable sources provide this crucial information:

- Amundi's Website: The official website of Amundi, the ETF provider, is the most reliable source for real-time and historical NAV data.

- Financial News Websites: Many reputable financial news websites and portals (like Yahoo Finance, Google Finance, Bloomberg) publish daily ETF data, including NAVs.

- Brokerage Platforms: If you hold the Amundi DJIA UCITS ETF through a brokerage account, your account statement and platform will typically display the current and historical NAV. Keywords: NAV data, ETF provider, financial news, brokerage account, real-time data, historical data.

Conclusion: Mastering Amundi DJIA UCITS ETF NAV for Informed Investment Decisions

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is essential for making informed investment decisions. By comprehending how the NAV is calculated and the factors that influence it, you can better evaluate the ETF's performance and manage your portfolio effectively. Regularly monitoring the NAV, along with its influencing factors like DJIA movements and expense ratios, is key to optimizing your investment strategy. Keywords: Amundi DJIA UCITS ETF, NAV, ETF investment, informed decisions, portfolio management.

Learn more about the Amundi DJIA UCITS ETF and its NAV by visiting [link to relevant resource]. Regularly check the Amundi DJIA UCITS ETF's NAV to optimize your investment strategy.

Featured Posts

-

Tim Rice Creates New Lyrics For Disneys Lion King Land Of Sometimes

May 25, 2025

Tim Rice Creates New Lyrics For Disneys Lion King Land Of Sometimes

May 25, 2025 -

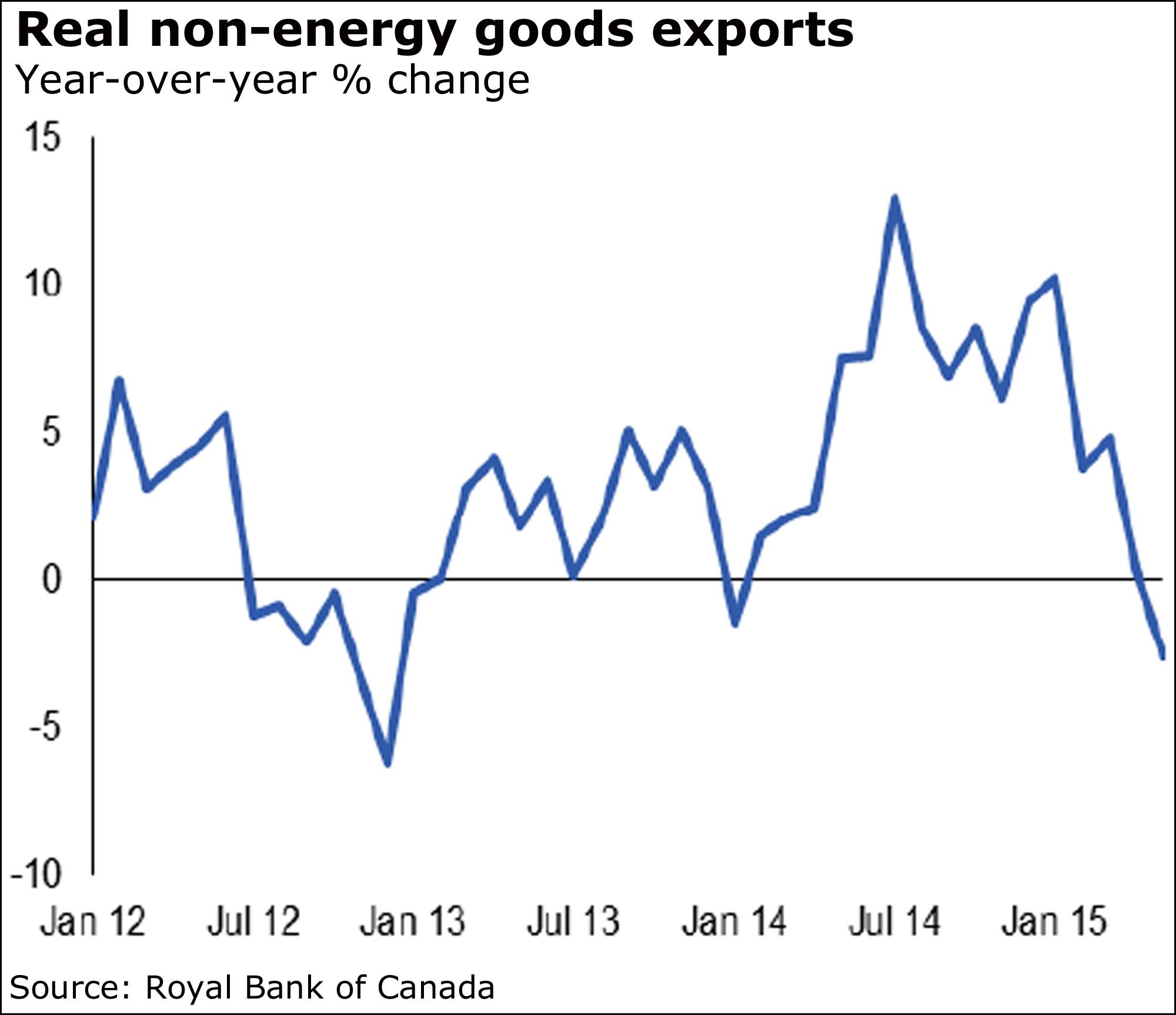

Bank Of Canada Rate Cut Odds Diminish On Strong Retail Sales

May 25, 2025

Bank Of Canada Rate Cut Odds Diminish On Strong Retail Sales

May 25, 2025 -

Rome Masters Zheng Through To Last 16 After Frech Win

May 25, 2025

Rome Masters Zheng Through To Last 16 After Frech Win

May 25, 2025 -

Presidential Seals Luxury Watches And Marriott Afterparties Investigating The Spending Habits Of High Ranking Officials

May 25, 2025

Presidential Seals Luxury Watches And Marriott Afterparties Investigating The Spending Habits Of High Ranking Officials

May 25, 2025 -

Is Glastonbury 2025s Lineup The Strongest Ever Featuring Charli Xcx Neil Young And More Must See Acts

May 25, 2025

Is Glastonbury 2025s Lineup The Strongest Ever Featuring Charli Xcx Neil Young And More Must See Acts

May 25, 2025