Amundi Dow Jones Industrial Average UCITS ETF (Dist): NAV Explained

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. It's essentially the true underlying value of the ETF's holdings. Understanding the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV is key to grasping its intrinsic worth. The NAV is calculated by taking the total market value of all the ETF's assets (like stocks in the Dow Jones Industrial Average companies), subtracting any liabilities (like expenses), and then dividing by the total number of outstanding shares.

- Calculation: The NAV calculation is relatively straightforward:

(Total Asset Value - Total Liabilities) / Total Number of Shares Outstanding = NAV per share. - Daily Calculation: The Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV, like most ETFs, is calculated daily, typically at the close of the market.

- Impact of Market Fluctuations: Market movements directly impact the NAV. If the Dow Jones Industrial Average rises, the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) will generally rise as well, and vice versa.

- Example: Let's say the Amundi Dow Jones Industrial Average UCITS ETF (Dist) holds $100 million in assets and has $1 million in liabilities, with 10 million shares outstanding. The NAV per share would be (($100 million - $1 million) / 10 million shares) = $9.90.

Amundi Dow Jones Industrial Average UCITS ETF (Dist) Specifics and its NAV

The Amundi Dow Jones Industrial Average UCITS ETF (Dist) is designed to track the performance of the Dow Jones Industrial Average, a leading index of 30 large, publicly-owned companies in the United States. Understanding its NAV is critical for evaluating its performance against the index.

- ETF Overview: This ETF aims to replicate the returns of the Dow Jones Industrial Average, providing investors with exposure to a diversified portfolio of blue-chip American companies.

- Underlying Assets: The ETF primarily holds shares of the 30 companies comprising the Dow Jones Industrial Average.

- Impact of Dividend Distribution ("Dist"): The "(Dist)" designation indicates that the ETF distributes dividends to shareholders. These distributions will reduce the NAV per share on the ex-dividend date.

- Currency Considerations: As the underlying assets are primarily US dollar-denominated, fluctuations in exchange rates between the US dollar and the investor's currency will impact the NAV expressed in their local currency.

- Where to find the NAV: You can typically find the daily Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV on the Amundi website, major financial news websites, and through your brokerage account.

Using NAV to Make Informed Investment Decisions

By comparing the ETF's market price to its NAV, investors can identify potential arbitrage opportunities. A significant divergence between the two could signal a buying or selling opportunity.

-

Comparing Prices: If the market price is significantly below the NAV, it might present a buying opportunity. Conversely, if the market price is significantly above the NAV, it might suggest a selling opportunity.

-

Performance Tracking: Monitoring NAV changes over time provides a clear picture of the ETF's performance. Consistent increases in NAV suggest positive performance.

-

Risk Assessment: Significant fluctuations in the NAV can indicate higher risk associated with the investment.

-

Long-term vs. Short-term Strategies: Analyzing the NAV trend helps inform both short-term trading decisions (e.g., exploiting price discrepancies) and long-term investment strategies (e.g., evaluating consistent growth).

-

Key Insights:

- Regularly monitor the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV.

- Compare the NAV to the market price to identify potential discrepancies.

- Use NAV changes to track the ETF's performance over time.

- Consider NAV in your overall risk assessment.

Mastering Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV for Successful Investing

Understanding the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV is essential for making informed investment choices. By regularly monitoring the NAV and comparing it to the market price, you can better manage your risk and potentially enhance your returns. Remember that the NAV is a crucial indicator of the underlying value of your investment.

Regularly monitor the Amundi Dow Jones Industrial Average UCITS ETF NAV to make informed investment decisions. For more information on the ETF and its NAV, visit the Amundi website. Understanding the Dow Jones Industrial Average ETF NAV, and more specifically the Amundi Dow Jones Industrial Average UCITS ETF NAV, is key to successful investing in this asset class. Mastering UCITS ETF NAV analysis will greatly benefit your investment strategy.

Featured Posts

-

The Today Show Almost Lost Dylan Dreyer The Untold Story

May 24, 2025

The Today Show Almost Lost Dylan Dreyer The Untold Story

May 24, 2025 -

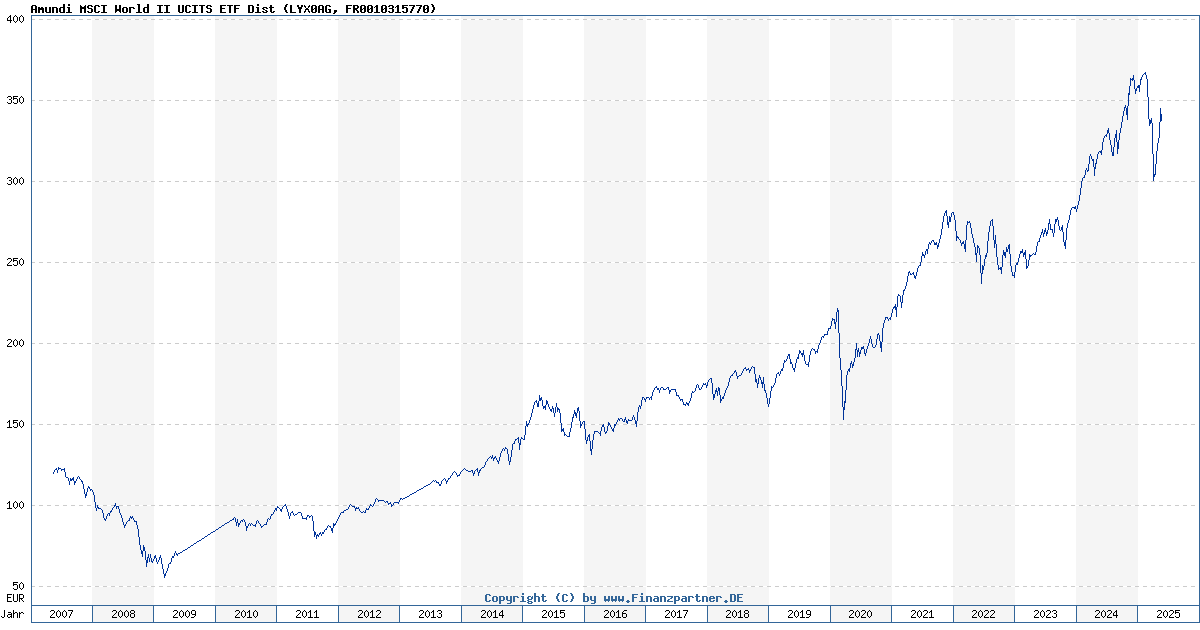

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025 -

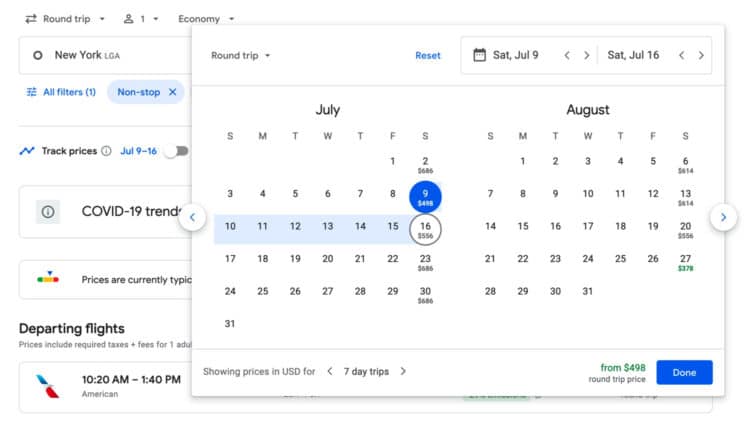

Sse Cuts Spending 3 Billion Reduction Amidst Economic Slowdown

May 24, 2025

Sse Cuts Spending 3 Billion Reduction Amidst Economic Slowdown

May 24, 2025 -

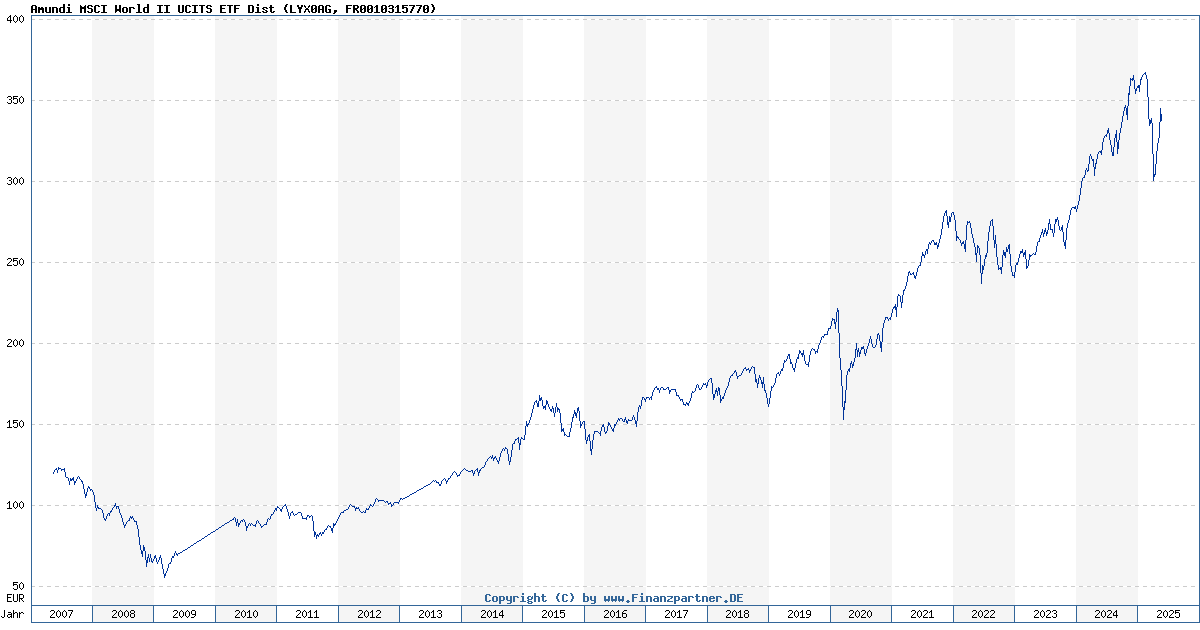

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Dist

May 24, 2025 -

Michigan Memorial Day 2025 Businesses Open Events And Holiday Information

May 24, 2025

Michigan Memorial Day 2025 Businesses Open Events And Holiday Information

May 24, 2025