Amundi MSCI World II UCITS ETF Dist: Net Asset Value (NAV) Explained

Table of Contents

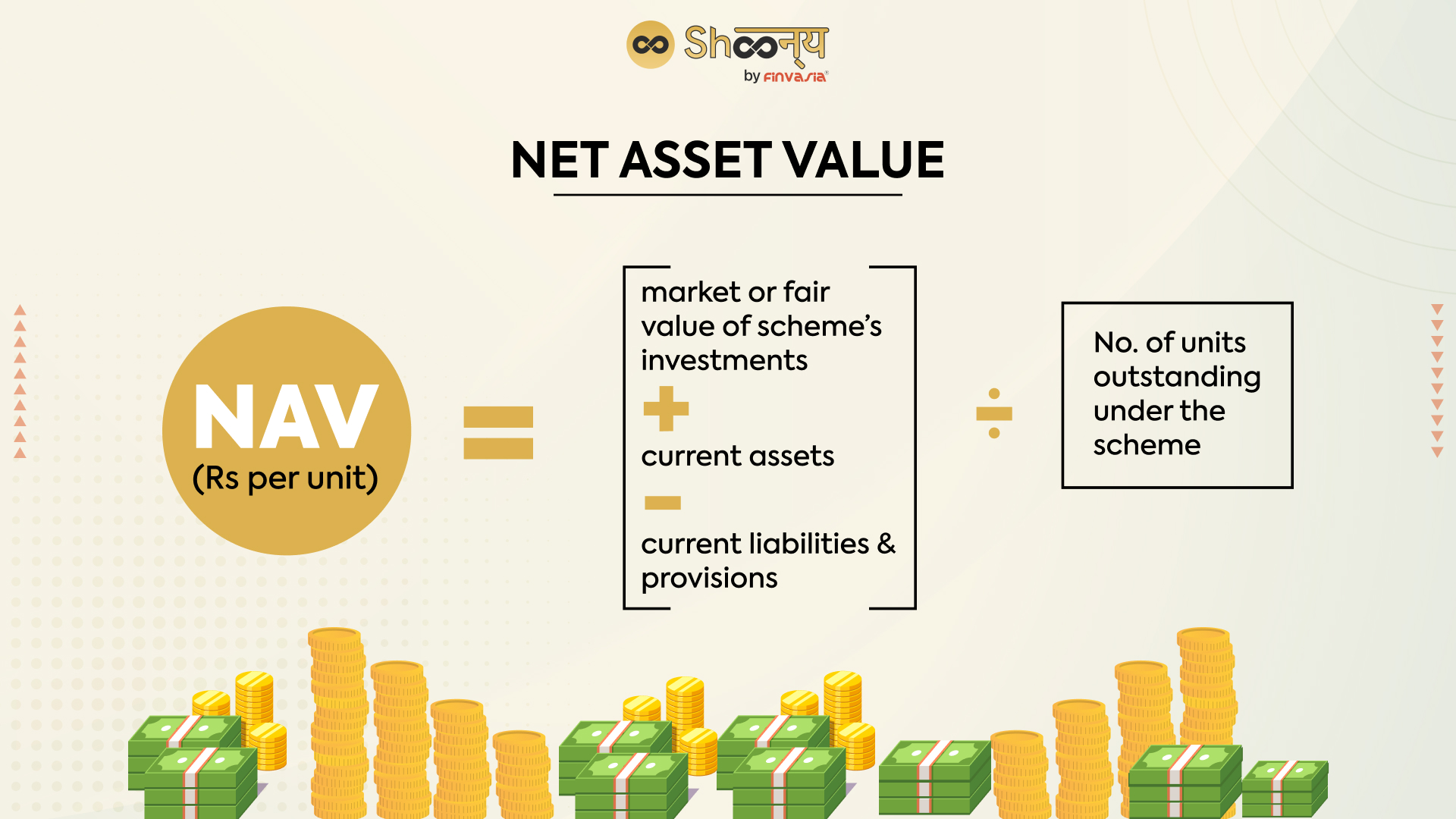

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. It essentially tells you the current market value of what your ETF investment holds. For the Amundi MSCI World II UCITS ETF Dist, the NAV calculation considers several key components:

- Market Value of Underlying Assets: This is the primary component and reflects the total market value of all the stocks, bonds, and other securities held within the ETF portfolio. The Amundi MSCI World II UCITS ETF Dist tracks the MSCI World Index, so its holdings mirror this broad global index. Fluctuations in the market value of these underlying assets directly impact the ETF's NAV.

- Liabilities: This includes expenses associated with running the ETF, such as management fees, administrative costs, and other operational expenses. These liabilities reduce the overall net value available to shareholders.

- Accrued Dividends: Any dividends received from the underlying holdings but not yet distributed to ETF shareholders are included in the NAV calculation. These accrued dividends contribute positively to the overall NAV.

A simplified formula for calculating NAV is:

NAV = (Total Market Value of Assets + Accrued Dividends - Liabilities) / Number of Outstanding Shares

The NAV is typically calculated daily, providing investors with an up-to-date picture of their investment's value. Understanding the Amundi MSCI World II UCITS ETF Dist NAV calculation is vital for a complete understanding of your investment. Tracking the ETF valuation through daily NAV updates ensures you stay informed about your investment's health and potential returns.

Why is NAV Important for Amundi MSCI World II UCITS ETF Dist Investors?

The NAV of the Amundi MSCI World II UCITS ETF Dist plays a critical role in several aspects of your investment:

- True Value Reflection: The NAV reflects the true underlying value of your investment, providing a clear picture of your assets. Unlike the market price, which can fluctuate throughout the day, the NAV gives a more accurate representation of what your shares are actually worth.

- Price Determination: While the market price of the ETF may differ slightly from the NAV due to supply and demand (bid-ask spread), the NAV serves as a benchmark for the ETF's fair value.

- Buy and Sell Decisions: Monitoring the NAV can help you make informed buy and sell decisions, particularly when considering the Amundi MSCI World II UCITS ETF Dist performance over time. A rising NAV generally indicates positive performance.

- Performance Tracking: By regularly tracking the NAV, you can accurately monitor the performance of your investment in the Amundi MSCI World II UCITS ETF Dist and assess its growth or decline over time. This allows for efficient investment returns analysis.

- Dividend Understanding: The NAV incorporates accrued dividends, providing a clear picture of how dividends impact your overall investment value. Understanding dividend yield becomes easier when you track NAV changes related to distributions.

Understanding the relationship between NAV and investment decisions is essential for maximizing your returns with the Amundi MSCI World II UCITS ETF Dist.

Where to Find the NAV for Amundi MSCI World II UCITS ETF Dist?

Accessing the daily NAV for the Amundi MSCI World II UCITS ETF Dist is straightforward. Reliable sources include:

- Amundi's Official Website: The most accurate and up-to-date information is typically found on the asset manager's official website.

- Financial News Websites: Reputable financial news sources such as Bloomberg, Yahoo Finance, and Google Finance often provide real-time or end-of-day NAV data for ETFs.

- Brokerage Platforms: Most brokerage platforms provide real-time or delayed NAV data for the ETFs held within your portfolio. Check your account's reporting features.

It's crucial to rely on official sources to ensure the accuracy of the Amundi MSCI World II UCITS ETF Dist NAV data. Remember that minor discrepancies might exist between the NAV and the market price of the ETF due to the bid-ask spread – the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. Accessing real-time NAV data helps minimize the impact of these discrepancies when making investment decisions. Regular ETF price tracking utilizing these resources will help you stay informed.

Understanding Dividend Distributions and their Impact on NAV

Dividend distributions from the underlying assets of the Amundi MSCI World II UCITS ETF Dist directly affect the NAV. When a dividend is paid, the NAV typically drops by the amount of the dividend per share. This is because the assets held within the ETF are reduced by the distributed amount. This distinction is important to grasp when comparing the gross and net asset value post-distribution. Understanding the Amundi MSCI World II UCITS ETF Dist dividends timeline allows for accurate assessment of your returns. Remember that while the NAV decreases immediately post-distribution, your overall investment's value is unchanged, as you have now received the cash dividend. The timing of dividend payments is generally communicated in advance by Amundi and is also available on financial news sites. Understanding the impact of NAV and dividends helps you to appropriately assess your overall investment performance. Consider the strategy of dividend reinvestment to further compound your returns.

Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist NAV

Understanding the Net Asset Value (NAV) is essential for evaluating the performance of your Amundi MSCI World II UCITS ETF Dist investments and making informed decisions. Regularly checking the Amundi MSCI World II UCITS ETF Dist NAV and utilizing official sources for accurate data empowers you to confidently manage your portfolio. By incorporating NAV analysis into your ETF investment strategy, you can better assess risk and potential return, optimizing your investment approach. Remember to regularly track your ETF to stay informed and actively manage your portfolio. Stay informed about the Net Asset Value of your Amundi MSCI World II UCITS ETF Dist investments to make the most of your portfolio.

Featured Posts

-

Marks And Spencer Cyber Attack 300 Million Cost Revealed

May 25, 2025

Marks And Spencer Cyber Attack 300 Million Cost Revealed

May 25, 2025 -

Zheng Defeats Sabalenka In Rome Faces Gauff In Next Round

May 25, 2025

Zheng Defeats Sabalenka In Rome Faces Gauff In Next Round

May 25, 2025 -

From Rowing Machine To Medical Miracle A Fathers 2 2 Million Fundraising Effort

May 25, 2025

From Rowing Machine To Medical Miracle A Fathers 2 2 Million Fundraising Effort

May 25, 2025 -

Investment In Amundi Djia Ucits Etf Monitoring Net Asset Value Nav

May 25, 2025

Investment In Amundi Djia Ucits Etf Monitoring Net Asset Value Nav

May 25, 2025 -

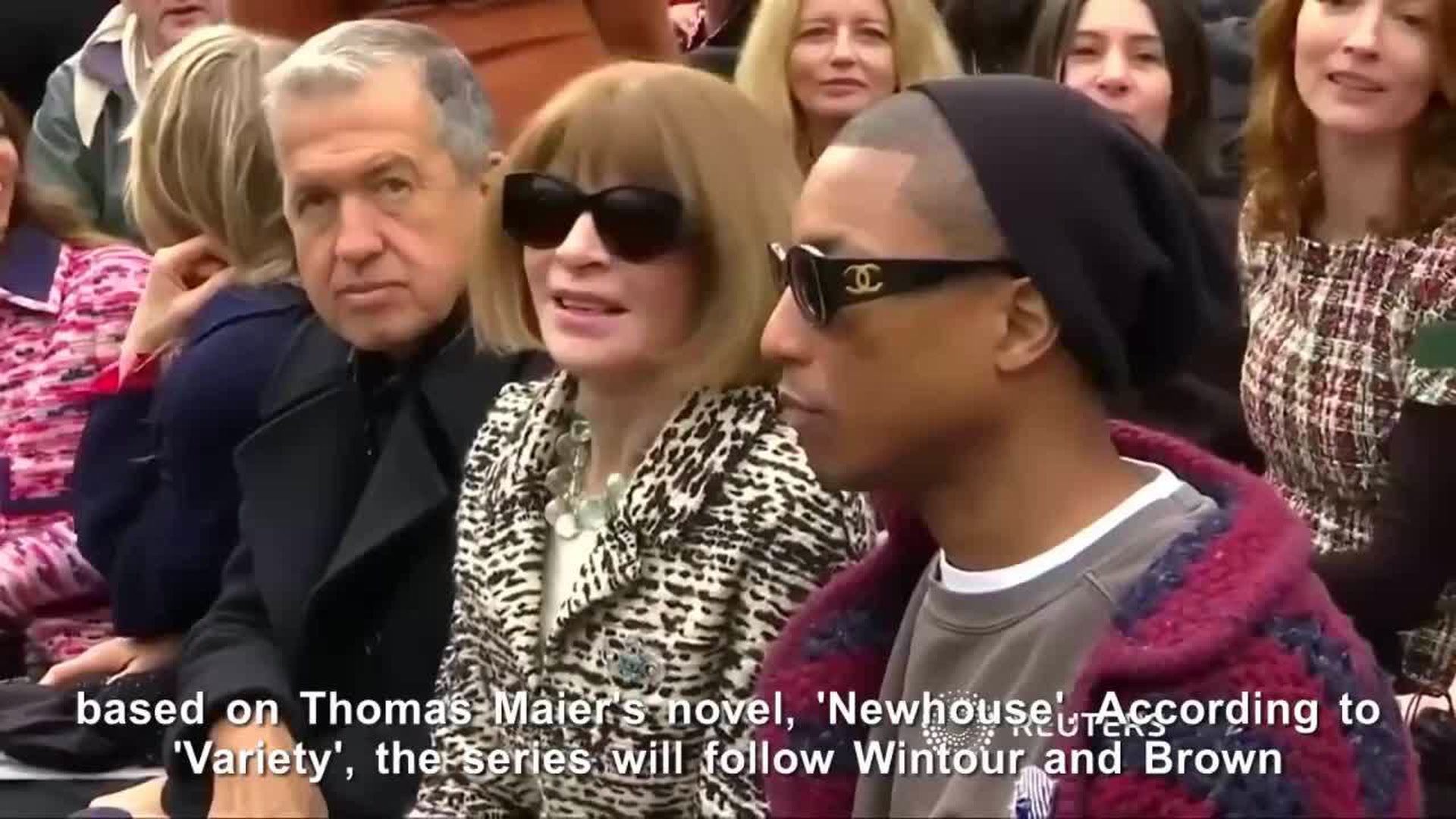

Naomi Campbells Potential Met Gala 2025 Absence A Feud With Anna Wintour

May 25, 2025

Naomi Campbells Potential Met Gala 2025 Absence A Feud With Anna Wintour

May 25, 2025