Amundi MSCI World II UCITS ETF Dist: Understanding Net Asset Value (NAV)

Table of Contents

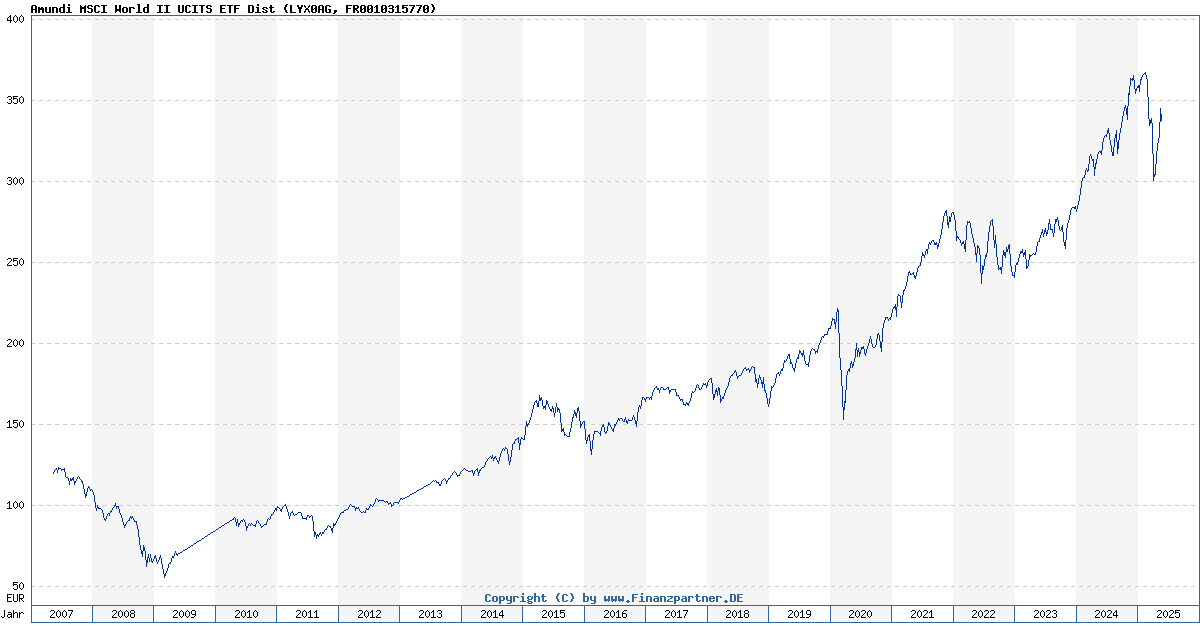

The Amundi MSCI World II UCITS ETF Dist is an exchange-traded fund that tracks the MSCI World Index, providing diversified exposure to a wide range of global equities. Understanding its Net Asset Value (NAV) is paramount to successful investment in this ETF. NAV, in the context of ETFs, represents the value of the ETF's underlying assets per share. It's a critical indicator of the ETF's performance and a key factor in making informed investment decisions. This article will cover what NAV is, how it impacts your investment in the Amundi MSCI World II UCITS ETF Dist, where to find this crucial data, and how dividend distributions influence it.

What is Net Asset Value (NAV)?

Net Asset Value (NAV) is the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF Dist, this calculation involves determining the total market value of all the stocks, bonds, or other assets held within the ETF's portfolio. This is then adjusted for any liabilities, such as fees and expenses, to arrive at the NAV per share. The NAV differs from the market price; the market price is the price at which the ETF shares are currently trading on the exchange, while the NAV reflects the intrinsic value of the ETF's holdings.

- NAV reflects the intrinsic value of the ETF. It represents the actual value of the underlying assets.

- Calculated daily, usually at market close. The NAV is calculated at the end of each trading day.

- Considers all assets held within the ETF portfolio. Every asset in the ETF's holdings contributes to the NAV calculation.

- Influenced by market movements of the underlying assets. Changes in the prices of the underlying assets directly affect the ETF's NAV.

How NAV Impacts Amundi MSCI World II UCITS ETF Dist Investors

Daily NAV fluctuations directly impact the value of your investment in the Amundi MSCI World II UCITS ETF Dist. Monitoring the NAV is essential for understanding your investment's performance and making informed buy/sell decisions. A rising NAV generally indicates positive performance, while a falling NAV suggests a decline in value. Furthermore, understanding the NAV helps you compare the Amundi MSCI World II UCITS ETF Dist to other similar ETFs, assisting in making informed investment choices.

Dividends paid out by the Amundi MSCI World II UCITS ETF Dist also affect the NAV. When a dividend is distributed, the NAV typically decreases by the amount of the dividend per share. This is because the ETF's assets are reduced to pay out the dividends. The relationship between NAV and ETF share price is generally closely correlated, although short-term discrepancies can occur due to market supply and demand.

- NAV changes directly impact your investment's value. A higher NAV means your investment is worth more.

- Tracking NAV helps you understand performance. It provides a clear picture of your investment's growth or decline.

- Understanding NAV helps in comparing similar ETFs. It allows for a more objective comparison of investment options.

- NAV helps gauge potential risks and rewards. It aids in assessing the volatility and potential returns of the investment.

Where to Find the Amundi MSCI World II UCITS ETF Dist NAV

Finding the daily NAV for the Amundi MSCI World II UCITS ETF Dist is straightforward. Several reliable sources provide this information:

- Amundi's official website: The ETF provider's website is the primary source for accurate and up-to-date NAV data.

- Major financial data providers (e.g., Bloomberg, Yahoo Finance): These platforms offer comprehensive financial data, including real-time and historical NAV information.

- Your brokerage account's platform: Most brokerage accounts provide access to real-time NAV data for the ETFs you hold.

Remember that reporting times for NAV may vary slightly between different sources. It is advisable to check the NAV regularly to stay updated on your investment's performance. Always prioritize official sources to ensure accuracy.

Amundi MSCI World II UCITS ETF Dist: NAV and Dividend Distribution

Dividend distributions are a crucial aspect of the Amundi MSCI World II UCITS ETF Dist and impact the NAV. The ex-dividend date is the date on which the stock trades without the dividend. After the ex-dividend date, the NAV decreases by the amount of the dividend as the assets are distributed. Receiving dividends typically involves having your brokerage account automatically reinvest them or receiving a direct deposit depending on your account settings. The tax implications vary based on your individual tax residency and should be considered as part of your overall investment strategy.

- Dividends are usually paid out of NAV. This results in a decrease in the NAV per share.

- NAV decreases after the ex-dividend date. This is a normal occurrence reflecting the distribution of dividends.

- Understanding the dividend payout schedule is crucial for planning. This helps you anticipate changes in the NAV and manage your investment effectively.

- Tax implications vary depending on your jurisdiction. Consult a tax professional for personalized advice.

Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist NAV for Informed Decisions

Understanding the Net Asset Value (NAV) is essential for making informed investment decisions regarding the Amundi MSCI World II UCITS ETF Dist. Regularly monitoring the NAV allows you to track the performance of your investment, make timely buy/sell decisions, and compare your investment with similar ETFs. Remember to consult reliable sources like Amundi's official website, major financial data providers, and your brokerage account to access the daily NAV data. By understanding the Net Asset Value of the Amundi MSCI World II UCITS ETF Dist, you can make more confident investment choices. Stay informed and monitor your NAV regularly for a successful investment journey.

Featured Posts

-

Glastonbury 2025 Headliners Disappointment And Controversy

May 24, 2025

Glastonbury 2025 Headliners Disappointment And Controversy

May 24, 2025 -

The Jonas Brothers Joe And The Couples Public Argument

May 24, 2025

The Jonas Brothers Joe And The Couples Public Argument

May 24, 2025 -

Ferraris Fastest Ranking 10 Standard Production Models By Fiorano Lap Time

May 24, 2025

Ferraris Fastest Ranking 10 Standard Production Models By Fiorano Lap Time

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Explained

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Explained

May 24, 2025 -

Is It Going To Rain In Nyc During Memorial Day Weekend Forecast

May 24, 2025

Is It Going To Rain In Nyc During Memorial Day Weekend Forecast

May 24, 2025