Analysis: Chinese Stocks Rise Following Market Correction Amidst US Discussions And Data Releases

Table of Contents

The Market Correction and its Aftermath

Chinese stocks experienced a notable correction in the [Insert Time Period, e.g., second quarter of 2024], impacting major indices such as the Shanghai Composite Index and the Hang Seng Index. This downturn stemmed from a confluence of factors including heightened regulatory scrutiny within specific sectors (e.g., technology, education), anxieties surrounding China's economic slowdown, and persistent geopolitical tensions with the US.

The correction resulted in significant losses. For instance, [Insert Example: e.g., the Shanghai Composite Index dropped by 15% within a month].

- Stocks Affected: [List examples of specific stocks and their percentage drops, e.g., Alibaba, Tencent, etc.].

- Timeline: The correction primarily occurred between [Start Date] and [End Date].

- Quantifiable Losses: [Provide specific figures for overall market capitalization loss during the correction].

The Subsequent Rise in Chinese Stocks

Following the correction, the Chinese stock market demonstrated a remarkable recovery, with indices experiencing a substantial rebound. [Insert Example: e.g., The Shanghai Composite Index surged by 10% within [Timeframe]]. This upswing was characterized by both speed and strength, suggesting a shift in investor sentiment.

- Sectors Performing Well: The technology and real estate sectors, previously heavily impacted, witnessed particularly robust gains.

- Trading Volume: Increased trading volume further indicated heightened investor activity.

- Catalysts for the Rise: [Mention specific events or news that could have contributed to the rise, e.g., positive government pronouncements on economic stimulus, easing of regulatory pressure in specific sectors].

The Role of US-China Discussions

Ongoing US-China discussions have played a significant, albeit complex, role in shaping investor sentiment towards Chinese stocks. While specific details of these discussions remain confidential, [Mention any publicly available information on recent talks or agreements]. Positive developments in these discussions, even incremental ones, tend to boost investor confidence, while negative news or escalating tensions can trigger sell-offs.

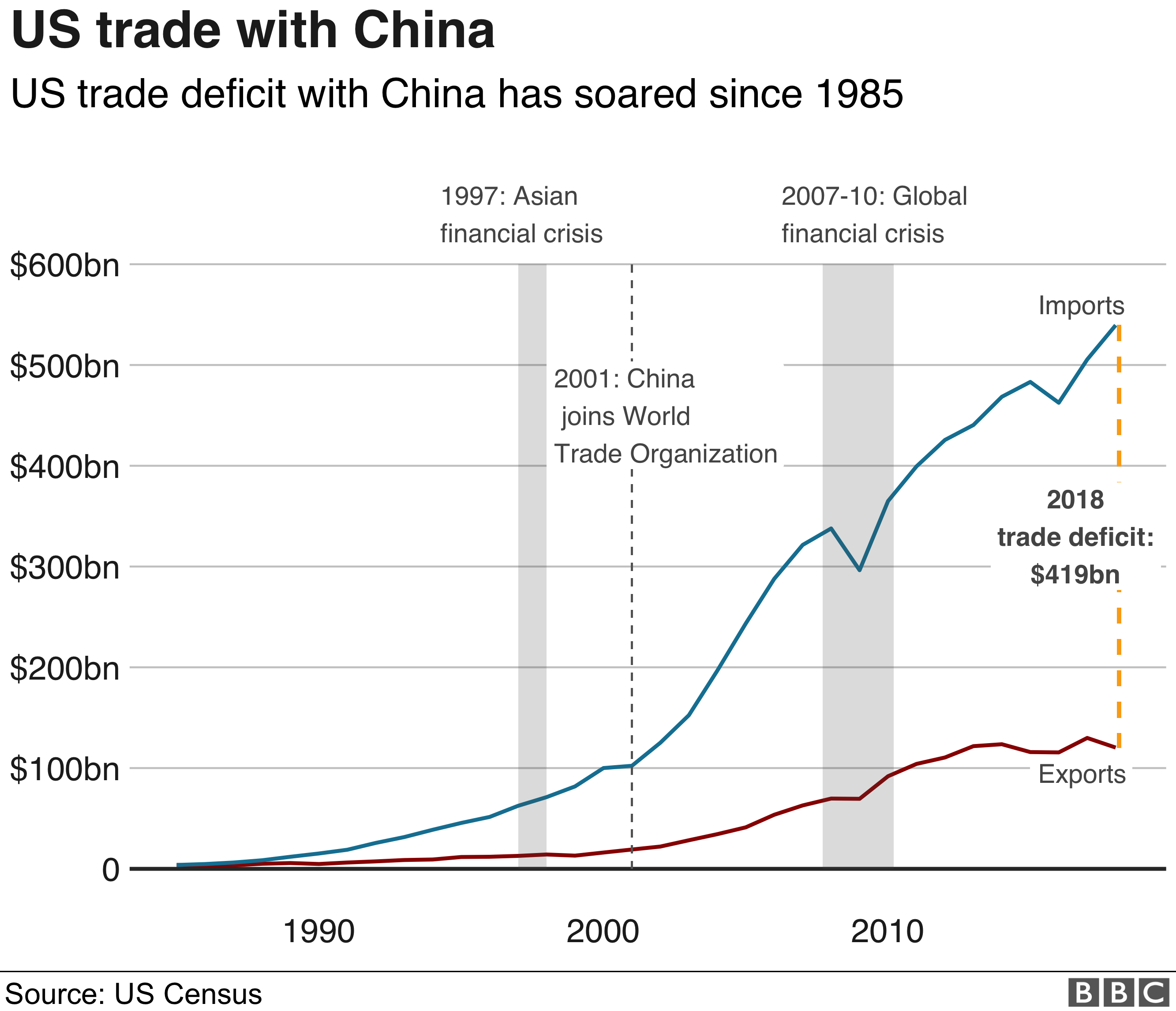

- Areas of Concern: Key concerns in US-China relations include trade disputes, technology competition, and national security issues.

- De-risking/Decoupling: The potential for de-risking or decoupling strategies by US companies is a significant factor influencing investor perceptions.

- Shift in Risk Perception: Investor risk appetite regarding Chinese investments is highly sensitive to the perceived stability and predictability of US-China relations.

Impact of US Economic Data Releases

US economic data releases, particularly those concerning inflation, interest rates, and GDP growth, indirectly impact Chinese stock markets. While not always exhibiting a direct correlation, these data releases significantly influence global market sentiment and investor risk appetite. Positive US economic data can boost global investor confidence, which often spills over to emerging markets like China. Conversely, negative data can trigger risk-aversion, leading to sell-offs in Chinese stocks.

- Key US Economic Indicators: [List specific indicators and explain their relevance, e.g., CPI, Fed rate decisions, US GDP growth].

- Mechanism of Influence: US data affects Chinese stocks primarily through its impact on global market sentiment and investor risk appetite. Strong US data can attract capital globally, potentially benefiting Chinese stocks.

- Examples: [Cite examples showing how specific data releases influenced Chinese stock prices, e.g., "Following a better-than-expected US inflation report, the Shanghai Composite Index rose by X%"].

Future Outlook for Chinese Stocks

Predicting the future of Chinese stocks remains challenging, given the multitude of interacting factors. While the recent rise is encouraging, investors should maintain a cautious perspective. Potential risks include further regulatory changes, global economic uncertainty, and the ongoing evolution of US-China relations. Opportunities may arise from government-led economic stimulus efforts or further easing of regulatory constraints in specific sectors.

- Key Considerations for Investors: Thorough due diligence, diversification, and a long-term investment horizon are crucial.

- Challenges and Uncertainties: Geopolitical risks, regulatory uncertainty, and economic volatility remain key challenges.

- Strategies for Volatility: Employing strategies like dollar-cost averaging and diversification can help mitigate risks associated with market fluctuations.

Conclusion: Analysis: Chinese Stocks Rise Following Market Correction Amidst US Discussions and Data Releases

This analysis highlights the complex interplay of factors driving the recent rise in Chinese stocks following a period of correction. The recovery is influenced by a combination of improving investor sentiment, the impact of US-China discussions, and the indirect effects of US economic data releases. Understanding these dynamics is crucial for making informed investment decisions. To stay ahead, continuously monitor developments in US-China relations, economic data releases, and relevant market analyses related to Chinese stock market analysis and investing in Chinese stocks. Regularly review your investment strategy and adjust accordingly to navigate the volatility inherent in this dynamic market.

Featured Posts

-

100 Tariff On Foreign Movies Understanding Trumps Policy Proposal

May 07, 2025

100 Tariff On Foreign Movies Understanding Trumps Policy Proposal

May 07, 2025 -

Dynamo Moscow President On Ovechkins Advisor Role And Future In Management

May 07, 2025

Dynamo Moscow President On Ovechkins Advisor Role And Future In Management

May 07, 2025 -

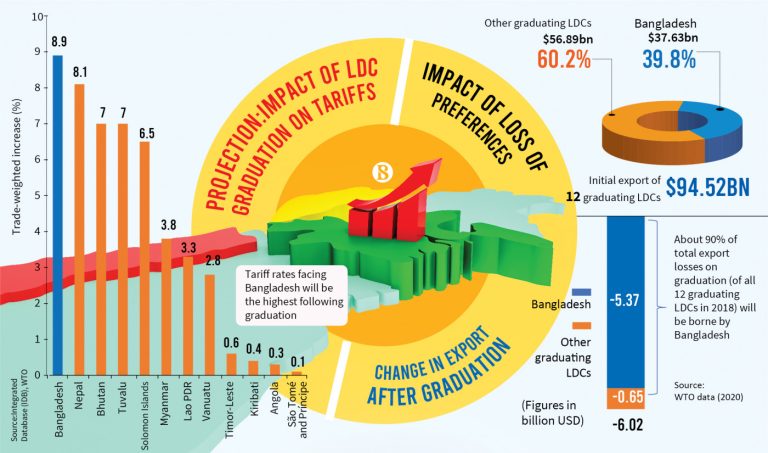

Strategies For Rapid Ldc Graduation Achieving Ca Success

May 07, 2025

Strategies For Rapid Ldc Graduation Achieving Ca Success

May 07, 2025 -

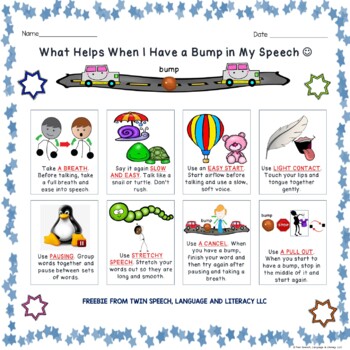

Ps 5 Stuttering Problems A Comprehensive Guide

May 07, 2025

Ps 5 Stuttering Problems A Comprehensive Guide

May 07, 2025 -

Smierc Piecioosobowej Rodziny Na Przejezdzie Kolejowym Brak Odpowiedzialnosci Za Tragedie

May 07, 2025

Smierc Piecioosobowej Rodziny Na Przejezdzie Kolejowym Brak Odpowiedzialnosci Za Tragedie

May 07, 2025