Analysis: SBI Holdings' XRP Distribution And Its Ripple XRP Implications

Table of Contents

SBI Holdings' XRP Ownership and its Market Significance

The Scale of SBI Holdings' XRP Investment

SBI Holdings' XRP investment is substantial, placing them among the largest holders globally. Precise figures fluctuate with market changes, but publicly available information and estimations consistently place them high in the rankings.

- Magnitude: While exact figures aren't always disclosed publicly, estimates suggest SBI Holdings holds a significant percentage of the total XRP supply. This makes them a key player in determining market dynamics.

- Comparison to Ripple: Their holdings are often compared to those of Ripple Labs itself, the creator of XRP, highlighting their significant influence on the overall XRP ecosystem. The relative size of their holdings compared to Ripple's has considerable market implications.

- Market Influence: The sheer scale of SBI Holdings' XRP holdings grants them significant potential market influence. Their actions, whether buying, selling, or simply holding, can impact XRP's price and overall market sentiment.

SBI Holdings' Strategic Investment Rationale

SBI Holdings' substantial XRP investment isn't likely a random act; it's a carefully considered strategic move.

- Long-Term Investment: A primary motivation could be a long-term investment strategy, betting on XRP's future growth and adoption within the Ripple ecosystem and beyond.

- Belief in Ripple's Technology: Confidence in Ripple's technology, its potential for cross-border payments, and its broader blockchain applications could be another key driver.

- Strategic Partnerships: SBI Holdings' investment might also be linked to strategic partnerships with Ripple, aiming for synergistic benefits and leveraging each other's strengths in the financial technology sector.

- Risk Assessment: Like any investment, SBI Holdings' XRP holdings carry inherent risks. Regulatory uncertainty, market volatility, and the overall success of Ripple's business model all contribute to the risk profile.

Impact of SBI Holdings' XRP Distribution on Market Liquidity

Potential for Large-Scale XRP Sales

The possibility of SBI Holdings selling a significant portion of their XRP holdings is a key factor influencing market liquidity and price volatility.

- Price Volatility: A large-scale sale could trigger significant price drops due to increased supply hitting the market. This would likely lead to increased market volatility and uncertainty.

- Market Reactions: The market's reaction would depend on various factors, including the volume sold, the speed of the sale, and prevailing market sentiment. A sudden dump could cause panic selling and further exacerbate price declines.

- Investor and Trader Implications: Investors and traders need to consider this potential risk when making decisions about XRP investments. Understanding the potential for large-scale selling is crucial for risk management.

SBI Holdings' Past Trading Activities

Analyzing SBI Holdings' past trading activities (if publicly available) provides insights into their potential future actions and their market impact.

- Past Market Response: Examining previous instances where SBI Holdings traded XRP, observing the market's response to these transactions, can provide valuable data for predictive modelling.

- Data-Driven Analysis: Using publicly available data on trading volumes, price changes, and market sentiment surrounding SBI Holdings' past activities can reveal patterns and predict potential future scenarios.

- Future Scenarios: Understanding past responses allows for more informed projections of market reactions to future SBI Holdings' XRP trading activities.

The Interplay Between SBI Holdings and Ripple

Existing Partnerships and Collaborations

SBI Holdings and Ripple have a history of collaboration, further solidifying the interconnectedness of their interests.

- Joint Ventures: Exploring the specifics of any known joint ventures or collaborative projects between SBI Holdings and Ripple is crucial in understanding the strategic alignment and potential influence on XRP distribution.

- Strategic Partnerships: Understanding the depth and nature of any strategic partnerships can illuminate the motivations behind SBI Holdings’ XRP investment and shed light on future distribution strategies.

Mutual Benefits and Strategic Alignment

The relationship between SBI Holdings and Ripple suggests a degree of synergistic collaboration.

- Support for Ripple's Initiatives: SBI Holdings' substantial XRP holdings could indirectly support Ripple's initiatives to expand XRP's usage in cross-border payments and other financial applications.

- Reciprocal Benefits: The benefits are likely reciprocal. Ripple’s success is likely linked to the success of major holders like SBI, resulting in a mutual interest in the success of the XRP ecosystem.

Regulatory Implications and Future Outlook for SBI Holdings' XRP

Regulatory Scrutiny and its Potential Impact

The regulatory landscape surrounding cryptocurrencies, particularly XRP, significantly influences SBI Holdings' decisions.

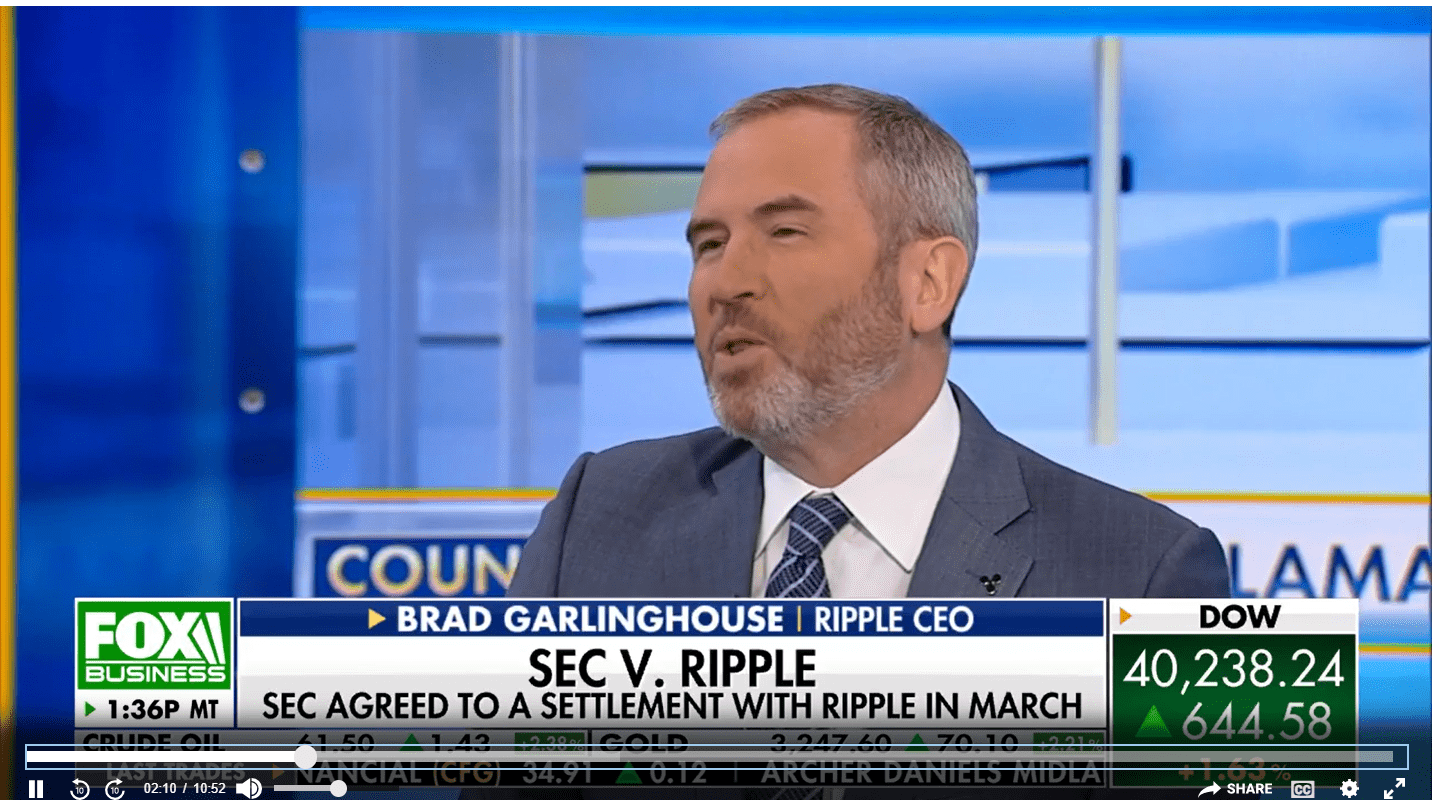

- Legal Battles and Uncertainty: The ongoing legal battles faced by Ripple Labs will inevitably impact SBI Holdings' strategic planning and risk assessment. The outcome of these legal challenges will dramatically affect XRP's future.

- Regulatory Scenarios: Considering various regulatory scenarios – ranging from favorable to unfavorable outcomes – allows for a more comprehensive risk assessment of SBI Holdings’ investment.

Predictions and Future Scenarios

Predicting SBI Holdings' future actions regarding their XRP holdings requires careful consideration of the factors discussed above.

- Continued Holding: SBI Holdings may continue to hold their XRP as a long-term investment, betting on future growth and adoption.

- Strategic Selling: They might strategically sell portions of their holdings to capitalize on market opportunities or manage risk.

- Expansion of Activities: They could expand their XRP-related activities, perhaps exploring new use cases or partnerships within the Ripple ecosystem.

Conclusion: Key Takeaways and Call to Action

Analyzing SBI Holdings' XRP distribution and its Ripple XRP implications reveals a complex interplay of strategic investment, market dynamics, and regulatory uncertainty. SBI Holdings' significant XRP holdings grant them considerable influence on the market, making their actions crucial to watch. Understanding their past activities, strategic partnerships with Ripple, and the regulatory landscape are all essential to predicting future scenarios and evaluating the potential impact on XRP's price and market liquidity.

To stay informed about SBI Holdings' activities and their ongoing impact on the XRP market, continue researching their public statements, follow relevant news sources, and monitor market trends related to SBI Holdings' XRP distribution and its Ripple XRP implications. [Link to a relevant news source or financial analysis site].

Featured Posts

-

Stroomproblemen Nieuwbouw School Kampen Vertraagd Door Netwerkkwestie

May 02, 2025

Stroomproblemen Nieuwbouw School Kampen Vertraagd Door Netwerkkwestie

May 02, 2025 -

Riot Fest 2025 Green Day Weezer And More Announced

May 02, 2025

Riot Fest 2025 Green Day Weezer And More Announced

May 02, 2025 -

Is Fortnite Offline Checking Server Status And Update 34 21 Details

May 02, 2025

Is Fortnite Offline Checking Server Status And Update 34 21 Details

May 02, 2025 -

Winter Storm Overwhelms Tulsa Firefighters 800 Calls For Service

May 02, 2025

Winter Storm Overwhelms Tulsa Firefighters 800 Calls For Service

May 02, 2025 -

Ripple Vs Sec The 50 M Settlement And Its Implications For Xrp Investors

May 02, 2025

Ripple Vs Sec The 50 M Settlement And Its Implications For Xrp Investors

May 02, 2025