Analyst Predicts Bitcoin Rally: Chart Analysis (May 6th)

Key Technical Indicators Supporting the Bitcoin Rally Prediction

This Bitcoin chart analysis relies heavily on several key technical indicators to support the predicted rally. Understanding these indicators is crucial for interpreting the analyst's prediction. The analysis incorporates:

-

Relative Strength Index (RSI): The RSI, a momentum indicator, shows oversold conditions. This suggests that the recent price decline may be nearing its end, paving the way for a potential price rebound. An RSI below 30 often signals a buying opportunity. The analyst points to a recent uptick in the RSI as a significant positive sign.

-

Moving Average Convergence Divergence (MACD): The MACD, another momentum indicator, suggests a bullish crossover. This is a strong indication of a potential upward trend. The analyst highlights the fact that the MACD line has crossed above the signal line, further bolstering the case for a Bitcoin rally.

-

Support and Resistance Levels: The analyst has identified key support and resistance levels on the Bitcoin chart. A break above a significant resistance level would confirm the bullish trend. The analyst identifies these levels and discusses the implications of a successful break.

-

Trading Volume: Recent spikes in trading volume accompanying price increases further support the analyst's prediction. High volume confirms the strength of the price movement, making it less likely to be a temporary fluctuation.

-

Bollinger Bands: The analyst also incorporates Bollinger Bands into their analysis. The price's position relative to the bands adds another layer of confirmation to the potential for a Bitcoin rally. Specifically, the price bouncing off the lower band is seen as a bullish signal.

Macroeconomic Factors Influencing the Predicted Bitcoin Rally

Beyond technical analysis, macroeconomic factors also play a significant role in this Bitcoin price prediction. The analyst considers the following:

-

Inflation: The current high inflation rates are cited as a potential driver for increased Bitcoin price. Investors often turn to Bitcoin as a hedge against inflation, potentially increasing demand and pushing the price upwards.

-

Interest Rates: Potential interest rate changes by central banks can impact the crypto market, including Bitcoin. The analyst assesses how these potential changes could affect the Bitcoin price, considering potential impacts on investor risk appetite.

-

Regulatory Environment: The evolving regulatory environment surrounding cryptocurrencies is another factor. The analyst examines recent regulatory developments and their potential impact on Bitcoin’s price, highlighting potential positive or negative influences.

-

Global Economy: The overall health of the global economy is also considered. The analyst weighs the impact of global economic uncertainty on investor behavior, especially in relation to riskier assets like Bitcoin.

Potential Bitcoin Price Targets and Timeframes

Based on their analysis, the analyst provides Bitcoin price targets and potential timeframes for the predicted rally. This should be interpreted with caution, as price predictions are inherently uncertain:

-

Short-Term: The analyst suggests potential short-term BTC price targets within the next few weeks or month. These targets are based on the technical indicators and the analyst's assessment of market sentiment.

-

Mid-Term: The analyst also projects mid-term Bitcoin price targets for the coming quarter or year. These targets are more speculative, relying on continued positive macroeconomic conditions and sustained bullish market sentiment.

-

Timeframes: The analyst provides potential timeframes for the rally to unfold, emphasizing that these are estimates based on current market conditions and could be subject to significant change.

Risks and Considerations: Potential Downsides to the Bitcoin Rally Prediction

Despite the bullish outlook, it's crucial to acknowledge the inherent risks associated with Bitcoin and the cryptocurrency market:

-

Volatility: The cryptocurrency market is famously volatile. Sudden market corrections are possible, and the predicted rally could be disrupted or reversed.

-

Market Correction: The analyst acknowledges the possibility of a significant market correction, potentially leading to a substantial drop in the Bitcoin price.

-

Bear Market: The possibility of a prolonged bear market, characterized by sustained price declines, cannot be ruled out. The analyst highlights factors that could trigger such a scenario.

-

Risk Management: The analyst strongly emphasizes the importance of risk management in cryptocurrency trading. Diversification, stop-loss orders, and careful position sizing are crucial to mitigating potential losses.

Conclusion

This analysis of the analyst's Bitcoin chart prediction indicates a potential rally based on technical indicators and macroeconomic factors. The prediction points towards a positive outlook for the Bitcoin price, suggesting significant price increases in both the short and mid-term. While promising, the inherent volatility of the cryptocurrency market necessitates careful consideration of risks. The analyst's work offers valuable insights, but ultimately, investing in Bitcoin involves significant risk.

Call to Action: Stay informed about the latest developments in the Bitcoin market and continue following our analysis to understand the evolving dynamics of this predicted Bitcoin rally. Don't miss our future analyses for further insights on Bitcoin price predictions and chart interpretations. Learn more about Bitcoin price prediction strategies and improve your understanding of the BTC market.

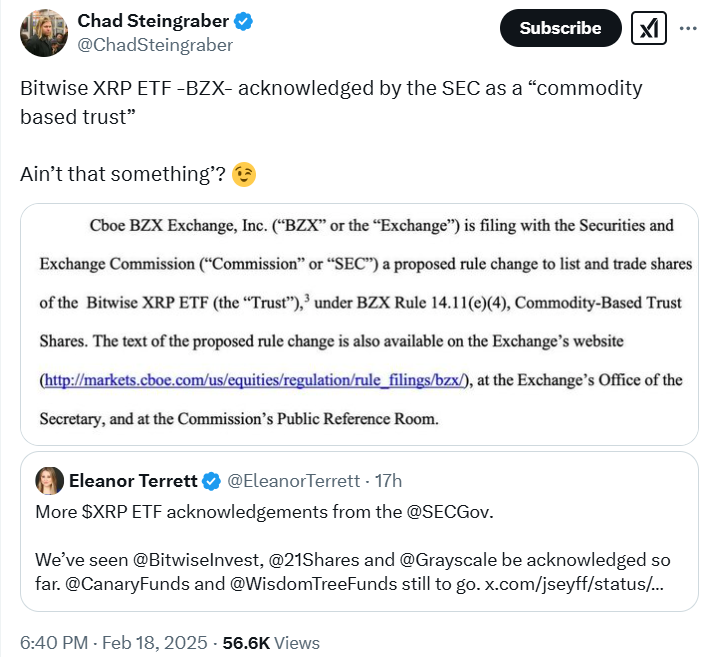

Xrp News Sec Classification Commodity Or Security

Xrp News Sec Classification Commodity Or Security

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

Examining A 1 500 Bitcoin Price Increase Projection

Examining A 1 500 Bitcoin Price Increase Projection

Minecraft Superman A 5 Minute Preview From A Thailand Theater

Minecraft Superman A 5 Minute Preview From A Thailand Theater

Analyzing Xrps 400 Rise Future Price Predictions And Analysis

Analyzing Xrps 400 Rise Future Price Predictions And Analysis