Analyzing CoreWeave Inc.'s (CRWV) Stock Performance: The Thursday Dip

Table of Contents

Pre-Dip Market Sentiment and CRWV's Position

Before Thursday's downturn, the overall market sentiment was relatively positive, with many tech stocks experiencing steady growth. However, broader market trends, including rising interest rates and concerns about inflation, were casting a shadow on the sector. CRWV, while showing strong growth potential in its niche, wasn't immune to these macroeconomic headwinds.

- CRWV Stock Price History: Leading up to the dip, CRWV had demonstrated a period of consistent growth, fueled by increasing demand for its cloud computing and AI infrastructure solutions.

- Recent News and Announcements: Any recent news releases or announcements impacting investor confidence should be carefully examined. This could include earnings reports, partnerships, or regulatory updates. A lack of significant negative news before the dip makes the sudden drop even more intriguing and warrants further investigation.

- Pre-Market Activity: Analyzing pre-market activity can often provide clues to upcoming price movements. A significant drop in pre-market trading could have foreshadowed Thursday's decline, indicating a potential catalyst for the sell-off.

Analyzing the Thursday Dip: Potential Causes

The sudden and sharp drop in CRWV's stock price on Thursday requires a multifaceted analysis to pinpoint the exact cause. Several potential factors could have contributed:

- Specific News: The absence of major negative news adds to the mystery. Any whispers of regulatory changes or unforeseen technological challenges could have influenced the decline.

- Financial Reports: A less-than-stellar financial report, if released, might explain investor concern. Investors scrutinize key metrics for any signs of slowing growth or increasing debt.

- Analyst Downgrades: Negative analyst ratings or a sudden shift in analyst sentiment could trigger a sell-off. Investors often react to the opinions of financial experts.

- Broader Market Factors: The overall market's performance plays a crucial role. A broader market correction or sector-specific downturn could disproportionately impact high-growth stocks like CRWV.

- Trading Volume: Examining the trading volume during the dip is essential. Unusually high volume would suggest significant selling pressure, confirming a substantial shift in investor sentiment.

- Short Selling: A surge in short-selling activity could amplify downward pressure, as short sellers bet against the stock's future performance.

Impact on Long-Term Investment Strategy

The Thursday dip presents a critical juncture for long-term investors. Is this a temporary setback or a sign of deeper underlying issues?

- Fundamental Analysis: A thorough fundamental analysis of CRWV's financials is crucial. This includes examining revenue growth, profitability, debt levels, and cash flow. Strong fundamentals would suggest that the dip presents a buying opportunity.

- Technical Analysis: Technical indicators like moving averages and relative strength index (RSI) can provide insights into the stock's short-term and medium-term trajectory. These tools can help determine if the price has reached a support level or is continuing its downward trend.

- Growth Potential: CRWV operates in a high-growth sector. The long-term potential for cloud computing and AI infrastructure remains significant. This sector’s growth trajectory should be considered when evaluating the investment's long-term prospects.

- Buying Opportunity?: The dip might represent a buying opportunity for investors with a long-term horizon and confidence in CRWV's future. However, it's essential to weigh the risks against the potential rewards.

Competitor Analysis and Market Share

Analyzing CRWV's competitive landscape is vital for understanding its position within the cloud computing and AI infrastructure markets.

- CRWV Competitors: Identifying key competitors (e.g., AWS, Azure, Google Cloud) and comparing their recent performance can provide context for CRWV's stock movement.

- Market Share: Assessing CRWV's market share and its growth trajectory compared to its competitors helps gauge its competitive strength and future potential. A relative loss of market share could contribute to investor concerns.

- Competitive Landscape: Analyzing the competitive landscape, including factors such as pricing strategies, technological advancements, and customer acquisition, is crucial for understanding the company's long-term sustainability.

Conclusion: Understanding and Navigating the CoreWeave Inc. (CRWV) Stock Dip

Thursday's dip in CRWV's stock price highlights the volatility inherent in the tech sector. While several factors could have contributed to the decline, a thorough analysis of the company's fundamentals, competitive positioning, and the broader market conditions is essential. For long-term investors, this dip might present a buying opportunity, provided a comprehensive due diligence process confirms the company's long-term growth prospects and the temporary nature of the setback. However, it’s crucial to acknowledge the inherent risks involved.

Before making any investment decisions regarding CoreWeave Inc. (CRWV) stock, conduct your own thorough research, examining the company's financial reports and seeking professional financial advice if needed. Stay informed about market trends and news affecting CRWV to make informed decisions about your investment strategy. Remember, successful stock market investing requires careful analysis, patience, and a well-defined risk tolerance.

Featured Posts

-

Ing 2024 Form 20 F Financial Report And Key Performance Indicators

May 22, 2025

Ing 2024 Form 20 F Financial Report And Key Performance Indicators

May 22, 2025 -

Heartwarming Meaning Behind Peppa Pigs New Baby Sisters Name Revealed

May 22, 2025

Heartwarming Meaning Behind Peppa Pigs New Baby Sisters Name Revealed

May 22, 2025 -

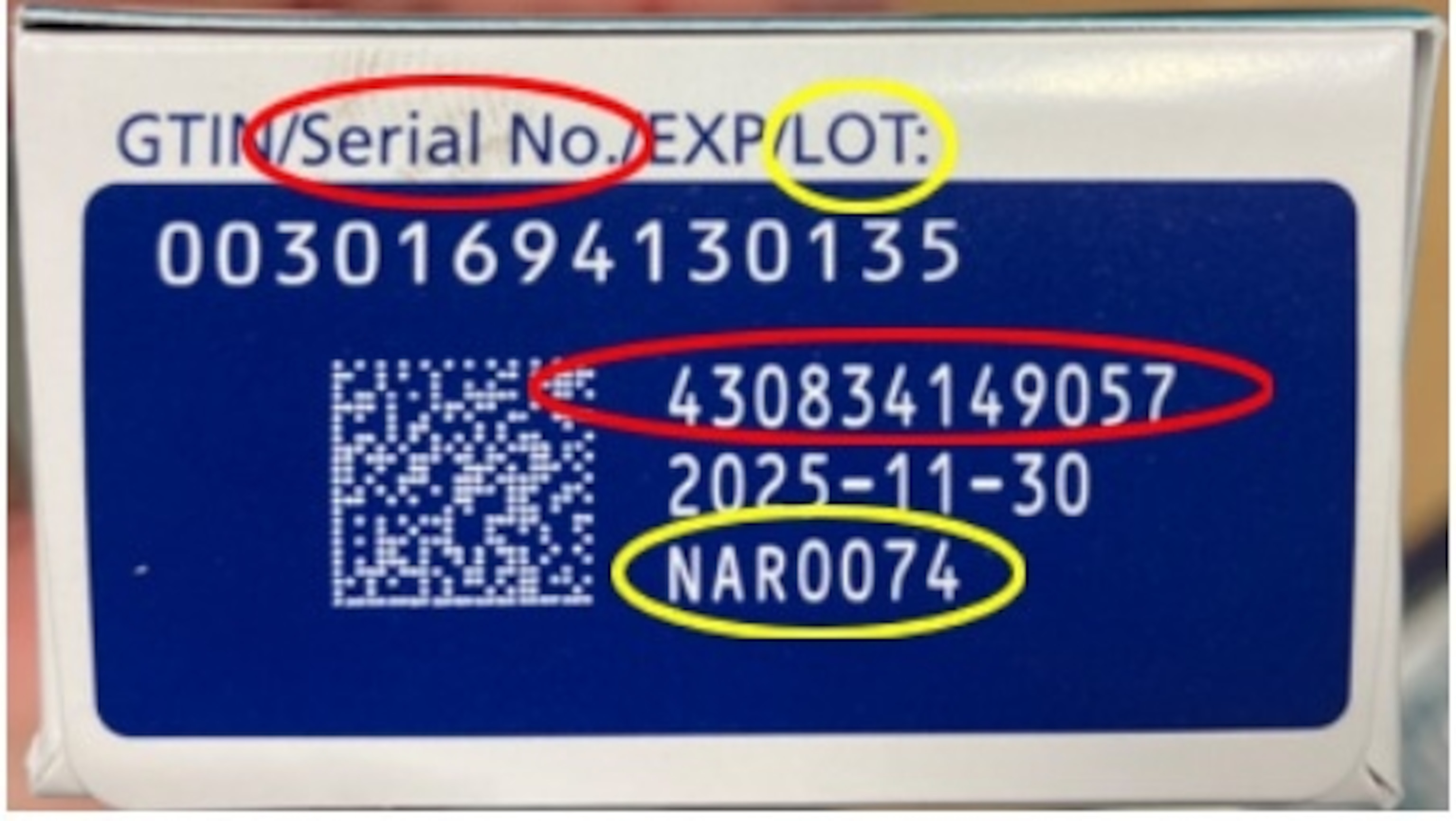

Ozempic Supply Disrupted Fda Enforcement And Its Consequences

May 22, 2025

Ozempic Supply Disrupted Fda Enforcement And Its Consequences

May 22, 2025 -

Hout Bay Fcs Rise The Klopp Connection

May 22, 2025

Hout Bay Fcs Rise The Klopp Connection

May 22, 2025 -

Revised Core Weave Ipo Price 40 Per Share

May 22, 2025

Revised Core Weave Ipo Price 40 Per Share

May 22, 2025