ING 2024 Form 20-F: Financial Report And Key Performance Indicators

Table of Contents

Investing wisely requires a thorough understanding of a company's financial health. For investors interested in ING, the 2024 Form 20-F filing is an invaluable resource. This comprehensive report offers a detailed look into ING's financial performance, key performance indicators (KPIs), and future outlook. This article will dissect the key aspects of the ING 2024 Form 20-F, providing insights into ING's financial health and helping you make informed investment decisions. We'll explore key financial highlights, analyze crucial KPIs, examine segment performance (if available), and discuss the risks and opportunities outlined in the report.

Key Financial Highlights from ING's 20-F Filing

Keywords: ING revenue, ING net income, ING assets, ING liabilities, ING profitability, ING financial statements

The ING 2024 Form 20-F provides a comprehensive overview of the company's financial position. Understanding the key figures is crucial for assessing ING's overall financial health and profitability. While precise figures require accessing the official filing, we can outline the key data points to look for:

- Total Revenue (USD): [Insert Data from 20-F] – Analyzing the year-over-year growth or decline percentage reveals important trends in ING's revenue generation. A significant increase might indicate strong market performance and effective business strategies, while a decline warrants further investigation.

- Net Income (USD): [Insert Data from 20-F] – This figure represents ING's profitability after all expenses are deducted. Comparing this to previous years allows us to assess the company's ability to generate profits. A rising net income signals positive growth and financial stability.

- Total Assets (USD): [Insert Data from 20-F] – This metric reflects ING's overall size and resources. Year-over-year growth suggests expansion and potential for future growth.

- Total Liabilities (USD): [Insert Data from 20-F] – Analyzing liabilities in relation to assets provides insights into ING's financial leverage. A high debt-to-asset ratio could indicate increased financial risk.

- Return on Equity (ROE): [Insert Data from 20-F] – ROE is a key profitability ratio indicating how effectively ING is using shareholder investments to generate profits. A higher ROE generally signifies better performance.

- Earnings Per Share (EPS): [Insert Data from 20-F] – EPS indicates the portion of ING's net income allocated to each outstanding share, directly impacting shareholder returns.

Analysis of Key Performance Indicators (KPIs) in ING's 20-F

Keywords: ING Key Performance Indicators, ING financial ratios, ING risk management, ING capital adequacy, ING solvency

Beyond the basic financial statements, ING's 20-F will likely detail several key performance indicators crucial for understanding its operational efficiency and risk management. These KPIs provide a deeper insight into ING's financial health:

- Cost-to-income ratio: This ratio indicates ING's efficiency in managing operating expenses relative to revenue. A lower ratio suggests better cost control and increased profitability.

- Net interest margin: This metric reflects the difference between the interest income ING earns on loans and the interest it pays on deposits. A healthy net interest margin signifies efficient interest rate management and profitability.

- Capital adequacy ratio (CAR): This crucial indicator assesses ING's financial strength and its ability to absorb potential losses. A higher CAR indicates better resilience to financial shocks. Regulations dictate minimum CAR levels.

- Non-performing loans (NPLs): The percentage of NPLs highlights ING's credit risk exposure. A higher percentage of NPLs signals potential financial distress and increased risk.

- Loan growth: Analyzing loan portfolio growth indicates ING's ability to expand its business and generate revenue. Sustainable loan growth is a sign of strong market position and efficient lending practices.

Segment Performance Analysis within ING's 20-F

Keywords: ING retail banking, ING wholesale banking, ING investment banking, ING geographic segments

ING's 20-F may break down performance by business segments (retail banking, wholesale banking, investment banking, etc.) and geographic regions. Analyzing this segment-specific data allows for a more granular understanding of ING's overall financial health and the relative contributions of different divisions.

- Performance of retail banking segment: Look for metrics like customer growth, loan growth, and profitability within the retail banking division.

- Performance of wholesale banking segment: Examine key metrics like corporate loan growth, transaction volumes, and profitability within the wholesale segment.

- Performance of other significant segments (e.g., investment banking, asset management): Assess the performance of other significant business units using relevant industry benchmarks and indicators.

Risks and Opportunities Highlighted in ING's 20-F

Keywords: ING risk factors, ING regulatory compliance, ING future outlook, ING market conditions, ING economic outlook

ING's 20-F filing will undoubtedly discuss significant risks and opportunities that could impact its future performance. Understanding these factors is vital for making well-informed investment choices:

- Key risks related to macroeconomic conditions: This section will discuss risks related to global economic downturns, interest rate changes, and geopolitical instability.

- Regulatory and compliance risks: This section assesses the potential impact of evolving regulations and compliance requirements on ING's operations and profitability.

- Operational risks: This includes risks related to technological disruptions, cybersecurity breaches, and other operational challenges.

- Opportunities for growth in specific markets or sectors: ING may highlight potential growth opportunities in specific geographic regions or business sectors.

Conclusion

Understanding the intricacies of ING's 2024 Form 20-F is crucial for investors seeking to assess its financial health and future prospects. By carefully analyzing the key financial highlights, KPIs, segment performance, and identified risks and opportunities, investors can make more informed investment decisions. This article has provided a framework for interpreting the key information within the ING 2024 Form 20-F. Remember to access the full ING 2024 Form 20-F for a comprehensive understanding. Deepen your understanding of ING's financial performance by reviewing the complete report available on the official ING investor relations website [Insert Link Here]. Analyze ING's key performance indicators further to gain a complete picture of its financial position.

Featured Posts

-

Beenie Mans Nyc Takeover Is This The Future Of It A Stream

May 22, 2025

Beenie Mans Nyc Takeover Is This The Future Of It A Stream

May 22, 2025 -

European Union Trade Policy Macron Advocates For Buy European Strategy

May 22, 2025

European Union Trade Policy Macron Advocates For Buy European Strategy

May 22, 2025 -

Snehit Suravajjula Defeats Sharath Kamal In Wtt Contender Chennai 2025

May 22, 2025

Snehit Suravajjula Defeats Sharath Kamal In Wtt Contender Chennai 2025

May 22, 2025 -

Clisson L Administration Du College Face Au Nombre De Croix Portees Par Les Eleves

May 22, 2025

Clisson L Administration Du College Face Au Nombre De Croix Portees Par Les Eleves

May 22, 2025 -

3 Laebyn Yndmwn Lawl Mrt Lmntkhb Alwlayat Almthdt Alamrykyt Bqyadt Bwtshytynw

May 22, 2025

3 Laebyn Yndmwn Lawl Mrt Lmntkhb Alwlayat Almthdt Alamrykyt Bqyadt Bwtshytynw

May 22, 2025

Latest Posts

-

Rio Tintos Pilbara Defence A Response To Forrests Criticism

May 22, 2025

Rio Tintos Pilbara Defence A Response To Forrests Criticism

May 22, 2025 -

Is Googles Ai Strategy Working Investor Confidence And The Future Of Ai At Google

May 22, 2025

Is Googles Ai Strategy Working Investor Confidence And The Future Of Ai At Google

May 22, 2025 -

Googles Ai Ambitions Convincing Investors Of Its Proficiency

May 22, 2025

Googles Ai Ambitions Convincing Investors Of Its Proficiency

May 22, 2025 -

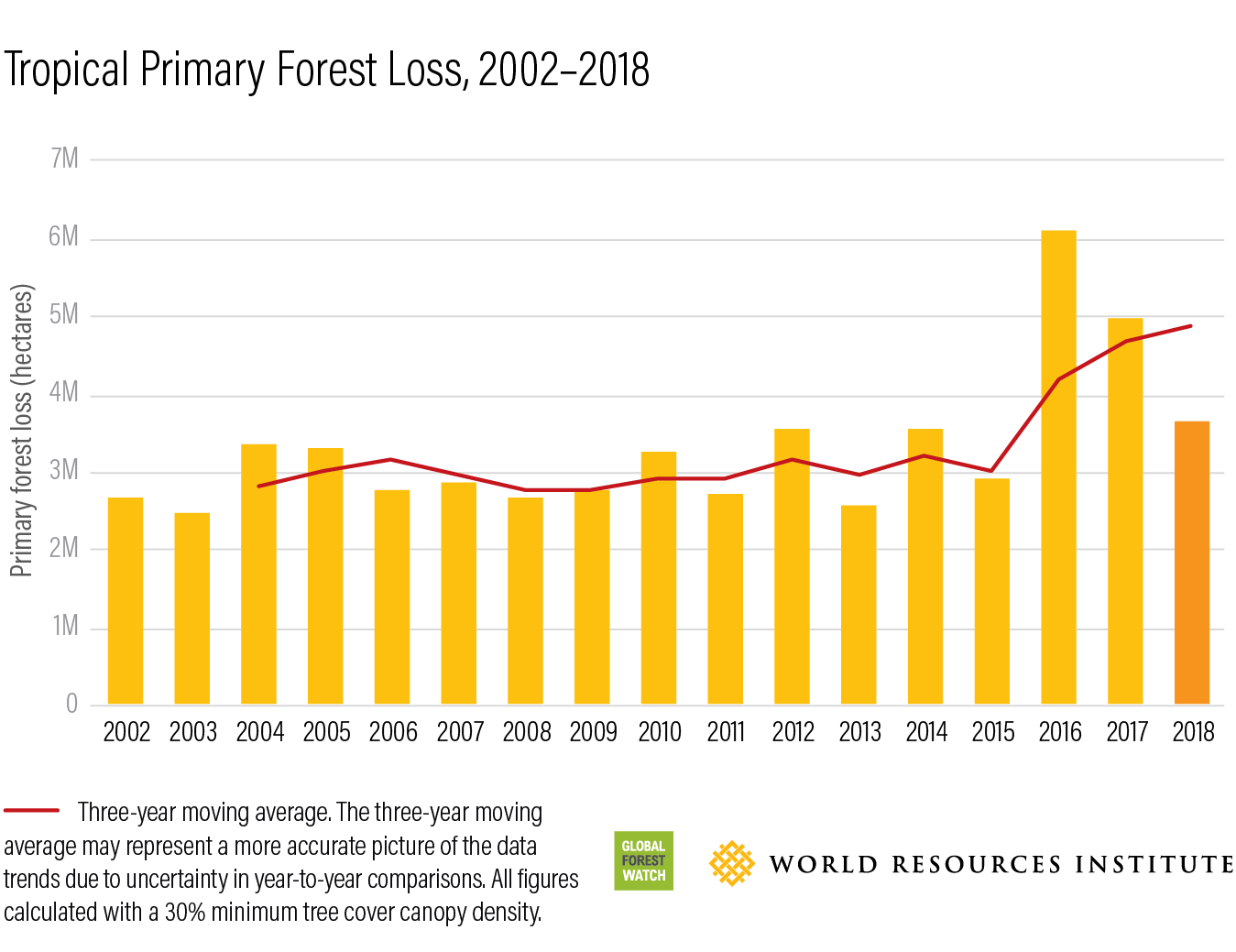

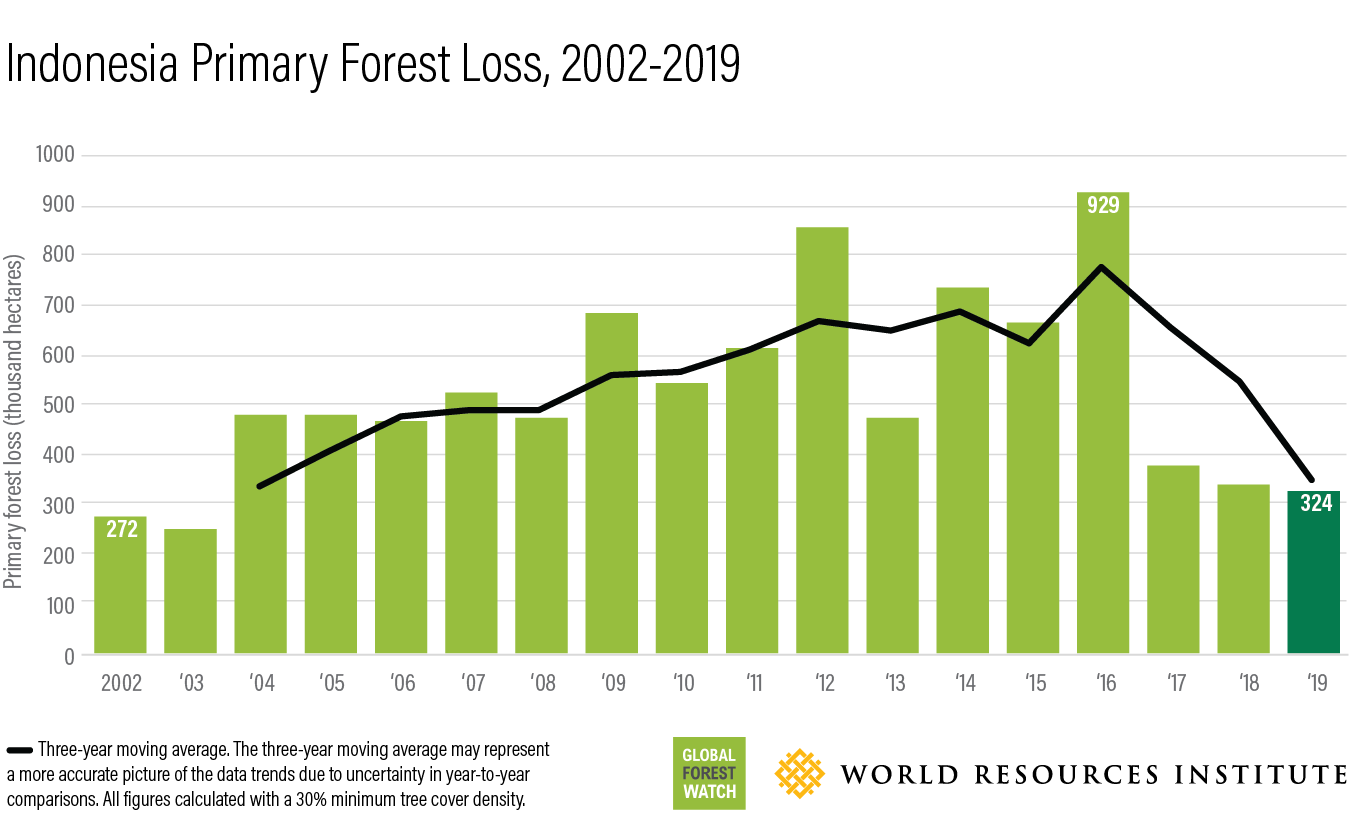

The Impact Of Wildfires Driving Record Global Forest Loss

May 22, 2025

The Impact Of Wildfires Driving Record Global Forest Loss

May 22, 2025 -

Wildfires And Deforestation A Record Year Of Global Forest Loss

May 22, 2025

Wildfires And Deforestation A Record Year Of Global Forest Loss

May 22, 2025