Analyzing The Ethereum Weekly Chart: A Potential Buy Signal

Table of Contents

Is now the time to buy Ethereum? This week's chart analysis reveals some intriguing potential buy signals for ETH. We'll delve into the key indicators suggesting a bullish trend may be on the horizon. We'll analyze the weekly Ethereum chart, focusing on crucial technical indicators and price action to determine if this is a genuine opportunity.

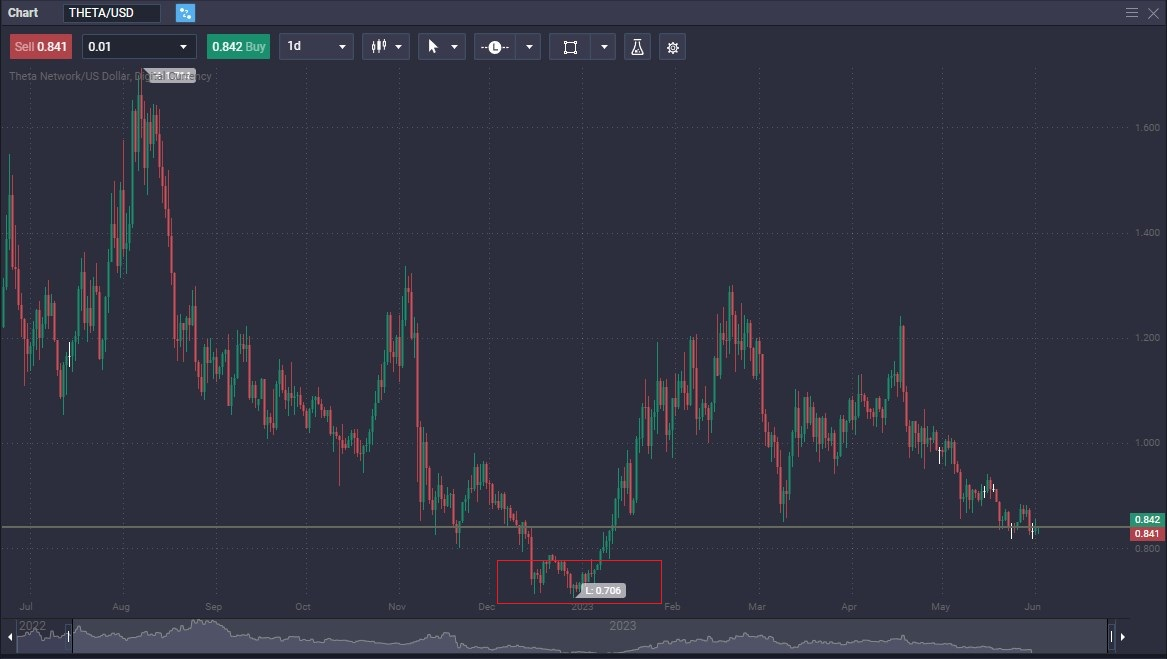

Price Action Analysis

Analyzing the price action on the weekly Ethereum chart is crucial for identifying potential buy signals. This involves looking at support and resistance levels, candlestick patterns, and trendlines.

Support and Resistance Levels

Significant support and resistance levels on the weekly Ethereum chart provide valuable insights into potential price movements. These levels represent price points where buying or selling pressure has historically been strong.

- Key Support: The $1500 level has historically acted as strong support for Ethereum. Breaks below this level in the past have often led to further price declines. However, successful bounces off this level suggest strong buying interest.

- Key Resistance: The $1700 level has acted as a significant resistance level. A decisive break above this level would signal a potential bullish breakout and could trigger further price appreciation. Previous attempts to break above this level have been met with selling pressure.

- Breakouts and Breakdowns: Monitoring breakouts above resistance and breakdowns below support is vital. A clean break above $1700 with strong volume would be a highly bullish signal, confirming the potential for a sustained uptrend. Conversely, a break below $1500 could signal a continuation of the downtrend.

Candlestick Patterns

Candlestick patterns offer valuable insights into the sentiment and potential future price movements of Ethereum. Observing these patterns on the weekly timeframe provides a longer-term perspective.

- Bullish Engulfing Pattern: A bullish engulfing pattern near the $1500 support level would be highly significant. This pattern suggests a potential reversal of the downtrend, as buyers overcame sellers' pressure.

- Hammer Candlestick: The appearance of a hammer candlestick at the bottom of a downtrend is a classic bullish reversal pattern. This indicates a potential bottoming-out process.

- Bearish Patterns: Conversely, the presence of bearish patterns like shooting stars or dark cloud covers near resistance levels could signal caution and potential price declines. Always consider both bullish and bearish patterns.

Trendlines

Identifying trendlines on the weekly Ethereum chart helps to understand the overall direction of the price.

- Uptrend: A clearly defined uptrend line, formed by connecting higher lows, suggests a bullish bias. Bounces off this trendline would confirm the underlying strength of the uptrend.

- Downtrend: A downtrend line, formed by connecting lower highs, indicates a bearish bias. Breaks below this trendline can signal a continuation of the downtrend.

- Trendline Breaks: Breakouts above uptrend lines often signal increased buying pressure and a continuation of the upward trend. Similarly, breakdowns below downtrend lines can signal a significant shift in momentum to the downside.

Technical Indicator Analysis

Technical indicators provide further insights into the Ethereum weekly chart's potential. We'll focus on moving averages, RSI, and MACD.

Moving Averages

Moving averages smooth out price fluctuations, making it easier to identify trends. We'll analyze the 50-week and 200-week moving averages.

- Golden Cross: A golden cross occurs when the 50-week MA crosses above the 200-week MA. This is a classic bullish signal that often precedes significant price upswings.

- Death Cross: The opposite, a death cross (50-week MA crossing below the 200-week MA), is a bearish signal.

- Price Position: The current position of the price relative to the moving averages is significant. A price above both the 50-week and 200-week MA is a positive sign, suggesting bullish momentum.

Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Overbought: An RSI above 70 on the weekly chart suggests the market is overbought, and a correction could be imminent.

- Oversold: An RSI below 30 suggests the market is oversold, potentially indicating a bounce.

- Neutral Readings: An RSI between 30 and 70 suggests neither overbought nor oversold conditions, leaving room for further price movement.

MACD

The Moving Average Convergence Divergence (MACD) is a momentum indicator that identifies changes in the strength and direction of a trend.

- Bullish Crossover: A bullish crossover occurs when the MACD line crosses above the signal line, suggesting increasing bullish momentum.

- Bearish Crossover: A bearish crossover happens when the MACD line crosses below the signal line, indicating decreasing bullish momentum.

- Histogram Analysis: The MACD histogram shows the difference between the MACD line and the signal line. A positive histogram indicates bullish momentum, while a negative histogram indicates bearish momentum.

Conclusion

The weekly Ethereum chart displays several potential buy signals. The price action analysis, coupled with supportive technical indicators like moving averages, RSI, and MACD, suggests a bullish outlook for ETH. However, remember that cryptocurrency markets are inherently volatile; thorough research and risk management are crucial. Consider your own risk tolerance and financial situation before making any investment decisions. Keep an eye on the Ethereum weekly chart for further confirmation of this potential buy signal and don't hesitate to conduct your own in-depth analysis before making any trades. Remember to analyze the Ethereum weekly chart regularly for the best possible investment decisions. Don't miss out on this potential opportunity; start your Ethereum analysis today!

Featured Posts

-

Inters Shock Win Against Bayern In Uefa Champions League

May 08, 2025

Inters Shock Win Against Bayern In Uefa Champions League

May 08, 2025 -

Dcs Superman Cinema Con Reveals Expand On Krypto The Superdogs Importance

May 08, 2025

Dcs Superman Cinema Con Reveals Expand On Krypto The Superdogs Importance

May 08, 2025 -

Examining A 1 500 Bitcoin Price Increase Projection

May 08, 2025

Examining A 1 500 Bitcoin Price Increase Projection

May 08, 2025 -

Ethereum Price To Reach 2 700 Wyckoff Accumulation Signals

May 08, 2025

Ethereum Price To Reach 2 700 Wyckoff Accumulation Signals

May 08, 2025 -

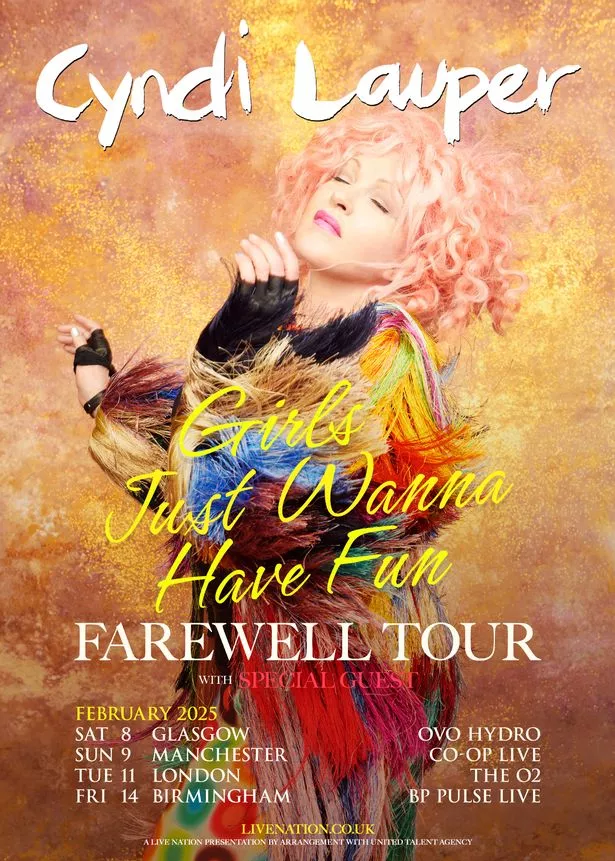

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025