Analyzing The Post-Election Australian Asset Market

Table of Contents

Impact of Election Results on Key Sectors

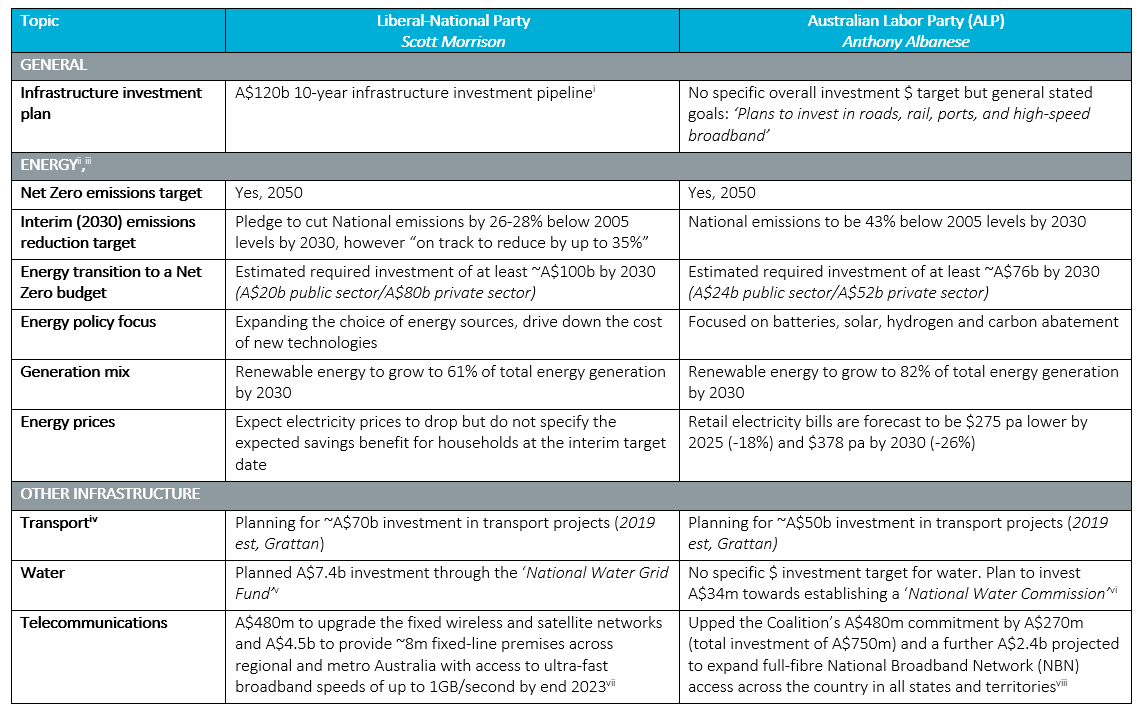

The outcome of the Australian election invariably influences various sectors differently. Analyzing these impacts is crucial for informed investment decisions. Let's examine some key sectors:

- Mining: The mining sector's performance is heavily reliant on government policies regarding resource extraction, environmental regulations, and export incentives. A government focusing on sustainable practices might lead to increased scrutiny and potential regulatory hurdles for certain mining operations, while policies favoring resource exports could boost the Australian mining stocks.

- Real Estate: Changes in interest rates, taxation policies (e.g., capital gains tax), and immigration policies all directly influence the Australian real estate market. A pro-growth government might stimulate the market through infrastructure projects and relaxed lending conditions, increasing real estate investment Australia. Conversely, stricter regulations could dampen growth.

- Technology: Government support for innovation, investment in digital infrastructure, and policies relating to data privacy and cybersecurity significantly impact the tech sector Australia. Funding initiatives and tax breaks for tech startups could fuel growth in this sector.

- Agriculture: Agricultural commodities Australia are sensitive to trade policies, climate change initiatives, and water management strategies. Government support for farmers through subsidies or trade agreements can positively impact this sector.

Changes in Monetary Policy and Interest Rates

The Reserve Bank of Australia (RBA) plays a crucial role in shaping the economic landscape. Its response to the election outcome is a key factor influencing the Post-Election Australian Asset Market.

- Interest Rate Adjustments: Depending on the government's fiscal policies and economic forecasts, the RBA might opt for interest rate hikes to curb inflation or cuts to stimulate growth. These adjustments significantly impact borrowing costs and consumer spending.

- Australian Dollar Exchange Rate: Changes in interest rates directly influence the Australian dollar exchange rate. Higher rates generally attract foreign investment, strengthening the AUD, while lower rates can weaken it.

- Bond Market Australia: The bond market Australia is highly sensitive to interest rate changes. Rising rates generally lead to lower bond prices, while falling rates typically push bond prices higher.

Analysis of the Australian Stock Market (ASX)

Analyzing the ASX's performance post-election is vital for understanding the broader market sentiment.

- Winning and Losing Sectors: Following an election, certain sectors typically outperform others based on the government's policy priorities. Identifying these winning and losing sectors on the ASX is crucial for strategic portfolio adjustments.

- Market Sentiment and Volatility: The initial period following an election often displays increased market volatility as investors assess the implications of the new government's policies. Understanding this sentiment is critical for navigating the market effectively.

- Key Market Indicators: Monitoring key indicators like the ASX 200, trading volume, and market capitalization provides valuable insights into the overall health and direction of the Australian share market.

Potential Investment Opportunities in the Post-Election Market

The Post-Election Australian Asset Market presents both challenges and opportunities for astute investors.

- Asset Class Selection: Depending on the government's policy direction, specific asset classes like infrastructure, renewable energy, or defensive stocks might offer promising returns. Careful analysis of the new policy environment is essential for identifying these opportunities.

- Portfolio Diversification Australia: Diversifying across different asset classes within the Australian market is key to mitigating risk. This might involve allocating investments across equities, bonds, real estate, and alternative assets.

- Risk Management Australia: Effective risk management strategies, including hedging and diversification, are crucial to navigate the volatility that often follows an election.

Conclusion: Making Informed Decisions in the Post-Election Australian Asset Market

The Australian election significantly impacts the Australian asset market outlook. Understanding the potential effects on key sectors, monetary policy, and the ASX is critical for making informed investment decisions. The post-election period often presents increased volatility, emphasizing the need for thorough research and a well-defined investment strategy. Stay informed about the evolving Post-Election Australian Asset Market and adapt your investment strategy accordingly. Consult with a financial advisor for personalized guidance to navigate the complexities of the Australian asset market outlook and unlock post-election investment opportunities Australia.

Featured Posts

-

Dismissing Valuation Concerns Bof As View On The Current Stock Market

May 06, 2025

Dismissing Valuation Concerns Bof As View On The Current Stock Market

May 06, 2025 -

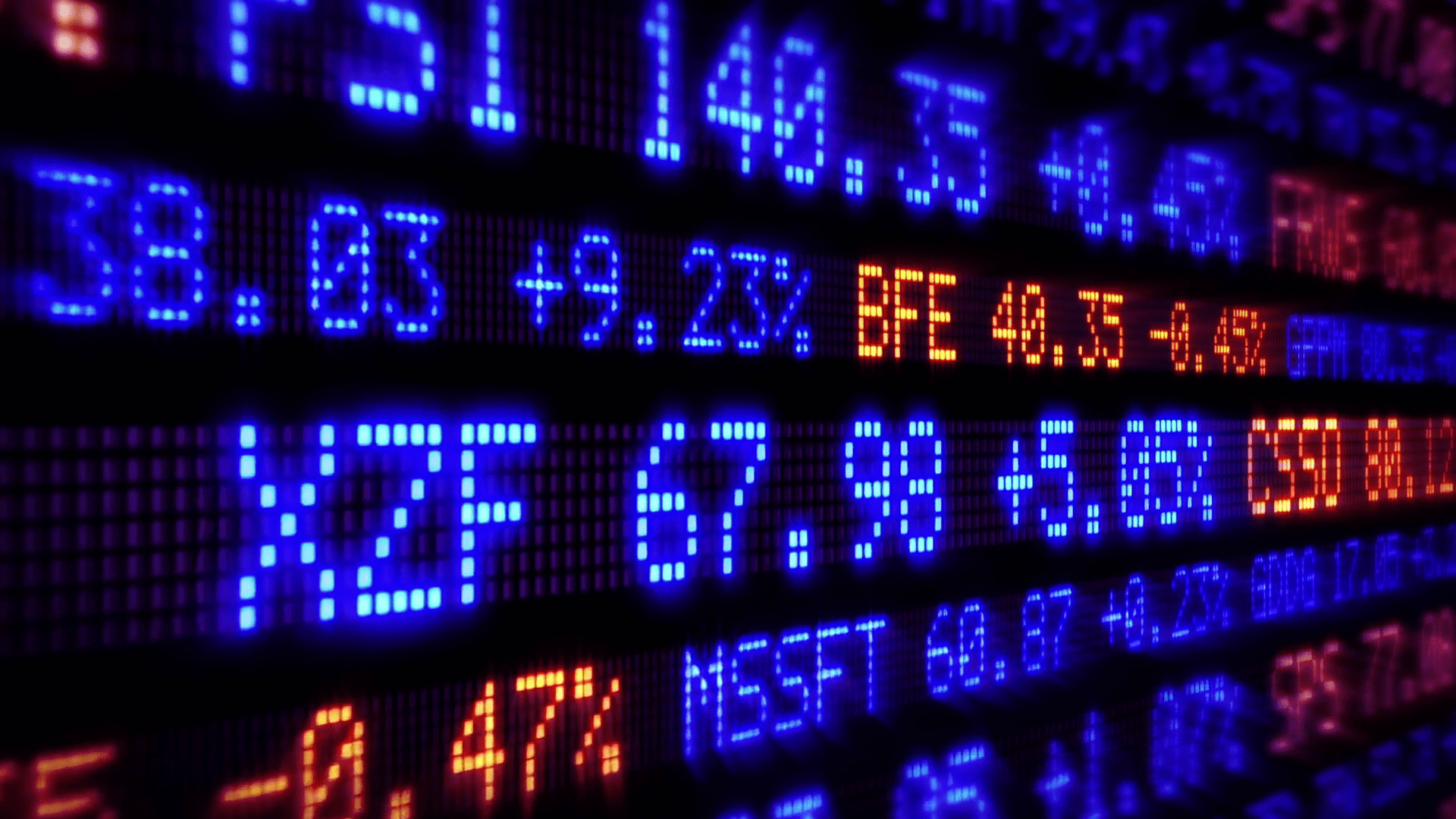

Chinas Automotive Market Obstacles And Opportunities For Foreign Investment

May 06, 2025

Chinas Automotive Market Obstacles And Opportunities For Foreign Investment

May 06, 2025 -

New Savage X Fenty Bridal Collection A Look At Rihannas Designs

May 06, 2025

New Savage X Fenty Bridal Collection A Look At Rihannas Designs

May 06, 2025 -

Miley Cyrus Plagiatsaanklacht Update Over De Rechtszaak Betreffende Haar Hit Die Lijkt Op Die Van Bruno Mars

May 06, 2025

Miley Cyrus Plagiatsaanklacht Update Over De Rechtszaak Betreffende Haar Hit Die Lijkt Op Die Van Bruno Mars

May 06, 2025 -

Wembanyama Rend Hommage A L Ancien Coach Des Spurs Gregg Popovich

May 06, 2025

Wembanyama Rend Hommage A L Ancien Coach Des Spurs Gregg Popovich

May 06, 2025