Analyzing The Potential For Energy Price Increases Under The New US Policy

Table of Contents

Meta Description: Explore the potential impact of the new US energy policy on energy prices. This analysis examines key factors influencing price changes and offers insights for consumers and businesses.

The recently implemented US energy policy has sparked considerable debate regarding its potential impact on energy prices. This analysis delves into the various factors that could contribute to energy price increases, offering a comprehensive overview for consumers and businesses seeking to understand and prepare for potential fluctuations. We will examine the policy's effects on different energy sources and discuss mitigation strategies.

Impact on Fossil Fuel Prices

Increased Regulations on Oil and Gas Production

The new US energy policy includes stricter environmental regulations targeting oil and gas production. This could lead to several factors impacting prices:

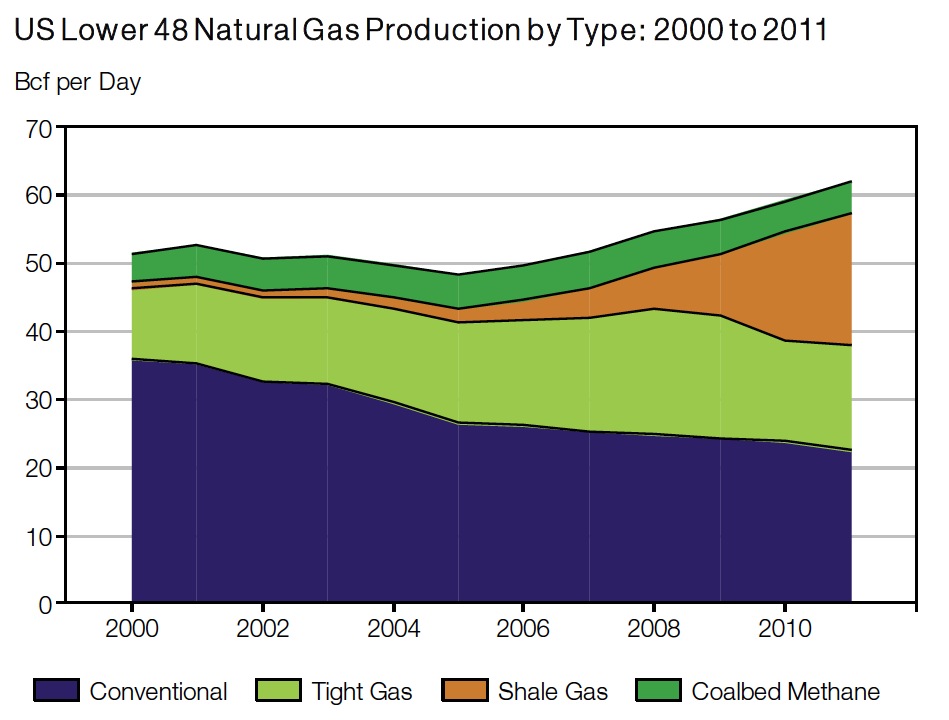

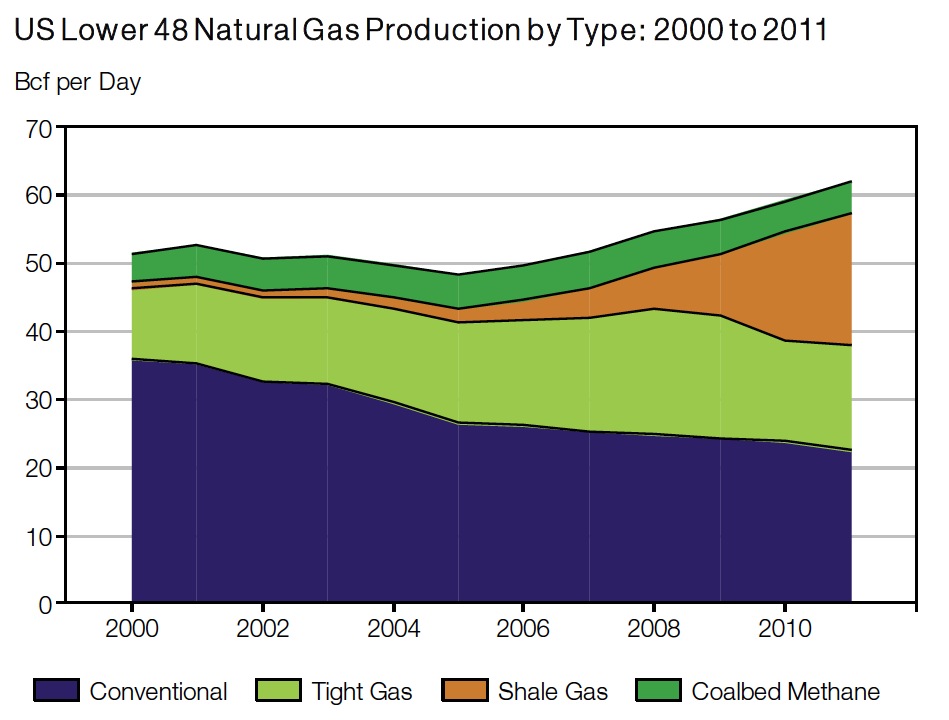

- Reduced Supply: More stringent permitting processes, increased compliance costs associated with emissions reduction, and potential limitations on drilling in certain areas could lead to a decrease in the overall supply of fossil fuels. This reduced supply directly impacts prices, driving them upwards. For instance, the newly implemented methane emission regulations could significantly increase the cost of natural gas extraction.

- Licensing Delays: The more complex approval process for new oil and gas projects under the new policy introduces delays, further limiting the available supply in the short-term. This delay can cause shortages and price volatility, particularly affecting gasoline and heating oil prices.

- Increased Compliance Costs: Companies must invest heavily in new technologies and processes to meet the stricter environmental standards. These increased costs are often passed on to consumers in the form of higher energy prices.

While the policy aims to incentivize investment in renewable energy sources, the short-term impact on the supply and price of fossil fuels like gasoline, natural gas, and heating oil is likely to be an increase.

Shifting Global Energy Markets

The US energy policy also plays a significant role in the global energy landscape. Its impact extends beyond domestic markets:

- Import/Export Prices: Changes in US energy production and consumption can influence global energy trade dynamics, affecting import and export prices for various energy sources. Increased domestic demand for renewable energy might lead to increased imports of fossil fuels from other countries.

- Geopolitical Factors: International relations and geopolitical stability heavily influence energy prices. Trade wars, sanctions, or conflicts in major oil-producing regions can disrupt supply chains, causing price spikes irrespective of US domestic policy.

- International Agreements: The US's role in international climate agreements and its commitment to emission reduction targets will impact global energy markets and the prices of fossil fuels. Agreements aimed at reducing emissions might lead to increased prices of carbon-intensive energy sources.

Influence on Renewable Energy Costs

Subsidies and Incentives for Renewables

The new policy includes substantial subsidies and tax credits designed to accelerate the transition towards renewable energy sources:

- Reduced Costs of Solar and Wind: Government incentives directly lower the cost of solar panels, wind turbines, and other renewable energy technologies, making them more competitive with fossil fuels. This increased competitiveness drives down the overall cost of renewable energy.

- Increased Competition and Innovation: Subsidies encourage more companies to enter the renewable energy market, fostering competition and accelerating technological advancements that further reduce costs.

- Renewable Portfolio Standards (RPS): Many states have RPS mandates requiring a certain percentage of electricity generation from renewable sources. This creates a consistent demand for renewable energy, stimulating investment and driving down costs.

Challenges in Renewable Energy Infrastructure

Despite the incentives, challenges remain in rapidly expanding renewable energy infrastructure:

- Grid Modernization: Integrating large amounts of intermittent renewable energy sources like solar and wind requires significant upgrades to the existing electricity grid. This modernization comes with substantial costs that could impact the final cost of renewable energy.

- Land Use Restrictions and Permitting: The permitting process for renewable energy projects can be lengthy and complex, delaying the deployment of new facilities and potentially increasing costs. Land use conflicts and environmental concerns can further complicate the process.

- Intermittency and Storage: The intermittent nature of solar and wind power requires energy storage solutions to ensure a reliable supply of electricity. The high cost of energy storage technologies currently represents a challenge to the widespread adoption of renewables.

Economic and Geopolitical Factors

Inflation and Economic Growth

Macroeconomic factors significantly influence energy prices:

- Inflationary Pressures: General inflation in the economy affects energy prices, as the cost of production and transportation increases.

- Economic Growth and Demand: Strong economic growth typically boosts energy demand, which can lead to higher energy prices. Conversely, economic slowdowns can decrease demand and lower prices.

- Interplay with Economic Stability: Fluctuations in energy prices can have a significant impact on overall economic stability, affecting businesses, consumers, and government budgets. High energy prices can be a drag on economic growth.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical events can create significant volatility in energy markets:

- Wars and Conflicts: Conflicts in oil-producing regions can disrupt supply chains, leading to shortages and drastic price increases.

- Natural Disasters: Natural disasters like hurricanes or earthquakes can damage energy infrastructure, temporarily reducing supply and causing price spikes.

- Supply Chain Disruptions: Disruptions to global supply chains, such as those caused by the COVID-19 pandemic, can impact the availability and price of various energy sources.

Conclusion

The new US energy policy presents a complex interplay of factors that could significantly influence energy prices. While incentives for renewable energy sources offer long-term potential for cost reductions, short-term impacts on fossil fuel prices are likely due to increased regulations and shifting global dynamics. Economic and geopolitical instability further add to the uncertainty.

Understanding the potential for energy price increases under the new US policy is crucial for both consumers and businesses. Conduct thorough research, explore energy efficiency measures, and consider diversifying energy sources to mitigate risks associated with price fluctuations. Stay informed on updates to the US energy policy and its evolving impact on energy markets.

Featured Posts

-

Real Madrid To Launch 90m Pursuit Of Manchester United Player

May 30, 2025

Real Madrid To Launch 90m Pursuit Of Manchester United Player

May 30, 2025 -

Real Estate Market Crash Home Sales Plummet To Crisis Levels

May 30, 2025

Real Estate Market Crash Home Sales Plummet To Crisis Levels

May 30, 2025 -

Bruno Fernandes Close To Joining Tottenham Hotspur

May 30, 2025

Bruno Fernandes Close To Joining Tottenham Hotspur

May 30, 2025 -

Cassidy Hutchinson From January 6th Witness To Author This Fall

May 30, 2025

Cassidy Hutchinson From January 6th Witness To Author This Fall

May 30, 2025 -

Cannes Film Festival Guillermo Del Toros Sangre Del Toro Documentary Unveiled

May 30, 2025

Cannes Film Festival Guillermo Del Toros Sangre Del Toro Documentary Unveiled

May 30, 2025