Analyzing Wedbush's Apple Price Target Cut: Long-Term Implications

Table of Contents

Understanding Wedbush's Rationale Behind the Price Target Cut

Wedbush's decision to lower its Apple price target wasn't arbitrary. Their analysis points to several key factors contributing to a more cautious outlook. The firm cited concerns about several interconnected issues impacting Apple's near-term performance and, consequently, its long-term valuation.

-

Weakening Consumer Demand: A slowdown in consumer spending, particularly in the high-end smartphone market, is a major concern. Global economic uncertainty and inflation are impacting consumer purchasing decisions.

-

Increased Competition in the Smartphone Market: Intense competition from Android manufacturers, offering comparable features at lower price points, is eating into Apple's market share.

-

Specific Concerns Regarding iPhone Sales: Wedbush likely factored in specific sales data, potentially indicating slower-than-expected iPhone 14 sales or concerns about future iPhone demand.

-

Impact of Global Economic Uncertainty: Geopolitical instability and global economic headwinds are creating uncertainty in the tech sector, impacting investor sentiment and consumer confidence.

While detailed specifics from Wedbush's internal analysis are usually not publicly available, it's clear that the combination of these factors led to the price target reduction. An assessment of Wedbush's historical accuracy in predicting Apple's price movements would provide valuable context, though this data requires independent verification and analysis.

Impact on Apple's Stock Price and Investor Sentiment

The immediate market reaction to Wedbush's Apple price target cut was, as expected, negative. Apple's stock price experienced a noticeable dip following the announcement, reflecting the impact of negative sentiment. The extent of the price drop can be quantified by examining specific market data on the day of and following the announcement.

-

Short-term stock price volatility: The price experienced significant fluctuations immediately following the news, indicating uncertainty among traders.

-

Changes in trading volume: An increase in trading volume is often observed following significant news, reflecting increased activity and investor reaction.

-

Analyst ratings adjustments: Other analysts may adjust their ratings on Apple stock in response to Wedbush’s report, creating a ripple effect.

-

Impact on investor confidence: The price target cut likely eroded investor confidence, leading to some selling pressure.

-

Comparison to previous price target adjustments: Comparing this event with past instances of price target adjustments by Wedbush and other analysts can offer valuable perspective. Analyzing the market's responses to similar events in the past helps understand the potential long-term impacts.

Long-Term Implications for Apple's Growth and Innovation

While the immediate impact of Wedbush's Apple price target cut is concerning, the long-term implications are more nuanced and require careful consideration. The cut doesn't necessarily signal a catastrophic decline for Apple.

-

Potential impact on R&D spending: A dip in stock price might influence Apple's R&D budget, potentially affecting future innovation. However, Apple's history indicates a strong commitment to research and development regardless of short-term market fluctuations.

-

Effect on future product launches: The success of future products, particularly the iPhone 15 and other potential releases, will largely determine Apple's future trajectory. Strong new product launches could mitigate the impact of the price target reduction.

-

Long-term strategic adjustments by Apple: Apple might undertake strategic adjustments to navigate the challenges, such as focusing more on its services business or expanding into new markets.

-

Opportunities for growth in other sectors: Apple's services sector, wearables, and other product lines remain strong growth areas and could offset any slowdown in iPhone sales.

-

Competitive landscape analysis: The competitive landscape remains dynamic, and Apple's ability to innovate and adapt will be crucial in maintaining its market position.

Alternative Perspectives and Counterarguments

It is essential to acknowledge that Wedbush's analysis is not universally accepted. Other analysts and investment firms may hold more optimistic views on Apple's future prospects.

-

Optimistic forecasts from other analysts: Some analysts may see the current slowdown as temporary, highlighting Apple's strong brand loyalty and resilience.

-

Potential for unexpected growth drivers: Unforeseen technological advancements or market shifts could create new growth opportunities for Apple.

-

Strong brand loyalty and customer base: Apple's strong brand recognition and loyal customer base provide a significant buffer against short-term challenges.

-

Resilience of Apple's services business: Apple's services business continues to generate significant revenue and represents a key area of future growth.

Conclusion: Assessing the Future After Wedbush's Apple Price Target Cut

Wedbush's Apple price target cut highlights concerns about weakening consumer demand, increased competition, and global economic uncertainty. While the short-term market reaction has been negative, the long-term implications remain less certain. Apple's ability to innovate, adapt to market changes, and leverage its diverse product portfolio will be crucial in determining its future performance. It's crucial to remember that investing involves inherent risk, and multiple perspectives are needed for informed decision-making. Before making any investment decisions related to Apple stock, conduct thorough research, considering the implications of Wedbush's Apple price target cut and other relevant factors. Consider consulting financial advisors and exploring reputable sources for in-depth analysis. Remember, understanding Wedbush's Apple price target cut is only one piece of a much larger puzzle.

Featured Posts

-

Solve The Nyt Mini Crossword March 12 2025 Answers And Hints

May 24, 2025

Solve The Nyt Mini Crossword March 12 2025 Answers And Hints

May 24, 2025 -

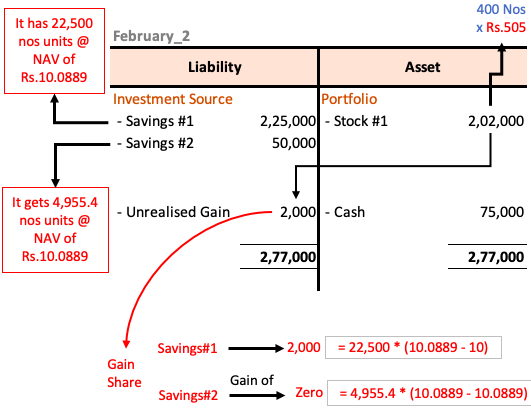

Analyzing The Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Joe Jonas Stuns Fort Worth Stockyards With Impromptu Performance

May 24, 2025

Joe Jonas Stuns Fort Worth Stockyards With Impromptu Performance

May 24, 2025 -

Proverte Svoi Znaniya Oleg Basilashvili Test Na Znanie Roley

May 24, 2025

Proverte Svoi Znaniya Oleg Basilashvili Test Na Znanie Roley

May 24, 2025 -

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025