Apple Price Target Lowered, But Wedbush Stays Bullish: Investment Advice

Table of Contents

Wedbush's Rationale for Maintaining a Bullish Outlook on Apple Stock

Wedbush's continued bullishness on Apple stock stems from several key factors, indicating strong long-term growth potential despite recent market volatility.

Strong iPhone Sales and Services Revenue Growth

Despite macroeconomic headwinds, Apple continues to demonstrate impressive performance. iPhone sales remain robust, solidifying Apple's position as a market leader. Equally significant is the consistent growth of Apple's services revenue stream, which provides a resilient and recurring income source.

- Strong iPhone Sales: Recent quarterly reports show continued high demand for iPhones, particularly in key markets. Apple's market share dominance remains largely unchallenged.

- Services Revenue Growth: Apple's services ecosystem – including Apple Music, iCloud, Apple TV+, and the App Store – continues to expand rapidly, generating a predictable and growing revenue stream. The subscription-based nature of many of these services ensures recurring revenue, less susceptible to economic downturns than hardware sales.

- Market Share Dominance: Apple's premium brand positioning and loyal customer base contribute significantly to its consistent market share leadership, providing a strong foundation for future growth.

Future Growth Potential in Emerging Technologies

Apple’s strategic investments in emerging technologies offer substantial long-term growth potential, positioning the company for future success beyond its current product lineup.

- AR/VR: Apple's rumored entry into the augmented and virtual reality markets could significantly disrupt these sectors, offering a new revenue stream and solidifying its position at the forefront of technological innovation.

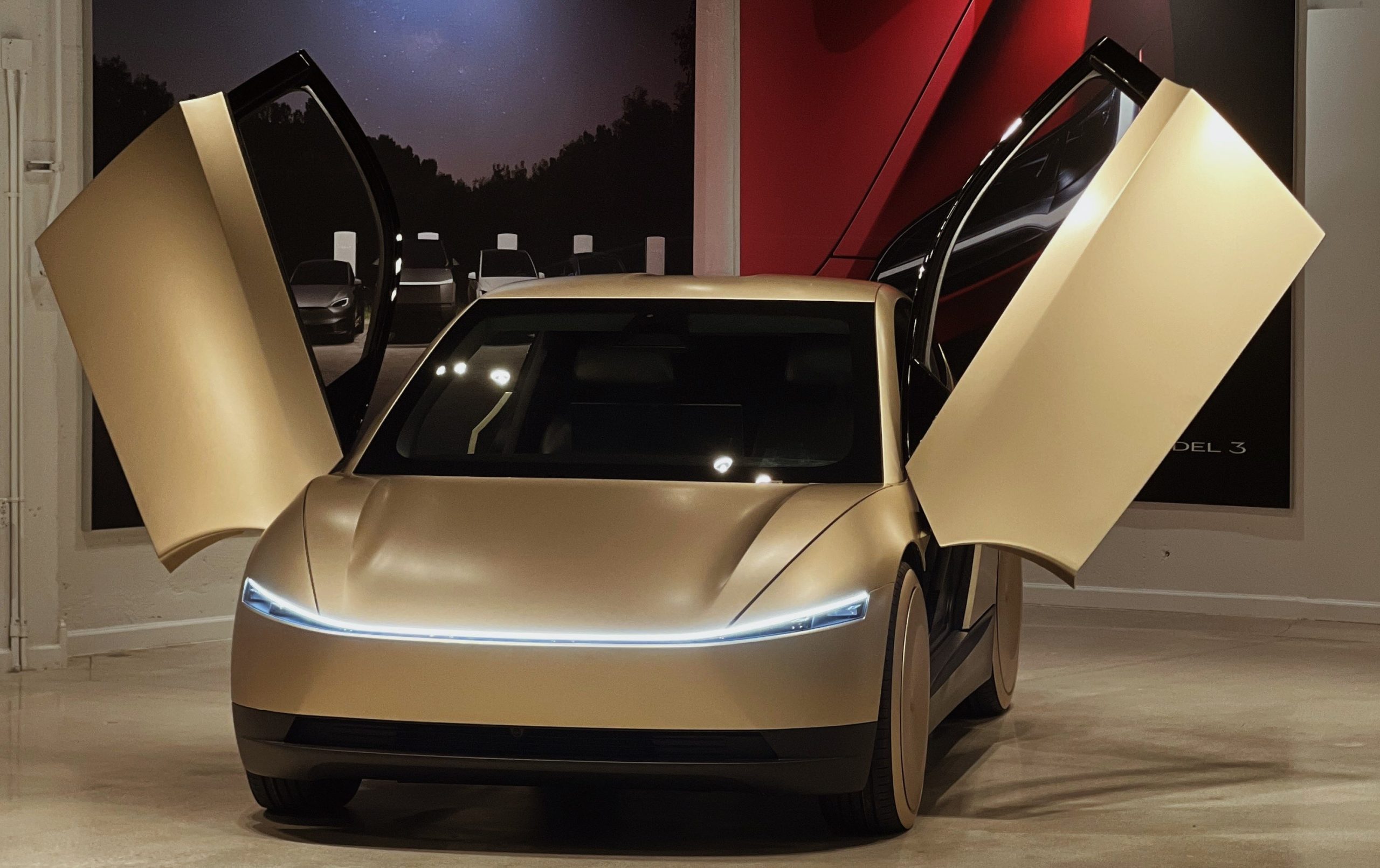

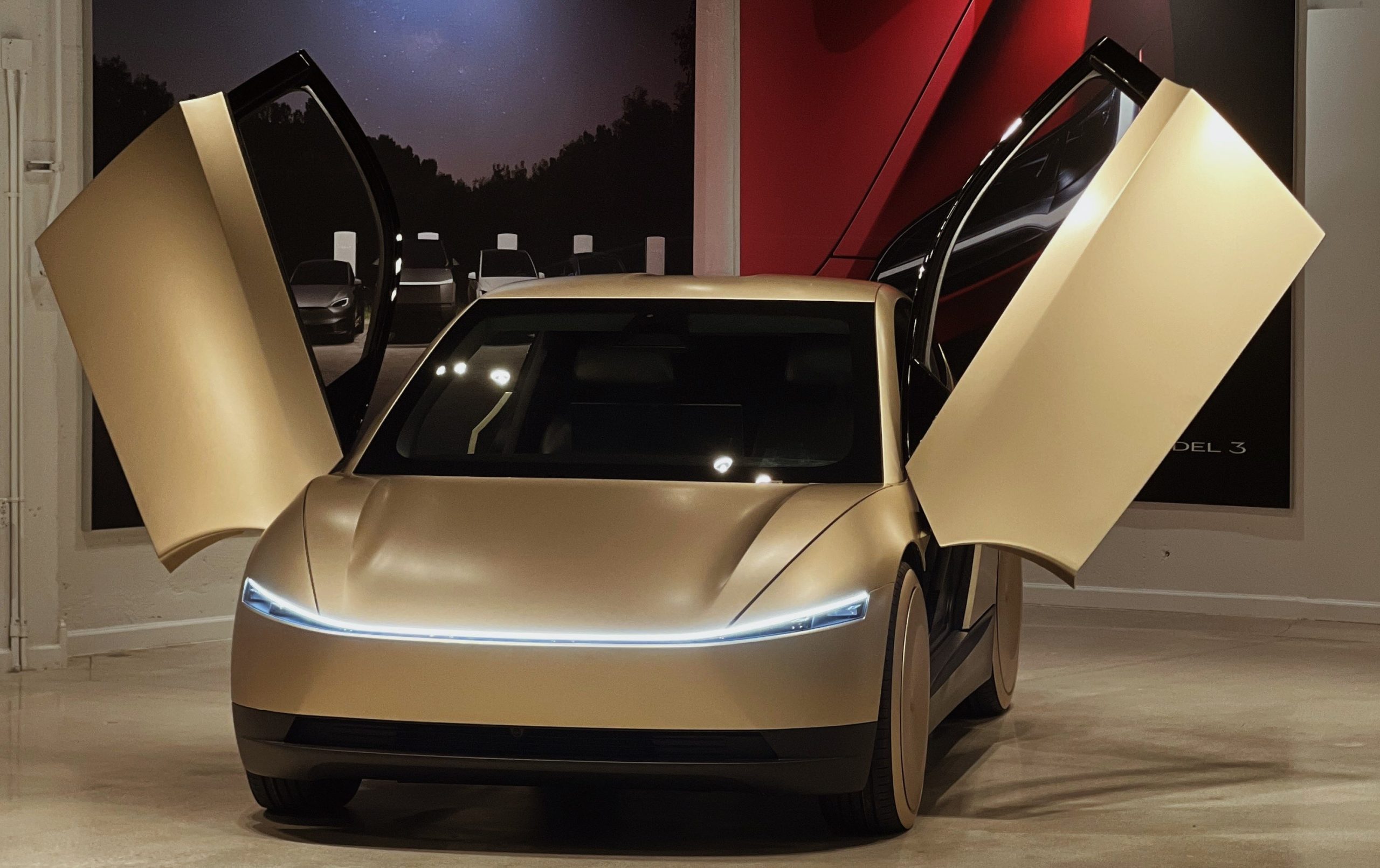

- Electric Vehicles (Apple Car): Speculation around an Apple-branded electric vehicle suggests a potentially massive future market opportunity, though the timeline remains uncertain. Success in this area could redefine Apple's market reach.

- Other Innovations: Apple consistently invests in research and development, exploring various technologies that could yield significant future returns. This ongoing innovation is a key component of Wedbush’s bullish forecast.

Resilience Against Economic Downturn

Wedbush highlights Apple's unique resilience in the face of economic uncertainty. Its strong brand loyalty, robust financial position, and diverse revenue streams contribute to its ability to withstand market fluctuations better than many competitors.

- Strong Cash Reserves: Apple possesses significant cash reserves, providing a financial cushion to weather economic downturns and pursue strategic investments.

- Brand Loyalty: Apple enjoys exceptional brand loyalty, leading to consistent customer demand, even during periods of economic contraction.

- Historical Performance: Apple’s historical performance during previous economic downturns demonstrates a relative resilience compared to other tech companies.

Analyzing the Lowered Price Targets from Other Analysts

While Wedbush maintains a bullish outlook, other analysts have lowered their Apple price targets, reflecting differing perspectives on the company's future.

Reasons for the Divergent Opinions

The divergence in analyst opinions stems from several factors:

- Slowing Economic Growth: Concerns about a potential global recession and reduced consumer spending are influencing some analysts to take a more cautious approach.

- Increased Competition: The increasing competition in the smartphone and other tech markets is another factor that may be contributing to lowered price targets.

- Supply Chain Issues: Ongoing supply chain disruptions and geopolitical uncertainties could impact Apple's production and sales, potentially affecting profitability.

Understanding the Risks Associated with Investing in Apple

Despite the bullish outlook, investing in Apple stock carries inherent risks:

- Geopolitical Risks: Global political instability and trade tensions could negatively impact Apple's operations and supply chains.

- Regulatory Changes: Changes in regulations, particularly regarding data privacy and antitrust issues, could affect Apple's business model and profitability.

- Changes in Consumer Preferences: Shifting consumer preferences and the emergence of new technologies could impact Apple's market share and future growth.

Comparing Different Analyst Ratings and Price Targets

| Analyst Firm | Price Target | Rating | Date |

|---|---|---|---|

| Wedbush Securities | $210 | Outperform | October 26, 2023 (Example) |

| Morgan Stanley | $175 | Equal-Weight | October 26, 2023 (Example) |

| Goldman Sachs | $180 | Neutral | October 26, 2023 (Example) |

| (Note: These are example data points and should be replaced with current, accurate information from reputable financial sources.) |

Investment Advice Based on Current Market Conditions

Navigating the current Apple stock market requires a thoughtful approach to investment strategy and risk management.

Strategies for Managing Risk

To mitigate risk when investing in Apple stock, consider these strategies:

- Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio to reduce the impact of any single stock's performance.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of the stock price. This reduces the risk of investing a lump sum at a market peak.

- Stop-Loss Orders: Set a stop-loss order to automatically sell your shares if the price falls below a certain level, limiting potential losses.

Considering Your Personal Financial Situation

Before making any investment decisions, carefully consider:

- Your Financial Goals: Align your investment strategy with your long-term financial objectives.

- Your Risk Tolerance: Invest only an amount you're comfortable losing.

- Seek Professional Advice: Consult a qualified financial advisor for personalized guidance tailored to your individual circumstances.

Conclusion

The current Apple price target debate presents a complex picture. While Wedbush remains bullish, citing strong fundamentals and future growth potential, other analysts express concerns about macroeconomic factors and increased competition. Understanding both perspectives is crucial for informed decision-making. Thorough research, considering your personal financial situation, and potentially seeking professional financial advice are vital steps before making any investment decisions related to Apple stock. Understanding the nuances of the current Apple price target debate is crucial for making informed investment decisions. Conduct thorough research and consult a financial advisor before making any moves in the Apple stock market.

Featured Posts

-

Amsterdam Stock Index Plunges Over 4 Hits Year Low

May 24, 2025

Amsterdam Stock Index Plunges Over 4 Hits Year Low

May 24, 2025 -

Tim Cooks Tariff Announcement Triggers Apple Stock Sell Off

May 24, 2025

Tim Cooks Tariff Announcement Triggers Apple Stock Sell Off

May 24, 2025 -

Crystal Palace Target Free Transfer For Kyle Walker Peters

May 24, 2025

Crystal Palace Target Free Transfer For Kyle Walker Peters

May 24, 2025 -

Today Show Co Hosts Comment On Anchors Prolonged Leave

May 24, 2025

Today Show Co Hosts Comment On Anchors Prolonged Leave

May 24, 2025 -

Emergency Services Respond To Major Crash Road Closure In Effect

May 24, 2025

Emergency Services Respond To Major Crash Road Closure In Effect

May 24, 2025