Apple Stock: $200 Entry Point For A Potential $254 Target? Analysis And Guidance

Table of Contents

Apple's Current Financial Performance and Future Projections

Revenue Growth and Profitability

Apple consistently demonstrates robust financial performance. Recent quarterly reports showcase impressive revenue growth, fueled by strong sales of iPhones, Macs, and wearables. Net income and earnings per share (EPS) remain healthy, indicating profitability and a strong financial foundation. The anticipated launch of the iPhone 15 and new Mac models is expected to further boost revenue and solidify Apple's position as a market leader.

- Q[Insert Quarter] 2024 Revenue: [Insert Data] - showcasing [Percentage]% growth compared to the same quarter last year.

- EPS: [Insert Data] - reflecting [Percentage]% increase compared to the same quarter last year.

- iPhone Sales: [Insert Data and analysis showing sales trends] – highlighting the continued dominance in the smartphone market.

Visual representation of this data through charts and graphs would further enhance understanding. These positive trends in Apple financial performance strongly suggest a healthy outlook for future growth. Keywords: Apple financial performance, revenue growth, net income, EPS, iPhone sales, Apple product launches.

Market Share and Competitive Landscape

Apple maintains a significant market share in various sectors, including smartphones, wearables, and tablets. Although facing competition from Android-based smartphones and other tech companies, Apple's brand loyalty and strong ecosystem continue to provide a significant competitive advantage. While challenges exist, opportunities abound in expanding into new markets and leveraging emerging technologies.

- Smartphone Market Share: [Insert Data and analysis of Apple's market share compared to competitors like Samsung and others.]

- Wearables Market: [Insert Data and analysis highlighting Apple Watch's market position and growth potential.]

- Competitive Threats: [Discuss potential threats, such as increased competition from Android manufacturers or emerging technologies.]

Keywords: Apple market share, competitive analysis, smartphone market, wearable technology, tech competition.

Innovation and Future Product Roadmap

Apple's sustained success is rooted in its commitment to innovation. Continuous development and the anticipated release of new products, including advancements in AR/VR and potential developments in the autonomous vehicle market (Apple Car), suggest a robust future product roadmap. These innovative endeavors can significantly influence future revenue streams and solidify Apple's position as a tech innovator.

- AR/VR Headset: [Discuss potential market impact and sales projections.]

- Apple Car: [Discuss the potential disruption of the automotive industry and its long-term impact on Apple's revenue.]

- Other Innovations: [Mention any other potential technological advancements.]

Keywords: Apple innovation, future products, AR/VR, Apple car, technological advancements.

Valuation and Potential for $254 Target

Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis provides a valuation model to support the potential $254 target price for Apple stock. This model considers projected future cash flows and discounts them to their present value, factoring in a reasonable discount rate. While assumptions and limitations inherent in any DCF model must be acknowledged, the analysis suggests a strong potential for upside based on current market conditions and future growth prospects.

- Assumptions: [Clearly outline the key assumptions used in the DCF model.]

- Discount Rate: [Explain the chosen discount rate and its rationale.]

- Terminal Value: [Detail the method used to calculate the terminal value.]

Keywords: Apple valuation, DCF analysis, target price, stock valuation model.

Comparable Company Analysis

Comparing Apple's valuation multiples (such as the Price-to-Earnings ratio or P/E ratio) to those of comparable companies provides further insight. This analysis considers factors such as growth rates, profitability, and risk profiles. While discrepancies may exist due to Apple's unique position in the market, this comparative approach strengthens the overall valuation assessment.

- Comparable Companies: [List the companies used in the comparison and justify their selection.]

- Valuation Multiples: [Compare key valuation multiples like P/E ratio, PEG ratio, etc.]

- Rationale for Discrepancies: [Explain any significant differences in valuation multiples.]

Keywords: Apple valuation multiples, peer comparison, comparable company analysis, stock valuation.

Risk Assessment

Investing in any stock involves risk. Potential risks impacting Apple's stock price include economic downturns, geopolitical instability, increased competition, and changes in consumer demand. A thorough understanding of these risks is crucial for informed decision-making.

- Economic Downturn Risk: [Discuss the potential impact of a recession on Apple's sales.]

- Geopolitical Risks: [Analyze the potential influence of global events on Apple's business.]

- Competitive Pressure: [Reiterate the potential impact of competition on Apple's market share.]

Keywords: Apple stock risks, market volatility, economic outlook, geopolitical risks.

Investment Strategy and Guidance

Entry Point Strategy

The proposed $200 entry point for Apple stock is based on the comprehensive analysis conducted. A well-defined stop-loss order is recommended to manage risk. This strategy would allow investors to limit potential losses should the stock price decline below a certain threshold.

- Stop-Loss Order: [Recommend a specific stop-loss price and explain the rationale.]

- Risk Tolerance: [Emphasize the importance of aligning investment decisions with individual risk tolerance.]

- Diversification: [Encourage diversification as part of a broader investment portfolio.]

Keywords: Apple stock entry point, stop-loss order, risk management, investment strategy.

Holding Period and Exit Strategy

Based on the $254 target, a suggested holding period could be [Insert timeframe, e.g., 12-18 months]. However, market conditions are dynamic; therefore, a flexible exit strategy is essential. This might involve taking profits at the target price or adjusting the holding period based on market developments. Regular monitoring and re-evaluation are crucial.

- Target Price Adjustment: [Explain how to adjust the target price based on market conditions.]

- Market Monitoring: [Emphasize the need for continuous monitoring of the market and relevant news.]

- Flexibility: [Highlight the importance of flexibility in adapting the investment strategy.]

Keywords: Apple stock holding period, exit strategy, profit taking, investment timeline.

Conclusion: Is Apple Stock at $200 a Smart Investment? Actionable Insights for your Apple Stock Portfolio

This analysis suggests that Apple stock, at a price of around $200, could present a compelling entry point with the potential to reach a $254 target. However, this is not financial advice. Thorough due diligence, including considering the risks outlined, is crucial before making any investment decisions. Investing in Apple stock requires careful consideration of your personal financial situation and risk tolerance. Conduct further research, consider the analysis provided here, and make informed decisions regarding your investment in Apple Stock. Explore resources for Investing in Apple Stock, analyze Apple Stock Price Predictions, and review other relevant Apple Stock Analysis to enhance your understanding and build a robust investment strategy.

Featured Posts

-

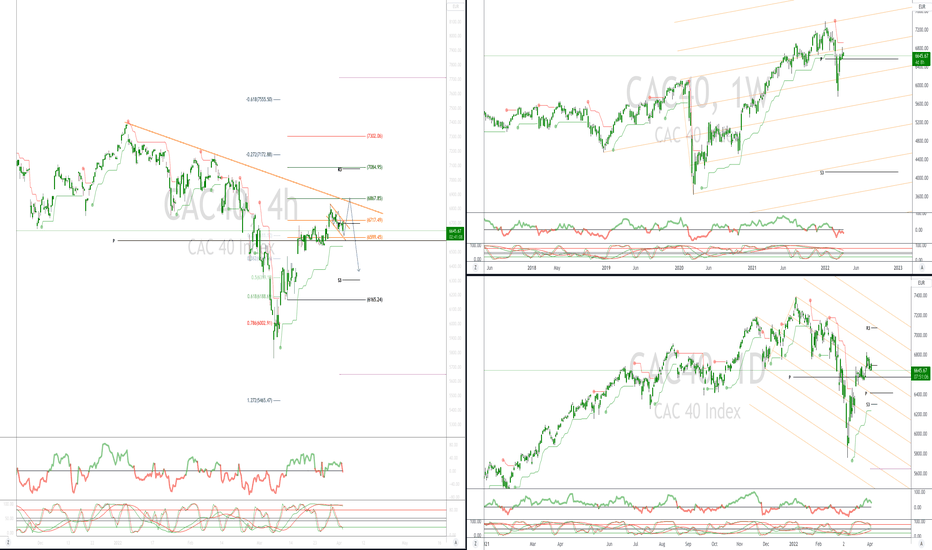

Slight Cac 40 Dip At Weeks End Stable Weekly Performance March 7 2025

May 24, 2025

Slight Cac 40 Dip At Weeks End Stable Weekly Performance March 7 2025

May 24, 2025 -

Newark Airport Chaos Trump Era Plan Blamed By Air Traffic Controllers

May 24, 2025

Newark Airport Chaos Trump Era Plan Blamed By Air Traffic Controllers

May 24, 2025 -

Your Dream Country Escape Location Lifestyle And Logistics

May 24, 2025

Your Dream Country Escape Location Lifestyle And Logistics

May 24, 2025 -

Glastonbury 2024 Unannounced Us Band To Play

May 24, 2025

Glastonbury 2024 Unannounced Us Band To Play

May 24, 2025 -

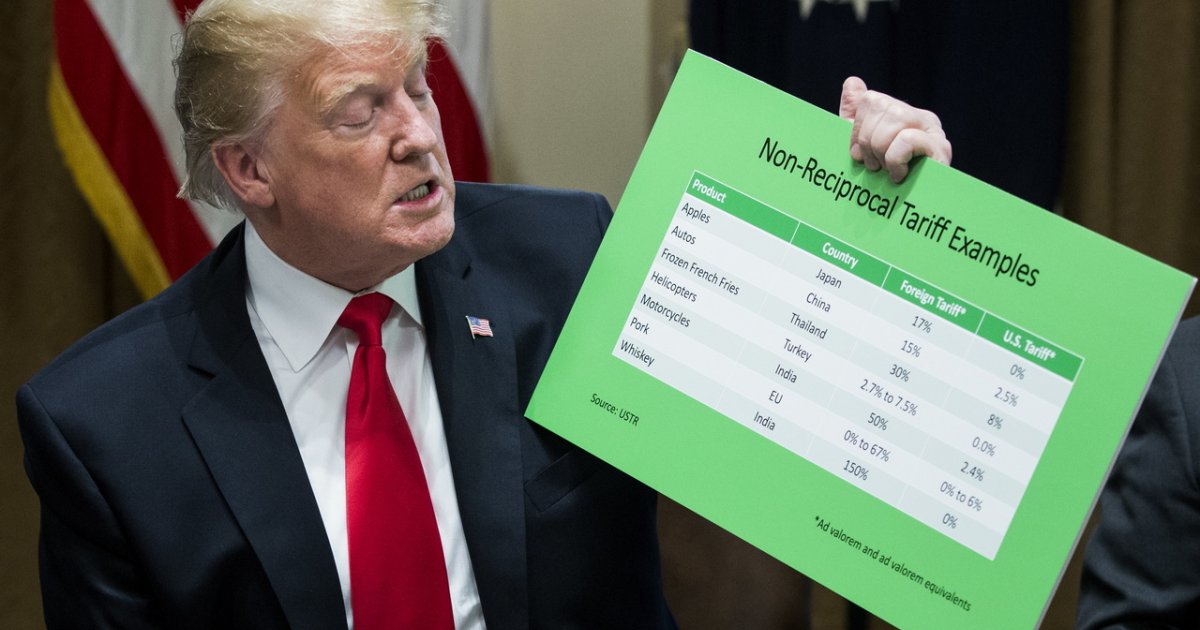

Borse In Picchiata L Impatto Dei Dazi E Le Contromisure Ue

May 24, 2025

Borse In Picchiata L Impatto Dei Dazi E Le Contromisure Ue

May 24, 2025