Apple Stock (AAPL): Key Price Levels To Watch

Identifying Key Support Levels for AAPL Stock

Understanding AAPL support levels is fundamental to successful AAPL stock trading. A support level represents a price range where buying pressure is typically strong enough to prevent further price declines. Identifying these levels allows investors to potentially capitalize on buying opportunities. Several methods can be used to pinpoint key support prices for AAPL:

-

Examine recent lows in AAPL stock price: Look at the recent lows the stock has hit. These lows often act as immediate support levels. A break below these recent lows might signal a stronger downward trend. For example, if AAPL recently bottomed out at $165, this price point becomes a crucial support level to watch.

-

Analyze the psychological significance of round numbers (e.g., $150, $160): Round numbers often act as significant psychological support levels because traders tend to place buy orders at these price points. For AAPL, levels like $150 or $160 could act as strong support.

-

Look at previous support levels that have held in the past: Historical price action is a valuable tool. If AAPL has bounced off a particular price level multiple times in the past, it suggests that this level holds significance and might act as support again.

-

Consider using moving averages (e.g., 50-day, 200-day) as support indicators: Moving averages smooth out price fluctuations and can help identify trends. A break below a key moving average, like the 200-day moving average, could be a bearish signal. Conversely, a bounce off this moving average might suggest that support is holding. Studying these AAPL support levels can be a great indicator of future AAPL stock price movement.

Pinpointing Key Resistance Levels for AAPL Stock

Just as support levels indicate potential buying opportunities, resistance levels signal potential selling pressure. Resistance levels represent price ranges where selling pressure is typically strong enough to prevent further price increases. Identifying resistance levels can help investors determine potential profit-taking points or identify areas where selling pressure might be high.

-

Identify recent highs in AAPL stock price: Recent highs often act as immediate resistance levels. A break above these recent highs usually signals a potential uptrend.

-

Analyze psychological resistance levels (e.g., $180, $200): Similar to support, round numbers like $180 or $200 for AAPL can act as significant psychological resistance levels. Traders might be more inclined to sell near these round figures.

-

Consider previous resistance levels that have been broken: If AAPL has previously struggled to break through a particular price level, it might encounter resistance again at that level. However, a successful break above a previous resistance level can signal a significant shift in momentum.

-

Utilize moving averages to pinpoint potential resistance: Moving averages, especially the 50-day and 200-day, can also help identify resistance levels. A price approaching a key moving average might experience selling pressure.

Analyzing Apple's Financial Performance and its Impact on Stock Price

Apple's financial health directly influences the AAPL stock price. Analyzing Apple's earnings reports, revenue, and future guidance is vital for understanding the potential trajectory of the stock. A strong financial performance usually boosts investor confidence, leading to higher demand and price increases. Conversely, weaker-than-expected results often lead to price drops.

-

Analyze quarterly earnings reports and their impact on AAPL: Earnings reports provide a detailed snapshot of Apple's financial performance. Beating or missing earnings estimates significantly impacts the AAPL stock price.

-

Consider the influence of new product releases on stock price: New product launches, such as new iPhones or MacBooks, often significantly influence investor sentiment and the AAPL stock price. Successful product releases can drive up the price, while underwhelming launches might lead to price declines.

-

Discuss the impact of overall market sentiment on AAPL’s performance: Even with strong fundamentals, the broader market sentiment can impact AAPL's stock price. During periods of overall market uncertainty, even strong companies like Apple can experience price drops.

-

Analyze future growth projections and their potential effect on the stock: Analyst predictions and Apple's own guidance regarding future growth are crucial factors that influence investor expectations and thus affect the AAPL stock price.

Understanding Market Sentiment and its Effect on AAPL Stock

Market sentiment, encompassing investor optimism or pessimism, significantly impacts AAPL stock price. Positive sentiment leads to buying pressure and price increases, while negative sentiment fuels selling and price drops.

-

Analyze news articles and social media sentiment towards Apple: News articles, social media trends, and online discussions can provide valuable insights into overall investor sentiment. A surge in positive news usually reflects positive sentiment, while negative news might indicate pessimism.

-

Discuss the impact of analyst ratings and recommendations on the stock price: Analyst ratings and recommendations can heavily influence investor decisions, creating buying or selling pressure depending on the rating. A strong buy rating from a reputable analyst firm might lead to increased buying activity, while a sell rating could cause price drops.

-

Analyze trading volume and its correlation with price movements: High trading volume often signifies significant interest in the stock. High volume accompanied by price increases suggests strong buying pressure, while high volume with price decreases indicates strong selling pressure.

-

Consider the broader market conditions and their influence on AAPL: Broader macroeconomic factors, such as interest rate changes, inflation, and geopolitical events, can influence investor risk appetite and ultimately affect AAPL’s price.

Conclusion

This article highlighted key support and resistance levels for Apple stock (AAPL), emphasizing the importance of understanding these price points for successful investing. We examined technical indicators, financial performance, and market sentiment as crucial factors influencing AAPL’s price. By carefully monitoring these key price levels for Apple Stock (AAPL) and staying informed on market trends and financial reports, you can make more informed investment decisions. Continue researching and analyzing the Apple Stock (AAPL) market to enhance your investment strategy. Remember to always conduct thorough due diligence before making any investment decisions.

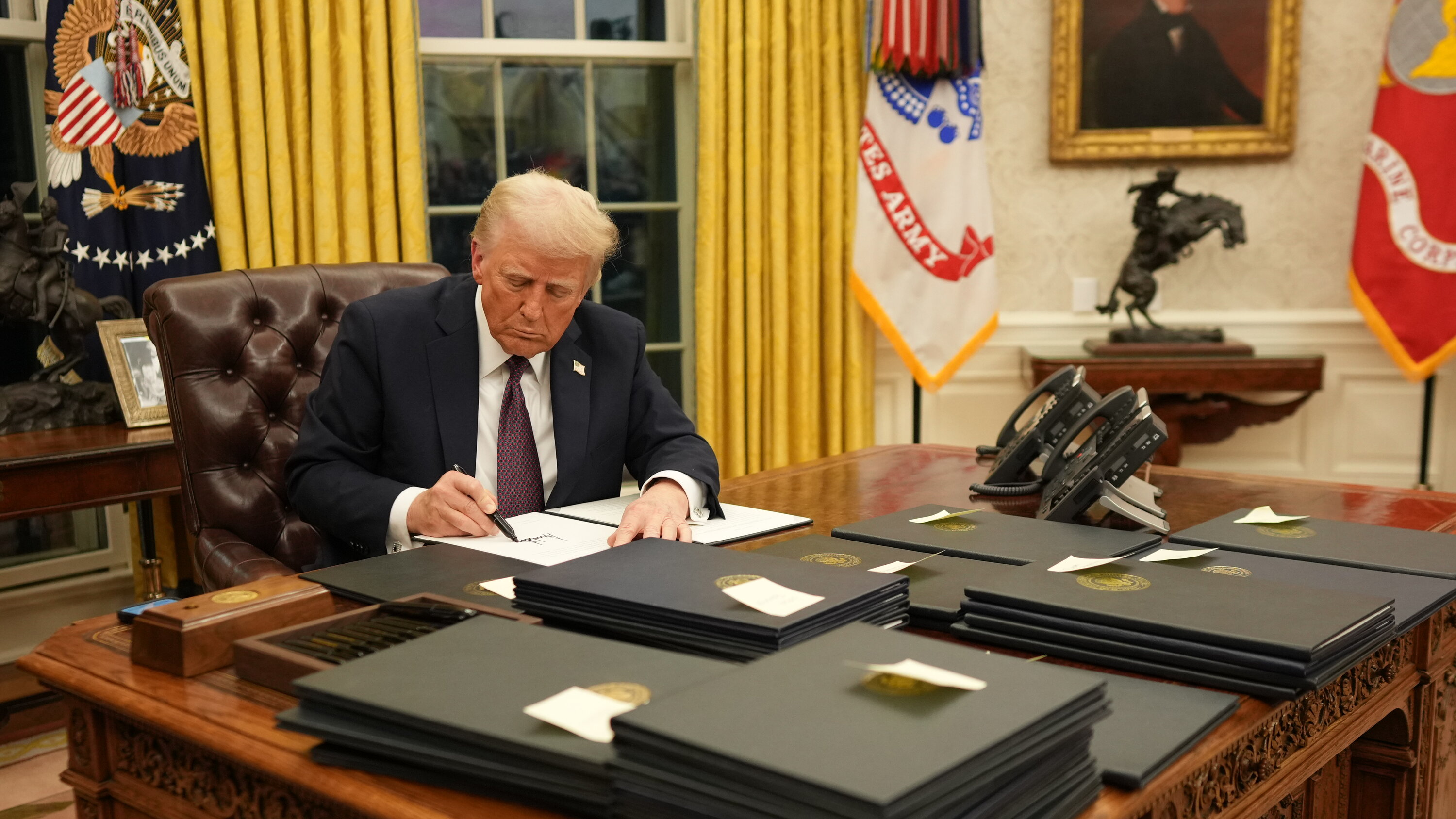

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

How To Get Bbc Big Weekend 2025 Sefton Park Tickets A Complete Guide

How To Get Bbc Big Weekend 2025 Sefton Park Tickets A Complete Guide

Euronext Amsterdam Market Reaction 8 Stock Increase After Trumps Tariff Announcement

Euronext Amsterdam Market Reaction 8 Stock Increase After Trumps Tariff Announcement

Burclar Ve Cekim Guecue Seytan Tueyue Etkisi

Burclar Ve Cekim Guecue Seytan Tueyue Etkisi

Nfl Celebration Rules Relaxed The Rise And Survival Of The Tush Push

Nfl Celebration Rules Relaxed The Rise And Survival Of The Tush Push