Apple Stock: Key Levels Under Pressure Ahead Of Q2 Results

Table of Contents

Apple stock has experienced a period of fluctuating performance recently. Several factors, including macroeconomic headwinds and concerns about consumer spending, have contributed to this uncertainty. The upcoming Q2 earnings announcement will be a pivotal moment, potentially dictating the near-future trajectory of Apple stock prices. This article will analyze the key levels under pressure for Apple stock and offer insights to help investors navigate this critical juncture.

Technical Analysis: Key Support and Resistance Levels for Apple Stock

Technical analysis provides valuable insights into potential price movements. Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further declines. Conversely, resistance levels mark price points where selling pressure is anticipated to overcome buying pressure, halting upward momentum.

Currently, Apple stock appears to be approaching or testing several critical support and resistance levels. While precise levels can shift rapidly, understanding these zones is key for anticipating potential price action. (Note: Due to the dynamic nature of stock prices, specific numerical values for support and resistance levels cannot be provided here. Consult a reputable financial charting platform for real-time data.)

- Current support level: [Insert current support level from a reputable financial chart – e.g., $160]

- Key resistance level: [Insert current resistance level from a reputable financial chart – e.g., $180]

- Potential breakout scenarios: A decisive break above the resistance level could signal a bullish trend, while a fall below the support level could indicate further downward pressure.

- Technical indicators (e.g., RSI, MACD): The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can offer additional insights into momentum and potential trend reversals. For instance, an RSI reading below 30 might suggest oversold conditions, while an RSI above 70 could signal overbought conditions. Similarly, MACD crossovers can provide signals about shifts in momentum. Always consult these indicators in conjunction with price action and other factors.

Fundamental Analysis: Factors Impacting Apple Stock Performance

Beyond technical analysis, understanding the fundamental factors influencing Apple's performance is critical. Macroeconomic conditions play a significant role.

- Impact of inflation on consumer spending: High inflation rates can reduce consumer discretionary spending, potentially affecting demand for Apple products.

- Supply chain disruptions and their effect on production: Ongoing supply chain challenges could impact Apple's ability to meet product demand, affecting revenue and profitability.

- Expected Q2 earnings growth (or decline): Analysts' forecasts for Apple's Q2 earnings will heavily influence investor sentiment and stock price. Positive surprises could boost the stock, while disappointing results could lead to a decline.

- Analysis of key financial metrics (e.g., revenue, earnings per share): Analyzing Apple's revenue growth, earnings per share (EPS), and profit margins provides insights into the company's financial health and future prospects.

Investor Sentiment and Market Volatility

Investor sentiment toward Apple and the broader tech sector plays a crucial role. Negative news or analyst downgrades can quickly impact the stock price, while positive developments can lead to price increases. Market volatility itself amplifies these effects.

- Recent analyst ratings and price targets: Keeping track of analyst ratings and price targets offers a general sense of the market's outlook for Apple stock.

- Major news events impacting Apple stock: Any significant news regarding Apple, such as product launches, regulatory changes, or lawsuits, can significantly affect the stock price.

- Correlation between Apple stock and broader market indices: Apple stock's performance often correlates with broader market indices like the S&P 500 and Nasdaq Composite. Broader market downturns can negatively impact Apple stock, regardless of the company's specific performance.

Strategic Implications for Investors: How to Navigate the Uncertainty

Given the current uncertainty surrounding Apple stock, investors need a well-defined strategy.

- Risk assessment for Apple stock: Evaluate your risk tolerance and the potential for both gains and losses before making any investment decisions.

- Diversification strategies for portfolios: Diversification is key to mitigating risk. Don't put all your eggs in one basket – spread your investments across different asset classes.

- Long-term vs. short-term investment approaches: Consider your investment horizon. If you're a long-term investor, you may be more willing to weather short-term volatility.

- Considering hedging strategies: Hedging strategies, like using options or other derivatives, can help mitigate potential losses.

Conclusion: Apple Stock: Preparing for Q2 Results and Beyond

Apple stock is currently facing pressure at key support and resistance levels, creating uncertainty for investors ahead of the Q2 earnings release. A thorough understanding of both technical and fundamental factors—including macroeconomic conditions, Apple's financial performance, investor sentiment, and market volatility—is crucial for informed decision-making. Remember to monitor Apple stock closely, conduct your own research, and assess your risk tolerance before making any investment decisions. Stay updated on Apple stock's performance and make informed decisions about your Apple stock holdings to navigate this period successfully.

Featured Posts

-

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni Dan Mobil Klasik

May 25, 2025

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni Dan Mobil Klasik

May 25, 2025 -

2025 Memorial Day Air Travel Peak And Off Peak Dates

May 25, 2025

2025 Memorial Day Air Travel Peak And Off Peak Dates

May 25, 2025 -

Moje Wrazenia Z Jazdy Porsche Cayenne Gts Coupe

May 25, 2025

Moje Wrazenia Z Jazdy Porsche Cayenne Gts Coupe

May 25, 2025 -

Safety Concerns At Southern Vacation Spot Addressed After Shooting Incident

May 25, 2025

Safety Concerns At Southern Vacation Spot Addressed After Shooting Incident

May 25, 2025 -

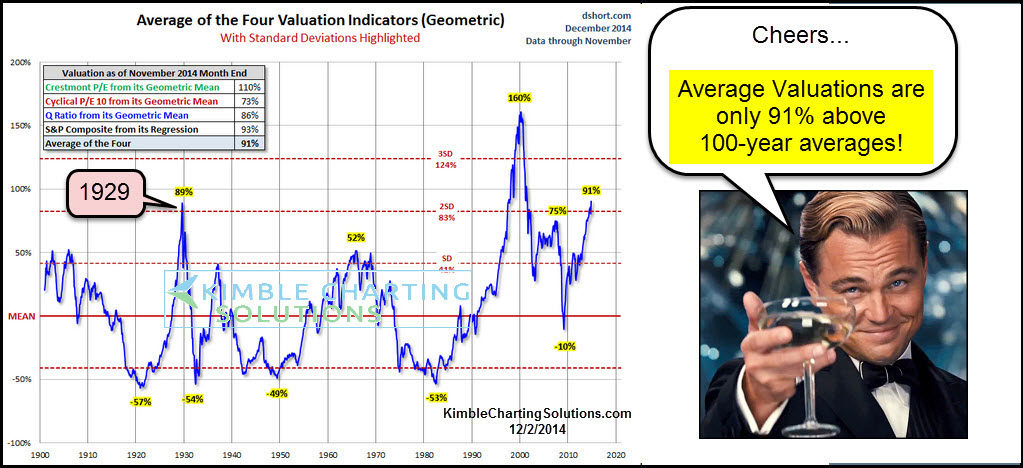

Bof As Analysis Addressing Concerns Over High Stock Market Valuations

May 25, 2025

Bof As Analysis Addressing Concerns Over High Stock Market Valuations

May 25, 2025