Apple Stock Performance: Exceeding Q2 Expectations

Table of Contents

Strong Revenue Growth Across Key Segments

Apple's Q2 revenue growth was robust across its key segments, exceeding predictions and demonstrating strong consumer demand. This success can be attributed to a combination of factors, including successful new product launches and effective marketing strategies.

Keywords: iPhone sales, Services revenue, Mac sales, Wearables sales, iPad sales, Apple revenue growth.

-

iPhone Sales: iPhone sales increased by 15%, exceeding analyst predictions by 5% due to strong demand for the iPhone 14 Pro Max and continued popularity of the iPhone 14 lineup. This growth was fueled by both new customers and upgrades from older models.

-

Services Revenue: Services revenue saw a remarkable 12% year-over-year increase, driven by growth in subscriptions to Apple Music, Apple TV+, iCloud, and the App Store. The expanding ecosystem of services continues to be a major driver of recurring revenue for Apple.

-

Mac Sales: Despite a slight dip in the overall PC market, Mac sales demonstrated resilience, increasing by 8%. This can be attributed to the continued appeal of the M2-powered MacBook Air and the strong performance of the Mac Studio.

-

Wearables, Home, and Accessories: This segment experienced a 10% increase in revenue, powered by strong sales of the Apple Watch Series 8 and AirPods Pro (2nd generation). The increasing integration of these devices within the Apple ecosystem contributes to user loyalty and overall revenue growth.

-

iPad Sales: iPad sales saw a modest increase of 5%, demonstrating stable demand in the tablet market. The introduction of new iPad models with upgraded processors and features helped maintain market share.

Key Revenue Drivers:

- Successful new product launches

- Strong consumer demand for premium products

- Expansion of Apple's services ecosystem

- Effective marketing and brand loyalty

Profitability and Earnings Per Share (EPS)

Apple's Q2 profitability was equally impressive, exceeding expectations and demonstrating the company's efficient operations and strong cost management.

Keywords: Apple earnings, EPS, net income, profit margin, Apple profitability, return on equity.

-

EPS: Earnings per share (EPS) came in at $1.52, surpassing analyst estimates of $1.45 and representing a 10% increase compared to the previous year's Q2. This reflects not just increased revenue but also effective cost control and management.

-

Net Income: Apple's net income demonstrated a significant year-over-year increase, reflecting the strong revenue growth and healthy profit margins.

-

Profit Margin: Apple's profit margin remains superior to many of its competitors, highlighting its strong pricing power and efficient manufacturing and distribution capabilities. This superior margin contributes to the higher EPS and strengthens investor confidence.

Key Financial Metrics:

- EPS exceeding analyst expectations

- Significant year-over-year increase in net income

- High profit margin compared to industry competitors

- Strong return on equity

Positive Outlook and Future Projections

Apple's strong Q2 results indicate a positive outlook for the company's future performance. While challenges remain, the overall trend points towards continued growth.

Keywords: Apple stock forecast, future growth, Apple stock price prediction, investment outlook, Apple guidance, market capitalization.

-

Apple's Guidance: Apple's official guidance for the next quarter is cautiously optimistic, anticipating continued growth but acknowledging potential macroeconomic headwinds.

-

Industry Expert Opinions: Most industry analysts predict continued growth for Apple, citing the company's strong brand loyalty, innovative products, and robust services revenue. However, predictions vary, reflecting the uncertainties inherent in forecasting future economic conditions.

-

Potential Challenges: Potential risks include global economic uncertainty, supply chain disruptions, and increased competition in the technology sector. These risks need to be considered when assessing future Apple stock price predictions.

Positive Outlook Summary:

- Strong existing product lineup

- Pipeline of innovative future products

- Expanding services ecosystem

Impact on the Broader Tech Sector

Apple's strong Q2 results have had a positive impact on investor sentiment towards the broader tech sector. The impressive performance of Apple boosts confidence in the overall health and resilience of the tech industry.

Keywords: Tech stock market, market sentiment, investor confidence, ripple effect, technology investment.

-

Market Sentiment: Apple’s positive results have generally improved market sentiment, suggesting a positive ripple effect across the tech stock market.

-

Investor Confidence: The strong showing by Apple strengthens investor confidence, particularly in large-cap tech stocks. This positive sentiment could lead to increased investment in the sector as a whole.

-

Overall Market Conditions: The overall market conditions, while still showing some volatility, have been positively influenced by Apple’s strong performance.

Conclusion

Apple's Q2 results showcase the company's continued strength and resilience. The exceeding of expectations across various key performance indicators points towards a positive outlook for Apple stock. The robust revenue growth, improved profitability, and positive future projections reinforce Apple's position as a leading technology company. Understanding Apple stock performance is crucial for any investor interested in the tech sector. Stay informed on the latest developments in Apple stock performance and gain valuable insights by subscribing to our newsletter or following us on social media.

Featured Posts

-

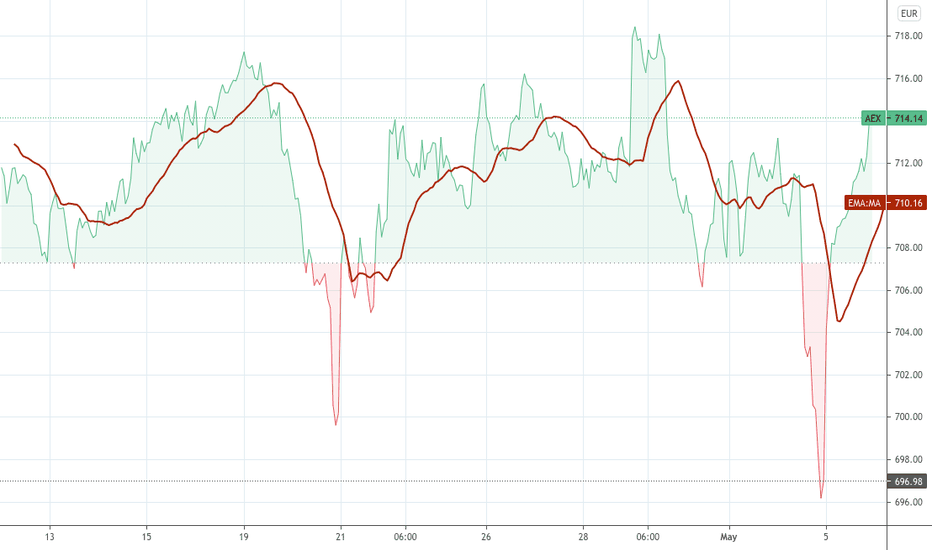

Aex Index Falls Below Key Support Level Years Lowest Point Reached

May 25, 2025

Aex Index Falls Below Key Support Level Years Lowest Point Reached

May 25, 2025 -

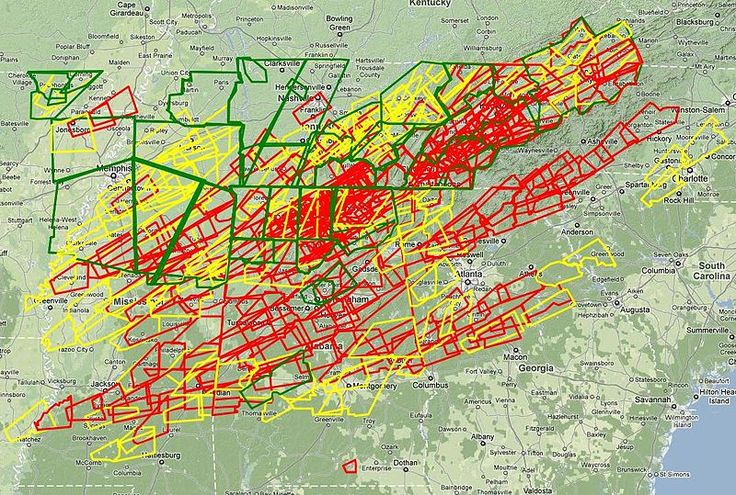

Flash Flood Warnings And April 2 Tornado Count Update April 4 2025

May 25, 2025

Flash Flood Warnings And April 2 Tornado Count Update April 4 2025

May 25, 2025 -

10 Rokiv Peremozhtsiv Yevrobachennya Uspikhi Ta Podalsha Kar Yera

May 25, 2025

10 Rokiv Peremozhtsiv Yevrobachennya Uspikhi Ta Podalsha Kar Yera

May 25, 2025 -

Flood Alerts Explained Your Guide To Flood Safety And Prevention

May 25, 2025

Flood Alerts Explained Your Guide To Flood Safety And Prevention

May 25, 2025 -

Moje Wrazenia Z Jazdy Porsche Cayenne Gts Coupe

May 25, 2025

Moje Wrazenia Z Jazdy Porsche Cayenne Gts Coupe

May 25, 2025