Are High Stock Market Valuations A Concern? BofA Says No. Here's Why.

Table of Contents

BofA's Arguments Against High Valuation Concerns

BofA's bullish stance on the market isn't based on blind optimism. Their argument rests on several key pillars, each contributing to their belief that current high stock market valuations are sustainable, at least for the foreseeable future.

Low Interest Rates and Abundant Liquidity

One of BofA's central arguments is the impact of low interest rates and abundant liquidity on stock valuations.

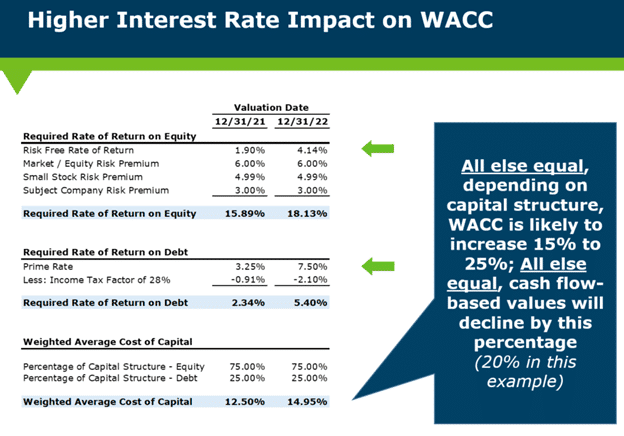

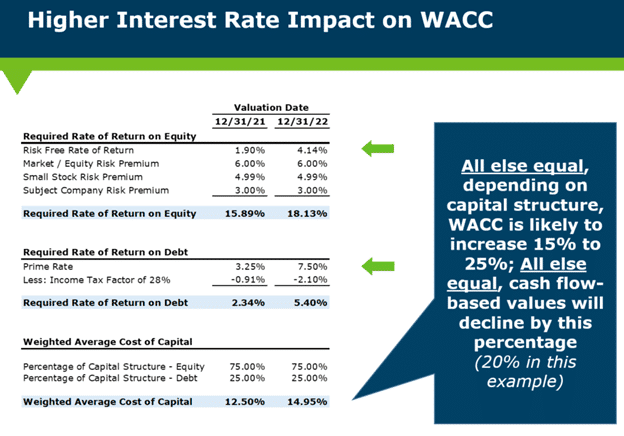

- Lower Discount Rates: Low interest rates directly influence the present value of future earnings. When discount rates (used in discounted cash flow models) are low, the present value of future corporate earnings is higher, thus supporting higher stock prices. This means that future profits are worth more today than they would be in a high-interest-rate environment.

- Quantitative Easing and Liquidity: Years of quantitative easing (QE) and other liquidity measures by central banks have injected vast amounts of capital into the financial system. This excess liquidity flows into various asset classes, including stocks, pushing prices higher. This abundant liquidity, even while tapering, continues to exert upward pressure on stock market valuation.

Strong Corporate Earnings and Profitability

BofA also highlights the robust performance of many corporations. Strong earnings and healthy profit margins are crucial justifications for the current valuations.

- Sector Performance: Several sectors, particularly technology and healthcare, have demonstrated exceptional earnings growth. These strong performers significantly impact overall market valuation.

- Innovation Driving Profits: Technological advancements and continuous innovation fuel corporate profits, boosting investor confidence and supporting higher stock prices. Companies leveraging AI, automation, and other disruptive technologies see sustained increases in profits, justifying higher price-to-earnings ratios.

- Profit Margin Strength: Across many sectors, profit margins remain healthy, indicating that companies are effectively managing costs and maximizing their revenue streams. Sustained profit margin growth further reinforces the argument for higher valuations.

Long-Term Growth Prospects

BofA's optimistic view extends to the long-term growth prospects of the global economy. They believe several factors will continue to drive economic expansion, supporting higher stock market valuations over the longer term.

- Technological Advancements: Continued breakthroughs in technology will fuel productivity gains and economic growth, creating opportunities for further corporate expansion and higher earnings.

- Emerging Markets Growth: The continued expansion of emerging markets presents significant growth opportunities for multinational corporations, further supporting long-term stock market growth.

- BofA's Forecasts: BofA's specific economic forecasts (which should be consulted directly for the most up-to-date information) generally indicate a positive outlook, providing further support for their argument.

Counterarguments and Potential Risks

While BofA presents a compelling case, it's crucial to acknowledge counterarguments and potential risks associated with high stock market valuations.

Valuation Metrics and Historical Comparisons

Several valuation metrics raise concerns.

- P/E Ratio and Shiller P/E: Both the traditional Price-to-Earnings (P/E) ratio and the cyclically adjusted P/E ratio (Shiller P/E) are currently relatively high compared to historical averages. This suggests that stocks might be overvalued relative to their earnings.

- Limitations of Historical Data: However, relying solely on historical comparisons can be misleading. Structural changes in the economy, technological advancements, and global shifts make direct historical comparisons less precise. BofA acknowledges this but maintains that the other factors they highlight outweigh these valuation concerns.

Geopolitical and Economic Uncertainty

Several external factors could significantly impact stock market valuations.

- Inflationary Pressures: Persistent inflation could erode corporate profits and reduce investor confidence.

- Geopolitical Instability: Geopolitical events (e.g., wars, trade disputes) create uncertainty and volatility in the market, potentially leading to sharp corrections.

- Supply Chain Disruptions: Ongoing supply chain disruptions can negatively impact corporate performance, hurting earnings and affecting valuations. These disruptions often cascade through the economy, impacting broader market sentiment and investor confidence.

Conclusion: Navigating High Stock Market Valuations – A Balanced Perspective

BofA's arguments highlight the importance of considering factors beyond traditional valuation metrics when assessing the current market environment. Low interest rates, abundant liquidity, robust corporate earnings, and positive long-term growth prospects all contribute to their view that high stock market valuations are not necessarily a cause for immediate concern. However, potential risks associated with high valuations, along with geopolitical and economic uncertainties, must also be carefully considered. A balanced perspective is crucial. Conduct further research, consult with a qualified financial advisor, and develop a well-informed investment strategy based on your individual risk tolerance and long-term financial goals when navigating high stock market valuations.

Featured Posts

-

Office 365 Hackers Multi Million Dollar Scheme Exposed

Apr 24, 2025

Office 365 Hackers Multi Million Dollar Scheme Exposed

Apr 24, 2025 -

Open Ai To Acquire Google Chrome Chat Gpt Ceos Bold Claim

Apr 24, 2025

Open Ai To Acquire Google Chrome Chat Gpt Ceos Bold Claim

Apr 24, 2025 -

B And B April 3 Recap Liam Collapses After Major Argument With Bill

Apr 24, 2025

B And B April 3 Recap Liam Collapses After Major Argument With Bill

Apr 24, 2025 -

Chat Gpt Maker Open Ai Faces Ftc Investigation A Deep Dive

Apr 24, 2025

Chat Gpt Maker Open Ai Faces Ftc Investigation A Deep Dive

Apr 24, 2025 -

Ja Morant Probe Nba Launches Investigation Following Latest Report

Apr 24, 2025

Ja Morant Probe Nba Launches Investigation Following Latest Report

Apr 24, 2025