Are Recession Fears Cooling The Canadian Housing Market? BMO Survey Says Yes

Table of Contents

The Canadian economy is facing a period of uncertainty, with recession fears casting a long shadow over various sectors. Nowhere is this anxiety more palpable than in the Canadian housing market, traditionally a cornerstone of the nation's economic strength. A recent BMO survey suggests that these recession fears are indeed having a cooling effect on the market, prompting crucial questions for homeowners and prospective buyers alike. This article analyzes the survey's findings and explores their implications for the future of Canadian real estate.

Key Findings from the BMO Survey

The BMO survey, conducted in [Insert Month, Year] using a representative sample of [Insert Sample Size] Canadian homeowners and prospective buyers, employed [Insert Methodology, e.g., online questionnaires, telephone interviews]. Its key findings paint a picture of a slowing market, significantly impacted by the current economic climate. The survey explored various aspects of the Canadian real estate market, focusing on sales activity, price changes, and consumer sentiment.

Here are some of the key takeaways:

-

Housing Sales Decline: The survey revealed a [Insert Percentage]% decrease in housing sales compared to the same period last year, indicating a significant slowdown in market activity across the country. This drop in Canadian housing sales is consistent with the general trend of decreased buyer confidence.

-

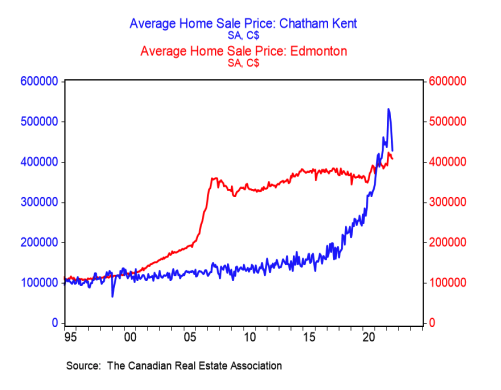

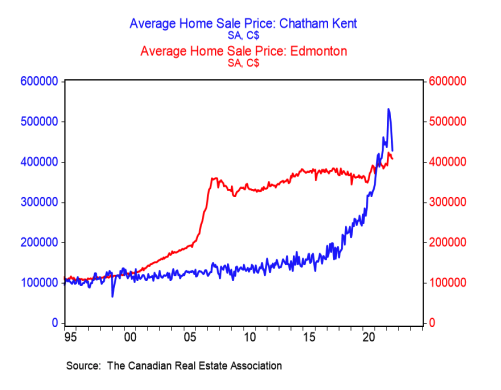

Home Price Adjustments: Average home prices showed a [Insert Percentage]% decrease compared to [Insert Comparison Period], suggesting a potential correction in the previously overheated market. While price decreases aren't uniform across the country, the overall trend points towards a cooling market. This impacts the Canadian real estate market as a whole.

-

Weakening Buyer Confidence: The survey indicated a marked decrease in buyer confidence, with [Insert Percentage]% of respondents expressing concerns about the economic outlook and its potential impact on their ability to purchase a home. This lack of confidence contributed significantly to the decline in housing sales. The Canadian housing market is clearly feeling the pressure.

The Impact of Recession Fears on the Housing Market

Recessionary concerns are significantly impacting buyer behavior in the Canadian housing market. Economic uncertainty fosters hesitancy, leading to decreased demand and a slowdown in sales activity. This relationship between economic uncertainty and reduced housing demand is clearly evident in the BMO survey results.

Several factors contribute to this buyer hesitancy:

- Rising Interest Rates: Increased interest rates make mortgages more expensive, reducing affordability and deterring potential buyers from entering the market. This is a major factor in cooling the Canadian housing market.

- Inflationary Pressures: Rising inflation erodes purchasing power, leaving consumers with less disposable income to allocate towards housing expenses.

- Job Market Uncertainty: Concerns about job security and potential layoffs make prospective buyers more cautious about making significant financial commitments like purchasing a home.

- Potential for Further Price Corrections: The anticipation of further price drops prompts many potential buyers to wait and see, delaying purchasing decisions.

These factors combined create a perfect storm impacting Canadian real estate trends.

Regional Variations in the Cooling Market

While the BMO survey suggests a general cooling effect across the Canadian housing market, the impact is not uniform across all regions. Regional variations in economic conditions, population growth, and inventory levels contribute to these differences.

For example:

-

Ontario: The Ontario housing market, particularly in [Insert City, e.g., Toronto], experienced a more significant slowdown compared to some other provinces due to [Explain Local Factors, e.g., higher interest rate sensitivity, increased inventory].

-

British Columbia: The BC real estate market, while also experiencing a cooling effect, showed more resilience compared to Ontario due to [Explain Local Factors, e.g., strong immigration, limited housing supply].

Understanding these regional variations is crucial for navigating the complexities of the Canadian housing market. Analyzing provincial housing markets individually provides a more accurate picture than a national overview.

Expert Opinions and Future Predictions

Experts offer mixed perspectives on the future trajectory of the Canadian housing market. Some economists predict a prolonged period of slowdown, with further price corrections and reduced sales activity. Others are more optimistic, suggesting that the market will stabilize once interest rate hikes ease.

Key predictions from various real estate experts and economists include:

- Moderate Price Corrections: Most experts predict further, albeit moderate, price corrections in the coming months, but not a dramatic crash.

- Gradual Sales Recovery: A gradual recovery in sales activity is anticipated once economic uncertainty subsides and interest rates stabilize.

- Interest Rate Plateau: Many believe that interest rates will plateau or even start to decrease within the next [Insert timeframe], supporting a gradual market rebound. However, these interest rate predictions vary.

The overall economic outlook will significantly influence the future of Canadian real estate.

Conclusion

The BMO survey clearly indicates that recession fears are having a noticeable cooling effect on the Canadian housing market. The key takeaways include a decline in housing sales, adjustments in home prices, and weakening buyer confidence. Regional variations exist, but the overall trend points towards a slowing market. Expert opinions suggest a period of adjustment and moderate price corrections are likely.

Stay updated on the ever-evolving Canadian housing market. Monitor our website for further analysis on recession fears and their impact on Canadian housing market trends and real estate updates.

Featured Posts

-

Bitcoin Price Explodes Approaches 100 000 Following 10 Week Peak

May 07, 2025

Bitcoin Price Explodes Approaches 100 000 Following 10 Week Peak

May 07, 2025 -

Vatican Deactivates Cell Service For Papal Election

May 07, 2025

Vatican Deactivates Cell Service For Papal Election

May 07, 2025 -

Play Station 5 Pro Teardown A Comprehensive Internal Analysis

May 07, 2025

Play Station 5 Pro Teardown A Comprehensive Internal Analysis

May 07, 2025 -

The Chucksters Unpopular Opinion The Cleveland Cavaliers Future

May 07, 2025

The Chucksters Unpopular Opinion The Cleveland Cavaliers Future

May 07, 2025 -

Isabela Merceds Hawkgirl Organic Wings For The Superman Universe

May 07, 2025

Isabela Merceds Hawkgirl Organic Wings For The Superman Universe

May 07, 2025