Are Stretched Stock Market Valuations Justified? BofA's View

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's assessment of current market conditions is multifaceted, incorporating a detailed analysis of economic growth projections and the impact of interest rate hikes.

Economic Growth Projections

BofA's economic growth projections play a vital role in their stock market valuation assessment. Their forecasts provide a crucial backdrop for understanding the sustainability of current market prices.

- GDP Growth: BofA recently projected a [insert specific percentage]% GDP growth for [insert year], slightly lower than previous estimates due to [insert specific reason, e.g., persistent inflation, supply chain disruptions]. This slower growth rate could impact corporate earnings and influence stock valuations.

- Inflation Rates: BofA forecasts inflation to remain elevated at [insert percentage]% in [insert year], before gradually decreasing to [insert percentage]% by [insert year]. Persistent inflation can erode corporate profits and negatively affect investor sentiment, thus impacting stock market valuations.

- Recession Risk: BofA's analysts have assigned a [insert percentage]% probability of a recession in [insert year], citing [insert specific reasons, e.g., high interest rates, tight monetary policy]. A recession would significantly impact corporate earnings and could lead to a downward correction in stock market valuations. This contributes significantly to the discussion of stretched stock market valuations.

Interest Rate Hikes and Their Impact

Central banks' aggressive interest rate hikes are a significant factor in BofA's analysis of stretched stock market valuations. These hikes directly impact corporate borrowing costs and investor sentiment.

- Expected Interest Rate Increases: BofA anticipates [insert number] further interest rate increases of [insert percentage] points each by [insert timeframe]. This tightening of monetary policy aims to curb inflation but could negatively impact economic growth and corporate profitability.

- Impact on Corporate Earnings: Higher interest rates increase borrowing costs for companies, potentially squeezing profit margins and slowing down investments. This could directly translate to lower corporate earnings, affecting stock prices and valuations.

- Implications for Investor Sentiment: Increased interest rates make bonds more attractive compared to stocks, potentially diverting investor funds from the equity market. This shift in investor sentiment could further contribute to pressure on stock valuations.

Analysis of Valuation Metrics According to BofA

BofA utilizes a range of valuation metrics to assess whether current stock prices are justified. Their analysis goes beyond simple price-to-earnings ratios (P/E), incorporating a broader perspective.

Price-to-Earnings Ratio (P/E)

The P/E ratio is a cornerstone of stock valuation. BofA's analysis of P/E ratios across sectors reveals a mixed picture.

- Current P/E Ratios: Current market-wide P/E ratios are [insert value], which are [insert description: e.g., above/below] historical averages. Specific sectors like [insert sector examples] show particularly high/low P/E ratios, indicating potential over/undervaluation.

- Comparison to Historical Averages: BofA compares current P/E ratios to their historical averages, examining deviations and potential implications for future market performance. A significantly elevated P/E ratio could indicate stretched valuations.

- Sustainability of Current P/E Ratios: BofA's analysts assess the sustainability of current P/E ratios considering future earnings growth expectations and potential economic headwinds. They determine whether these valuations can be justified given the economic outlook.

Other Key Valuation Metrics

BofA's comprehensive valuation analysis extends beyond P/E ratios. They consider other key metrics to paint a holistic picture.

- Price-to-Sales Ratio (P/S): BofA analyzes P/S ratios across different sectors, comparing them to historical norms and sector-specific benchmarks. High P/S ratios may point towards stretched valuations in certain sectors.

- Price-to-Book Ratio (P/B): This metric gives an indication of a company's net asset value. BofA examines P/B ratios to assess whether market valuations reflect the underlying asset values of companies.

- Dividend Yields: BofA considers dividend yields to gauge the relative attractiveness of stocks compared to fixed-income investments. Low dividend yields could indicate a premium placed on growth prospects, potentially reflective of stretched valuations.

BofA's Investment Recommendations and Strategies

Based on their assessment of economic conditions and valuation metrics, BofA provides specific investment recommendations and strategies for investors.

Sector-Specific Views

BofA's sector-specific views offer insights into which sectors they deem overvalued and undervalued.

- Overvalued Sectors: BofA has identified [insert sector examples] as potentially overvalued based on their valuation analysis, suggesting caution for investors in these areas. Their rationale likely stems from high P/E or P/S ratios relative to future earnings growth prospects.

- Undervalued Sectors: Conversely, BofA points to [insert sector examples] as potentially undervalued, representing possible opportunities for investors. This assessment is supported by their analysis of valuation metrics relative to earnings growth potential.

Overall Market Outlook and Cautions

BofA's overall outlook on the stock market acknowledges the inherent risks associated with current valuations.

- Market Outlook: BofA’s overall market outlook is [insert outlook: e.g., cautiously optimistic/neutral/bearish] based on their assessment of stretched stock market valuations, inflation, and interest rate hikes.

- Risk Management: They emphasize the need for robust risk management strategies, including diversification to mitigate potential losses. This is crucial given the uncertainty surrounding future economic performance.

- Potential Market Corrections: BofA warns about the possibility of market corrections or further volatility, given the high valuations in certain sectors. They advise investors to maintain a long-term perspective and to avoid impulsive trading decisions.

Evaluating Stretched Stock Market Valuations: The BofA Verdict and Your Next Steps

BofA's analysis suggests that current stretched stock market valuations present a complex picture. While some sectors appear overvalued based on their analysis of metrics like P/E ratios and future earnings expectations, others may offer investment opportunities. Their cautions about persistent inflation, interest rate hikes, and potential economic slowdowns underscore the need for careful risk management. The key takeaways include the importance of considering BofA's economic growth forecasts, the nuanced interpretations of valuation metrics like the P/E ratio, and the need for a sector-specific approach to investment.

To gain a comprehensive understanding of BofA's perspective and make informed investment decisions, delve deeper into their research reports and market commentary. Assessing stock market valuations requires a thorough analysis, considering a wide range of factors and incorporating diverse perspectives. By understanding BofA's detailed analysis of stretched valuations, investors can better position themselves for success in the current market environment. Visit [insert link to BofA's relevant resources] to access their in-depth analysis of stock market valuations and make informed investment decisions.

Featured Posts

-

Brit Paralympian Missing At Wrestle Mania Found Safe

Apr 29, 2025

Brit Paralympian Missing At Wrestle Mania Found Safe

Apr 29, 2025 -

Key Republican Groups Opposing Trumps Tax Cuts

Apr 29, 2025

Key Republican Groups Opposing Trumps Tax Cuts

Apr 29, 2025 -

Are Stretched Stock Market Valuations Justified Bof As View

Apr 29, 2025

Are Stretched Stock Market Valuations Justified Bof As View

Apr 29, 2025 -

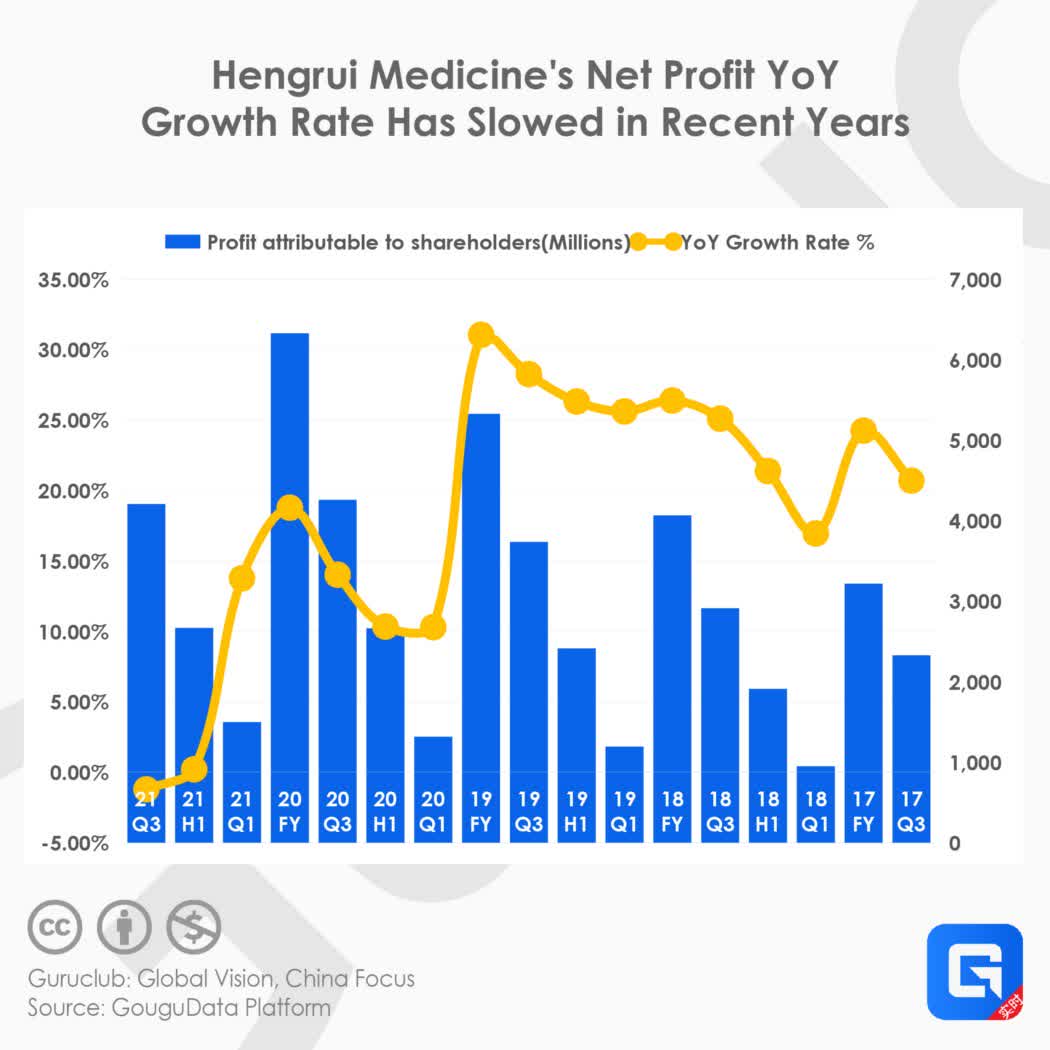

China Approves Hengrui Pharmas Hong Kong Stock Offering

Apr 29, 2025

China Approves Hengrui Pharmas Hong Kong Stock Offering

Apr 29, 2025 -

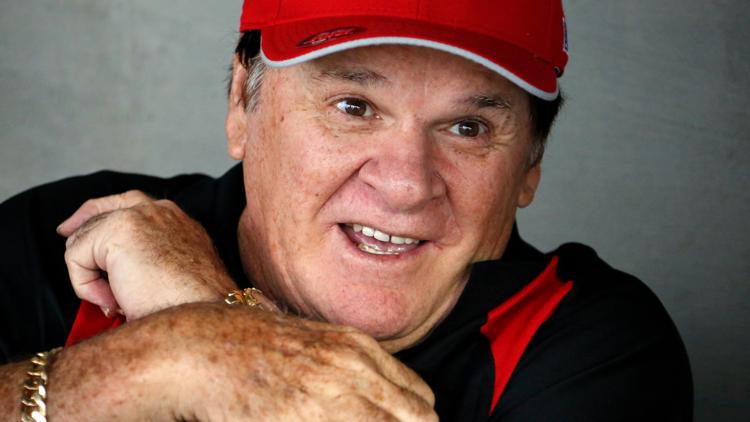

Pete Rose Pardon Trumps Plans And The Impact On Baseball

Apr 29, 2025

Pete Rose Pardon Trumps Plans And The Impact On Baseball

Apr 29, 2025